Is TradersKing safe?

Business

License

Is TradersKing Safe or Scam?

Introduction

TradersKing is a forex and binary options broker that has garnered attention in the trading community for its various offerings. Established in 2010 and headquartered in the Netherlands, the broker claims to provide a platform for all types of traders, catering to both novice and experienced investors. However, the need for traders to exercise caution when selecting a forex broker cannot be overstated. The forex market is rife with scams and unregulated entities, making it essential for traders to conduct thorough due diligence before committing their funds.

This article aims to assess the safety and legitimacy of TradersKing by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The investigation draws on multiple sources, including regulatory databases, user reviews, and expert analyses to provide a comprehensive overview of whether TradersKing is safe or a potential scam.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a critical factor in determining its legitimacy. TradersKing, unfortunately, presents a concerning picture in this regard. The broker is not regulated by any recognized financial authority, which raises significant red flags for potential investors. The absence of regulation means that there is no oversight to ensure that the broker adheres to industry standards or protects client funds.

Here is a summary of the regulatory information for TradersKing:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation from reputable bodies such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) is alarming. Both of these regulators have issued warnings against unregulated brokers, indicating that TradersKing falls into this category. Without regulatory oversight, traders are vulnerable to potential fraud and mismanagement of their funds.

The quality of regulation is paramount; brokers overseen by high-tier regulators must meet stringent requirements, including minimum capital reserves and regular audits. TradersKing's absence from these regulatory frameworks suggests a lack of accountability, making it imperative for traders to question, Is TradersKing safe?

Company Background Investigation

TradersKing is operated by Lotens Partners Ltd., a company registered in St. Vincent and the Grenadines. The company's history is relatively short, having been established in 2010, yet it has already faced significant scrutiny. The ownership structure is opaque, with little information available about the individuals behind the company. This lack of transparency raises concerns regarding the integrity of the management team and their ability to operate a trustworthy trading platform.

Furthermore, the company's information disclosure practices are inadequate. Potential clients find it challenging to obtain critical details about the broker's operations, policies, and management. This opacity is a significant warning sign, as reputable brokers typically provide comprehensive information about their ownership, management, and operational practices.

The absence of a transparent corporate structure and the inability to verify the management team's credentials further exacerbate concerns about the broker's legitimacy. Thus, traders must consider whether they can trust a broker with such a dubious background. Given these factors, the question remains, Is TradersKing safe?

Trading Conditions Analysis

TradersKing advertises a variety of trading instruments, including forex, commodities, and cryptocurrencies. However, the trading conditions offered by the broker raise additional concerns. The fee structure appears to be less favorable compared to industry standards, which can significantly impact traders' profitability.

Here is a comparison of core trading costs associated with TradersKing:

| Fee Type | TradersKing | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.9 pips | 1.0-1.5 pips |

| Commission Model | None | Varies by broker |

| Overnight Interest Range | High | Moderate |

The spreads offered by TradersKing are notably higher than the industry average, which could erode potential profits for traders. Additionally, the lack of a clear commission structure raises questions about hidden fees that might be applied to trades. Such practices are common among unregulated brokers, who may impose unexpected charges to maximize their revenue at the expense of traders.

In evaluating whether TradersKing is safe, the unfavorable trading conditions and lack of transparency about fees are significant factors that potential clients should consider carefully.

Customer Fund Security

The safety of customer funds is a paramount concern for any trader. TradersKing's approach to fund security is troubling, as the broker does not provide adequate assurances regarding the protection of client assets. The absence of regulatory oversight means that there are no mandated measures in place to safeguard traders' funds.

Key considerations regarding fund security include:

- Segregation of Funds: It is unclear whether TradersKing segregates client funds from its operational accounts, a practice that is crucial for protecting traders' assets in the event of bankruptcy or financial mismanagement.

- Investor Protection: The lack of investor protection schemes, such as those offered by regulated brokers, means that traders have no recourse in the event of fraud or insolvency.

- Negative Balance Protection: There is no indication that TradersKing offers negative balance protection, which would prevent traders from losing more than their initial investment.

Given these deficiencies, the question of Is TradersKing safe? becomes increasingly pertinent. Traders should be wary of entrusting their funds to a broker that lacks robust security measures.

Customer Experience and Complaints

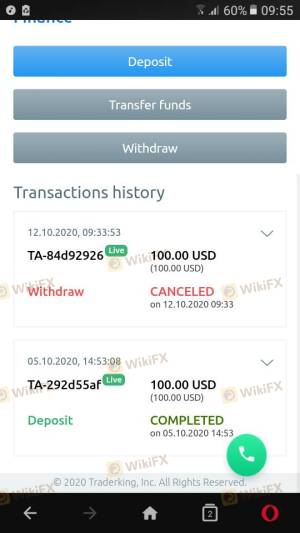

Customer feedback is an invaluable resource in assessing a broker's reliability. Reviews and complaints regarding TradersKing paint a concerning picture. Many users have reported difficulties in withdrawing funds, a common issue among unregulated brokers. Such complaints often include claims of delayed withdrawals, unresponsive customer service, and pressure tactics to deposit more funds.

Here is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Misleading Information | High | None |

Typical cases involve traders who, after making initial deposits, find themselves unable to access their funds. Some users have reported that their accounts were auto-traded without their consent, leading to significant losses. These complaints indicate a troubling pattern of behavior that raises serious questions about the integrity of TradersKing.

Given the negative experiences shared by users, it is crucial to consider whether TradersKing is safe to trade with, especially for those who value timely access to their funds and reliable customer support.

Platform and Execution

The trading platform offered by TradersKing is another critical aspect to evaluate. While the broker claims to provide access to popular trading platforms like MetaTrader 4, the performance and reliability of these platforms have been questioned by users. Reports of slippage, high latency, and frequent disconnections have been common.

The quality of order execution is also a concern. Traders have noted instances of rejected orders and poor execution speeds, which can significantly affect trading outcomes. The lack of transparency regarding execution practices further complicates the assessment of whether TradersKing is a trustworthy broker.

In light of these issues, traders must weigh the potential risks associated with using TradersKing's platform. The question remains, Is TradersKing safe for traders who require a stable and reliable trading environment?

Risk Assessment

When considering whether to engage with a broker like TradersKing, it is essential to conduct a comprehensive risk assessment. The lack of regulation, dubious company background, unfavorable trading conditions, and negative customer experiences all contribute to a high-risk profile.

Here is a summary of the key risk areas associated with TradersKing:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | Poor fund security measures |

| Operational Risk | Medium | Platform performance issues |

| Customer Service Risk | High | Poor response to complaints |

Given these risks, it is crucial for potential clients to consider strategies for mitigating their exposure. This could include starting with a small deposit, thoroughly reviewing withdrawal policies, and seeking alternative brokers with better regulatory standing.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is clear that TradersKing poses significant risks for potential traders. The broker's lack of regulation, unfavorable trading conditions, and negative customer feedback collectively suggest that it may not be a safe choice for trading.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, or FXCM, which are overseen by stringent regulatory bodies, offer greater security and transparency.

In conclusion, traders should approach TradersKing with caution and consider whether TradersKing is safe for their trading needs. The evidence points to a broker that may not prioritize the safety and security of its clients, making it essential for traders to explore other options before committing their funds.

Is TradersKing a scam, or is it legit?

The latest exposure and evaluation content of TradersKing brokers.

TradersKing Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradersKing latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.