Is TradeTIME safe?

Pros

Cons

Is Tradetime A Scam?

Introduction

Tradetime is a forex broker that has attracted attention within the trading community for its range of trading options and competitive conditions. Operating primarily as an offshore entity, it claims to provide access to a wide array of financial instruments, including forex, commodities, stocks, indices, and cryptocurrencies. However, the offshore nature of its registration raises significant concerns about its reliability and trustworthiness. As traders increasingly seek to navigate the complex landscape of online trading, it is crucial to conduct thorough evaluations of brokers like Tradetime. This article aims to provide an objective assessment of Tradetime's legitimacy and safety by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

Regulation and Legitimacy

Regulatory oversight is a cornerstone of a broker's credibility, ensuring that it adheres to industry standards and protects customer interests. Tradetime is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory framework. This raises questions about the broker's commitment to maintaining a secure trading environment.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | N/A | Vanuatu | Unverified |

The Vanuatu Financial Services Commission (VFSC) is often criticized for its lack of stringent regulatory requirements, allowing brokers to operate with minimal oversight. Comparatively, more reputable jurisdictions like the UK‘s Financial Conduct Authority (FCA) and Australia’s Australian Securities and Investments Commission (ASIC) impose strict regulations, including minimum capital requirements and regular audits. The absence of robust regulatory oversight for Tradetime suggests a higher risk for traders, as they may not have access to the same level of investor protection.

Company Background Investigation

Tradetime is owned by Alman Dex Group Ltd, which operates under a vague corporate structure. The company's history indicates that it has undergone several changes in registration and operational addresses, often moving to different jurisdictions to escape scrutiny. This lack of transparency raises red flags about its operational integrity and accountability.

The management team behind Tradetime is not well-documented, and there is limited information available regarding their qualifications or industry experience. This lack of transparency can be concerning for potential clients who seek assurance that they are dealing with a knowledgeable and competent team. Furthermore, the company's communication regarding its operations and management is often unclear, which can further erode trust among prospective traders.

Trading Conditions Analysis

Tradetime's trading conditions include a variety of account types and fee structures. However, the overall cost of trading with Tradetime may not be as competitive as it initially appears.

| Fee Type | Tradetime | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.0 pips | 0.6 pips |

| Commission Model | $10 per lot (Raw Account) | $4 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Tradetime are relatively high compared to industry standards, particularly for major currency pairs. Additionally, the commission structure may not be favorable for traders who are looking for low-cost trading options. Reports indicate that clients have faced unexpected fees, which can complicate the overall trading experience and lead to frustration.

Client Fund Security

The safety of client funds is paramount in the trading industry, and Tradetime's measures in this regard warrant careful examination. The broker claims to implement fund segregation, meaning that client funds are kept separate from the company's operational funds. However, the effectiveness of these measures is questionable given the lack of regulatory oversight.

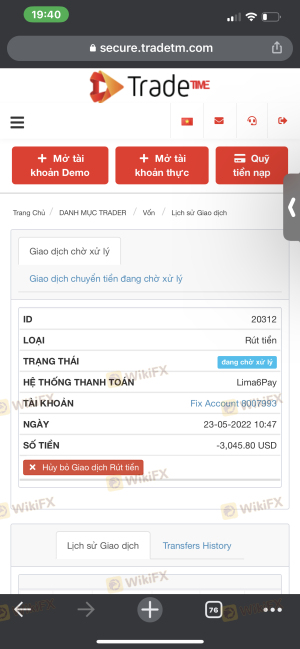

Furthermore, Tradetime does not participate in any investor compensation schemes, which means that in the event of insolvency, clients may not have any recourse to recover their funds. Historical complaints from traders about difficulties in withdrawing funds further highlight potential issues regarding the safety of client capital.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Reviews of Tradetime reveal a pattern of complaints, primarily focused on withdrawal issues and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| High Pressure Sales Tactics | Medium | Minimal |

| Account Blocking | High | Unresponsive |

Many clients have reported being unable to withdraw their funds, with some stating that their accounts were blocked without explanation. This has led to significant dissatisfaction and accusations of fraud against the broker. Additionally, the company's response to these complaints has often been lackluster, with many traders feeling ignored or dismissed.

Platform and Trade Execution

Tradetime offers a proprietary trading platform alongside the widely-used MetaTrader 4 (MT4). While the MT4 platform is known for its reliability and advanced features, the proprietary platform has received mixed reviews concerning its performance and stability.

Traders have reported issues with order execution, including slippage and rejected orders, which can adversely affect trading outcomes. The absence of clear evidence regarding the broker's execution quality raises concerns about potential manipulation or unfair practices.

Risk Assessment

Engaging with Tradetime entails a range of risks that traders should be aware of before making a decision.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of robust oversight increases the risk of fraud. |

| Fund Security Risk | High | Absence of compensation schemes and reports of withdrawal issues. |

| Customer Service Risk | Medium | Poor response to complaints and high-pressure sales tactics. |

To mitigate these risks, traders should conduct thorough research, consider using regulated alternatives, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tradetime is not a safe broker. Its offshore registration, lack of robust regulatory oversight, and numerous complaints from clients raise significant concerns about its legitimacy. Potential traders should exercise extreme caution when considering this broker.

For those looking for a reliable trading experience, it is advisable to choose brokers regulated by reputable authorities such as the FCA or ASIC. Alternatives like FP Markets or IG Group may provide safer trading environments with better customer protections. Always ensure to conduct due diligence and assess the risks before engaging with any trading platform.

In summary, is Tradetime safe? The overwhelming consensus points to the conclusion that it poses significant risks, and traders should be wary of engaging with this broker.

Is TradeTIME a scam, or is it legit?

The latest exposure and evaluation content of TradeTIME brokers.

TradeTIME Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradeTIME latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.