Is ZH INTER safe?

Pros

Cons

Is Zh Inter Safe or Scam?

Introduction

In the rapidly evolving world of Forex trading, Zh Inter has emerged as a player in the market, specifically positioned as a Forex brokerage based in Hong Kong. Established in 2021, the broker claims to offer a range of trading services, including popular trading platforms such as MetaTrader 4 and 5. However, as the Forex market becomes increasingly saturated, traders need to exercise caution when selecting a broker. The potential for scams and fraudulent practices is high, making it essential to evaluate the reliability and safety of any trading platform before committing funds.

This article aims to provide a comprehensive assessment of Zh Inter, utilizing a multi-faceted approach to evaluate its legitimacy. Our investigation will focus on regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment. By synthesizing both qualitative and quantitative data, we hope to clarify whether Zh Inter is safe for traders or if it raises red flags that warrant concern.

Regulation and Legitimacy

The regulatory framework within which a Forex broker operates is crucial for assessing its legitimacy. Regulatory bodies enforce rules and standards that protect traders from potential fraud and malpractice. In the case of Zh Inter, it has been confirmed that the brokerage operates without valid regulatory oversight. According to sources, Zh Inter is not authorized or regulated by any recognized financial authority, which raises significant concerns regarding its operational practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Hong Kong | Not Regulated |

The absence of regulatory oversight means that Zh Inter does not have to adhere to the stringent standards typically imposed on licensed brokers. This lack of regulation can lead to a higher risk of unethical practices, such as unjustified rejection of withdrawal requests or manipulation of trading conditions. Furthermore, the low score of 1.27/10 on platforms like WikiFX reinforces the notion that traders should approach this broker with extreme caution. Historical compliance issues and the absence of a regulatory safety net make it imperative for potential clients to consider these factors seriously.

Company Background Investigation

Zh Inter, officially known as Zh International Capital Pty Ltd, has a relatively short operational history, having been incorporated in 2021. The company is based in Hong Kong, a region known for its financial services, but this does not inherently guarantee safety or reliability. The ownership structure and transparency of the brokerage are also critical factors to consider. Unfortunately, detailed information about the management team or the ownership structure of Zh Inter is scarce, leading to questions about the company's accountability and operational integrity.

A lack of transparency in a brokerage can often indicate potential issues. The absence of publicly available information about the management team and their qualifications raises concerns about the professionalism and expertise behind the brokerage. Traders typically benefit from brokers that are open about their leadership and operational strategies. The inability to find any substantial information about Zh Inter's management further complicates the assessment of its credibility.

Trading Conditions Analysis

When evaluating a Forex broker, understanding the trading conditions they offer is paramount. Zh Inter claims to provide competitive spreads and leverage options; however, the specifics of these conditions remain unclear due to the temporary unavailability of their official website. It is crucial for traders to have a clear understanding of the fee structure and any potential hidden costs.

| Fee Type | Zh Inter | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information on trading conditions raises concerns about transparency and fairness. Traders should be wary of any broker that does not provide comprehensive details regarding their fee structure, as this could indicate potential hidden charges that could erode profits. Moreover, the absence of a well-defined commission model may lead to unexpected costs during trading, further complicating the trading experience.

Client Fund Safety

The safety of client funds is a critical consideration when choosing a Forex broker. Zh Inter's lack of regulatory oversight raises serious concerns about the measures in place to protect client funds. Generally, regulated brokers are required to keep client funds in segregated accounts, ensuring that traders' capital is protected even if the broker faces financial difficulties.

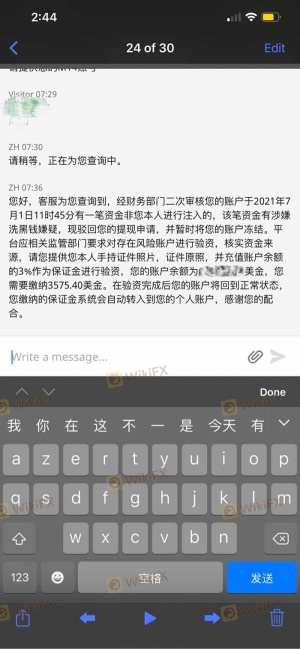

In the case of Zh Inter, there is no verifiable information available regarding their fund safety measures, such as whether they implement fund segregation or offer negative balance protection. This lack of transparency can pose significant risks to traders, especially in volatile market conditions. Historical issues related to fund safety, such as the rejection of withdrawal requests reported by users, further exacerbate these concerns. Without a solid assurance of fund safety, traders may be putting their capital at risk by engaging with this broker.

Customer Experience and Complaints

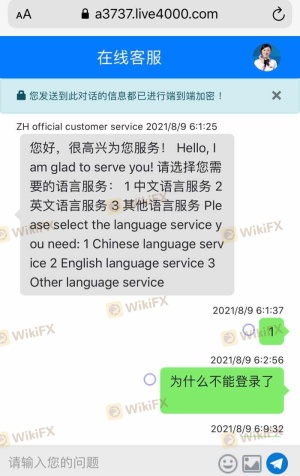

Customer feedback is often a reliable indicator of a broker's reliability and service quality. In the case of Zh Inter, multiple negative reviews have surfaced, indicating a troubling pattern of complaints. Users have reported issues with withdrawal requests being rejected and poor customer service responses, which are significant red flags for any potential investor.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Poor |

Typical cases include traders who have experienced significant delays in processing withdrawals, leading to frustration and financial strain. The inability to reach customer support channels adds another layer of concern, as effective communication is crucial in resolving issues that may arise during trading. When a broker fails to address customer complaints adequately, it raises questions about their commitment to client satisfaction and overall reliability.

Platform and Execution

The trading platform's performance is another vital aspect of evaluating a broker. A reliable platform should offer stability, speed, and user-friendly features to enhance the trading experience. Unfortunately, information regarding Zh Inter's platform performance remains limited due to the unavailability of their official website. Traders should be cautious if a broker does not provide clear and accessible information about their trading platform.

Additionally, concerns about order execution quality, slippage, and rejection rates are critical. Traders need assurance that their orders will be executed promptly and at the desired price. Any indication of potential platform manipulation or poor execution quality could significantly impact trading outcomes.

Risk Assessment

Engaging with Zh Inter carries inherent risks that potential traders must consider. The lack of regulatory oversight, poor customer feedback, and unclear trading conditions contribute to a heightened risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulation in place. |

| Fund Safety | High | Lack of transparency regarding fund protection measures. |

| Customer Support | Medium | Numerous complaints regarding poor service and withdrawal issues. |

To mitigate these risks, traders should conduct thorough research, consider starting with a small investment, and be prepared to switch brokers if issues arise. It is advisable to prioritize brokers with established regulatory credentials and a positive track record of customer service.

Conclusion and Recommendations

Based on the evidence gathered, it is clear that Zh Inter exhibits several concerning traits that suggest it may not be a safe trading option. The absence of regulatory oversight, coupled with numerous negative customer reviews and unclear trading conditions, raises significant red flags. Traders should exercise extreme caution when considering this broker.

For those seeking reliable alternatives, it is recommended to explore brokers with strong regulatory backing, transparent fee structures, and positive customer feedback. Established names in the industry often provide a safer trading environment, ensuring that traders can operate with confidence.

In summary, is Zh Inter safe? The available evidence strongly suggests that potential clients should be wary and consider other options to safeguard their investments.

Is ZH INTER a scam, or is it legit?

The latest exposure and evaluation content of ZH INTER brokers.

ZH INTER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZH INTER latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.