scamed 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

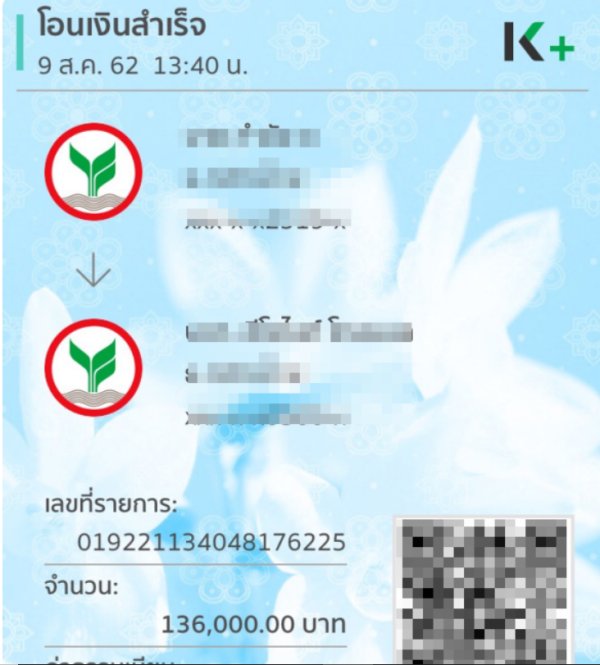

The broker scamed positions itself as a low-cost trading platform that predominantly attracts beginner traders looking for affordable market entry points. It claims to offer high returns which may appeal to those inclined towards high-risk investments. However, this seemingly attractive proposition comes with significant caveats. A lack of regulatory oversight combined with numerous unfavorable user reviews raises alarming red flags about the safety and reliability of this broker. It is crucial for prospective investors, particularly novices, to weigh these trade-offs before proceeding. While scamed may present attractive low-cost options, potential risks include hidden fees, fund withdrawal issues, and a general lack of transparency, making it a questionable choice for anyone serious about safeguarding their investments.

⚠️ Important Risk Advisory & Verification Steps

WARNING: Investing with unregulated brokers like scamed may expose you to serious financial risks.

- Risk Statement: Lack of oversight could lead to potential financial loss and commercial misconduct.

- Potential Harms:

