Is SMO safe?

Pros

Cons

Is SMO A Scam?

Introduction

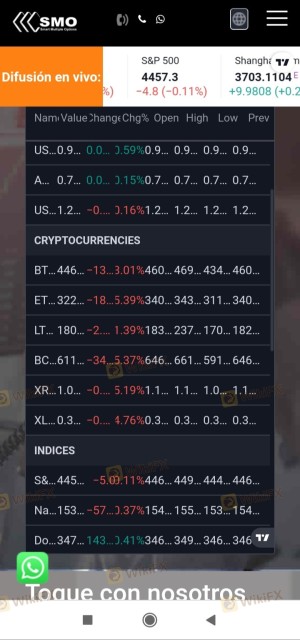

SMO, or Smart Multiple Options, is a forex broker that has positioned itself in the competitive landscape of online trading since its establishment in 2020. Operating primarily in the United States, SMO offers various trading services, including forex, commodities, and indices. However, the rapid growth of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully evaluate the legitimacy of brokers before committing their funds. This article aims to provide an in-depth analysis of SMO to determine whether it is a safe trading platform or a potential scam. Our investigation is based on a comprehensive review of regulatory status, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its credibility. Regulatory bodies enforce standards that protect investors and ensure fair trading practices. Unfortunately, SMO has not been found to be regulated by any recognized financial authority. This lack of oversight raises significant concerns regarding the safety of funds and the broker's adherence to industry standards.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight means that traders using SMO do not have the protections that come with licensed brokers. In the event of disputes or financial issues, clients may find themselves without recourse. Moreover, unregulated brokers often operate with higher risks, as they are not bound by the same standards that licensed brokers must adhere to. Therefore, it is essential for potential clients to be aware of these risks when considering whether SMO is safe for trading.

Company Background Investigation

SMO was founded in 2020, making it a relatively new player in the forex market. The company operates under the name Smart Multiple Options Inc., and its primary service area is the United States. However, detailed information about the ownership structure and management team remains scarce. The lack of transparency regarding the company's background can be a red flag for potential investors.

The management team's experience and qualifications are vital indicators of a broker's reliability. Unfortunately, there is little public information available about the individuals behind SMO. This lack of clarity can lead to concerns about the broker's operational integrity. Furthermore, without a proven track record of compliance and ethical practices, it is challenging to ascertain whether SMO is safe for trading.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is crucial. SMO's fee structure and trading costs can significantly impact a trader's profitability. However, due to the absence of detailed information on their website, it is difficult to ascertain the full scope of their fees and commissions.

| Fee Type | SMO | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies (1-3 pips) |

| Commission Model | N/A | Varies (0-10 USD) |

| Overnight Interest Range | N/A | Varies (0.5%-2%) |

The lack of transparency surrounding fees can be problematic for traders, as unexpected costs can erode profits. Additionally, if SMO employs any unusual or hidden fees, it could further complicate the trading experience. Hence, traders should exercise caution and conduct thorough research to determine if SMO is safe for their trading activities.

Client Funds Security

The security of client funds is paramount when selecting a forex broker. Traders need to know that their money is safe and accessible when needed. Unfortunately, SMO has not provided sufficient information regarding its security measures. Without clear policies on fund segregation, investor protection, and negative balance protection, potential clients may be left vulnerable.

In general, regulated brokers are required to keep client funds in separate accounts, ensuring that they are not used for operational expenses. Additionally, many licensed brokers offer investor compensation schemes to protect clients in the event of insolvency. SMO's lack of regulatory oversight raises concerns about whether it adheres to these best practices, making it essential for traders to question whether SMO is safe for their investments.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. However, reviews of SMO indicate a troubling pattern of complaints. Many users have reported issues with fund withdrawals and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Transparency Concerns | High | Unresponsive |

For instance, several clients have claimed that their withdrawal requests were either delayed or denied, raising serious concerns about the broker's operational integrity. Furthermore, the quality of customer service has been criticized, with reports of unprofessional interactions and long response times. Such complaints suggest that traders may face significant challenges when dealing with SMO, further questioning whether SMO is safe for trading.

Platform and Execution

The performance of a trading platform is essential for a smooth trading experience. Traders expect a stable and efficient platform for executing orders. However, there is limited information available regarding SMO's platform reliability and execution quality. Reports of slippage and order rejections could indicate potential issues with the trading environment.

A lack of transparency regarding the technology and infrastructure used by SMO can lead to concerns about platform manipulation or unfair trading practices. If traders encounter significant slippage or frequent order rejections, it may signal that SMO is not safe for their trading activities.

Risk Assessment

Using SMO as a forex broker presents several risks that traders should carefully consider. The absence of regulatory oversight, combined with the lack of transparency and numerous customer complaints, paints a concerning picture of the broker's reliability.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, high potential for fraud. |

| Financial Risk | Medium | Lack of transparency regarding fees and fund security. |

| Operational Risk | High | Complaints about withdrawal issues and poor customer service. |

To mitigate these risks, traders should conduct thorough research and consider using a demo account to test the platform before committing significant funds. Additionally, seeking out alternative brokers with solid regulatory standing and positive reviews may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the analysis of SMO raises several red flags that suggest it may not be a safe option for forex trading. The lack of regulation, transparency issues, and numerous customer complaints indicate that traders should exercise extreme caution. It is advisable for potential clients to consider reputable alternatives that are regulated by recognized financial authorities.

For traders seeking safety and reliability, brokers regulated by top-tier authorities such as the FCA, ASIC, or SEC should be prioritized. These brokers typically offer better protections for client funds and a more transparent trading experience. Ultimately, the question remains: Is SMO safe? Based on the evidence presented, it appears that traders should be wary of this broker and consider other options to safeguard their investments.

Is SMO a scam, or is it legit?

The latest exposure and evaluation content of SMO brokers.

SMO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SMO latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.