Is TRADEHASH safe?

Business

License

Is Tradehash Safe or Scam?

Introduction

Tradehash is a forex broker that has positioned itself in the competitive landscape of online trading, offering services such as CFDs, forex, and indices. However, the credibility of Tradehash has come under scrutiny, prompting many traders to question whether it is a reliable platform or merely a facade for fraudulent activities. In an industry rife with scams, it is crucial for traders to conduct thorough evaluations of forex brokers before committing their funds. This article aims to investigate the legitimacy of Tradehash by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The assessment is based on extensive research, including reviews from industry experts and feedback from actual users.

Regulation and Legitimacy

The regulatory environment is a fundamental aspect of any trading platform, serving as a safeguard for investors. Unfortunately, Tradehash operates without any significant regulatory oversight, raising serious concerns about its legitimacy. The absence of a valid license from reputable authorities means that traders are exposed to considerable risks, including the potential for loss of funds without any recourse.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation is alarming, as it indicates that Tradehash is not subject to any oversight or compliance checks that would typically protect investors. In fact, the broker claims to be registered in the Marshall Islands, a known tax haven and common location for unregulated entities. This raises questions about the quality of its operations and the safety of client funds. Furthermore, historical compliance issues have been reported, with warnings issued by various financial authorities regarding the unlicensed nature of Tradehash's operations. Consequently, the consensus among experts is that Tradehash is not safe for trading.

Company Background Investigation

A comprehensive understanding of a broker's history, ownership, and management team is essential for evaluating its credibility. Tradehash is owned by Gembell Limited, a company that lacks transparency regarding its operational history and management structure. The absence of detailed information about the team behind Tradehash further complicates the assessment of its legitimacy. Legitimate brokers typically provide information about their executives and their qualifications, which is conspicuously missing in this case.

Moreover, the company's website does not offer adequate information about its services, leading to suspicions about its operational integrity. Transparency is a critical factor in establishing trust, and the lack of it raises red flags for potential investors. The inability to verify the ownership and operational details of Tradehash further reinforces the notion that Tradehash is potentially unsafe for traders looking to invest their money.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its competitiveness and fairness. Tradehash has a complex fee structure that may not be immediately apparent to new users. The broker claims to offer a variety of trading instruments, yet the specifics regarding spreads, commissions, and overnight fees are not clearly outlined.

| Fee Type | Tradehash | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies (0 - 10 USD) |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The lack of clarity regarding fees is concerning, especially if traders are subjected to hidden costs that could diminish their profits. Additionally, the broker's policies regarding withdrawals and deposits are often criticized, with reports of excessive fees and delays being common complaints among users. This opacity in trading conditions raises questions about the broker's fairness and transparency, reinforcing the notion that Tradehash may not be a safe choice for traders.

Customer Fund Safety

The safety of customer funds is paramount in the trading industry. Unfortunately, Tradehash does not provide adequate measures to ensure the security of client deposits. The absence of segregated accounts, investor protection schemes, and negative balance protection policies means that traders' funds are at risk.

Moreover, there have been historical incidents where users reported difficulties in withdrawing their funds, which is a significant red flag. The lack of robust security measures raises concerns about the broker's commitment to safeguarding client assets. Given these factors, it is reasonable to conclude that Tradehash does not prioritize customer fund safety.

Customer Experience and Complaints

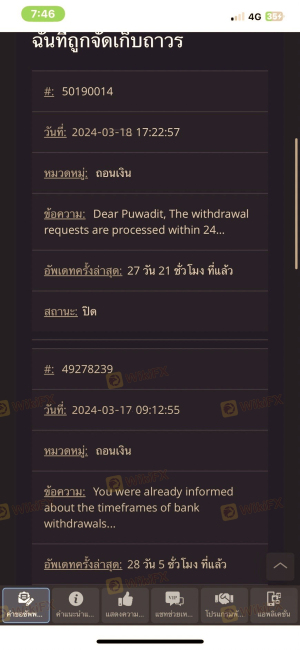

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of Tradehash reveal a pattern of negative experiences, with many users citing issues related to withdrawal difficulties, poor customer service, and lack of responsiveness from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service Quality | Medium | Inadequate |

| Platform Reliability | High | Unresolved |

Typical cases involve clients who have been unable to withdraw their funds or faced excessive fees when attempting to do so. Such complaints highlight significant operational flaws within Tradehash and indicate a lack of commitment to customer satisfaction. The prevalence of these issues suggests that Tradehash may not be a trustworthy platform for traders seeking a reliable trading experience.

Platform and Execution

The performance and reliability of a trading platform are critical for successful trading. Users have reported that Tradehash's platform is often unstable, with frequent outages and slow execution times. Additionally, issues such as slippage and order rejections have been noted, further complicating the trading experience.

The absence of clear evidence regarding the platform's execution quality raises concerns about potential manipulation or unfair practices. Traders rely on efficient execution to capitalize on market opportunities, and any disruptions can have significant financial implications. Given these performance issues, it is evident that Tradehash's platform may not provide a safe trading environment.

Risk Assessment

Engaging with Tradehash poses several risks that potential traders should be aware of. The lack of regulation, transparency, and customer fund protection measures collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated and unlicensed broker |

| Financial Risk | High | No protection for client funds |

| Operational Risk | Medium | Platform instability and performance issues |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Tradehash. It is crucial to consider alternative brokers that are regulated and offer transparent trading conditions.

Conclusion and Recommendations

In conclusion, the evidence gathered through this investigation strongly indicates that Tradehash is not a safe broker. The lack of regulation, transparency, and customer fund protection, combined with numerous negative customer experiences, paints a concerning picture of this trading platform.

For traders looking for a reliable and secure trading environment, it is advisable to explore alternatives that are well-regulated and have positive reviews from users. Some reputable options include brokers regulated by top-tier authorities such as the FCA or ASIC. By prioritizing safety and due diligence, traders can protect their investments and avoid potential scams like Tradehash.

Is TRADEHASH a scam, or is it legit?

The latest exposure and evaluation content of TRADEHASH brokers.

TRADEHASH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRADEHASH latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.