Regarding the legitimacy of STC Trade forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is STC Trade safe?

Pros

Cons

Is STC Trade markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

CWG Markets Ltd

Effective Date:

2018-07-02Email Address of Licensed Institution:

support@cwgmarkets.co.uk, complaints@cwgmarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.cwgmarkets.co.ukExpiration Time:

--Address of Licensed Institution:

76 Cannon Street 3rd Floor London EC4N 6AE UNITED KINGDOMPhone Number of Licensed Institution:

+442039471777Licensed Institution Certified Documents:

Is STC Trade a Scam?

Introduction

STC Trade is an online forex broker that has garnered attention in the foreign exchange market, particularly among traders looking for accessible trading platforms. Registered in Canada, the broker claims to offer a variety of financial instruments and trading options. However, the rise of online trading has also led to a proliferation of unregulated and potentially fraudulent brokers, making it essential for traders to carefully evaluate the legitimacy of any trading platform before committing their funds. In this article, we will investigate whether STC Trade is safe or a scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

Our investigation is based on a thorough analysis of various reports, user reviews, and regulatory information. We will employ a structured framework to assess STC Trades credibility and safety for potential investors.

Regulation and Legitimacy

The regulatory landscape is crucial for any forex broker, as it provides a framework for accountability and investor protection. A well-regulated broker is typically subject to strict oversight, which can help ensure that client funds are safeguarded and that the broker operates fairly. In the case of STC Trade, the regulatory situation appears concerning.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA (Clone) | 785129 | United Kingdom | Suspicious |

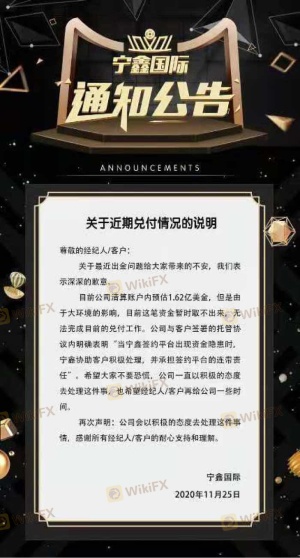

STC Trade has been associated with a suspicious clone of the FCA-regulated entity CWG Markets Ltd. This raises significant red flags regarding its legitimacy. Furthermore, several reports indicate that STC Trade has been listed as a scam broker, with a low rating of 1.40/10 on platforms like WikiFX. The lack of a valid regulatory license and the history of complaints against the broker suggest that it may not be a safe option for traders.

The quality of regulation is paramount; the FCA is known for its strict requirements, but the clone status implies that STC Trade may not adhere to such standards. Consequently, the absence of robust regulatory oversight raises questions about the safety of funds deposited with STC Trade.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its credibility. STC Trade, operating as STC Trade Development Limited, was established in Canada and has been active for approximately 2 to 5 years. However, information about the company's ownership and management team is scarce, which is concerning for potential investors.

There is little transparency regarding the company's operational history, and reports indicate that the broker's website has been inaccessible, further complicating the investigation into its legitimacy. The absence of a verifiable physical office location, as highlighted by on-site investigations, suggests that STC Trade may not have a genuine business infrastructure.

Moreover, the lack of clear communication and information disclosure from the management team raises significant concerns about the broker's transparency. Potential investors should be wary of engaging with a company that lacks a solid foundation and transparency, as it can be indicative of deeper issues.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential, as they directly impact the profitability and ease of trading. STC Trade claims to offer competitive trading conditions; however, scrutiny reveals potential issues that traders should consider.

