Is Stone Lion safe?

Pros

Cons

Is Stone Lion Safe or a Scam?

Introduction

Stone Lion is a relatively new player in the forex market, established in 2019. As a broker based in the United States, it aims to cater to traders seeking to navigate the complexities of foreign exchange trading. However, the rise of online trading has also seen a surge in fraudulent activities, making it imperative for traders to conduct thorough due diligence before engaging with any broker. Evaluating the trustworthiness of a forex broker like Stone Lion involves scrutinizing its regulatory status, company background, trading conditions, customer feedback, and overall security measures. This article utilizes a combination of narrative analysis and structured information to provide a comprehensive overview of whether Stone Lion is safe or potentially a scam.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is crucial in determining its legitimacy. A regulated broker is typically held to higher standards of accountability and transparency, offering greater protection to traders. Stone Lion claims to be regulated by the National Futures Association (NFA). Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0405201 | United States | Verified |

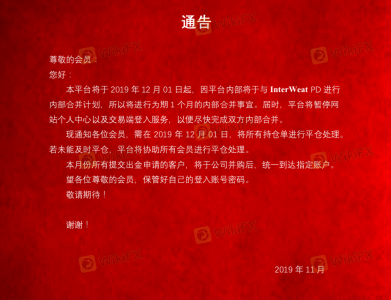

However, despite its regulatory claims, there are concerns about the quality of oversight. The NFA is known for its stringent regulations, but it has been noted that Stone Lion has received multiple complaints from users regarding withdrawal issues and lack of customer support. Such complaints raise red flags about the brokers operational integrity. Furthermore, the FCA has flagged Stone Lion as a clone firm, indicating that it may not be the legitimate entity it claims to be. This brings into question the overall safety of engaging with this broker.

Company Background Investigation

Stone Lion was founded in 2019 and has since aimed to establish itself within the competitive forex trading landscape. However, the lack of a comprehensive history raises concerns about its stability and reliability. The management teams background is also crucial in assessing the broker's trustworthiness. Unfortunately, there is limited information available regarding the qualifications and professional experiences of its executives. A transparent broker typically provides detailed information about its ownership structure and management team, which is lacking in Stone Lion's case.

Moreover, the broker's transparency is questionable, as it has received numerous complaints about its operational practices, including issues related to account access and withdrawal capabilities. Such a lack of transparency can be a significant indicator of potential risks, making it essential for traders to be cautious. Overall, the limited company background and transparency of Stone Lion raise serious concerns about whether Stone Lion is safe for trading.

Trading Conditions Analysis

When assessing a broker, understanding its trading conditions is vital. Stone Lion offers a range of trading instruments but has been criticized for its fee structure. Traders have reported unexpected charges and difficulties in withdrawing funds, which may indicate a lack of clarity in the broker's pricing model.

Heres a comparison of core trading costs:

| Fee Type | Stone Lion | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable | 1.0 - 2.0 pips |

| Commission Model | High | Low |

| Overnight Interest Range | Unclear | 1.5% - 3.0% |

The absence of clear information regarding spreads and commissions can lead to confusion and dissatisfaction among traders. Furthermore, the reported high commission rates compared to industry averages suggest that traders may not receive the best value for their investments. Such fee structures can be indicative of a broker that prioritizes profit over client satisfaction, raising concerns about whether Stone Lion is safe for trading.

Client Funds Safety

The safety of client funds is a critical aspect of any forex trading operation. Stone Lion claims to implement measures for fund security, including segregated accounts and investor protection policies. However, the effectiveness of these measures is uncertain, given the numerous complaints about withdrawal difficulties and the broker's overall transparency.

Traders should be particularly cautious about the lack of clear information regarding fund segregation and negative balance protection. Historical issues related to fund security, such as clients being unable to access their funds, further exacerbate concerns. Without robust security measures in place, traders risk losing their investments, which is a significant factor when determining if Stone Lion is safe.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability. Stone Lion has garnered a range of reviews, many of which highlight significant issues. Common complaints include withdrawal problems, unresponsive customer service, and allegations of the broker disappearing after significant losses.

Here is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

| Account Access | High | Non-responsive |

For instance, one user reported being unable to withdraw funds for several weeks, with customer service failing to provide adequate support. Such patterns of complaints suggest a troubling trend that could indicate deeper issues within the brokers operations. These experiences raise serious concerns about whether Stone Lion is safe for potential traders.

Platform and Execution

The trading platform offered by Stone Lion is based on MetaTrader 4, a widely-used platform known for its user-friendly interface and robust functionality. However, the performance and stability of the platform have been questioned, particularly regarding order execution quality. Reports of slippage and rejected orders indicate that traders may face challenges when executing trades, which can lead to financial losses.

Moreover, any signs of platform manipulation should be taken seriously. If a broker is found to be manipulating prices or executing trades in a manner that is not transparent, it poses a significant risk to traders. Therefore, assessing the platform's performance is crucial in determining if Stone Lion is safe for trading activities.

Risk Assessment

Engaging with any broker involves inherent risks, and Stone Lion is no exception. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Clone firm status raises concerns. |

| Financial Risk | High | Complaints about fund withdrawals. |

| Operational Risk | Medium | Issues with customer service and platform stability. |

To mitigate these risks, traders are advised to conduct thorough research, consider using risk management strategies, and avoid investing funds they cannot afford to lose. The potential for financial loss with Stone Lion is significant, making it essential for traders to be aware of these risks.

Conclusion and Recommendations

In conclusion, the evidence surrounding Stone Lion raises several red flags that suggest it may not be a safe trading option. The combination of regulatory concerns, a lack of transparency, negative customer experiences, and operational issues all contribute to a troubling picture. While some traders may still choose to engage with this broker, it is crucial to proceed with caution.

For traders seeking reliable alternatives, it is recommended to consider brokers that are well-regulated by top-tier authorities, have a proven track record, and demonstrate transparency in their operations. Overall, the question of whether Stone Lion is safe remains contentious, and potential traders should weigh the risks carefully before making any commitments.

Is Stone Lion a scam, or is it legit?

The latest exposure and evaluation content of Stone Lion brokers.

Stone Lion Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Stone Lion latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.