Is Tickcopy safe?

Business

License

Is Tickcopy A Scam?

Introduction

Tickcopy is an online forex broker that has recently emerged in the trading industry, positioning itself as a platform catering to both novice and experienced traders. With claims of offering competitive trading conditions and access to a variety of financial instruments, Tickcopy aims to attract a broad audience in the forex market. However, the influx of online trading platforms has also brought about a significant number of scams and unregulated brokers, prompting traders to exercise caution when selecting a broker. It is essential for traders to thoroughly evaluate the legitimacy of a broker to protect their investments and ensure a safe trading environment.

This article investigates whether Tickcopy is a scam or a legitimate trading platform. Our analysis is based on a comprehensive review of various sources, including regulatory information, company background, trading conditions, customer feedback, and overall risk assessment. By employing a structured evaluation framework, we aim to provide traders with a clear understanding of Tickcopy's credibility and safety.

Regulation and Legitimacy

A crucial aspect of assessing any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect client funds. Tickcopy claims to operate under the auspices of regulatory bodies; however, our investigation reveals a lack of credible regulatory oversight.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Not Verified |

| SVG Financial Authority | N/A | St. Vincent and the Grenadines | Not Regulated |

The above table highlights that Tickcopy does not possess any valid licenses from recognized regulatory authorities. Specifically, while Tickcopy asserts affiliation with the Australian Securities and Investments Commission (ASIC), a search of ASIC's registry reveals no record of such a broker. Additionally, St. Vincent and the Grenadines, where Tickcopy claims to be based, is known as an offshore zone with minimal regulatory oversight for forex brokers. This raises significant concerns regarding the broker's legitimacy and the safety of client funds.

The absence of regulation is a strong indicator that Tickcopy may not provide the necessary protections for traders, such as segregated accounts and negative balance protection. These factors contribute to the conclusion that Tickcopy is not safe and could potentially be a scam.

Company Background Investigation

An in-depth analysis of Tickcopy's company background reveals further red flags. The broker appears to have a limited operational history, having been founded in 2023. This short timeframe raises questions about its stability and experience in the market. Furthermore, details regarding the ownership structure and management team are either vague or entirely absent, which is a troubling sign for potential clients.

A transparent broker typically provides comprehensive information about its management team, including their professional backgrounds and experience in the financial sector. However, Tickcopy lacks this transparency, making it difficult for traders to assess the qualifications of the individuals managing their investments. This lack of information can lead to distrust and concerns about the broker's intentions.

In summary, the limited company history, coupled with a lack of transparency regarding management, suggests that Tickcopy may not be a trustworthy broker. The absence of verifiable information only adds to the skepticism surrounding its operations, reinforcing the notion that Tickcopy is not safe for traders.

Trading Conditions Analysis

When evaluating any forex broker, understanding the trading conditions is vital. Tickcopy offers several account types with varying minimum deposit requirements and trading conditions. However, the overall fee structure and potential hidden costs warrant scrutiny.

| Fee Type | Tickcopy | Industry Average |

|---|---|---|

| Spread (Major Currency Pairs) | 1.6 pips (Standard) | 1.0 - 1.5 pips |

| Commission Model | $1.90 per side (ECN) | $5 per lot |

| Overnight Interest Range | Unspecified | Varies widely |

The table above illustrates that Tickcopy's spreads are relatively high compared to industry averages, particularly for the standard account. Additionally, the commission structure for the ECN account may seem competitive; however, traders should be cautious of any additional fees that may not be disclosed upfront.

Moreover, the high minimum deposit requirement of $500 is significantly above the industry norm, which typically ranges from $100 to $250. Such high entry costs can be a barrier for many traders, particularly those new to the market. Furthermore, the lack of clarity regarding overnight interest and other fees raises concerns about the transparency of Tickcopy's pricing model.

In light of these factors, it is evident that the trading conditions at Tickcopy may not be favorable for traders. The combination of high fees, lack of transparency, and unusual deposit requirements further supports the assertion that Tickcopy is not safe for trading.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. A reliable broker should implement robust security measures to protect investors' capital. However, Tickcopy's approach to fund safety raises several concerns.

Tickcopy does not provide clear information regarding client fund segregation or investor protection policies. Legitimate brokers typically maintain segregated accounts, ensuring that client funds are kept separate from the company's operating funds. Additionally, many regulated brokers offer negative balance protection, which prevents clients from losing more than their deposited amount. Unfortunately, Tickcopy does not appear to offer these essential protections.

Moreover, the lack of regulatory oversight means that there is no governing body to hold Tickcopy accountable for any potential misuse of client funds. This situation presents a significant risk for traders, as the absence of regulation can lead to scenarios where funds may be mishandled or lost without recourse.

Given these factors, it is clear that Tickcopy is not safe in terms of client fund security. Traders should be extremely cautious when considering this broker, as the lack of protective measures significantly increases the risk of financial loss.