- Exposure to fraudulent activities

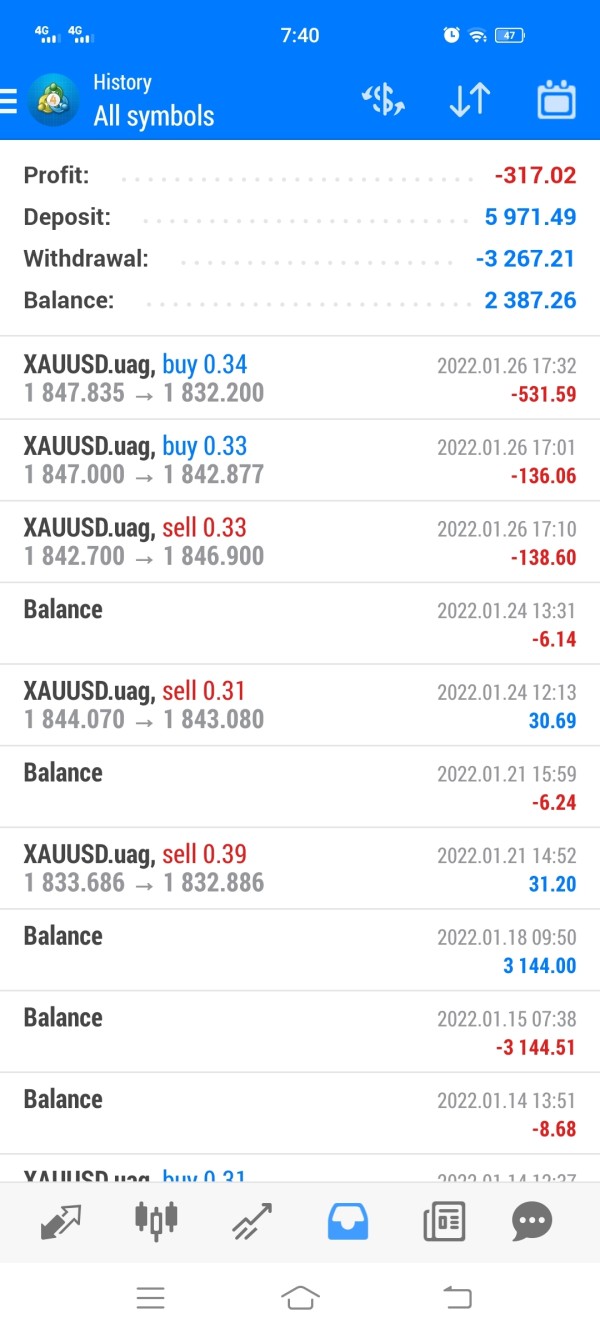

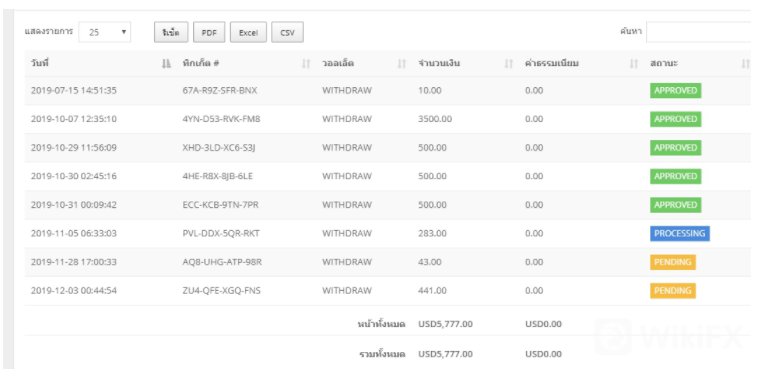

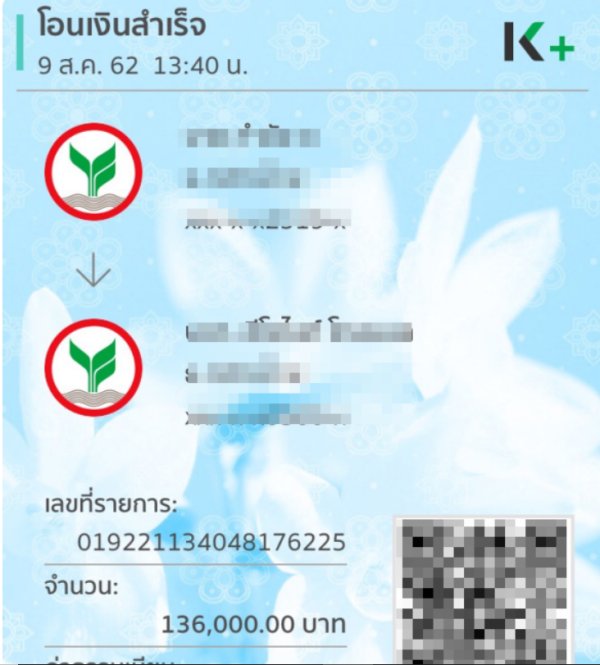

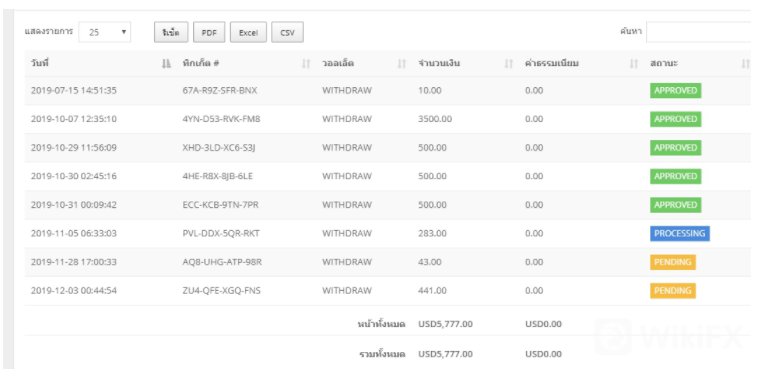

- Difficulty in withdrawing funds

- High withdrawal fees and hidden charges

To ensure your safety before investing, please follow these self-verification steps:

- Check Regulatory Status: Visit the NFA's BASIC database to verify if a broker is regulated.

- Research User Reviews: Look for the broker‘s reputation on credible review sites.

- Examine Terms and Conditions: Read carefully about fees, withdrawal conditions, and any other fine print.

- Contact Customer Support: Engage with the broker’s support to gauge responsiveness and transparency.

- Look for Red Flags: High-pressure sales tactics or promises of guaranteed returns are significant warning signs.

