Is STORM AGE CAPITAL safe?

Business

License

Is Storm Age Capital A Scam?

Introduction

Storm Age Capital is a relatively new player in the forex market, having been established in 2022. It positions itself as a platform offering a wide range of trading options, including forex, commodities, indices, and shares. However, the rapid growth of online trading has led to an influx of brokers, making it imperative for traders to carefully evaluate the legitimacy and reliability of these platforms. As the forex market is rife with potential scams, traders must be vigilant and conduct thorough research before investing their hard-earned money.

In this article, we will analyze the credibility of Storm Age Capital through various lenses, including its regulatory status, company background, trading conditions, and customer feedback. Our investigation is based on a comprehensive review of online sources, including user testimonials and expert analyses, ensuring a balanced and factual assessment of the broker's operations.

Regulation and Legitimacy

One of the cornerstones of a trustworthy forex broker is its regulatory status. Regulation serves to protect traders by ensuring that brokers adhere to strict financial guidelines and practices. Unfortunately, Storm Age Capital is unregulated, which raises significant concerns about its legitimacy. Below is a summary of its regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001295630 | Australia | Revoked |

The above table indicates that Storm Age Capital claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, further investigation reveals that its license has been revoked, rendering its regulatory status questionable at best. The absence of a valid license means that there is no oversight or accountability, which is a significant red flag for potential investors. Without regulation, traders are left vulnerable to potential fraud or mismanagement of funds.

Company Background Investigation

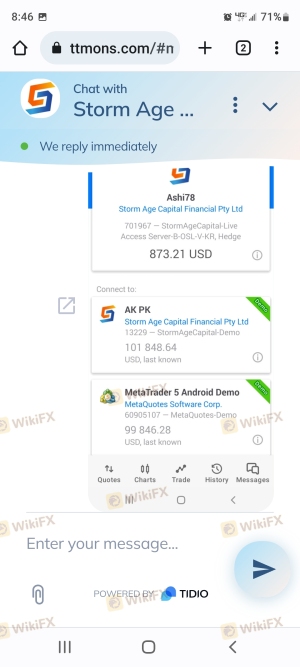

Storm Age Capital is operated by a company named Storm Age Capital Financial Pty Ltd. However, the lack of transparency surrounding the companys ownership structure and management is alarming. There is little information available about the company's history, development, or the qualifications of its management team. This opacity raises concerns about the broker's trustworthiness and operational integrity.

The company's website does not provide any contact information, such as a physical address, phone number, or email, making it difficult for potential clients to reach out for inquiries or support. This lack of transparency is a common characteristic of scam brokers, and it significantly undermines the credibility of Storm Age Capital.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its reliability. Storm Age Capital claims to provide competitive spreads and a user-friendly trading platform, but the specifics are largely unclear. The brokers fee structure remains ambiguous, which can lead to unexpected costs for traders. Below is a comparison of core trading costs:

| Fee Type | Storm Age Capital | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | Unknown | 1-2 pips |

| Commission Model | Unknown | Varies |

| Overnight Interest Range | Unknown | Varies |

The absence of clear information regarding fees and spreads is concerning. Traders typically expect transparency about trading costs, including spreads and commissions. The lack of this information suggests that Storm Age Capital may not be forthcoming about its pricing structure, which could lead to unexpected financial burdens for traders.

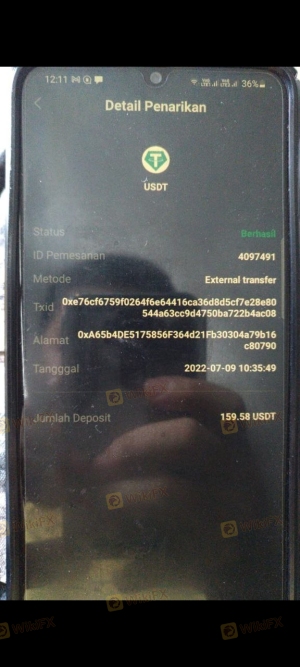

Client Fund Security

The security of client funds is paramount when choosing a forex broker. Storm Age Capital does not provide adequate information about its fund security measures. There is no indication of whether client funds are segregated from the broker's operational funds, which is a standard practice among regulated brokers. Without this safeguard, traders' investments could be at risk in the event of the broker's insolvency.

