Tradetime 2025 Review: Everything You Need to Know

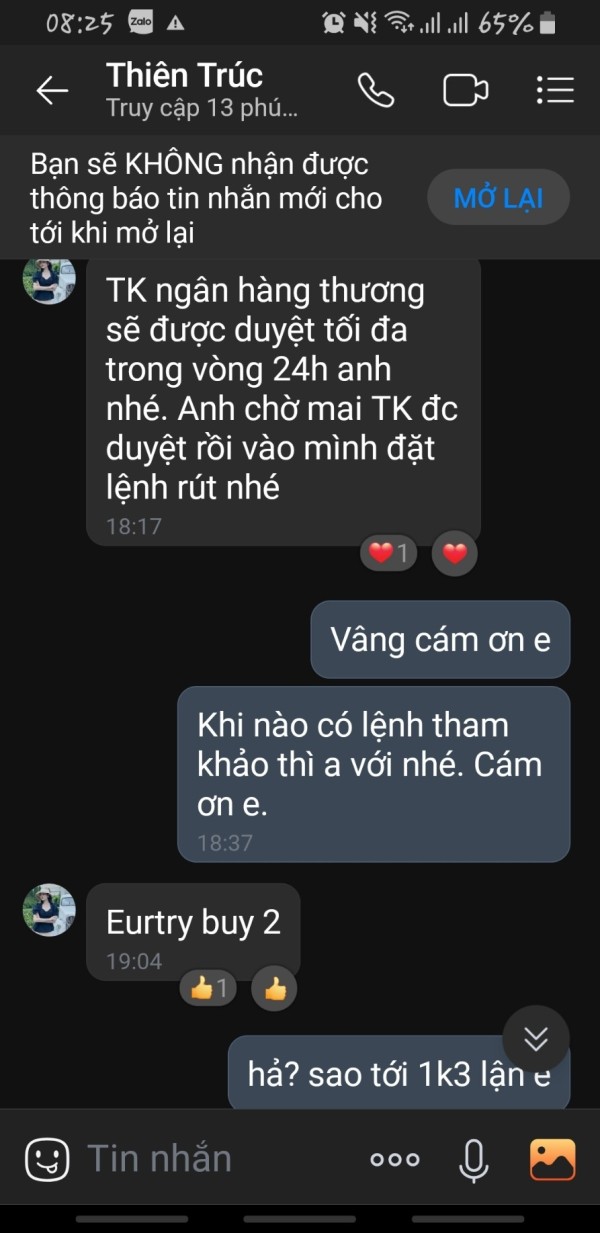

Tradetime has garnered significant attention in the forex trading community, but opinions on the broker are sharply divided. This review highlights both the positive aspects and the numerous concerns raised by traders and experts alike. While Tradetime claims to offer a wide range of trading tools and personalized services, many users report serious issues with withdrawals and overall trustworthiness.

Note: It's important to consider that Tradetime operates across different jurisdictions, which may complicate regulatory oversight and affect user experiences. This review aims to present a balanced view based on various sources to ensure fairness and accuracy.

Ratings Overview

We rate brokers based on user feedback, expert analysis, and available data.

Broker Overview

Founded in 2010, Tradetime is an offshore forex broker that claims to provide access to a variety of financial instruments, including forex, commodities, stocks, indices, and cryptocurrencies. The broker operates using the proprietary trading platform as well as the widely used MetaTrader 4 (MT4). Despite its claims of being regulated by the Vanuatu Financial Services Commission (VFSC), many sources indicate that the broker lacks adequate regulatory oversight, raising concerns about its legitimacy.

Detailed Section

Regulatory Status and Geographic Coverage

Tradetime claims to be regulated by the VFSC, which is considered a weaker regulatory authority compared to first-tier regulators like the FCA in the UK or ASIC in Australia. The lack of stringent oversight has led to numerous complaints from users regarding withdrawal issues and overall account safety. Reports indicate that the broker primarily targets clients from regions such as the UK, Australia, and New Zealand without proper licensing.

