Is UAG safe?

Pros

Cons

Is UAG Safe or Scam?

Introduction

UAG, also known as Universal Asset Group, positions itself as a forex broker operating within the volatile landscape of the foreign exchange market. Established in the United Arab Emirates, UAG claims to offer trading in various financial instruments, including forex, precious metals, and indices. However, the necessity for traders to conduct thorough due diligence before engaging with any forex broker cannot be overstated. The forex market is rife with potential pitfalls, and unregulated brokers can pose significant risks to investors' capital. This article aims to investigate the legitimacy of UAG, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation is based on a comprehensive review of multiple sources, including user feedback, regulatory information, and expert analyses.

Regulation and Legitimacy

The regulatory landscape is a crucial factor in assessing the safety of any forex broker. UAG has been flagged by multiple sources, including WikiFX, as an unregulated broker operating without valid licenses. The absence of regulatory oversight raises significant concerns regarding the protection of client funds and the integrity of trading practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation means that UAG does not adhere to any established financial standards, which typically include requirements for segregated accounts and investor compensation schemes. Such safeguards are designed to protect clients in the event of broker insolvency or misconduct. Furthermore, historical compliance issues have been reported, with numerous complaints highlighting difficulties in fund withdrawals and allegations of fraudulent activities, including operating as a Ponzi scheme.

Company Background Investigation

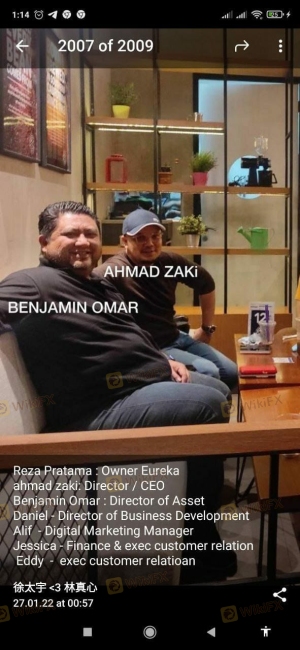

UAG's history is shrouded in ambiguity, with limited information available regarding its ownership structure and management team. Established around 2016, the broker claims to have developed a significant presence in the forex trading sector. However, the lack of transparency raises questions about the qualifications and experience of its leadership.

The company's operational base is reportedly in the United Arab Emirates, but it also claims to have connections to St. Vincent and the Grenadines. This duality in registration can often be a red flag, as many unregulated brokers exploit such jurisdictions to evade stringent regulatory scrutiny. The company's transparency regarding its business practices and ownership remains minimal, further complicating efforts to assess its credibility.

Trading Conditions Analysis

UAG presents various trading conditions, but potential clients should be wary of the overall cost structure and any hidden fees that may apply. The broker offers two primary account types: a standard account and an ECN account, with minimum deposits starting at $100 and $500, respectively.

| Fee Type | UAG | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | $2 per lot (ECN) | $0 - $5 per lot |

| Overnight Interest Range | Varies | Varies |

While UAG's spreads may seem competitive, the overall trading costs can be misleading. The commission structure, particularly for the ECN account, may not be as attractive when compared to industry standards. Additionally, the broker's policies regarding overnight interest and withdrawal fees are unclear, which could lead to unexpected expenses for traders.

Customer Funds Security

The safety of customer funds is paramount when choosing a forex broker. UAG lacks essential safety measures such as segregated accounts and investor protection schemes. The absence of regulatory oversight means that clients have limited recourse in the event of financial disputes or broker insolvency.

Historical complaints regarding fund withdrawal difficulties have surfaced, with numerous users reporting their inability to access their capital. Such issues raise significant concerns about UAG's commitment to safeguarding client investments. The lack of a robust security framework is a critical factor in determining whether UAG is safe for potential traders.

Customer Experience and Complaints

Analyzing customer feedback reveals a troubling pattern of dissatisfaction among UAG's clients. Many users have reported negative experiences, particularly concerning withdrawal processes and overall customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Inconsistent |

| Misleading Information | High | Unresponsive |

For instance, several traders have expressed frustration over delayed withdrawals, with some waiting for months without resolution. One user noted that after requesting a withdrawal of $7,500, they received no response from UAG for an extended period. Such complaints indicate a systemic issue within the broker's operational framework, leading to growing concerns about its legitimacy.

Platform and Trade Execution

The performance of trading platforms is essential for any trader's success. UAG offers the widely used MetaTrader 4 (MT4) platform, known for its user-friendly interface and extensive features. However, user reviews suggest that the platform may suffer from execution issues, including slippage and occasional order rejections.

Traders have reported instances where their orders were not executed in a timely manner, raising concerns about the broker's reliability. Additionally, the lack of transparency regarding platform performance metrics further complicates the evaluation of UAG's trading environment.

Risk Assessment

Engaging with UAG entails various risks, primarily due to its unregulated status and history of customer complaints.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | Potential loss of funds due to fraud |

| Operational Risk | Medium | Issues with trade execution and withdrawals |

To mitigate these risks, potential traders should consider utilizing regulated brokers with established reputations and robust safety measures. It is advisable to conduct thorough research and seek out brokers that comply with regulatory standards to ensure the protection of investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that UAG is not safe for traders. The broker's lack of regulation, coupled with numerous customer complaints and withdrawal issues, raises significant red flags. Engaging with UAG poses considerable risks, including potential loss of funds and inadequate recourse in the event of disputes.

For traders seeking a reliable and secure trading environment, it is highly recommended to opt for regulated brokers that adhere to stringent financial standards. Alternatives such as XM and FBS offer well-regulated trading conditions, investor protection, and a transparent operational framework. Ultimately, the importance of choosing a trustworthy broker cannot be overstated, as it directly impacts the safety of your investments in the forex market.

Is UAG a scam, or is it legit?

The latest exposure and evaluation content of UAG brokers.

UAG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UAG latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.