Moreover, the absence of investor protection schemes, such as those provided by regulatory bodies, further exacerbates the risks associated with trading with Storm Age Capital. Historical data on fund security issues or disputes involving the broker is also lacking, which could indicate potential problems that have gone unreported.

Customer Experience and Complaints

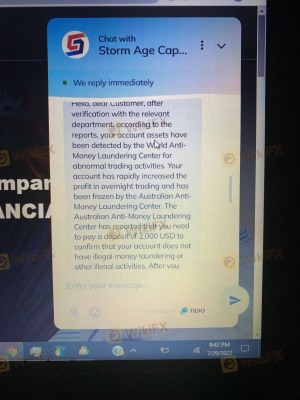

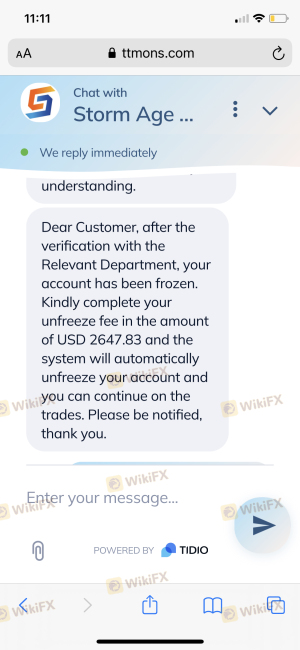

Customer feedback is an invaluable resource for assessing a broker's reliability. Unfortunately, the reviews for Storm Age Capital are largely negative. Many users report issues with withdrawals, claiming that the broker imposes excessive fees or delays in processing requests. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | High | Poor |

| Customer Support Delays | Medium | Poor |

Numerous complaints highlight a pattern of difficulties in accessing funds, which is a significant concern for any potential investor. For example, one user reported being unable to withdraw their funds after multiple requests, only to be met with excuses and additional fees. Such experiences raise alarms about the broker's operational integrity and commitment to customer service.

Platform and Trade Execution

A broker's trading platform is a critical component of the trading experience. Storm Age Capital claims to offer a dedicated trading platform, but many users report that it is often inaccessible or unreliable. The quality of order execution, including slippage and rejection rates, is also a key concern.

If traders are unable to execute trades efficiently, it can lead to significant financial losses. Reports of platform manipulation, where the broker may artificially influence trading outcomes, further complicate the reliability of Storm Age Capital's trading environment.

Risk Assessment

Engaging with Storm Age Capital comes with a multitude of risks. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status with revoked license. |

| Fund Security Risk | High | Lack of transparency regarding fund segregation. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

Given these risks, potential traders should exercise extreme caution. It is advisable to conduct thorough research and consider alternative brokers that offer robust regulatory oversight and transparent operations.

Conclusion and Recommendations

In summary, the evidence strongly suggests that Storm Age Capital poses significant risks to potential investors. The unregulated status, lack of transparency, and numerous complaints about withdrawal issues indicate that this broker may not be a safe option for trading. While some traders may be attracted by the promise of competitive spreads and diverse trading options, the underlying risks far outweigh the potential benefits.

For traders seeking a reliable forex trading experience, it is recommended to consider alternative brokers that are regulated by reputable authorities. Look for platforms that offer clear information about fees, robust customer support, and a proven track record of fund security. In light of the findings, it is prudent to approach Storm Age Capital with caution and consider other options to safeguard your investments.

Is STORM AGE CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of STORM AGE CAPITAL brokers.

STORM AGE CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

STORM AGE CAPITAL latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.