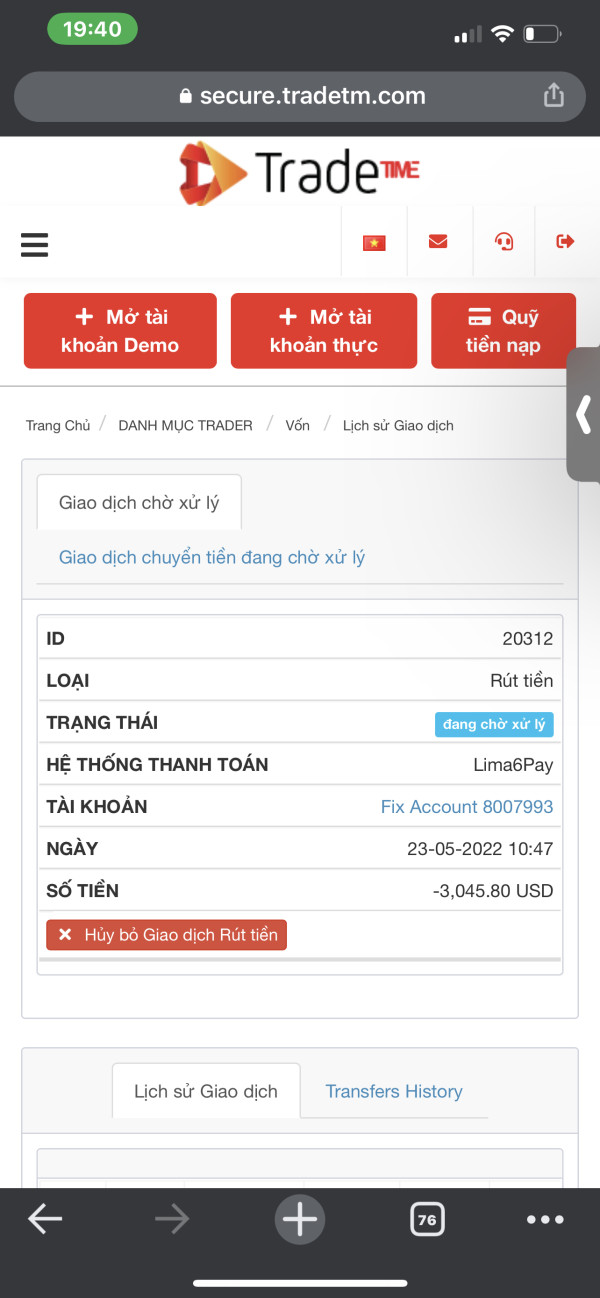

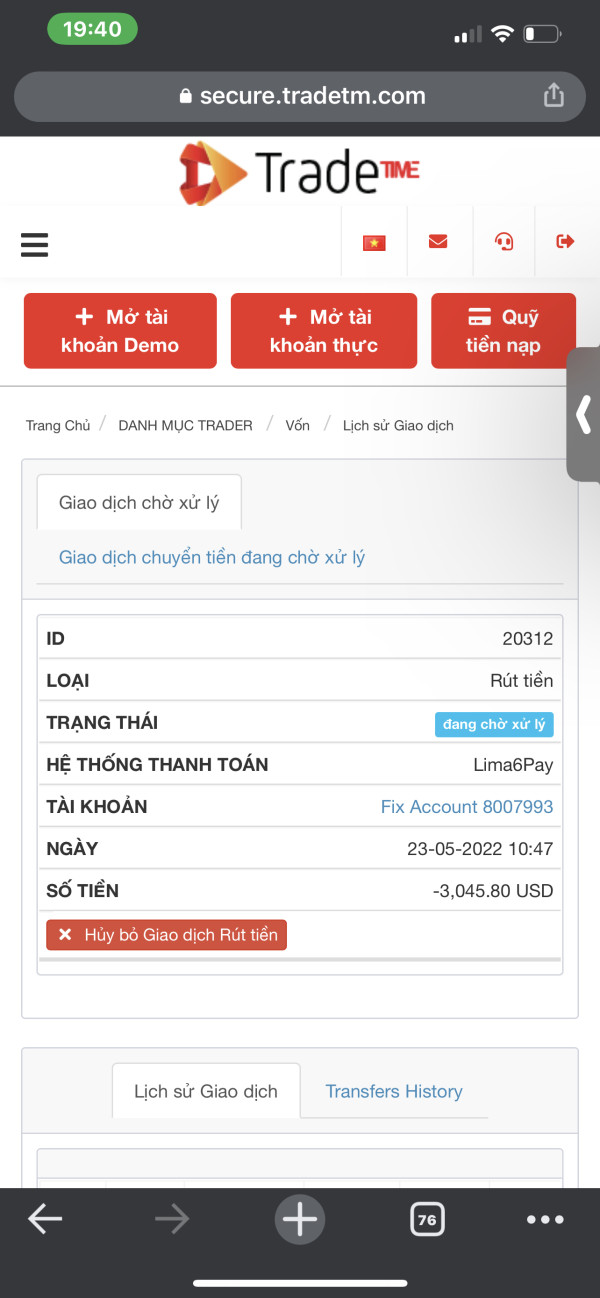

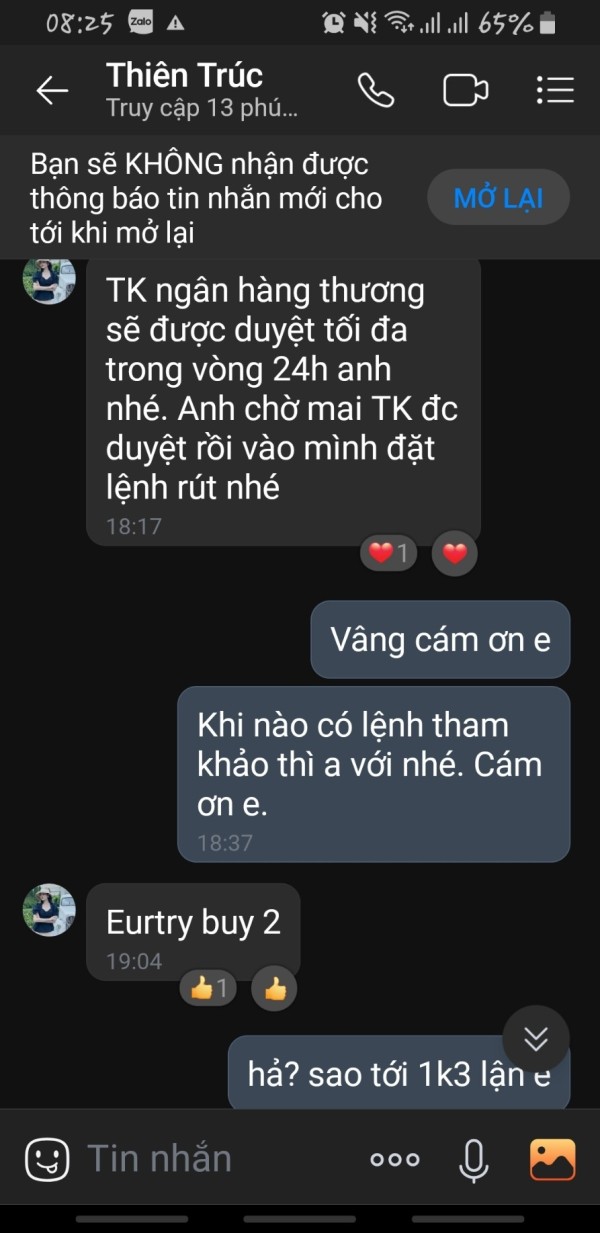

Deposit and Withdrawal Methods

Tradetime supports various deposit methods, including credit cards, debit cards, and e-wallets like Neteller and Skrill. However, the specifics regarding minimum deposit amounts are inconsistent, with some sources citing a minimum deposit of $250, while others mention $500. Withdrawals have been a significant concern, with many users reporting difficulties in retrieving their funds, often citing vague excuses from customer support.

Minimum Deposit

The minimum deposit requirement reportedly varies, with figures ranging from $250 to $500. This inconsistency can be confusing for potential traders. Furthermore, the high entry point may deter new traders who are looking to start with a smaller investment.

Tradetime offers various promotional bonuses, including a welcome bonus for new clients. However, the terms surrounding these promotions are often criticized for being misleading, with some users claiming that they are unable to withdraw funds once they have accepted a bonus.

Tradable Asset Classes

Tradetime claims to provide access to over 490 tradable instruments across multiple asset classes, including more than 60 currency pairs, commodities like gold and silver, and various indices. However, the actual availability of these assets has been questioned, with some users noting that the asset list appears incomplete.