Rating Framework

Broker Overview

Company Background and Positioning

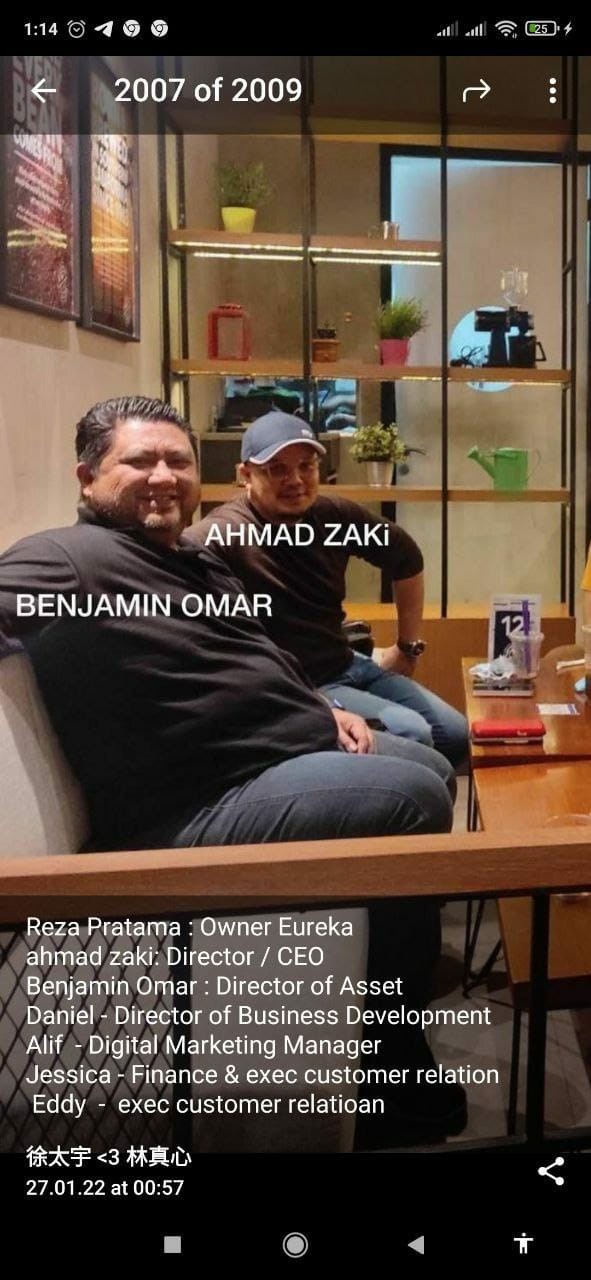

Founded in an era marked by rapid technological advancement in trading, scamed has managed to carve out a niche for itself within the competitive forex market. Operating from an undisclosed location, what stands out is its ability to attract inexperienced traders seeking budget-friendly options purportedly designed for maximizing profits. However, its lack of regulatory compliance and transparency about its operations continues to loom as a significant concern for potential clients.

Core Business Overview

Scamed offers trading in various asset classes including forex, commodities, and cryptocurrencies, primarily through web-based platforms. Despite its claims of affiliation with regulatory bodies, user testimonials and independent reviews reveal a contrasting reality, showcasing the broker's unregulated status, which raises red flags about its credibility.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty

The primary concern surrounding scamed is its unregulated status. There are glaring contradictions in the information regarding its regulatory claims. According to multiple sources, the broker has not been able to substantiate its compliance with any recognized financial authority. This can lead to unsafe trading environments and potential financial loss.

Regulatory Information Conflicts: Conflicting reports, especially from credible financial regulatory sites, point to an alarming lack of clarity regarding the brokers licensing and regulatory framework. This situation underscores the profound risks involved in engaging with such a broker.

User Self-Verification Guide:

Always check with authoritative regulatory sites like NFA's BASIC database to confirm broker legitimacy.

Research the broker on third-party review sites to gather user feedback.

Check the dates and details in complaints to discern if ongoing issues are being addressed.

Analyze the broker's geographic location and the regulatory body that oversees it.

Verify other user experiences and their withdrawal success rates.

Industry Reputation and Summary: User feedback is overwhelmingly negative—many express frustration over security and fund withdrawal issues.

“I struggled for weeks just trying to withdraw my funds, only to get excuse after excuse.”

This quote reflects the broader sentiment around scameds questionable reputation. Overall, it is critical for users to perform due diligence in verifying the authenticity and trustworthiness of any broker before investing.

Trading Costs Analysis

The double-edged sword effect

The brochure appeal of scamed Centers around its low commission structure and attractive trading conditions.

