Regarding the legitimacy of TigerWit forex brokers, it provides SCB and WikiBit, .

Is TigerWit safe?

Business

License

Is TigerWit markets regulated?

The regulatory license is the strongest proof.

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

TigerWit Limited

Effective Date:

--Email Address of Licensed Institution:

compliance@tigerwit.com, darell.taylor@tigerwit.com, jacquelin.hunt@tigerwit.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Sea Sky Lane, Sandyport, Nassau, Bahamas, 7th Floor, Augustine House, 6a Austin Friars, London, EC2N 2HA, United KingdomPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Tigerwit A Scam?

Introduction

Tigerwit is a forex broker that has positioned itself within the competitive landscape of online trading since its inception in 2015. Based in the United Kingdom and regulated by the Financial Conduct Authority (FCA), Tigerwit claims to offer a wide range of trading options including forex, commodities, and indices. However, with the rise of online trading, the market has also seen an influx of fraudsters and unreliable brokers, making it essential for traders to exercise caution and perform thorough due diligence before selecting a broker. This article aims to investigate whether Tigerwit is a safe trading platform or a potential scam by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk factors.

Regulation and Legitimacy

The regulation of a broker is a crucial factor in determining its legitimacy and safety for traders. Tigerwit is regulated by several authorities, which should theoretically provide a level of security and oversight for its clients. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 679941 | United Kingdom | Verified |

| SCB | SIA-F 185 | Bahamas | Verified |

The FCA is recognized as one of the top-tier regulatory bodies globally, known for its stringent requirements for financial firms. However, while Tigerwit does hold an FCA license, it also operates under the Securities Commission of the Bahamas (SCB), which is often viewed as a less stringent regulatory environment. The dual regulation raises questions about the broker's compliance with the highest standards of regulatory oversight, especially when it comes to protecting client funds and ensuring fair trading practices. Notably, there have been reports of regulatory issues in the past, which further complicates the perception of Tigerwits legitimacy.

Company Background Investigation

Tigerwit was founded in 2015 and has since expanded its operations globally. The company's ownership structure includes several subsidiaries, with its primary entity being registered in the UK. The management team comprises individuals with backgrounds in finance and technology, which could be a positive indicator of the broker's operational integrity. However, the lack of transparency regarding the company's ownership and management raises concerns.

The information provided on Tigerwits website is often vague, and potential clients may find it challenging to obtain detailed insights into the company's history and operational practices. Transparency in a broker's operations is essential for building trust, and the absence of comprehensive information about its history and ownership can be a red flag for potential investors.

Trading Conditions Analysis

Tigerwit offers a range of trading conditions that are generally competitive, but it is essential to scrutinize these terms for any unusual practices. The broker claims to provide low spreads and no commission on certain trades, which can be attractive to traders. However, the overall fee structure can be complex and may not be as straightforward as it appears. Below is a comparison of core trading costs:

| Fee Type | Tigerwit | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads on major currency pairs are competitive, they are slightly above the industry average, which may impact profitability for frequent traders. Furthermore, the lack of clarity regarding commission structures and any additional hidden fees could lead to unexpected costs for traders. This ambiguity in the fee structure can be concerning, especially for new traders who may not be aware of all potential charges.

Customer Fund Security

The safety of customer funds is paramount when evaluating any broker. Tigerwit claims to employ several measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security in case of financial difficulties.

However, historical issues related to fund security have been reported, which raises questions about the effectiveness of these measures. It is crucial for traders to understand the implications of these policies and whether they can trust the broker to safeguard their investments adequately. The absence of documented incidents of fund misappropriation is a positive sign, but the lack of transparency surrounding the broker's financial practices remains a concern.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a broker. Reviews of Tigerwit reveal a mixed bag of experiences from traders. Some users report satisfactory trading conditions and prompt customer service, while others have voiced concerns regarding withdrawal delays and unresponsive support.

Common complaints include issues with order execution, slippage, and difficulty in withdrawing funds. Below is a summary of the primary complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Order Execution Issues | Medium | Mixed response |

| Customer Support Issues | High | Unresponsive |

In particular, the complaints about withdrawal delays are concerning, as they can indicate potential issues with the broker's liquidity or financial stability. These experiences highlight the importance of evaluating a broker's customer service capabilities and responsiveness to issues that may arise during trading.

Platform and Execution Quality

The trading platform is a critical component of the trading experience. Tigerwit utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools. However, user experiences with the platform have been mixed, with reports of slippage and execution delays.

Traders have raised concerns about the quality of order execution, with some suggesting that the platform may manipulate prices to the detriment of clients. This is a serious allegation that could indicate unethical practices. It is essential for traders to be aware of these issues and consider whether they are comfortable trading on a platform that may exhibit such behavior.

Risk Assessment

Engaging with any broker carries inherent risks, and Tigerwit is no exception. The following risk assessment summarizes the primary risk areas associated with trading through this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Mixed regulatory oversight raises concerns. |

| Withdrawal Issues | High | Reports of delays and unresponsive support. |

| Order Execution Quality | Medium | Complaints about slippage and potential manipulation. |

To mitigate these risks, traders should conduct thorough research and consider diversifying their investments across multiple brokers. It is also advisable to start with a demo account to familiarize oneself with the platform before committing significant funds.

Conclusion and Recommendations

In conclusion, the assessment of Tigerwit raises several red flags that potential traders should consider. While the broker is regulated by the FCA, the mixed reviews, historical complaints, and concerns about order execution quality suggest that caution is warranted.

Is Tigerwit safe? The answer is not straightforward. While there are regulatory protections in place, the broker's operational practices and customer feedback indicate that it may not be the safest choice for all traders.

For those considering trading with Tigerwit, it may be prudent to explore alternative brokers with stronger reputations and more transparent practices. Brokers such as XTB, FP Markets, and HotForex offer competitive trading conditions and a more robust regulatory environment.

Ultimately, traders should prioritize safety, transparency, and reliable customer support when selecting a forex broker to ensure a secure trading experience.

Is TigerWit a scam, or is it legit?

The latest exposure and evaluation content of TigerWit brokers.

TigerWit Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

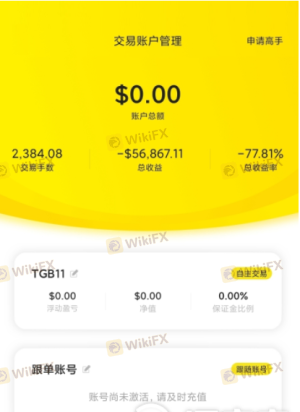

TigerWit latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.