Customer Experience and Complaints

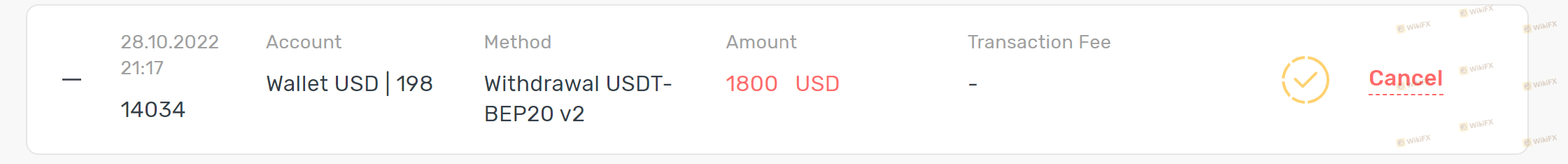

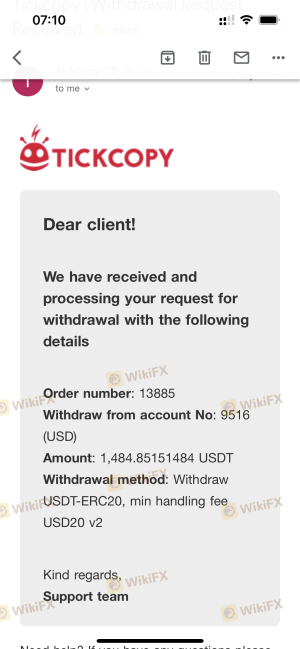

Customer feedback is a vital component of assessing a broker's reliability. An analysis of user reviews and complaints regarding Tickcopy reveals a pattern of dissatisfaction among clients. Common complaints include issues with withdrawal processes, high fees, and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Minimal |

| Unresponsive Support | High | Poor |

The table above summarizes key complaint categories and their severity. Many users report difficulties withdrawing their funds, with some claiming that their requests were either ignored or met with excessive delays. Additionally, complaints about high fees and unresponsive support staff further exacerbate the negative customer experience.

One typical case involved a trader who attempted to withdraw their funds after several months of trading. Despite multiple requests, the trader received no response from Tickcopy's support team, leading to frustration and loss of trust in the broker. Such experiences are alarming and highlight the potential risks associated with trading with Tickcopy.

Overall, the negative customer feedback and high severity of complaints strongly indicate that Tickcopy is not safe for traders. The lack of a reliable support system and unresolved withdrawal issues further contribute to the perception of Tickcopy as a potentially fraudulent broker.

Platform and Trade Execution

A broker's trading platform is crucial for providing traders with a seamless trading experience. Tickcopy claims to offer the widely-used MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and advanced trading tools. However, the performance and reliability of the platform are critical factors that need to be assessed.

User reviews suggest that while the MT4 platform is functional, there have been reports of issues related to order execution quality, including slippage and outright rejections of orders. Such problems can significantly impact trading performance and lead to financial losses.

Furthermore, the potential for platform manipulation is a concern with unregulated brokers. There are allegations that Tickcopy may manipulate its MT4 platform to create the illusion of trading activity, thus concealing potential fraudulent practices. This lack of transparency raises serious questions about the integrity of the trading environment provided by Tickcopy.

In conclusion, while the MT4 platform itself is reputable, the concerns surrounding execution quality and potential manipulation suggest that Tickcopy is not safe for traders seeking a reliable trading experience.

Risk Assessment

Engaging with an unregulated broker like Tickcopy carries inherent risks that traders must consider. The absence of regulatory oversight, combined with the broker's dubious practices, creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight. |

| Fund Safety Risk | High | Lack of fund segregation and investor protection. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

| Execution Risk | High | Potential for slippage and order rejections. |

The risk assessment table summarizes the key risk areas associated with Tickcopy. The high levels of regulatory and fund safety risks are particularly concerning, as they indicate a lack of accountability and protection for traders.

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with any broker. Additionally, it is essential to utilize regulated brokers that offer robust protections and transparent practices.

Conclusion and Recommendations

In conclusion, the investigation into Tickcopy reveals numerous red flags that strongly suggest it may be a scam. The lack of regulation, poor customer feedback, high fees, and questionable trading practices collectively paint a concerning picture of this broker.

Traders should exercise extreme caution when considering Tickcopy as a trading platform. Given the evidence presented, it is clear that Tickcopy is not safe and poses significant risks to traders' investments.

For those seeking reliable alternatives, it is advisable to consider well-regulated brokers that provide transparency, strong customer support, and robust fund protection. Brokers such as FXTM, IG, or OANDA are examples of reputable firms that offer a secure trading environment.

Ultimately, choosing a trustworthy broker is paramount to ensuring a positive trading experience and safeguarding your investments in the volatile forex market.

Is Tickcopy a scam, or is it legit?

The latest exposure and evaluation content of Tickcopy brokers.

Tickcopy Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tickcopy latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.