Advantages in Commissions: Many users highlight low commission rates when engaging in trades. This can be an enticing feature for new traders looking to minimize upfront costs.

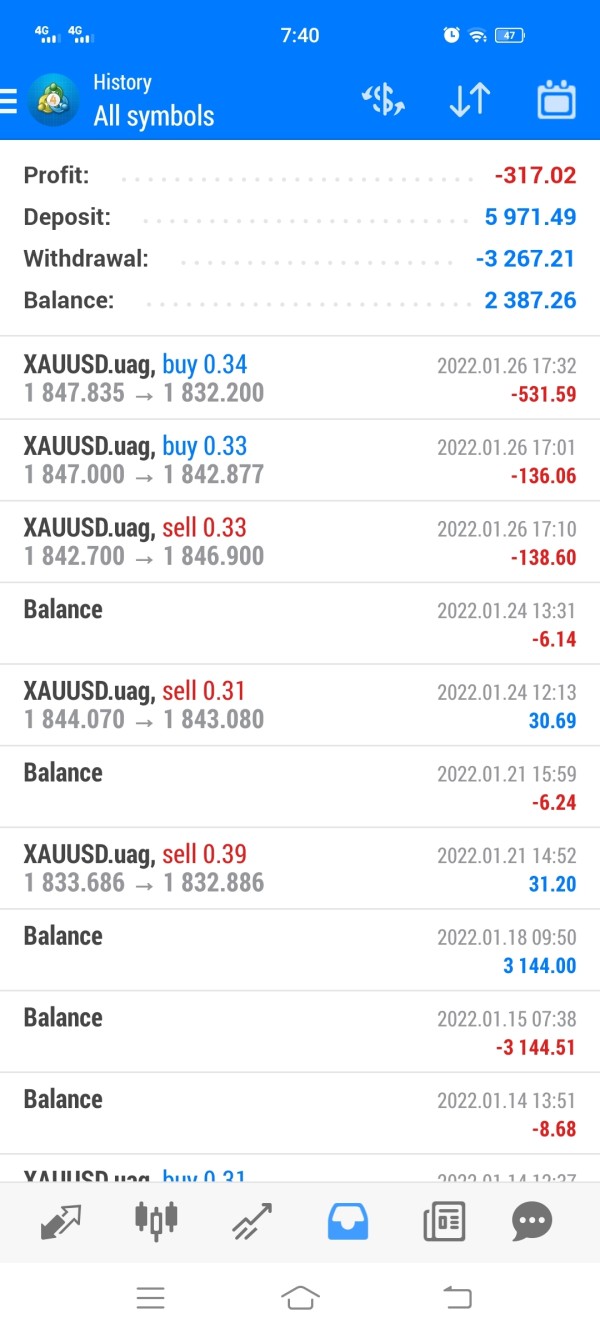

The "Traps" of Non-Trading Fees: However, numerous negative reviews have surfaced from accounts noting exorbitant withdrawal fees of $40 or higher and other hidden charges. As one user stated,

I was shocked to see a $30 withdrawal fee worded in the T&C as ‘transaction fee’. It felt deceptive."

- Cost Structure Summary: While the low commission fees attract beginners, when factoring in hidden costs associated with withdrawals, scamed becomes less appealing for those serious about trading. For novice traders focused primarily on cost, the overall structure might initially appear beneficial, but hidden fees reveal a more complex picture.