Costs (Spreads, Fees, Commissions)

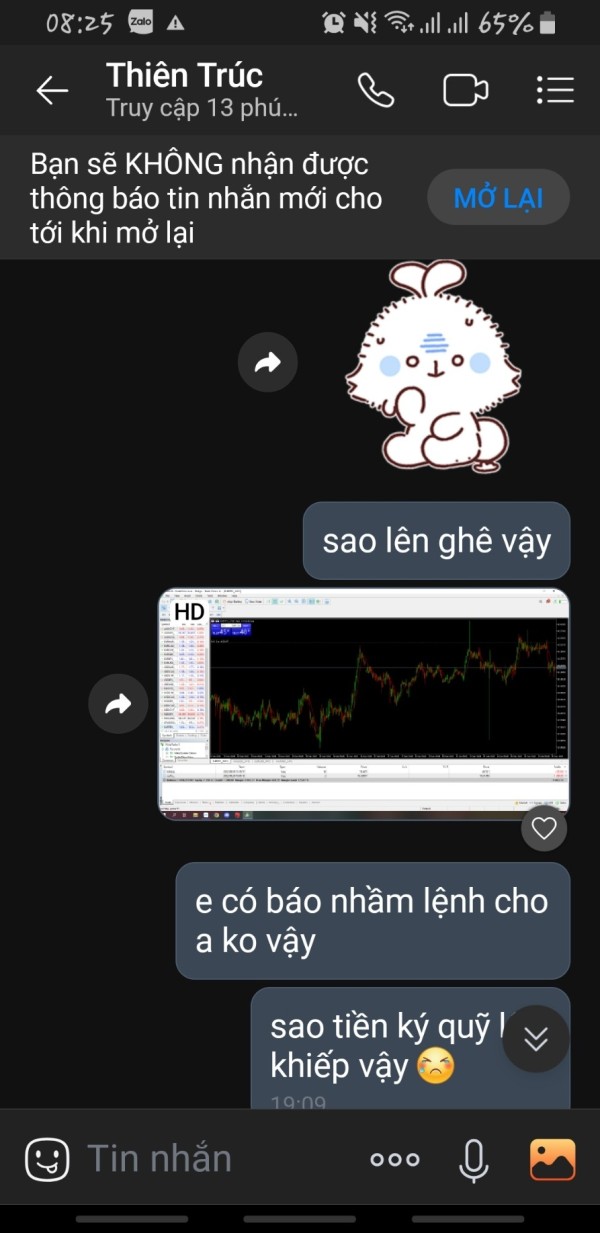

The cost structure at Tradetime is a major point of contention. Reports indicate that spreads can be quite high, with some accounts experiencing spreads starting at 3.3 pips for major forex pairs. Additionally, commission fees apply to certain account types, which can further erode profitability for traders.

Leverage Options

Tradetime offers leverage of up to 1:1000, which can amplify both potential gains and losses. While high leverage can be appealing to experienced traders, it also poses significant risks, especially for inexperienced traders who may not fully understand the implications.

Tradetime provides access to its proprietary trading platform and the popular MT4. While the proprietary platform is designed for ease of use, it lacks some advanced features available on MT4, such as automated trading capabilities. This limitation may deter traders who rely on algorithmic trading strategies.

Restricted Regions

Tradetime does not accept clients from certain regions, including the United States, Canada, and several other countries. This restriction is important for potential clients to consider, as it may limit their ability to open an account.

Available Customer Service Languages

Customer support at Tradetime is reportedly available in multiple languages, including English, Arabic, French, and Italian. However, user experiences with customer service have been largely negative, with many citing long response times and ineffective support.

Repeat Ratings Overview

Detailed Breakdown

-

Account Conditions: The minimum deposit is inconsistent, with sources reporting amounts between $250 and $500. Account types are available, but the lack of clarity on terms and conditions raises concerns.

Tools and Resources: Tradetime provides a proprietary platform and MT4, but lacks advanced trading features and educational resources, leaving traders wanting more.

Customer Service: Reports of inadequate support and long wait times for responses significantly impact user satisfaction.

Trading Experience: High spreads and commissions can hinder trading profitability, while leverage options may appeal to some but pose risks to others.

Trustworthiness: The lack of robust regulatory oversight and numerous negative user experiences lead to a low trust rating for Tradetime.

User Experience: Overall user experiences are mixed, with many traders reporting issues with withdrawals and account management.

In conclusion, while Tradetime presents itself as a versatile trading platform, the overwhelming concerns regarding its regulatory status, customer service, and withdrawal processes suggest that potential traders should exercise caution. The negative feedback from users and experts alike raises significant red flags about the broker's reliability and trustworthiness. Before investing with Tradetime, thorough research and consideration of alternative, well-regulated brokers are highly recommended.