| Fee Type | STC Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

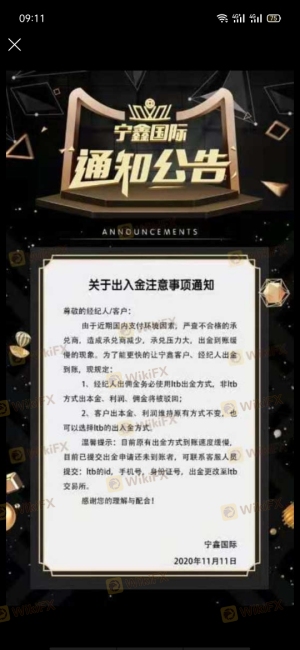

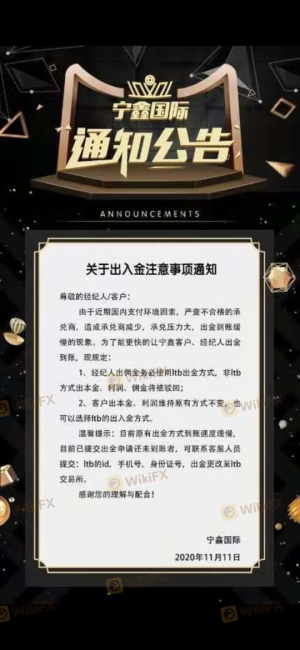

While the specific fees and spreads charged by STC Trade are not readily available, reports indicate that users have experienced unexpected fees and withdrawal issues. This lack of clarity in fee structures can be a significant concern for traders, as hidden charges can erode profits and lead to dissatisfaction.

Moreover, the platform has been reported to engage in practices that may not align with industry standards, which further complicates the evaluation of its trading conditions. Traders should ensure they fully understand the fee structures before engaging with STC Trade to avoid potential pitfalls.

Client Fund Security

The security of client funds is a primary concern for any trader. STC Trade's approach to fund safety is critical in determining whether it is a safe option. Reports indicate that the broker does not have adequate measures in place to protect client funds, raising alarm bells for potential investors.

In terms of fund security, it is essential to evaluate whether the broker employs measures such as segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, STC Trade has not provided sufficient information on these critical aspects. The absence of clear policies regarding fund security can lead to significant risks for traders, especially in the event of financial difficulties faced by the broker.

Furthermore, historical complaints from clients about withdrawal issues and fund accessibility further highlight the potential risks associated with trading through STC Trade. Traders should prioritize brokers that have a proven track record of fund security and transparency.

Customer Experience and Complaints

Customer feedback is invaluable in assessing the reliability of a broker. Reviews and complaints about STC Trade reveal a troubling pattern of negative experiences among users. Many traders have reported issues related to withdrawals, with claims that the broker has made it difficult or impossible to access their funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

The most common complaints include inability to withdraw funds, lack of responsiveness from customer support, and issues with account management. These issues not only indicate potential operational inefficiencies but also raise questions about the broker's commitment to customer service.

Several users have shared their experiences on forums, detailing their frustrations with STC Trade's customer support and withdrawal processes. For instance, one user reported being unable to withdraw their funds for weeks, while another highlighted the lack of communication from the support team.

Platform and Trade Execution

The performance of a trading platform is crucial for a successful trading experience. STC Trade employs the widely-used MetaTrader 4 platform, which is known for its functionality and user-friendly interface. However, the execution quality, slippage, and potential signs of manipulation are essential factors to consider.

While the platform is generally reliable, reports of execution issues and slippage have emerged from user reviews. Traders have noted instances of delayed order execution and difficulty in closing positions during volatile market conditions, which can significantly impact trading outcomes.

The lack of transparency regarding execution quality raises concerns about the overall reliability of the trading environment. Traders should remain cautious and consider these factors when evaluating whether STC Trade is safe for their trading activities.

Risk Assessment

Using STC Trade presents several risks that traders should carefully consider. The combination of regulatory concerns, customer complaints, and unclear trading conditions contributes to an overall risk profile that may not be suitable for all traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation raises concerns. |

| Fund Security Risk | High | Insufficient measures to protect client funds. |

| Customer Service Risk | Medium | Poor response to complaints and issues. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with STC Trade. It is advisable to consider alternative brokers with better regulatory oversight and proven track records in customer service and fund security.

Conclusion and Recommendations

In conclusion, the investigation into STC Trade raises significant concerns regarding its legitimacy and safety as a trading platform. The combination of a suspicious regulatory status, lack of transparency, poor customer feedback, and unresolved complaints suggests that traders should exercise caution when considering this broker.

While STC Trade may offer some trading opportunities, the potential risks associated with using this platform are substantial. Traders are advised to seek alternatives that have proven regulatory compliance, robust fund protection measures, and a solid reputation for customer service.

For those considering forex trading, reputable brokers such as OANDA, IG, or Forex.com may present safer options. Always prioritize due diligence and research to ensure a secure trading experience. Ultimately, the question remains: Is STC Trade safe? The evidence suggests that it may not be the best choice for traders seeking a reliable and secure trading environment.

Is STC Trade a scam, or is it legit?

The latest exposure and evaluation content of STC Trade brokers.

STC Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

STC Trade latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.