Regarding the legitimacy of SINOLINK FINANCIAL HOLDING forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is SINOLINK FINANCIAL HOLDING safe?

Risk Control

Software Index

Is SINOLINK FINANCIAL HOLDING markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Sinolink Securities (Hong Kong) Company Limited

Effective Date:

2004-06-05Email Address of Licensed Institution:

compliancehk@hksinolink.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.hksinolink.com.hkExpiration Time:

--Address of Licensed Institution:

香港上環皇后大道中183號中遠大廈35樓3501-08 室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Sinolink Safe or Scam?

Introduction

Sinolink is a Hong Kong-based forex broker that has been operational since 2004. Positioned as a significant player in the forex market, it provides a range of financial services including securities trading, futures contracts, asset management, and corporate financing. As the forex market is known for its volatility and the potential for scams, traders must exercise caution when selecting a broker. Evaluating a broker's legitimacy is crucial for safeguarding investments and ensuring a secure trading environment. This article aims to analyze whether Sinolink is a safe trading platform or if there are indications of fraudulent activities. The assessment is based on a thorough examination of regulatory compliance, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

Sinolink operates under the regulation of the Securities and Futures Commission (SFC) of Hong Kong, which is a reputable regulatory authority that oversees the financial markets in the region. Regulatory oversight is a critical factor in determining a broker's legitimacy, as it ensures adherence to strict operational guidelines designed to protect investors. Below is a summary of Sinolink's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | AAI195 | Hong Kong | Verified |

The SFC requires brokers to maintain certain standards, including the segregation of client funds, regular audits, and transparent reporting. Sinolink's compliance with these regulations enhances its credibility. Notably, there have been no negative regulatory disclosures against Sinolink during the evaluation period, indicating a clean compliance record. However, it is essential to recognize that not all regulatory bodies enforce the same level of scrutiny, and traders should remain vigilant in assessing the quality of oversight.

Company Background Investigation

Founded in 2004, Sinolink has established itself as a prominent financial institution in Hong Kong. The company is structured as Sinolink Securities (Hong Kong) Company Limited and is primarily involved in securities trading and asset management. The management team comprises professionals with substantial experience in finance and investment, contributing to the firm's operational integrity. Sinolink's ownership structure is transparent, with publicly available information regarding its corporate governance.

The company's history demonstrates resilience, having navigated various financial challenges since its inception. Transparency is a vital aspect of trust in the financial sector, and Sinolink has maintained a level of openness regarding its operations and management. This transparency is further evidenced by the availability of customer support channels and informational resources for clients.

Trading Conditions Analysis

Sinolink offers a competitive trading environment, but it is vital to analyze its fee structure and any potential hidden costs. The broker employs a commission-based model for trading, which can vary depending on the trading channel. Below is a comparison of Sinolink's core trading costs:

| Fee Type | Sinolink | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 3.0 pips |

| Commission Model | 0.25% (phone), 0.2% (online) | 0.1% - 0.3% |

| Overnight Interest Range | Varies | Varies |

Sinolink's commission rates are generally in line with industry standards, but traders should be cautious of any promotional bonuses that may come with conditions that could increase trading costs. Additionally, the lack of a demo account could be a disadvantage for novice traders seeking to familiarize themselves with the platform before committing real funds.

Client Fund Security

The safety of client funds is paramount in the forex trading landscape. Sinolink implements several measures to ensure the security of client deposits, including the segregation of funds in separate accounts and adherence to regulatory requirements. This practice minimizes the risk of misuse of client funds, enhancing the overall safety of trading with Sinolink. Furthermore, the broker does not have a history of significant security breaches or fund mismanagement, which is a positive indicator for potential clients.

However, it is crucial for traders to be aware of the lack of insurance for client funds, which could pose a risk in the event of the broker's insolvency. While regulatory oversight provides a degree of protection, the absence of additional insurance coverage may leave traders vulnerable.

Customer Experience and Complaints

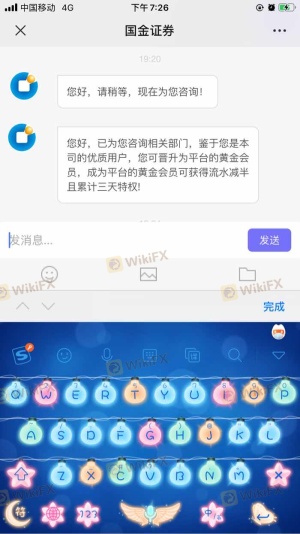

Customer feedback plays a significant role in assessing the reliability of a broker. Sinolink has received mixed reviews from clients, with some praising its customer service while others have reported issues. Common complaints include difficulties in fund withdrawals and unclear communication regarding account conditions. Below is a summary of the types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Management | Medium | Average response |

| Customer Support | Low | Generally responsive |

One notable case involved a client who reported difficulty accessing funds after depositing a significant amount. The broker's response time was longer than expected, leading to frustration. Such incidents highlight the importance of responsive customer service in maintaining client trust.

Platform and Execution

The trading platform offered by Sinolink is designed to facilitate a user-friendly experience, although it is not based on popular systems like MetaTrader 4 or 5. The platform's performance, stability, and order execution quality are critical factors for traders. Users have reported varying experiences with order execution, including instances of slippage and rejections. While the platform generally performs well, any signs of manipulation or inconsistencies in execution should be closely monitored.

Risk Assessment

Engaging with Sinolink carries certain risks, as is the case with any forex broker. A comprehensive risk assessment is essential for potential clients. Below is a risk summary for trading with Sinolink:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated but oversight varies |

| Financial Risk | Medium | No insurance for client funds |

| Customer Service Risk | High | Complaints about response times |

To mitigate these risks, traders should consider starting with a smaller investment and thoroughly reviewing all terms and conditions before committing funds. Additionally, maintaining open lines of communication with customer service can help address concerns promptly.

Conclusion and Recommendations

In conclusion, while Sinolink is regulated by the SFC and has a history of compliance, potential clients should remain cautious. The absence of insurance for client funds and mixed customer feedback raises valid concerns. Therefore, traders must assess their risk tolerance before engaging with this broker. For those seeking alternatives, consider brokers with robust regulatory oversight and a proven track record of customer satisfaction. Ultimately, the question "Is Sinolink safe?" can be answered with a cautious "yes," but with the caveat that due diligence is essential to navigate any potential risks.

Is SINOLINK FINANCIAL HOLDING a scam, or is it legit?

The latest exposure and evaluation content of SINOLINK FINANCIAL HOLDING brokers.

SINOLINK FINANCIAL HOLDING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SINOLINK FINANCIAL HOLDING latest industry rating score is 6.94, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.94 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.