Professional depth vs. beginner-friendliness

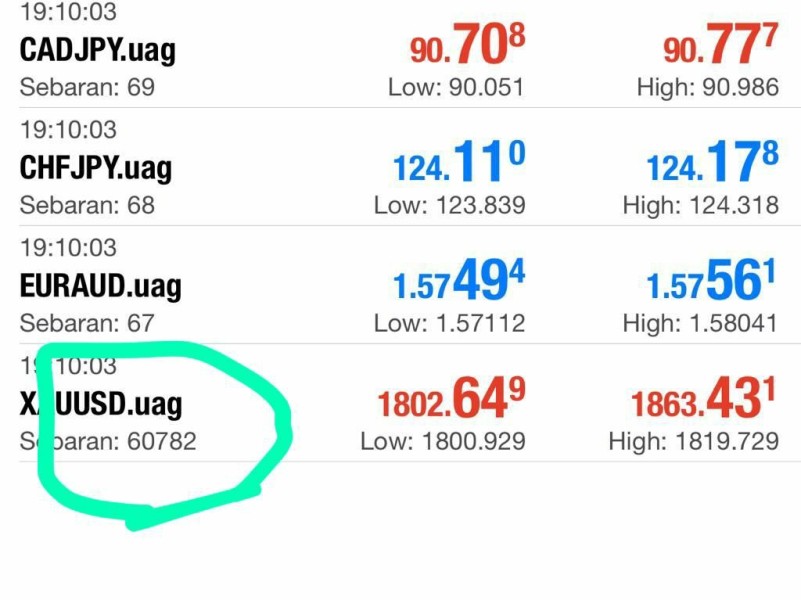

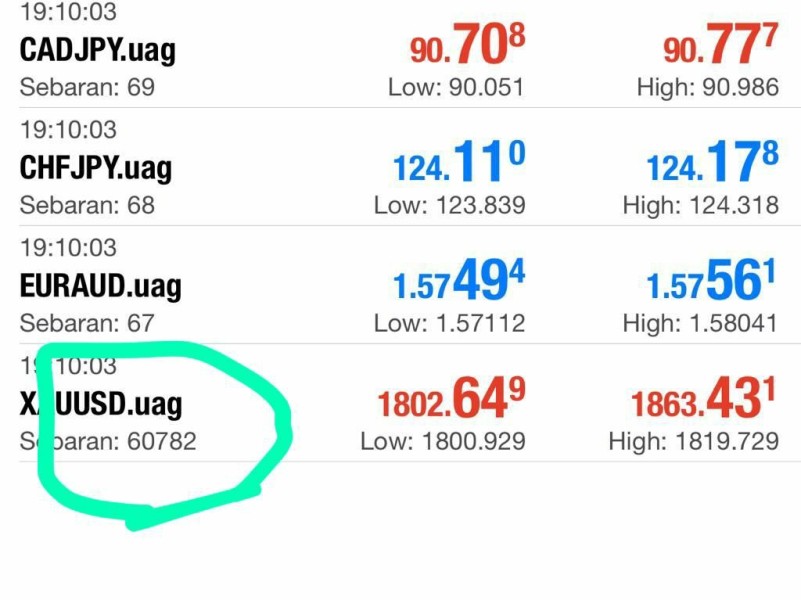

Platform Diversity: scamed claims to offer industry-leading platforms such as MT5, aimed at both beginner and advanced trading environments. However, external reviews often criticize the usability and functionality necessary for serious traders.

Quality of Tools and Resources: The available resources are limited, lacking advanced educational materials or analytical tools necessary for informed trading. Many users reported a deficiency in charting tools, which is critical for monitoring market conditions effectively.

Platform Experience Summary: User feedback frequently mentions poor experience and buggy interfaces. As one trader shared,

It feels unprofessional and outdated, not what I expect from a trading platform."

This sentiment emphasizes that scamed lacks the necessary infrastructure to support serious traders, ultimately affecting overall performance and user satisfaction.

User Experience Analysis

The attraction-repulsion chemistry

Onboarding and Accessibility: User reviews indicate an easy onboarding process that promotes initial interest. However, this is often coupled with a lack of adequate support post-signup, leading to frustration.

Platform Functionality and Usability: While the platform's interface appears user-friendly, the hidden fees and cumbersome withdrawal processes deter seamless user experiences.

General Sentiment: Participants in the trading community widely report dissatisfaction, with several expressing a reluctance to recommend the platform due to compounded transaction frustrations.

Customer Support Analysis

Offering help behind closed doors

Accessibility of Support: Many users cite difficulty in reaching customer support, with long wait times and unresponsive service.

Resolution of Issues: Feedback reveals an overall lack of effective resolutions to common trader issues.

Testimonials of Delay:

Every time I needed help, it felt like I was talking to a wall."

Account Conditions Analysis

Trading conditions that raise eyebrows

Withdrawal Processes: Multiple reports indicate that withdrawals are often met with significant delays. Users express growing frustration over the lack of clarity surrounding fees that are not explicitly stated upon signup.

Hidden Fees: Apart from high withdrawal fees, several users reported unexplained charges detracting from their trading budget.

Narrow User Preferences: Given the non-transparent nature relative to account conditions, traders who value flexibility or clear terms should approach scamed with caution.

Conclusion: Final Thoughts on scamed

In summary, while the scamed broker may entice novice traders with its low-cost trading options and high returns, serious risks loom due to its lack of regulatory oversight, compounded by troubling user experiences. Those considering investing through this broker should thoroughly weigh the benefits against the considerable drawbacks and prioritize due diligence in their investment decisions for the safeguarding of their funds.