Is Discover finance safe?

Pros

Cons

Is Discover Finance Safe or a Scam?

Introduction

Discover Finance is a forex brokerage that has gained attention in the trading community for its purported investment opportunities. However, with the rise of fraudulent schemes in the financial sector, traders must exercise caution when evaluating brokers. This article aims to provide a comprehensive analysis of Discover Finance to determine whether it is a safe trading platform or a potential scam. The investigation is based on multiple sources, including regulatory databases, user reviews, and expert analyses, ensuring a well-rounded assessment of the broker's credibility.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in assessing its safety. A regulated broker is typically subject to oversight by financial authorities that enforce strict standards to protect investors. Discover Finance, however, has been flagged as an unregulated broker, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation from recognized authorities such as the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC) is alarming. Regulatory oversight provides a layer of protection for traders, ensuring that brokers adhere to ethical practices and maintain transparency. Without such oversight, there is a heightened risk of encountering fraudulent activities. Moreover, historical compliance issues can further tarnish a broker's reputation. In the case of Discover Finance, the lack of a regulatory framework suggests that traders should proceed with extreme caution.

Company Background Investigation

Understanding the history and ownership structure of a brokerage can provide insights into its reliability. Discover Finance appears to have a limited online presence, with scant information available about its founding, development, and management team. This lack of transparency can be a red flag for potential investors.

The absence of clear ownership details and management backgrounds raises questions about accountability and trustworthiness. A reputable brokerage typically provides comprehensive information about its team, including qualifications and relevant experience in the financial industry. The lack of such disclosures may indicate that Discover Finance is not committed to maintaining transparency, further compounding concerns about its legitimacy.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, significantly impact a trader's overall experience. Discover Finance's fee structure has been scrutinized, with reports indicating that it may impose excessive charges that are not standard in the industry.

| Fee Type | Discover Finance | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Model | High | Low |

| Overnight Interest Range | Unclear | 0.5% - 2.0% |

The variability of spreads and the unclear commission model suggest that traders may encounter unexpected costs, which can erode profit margins. Furthermore, the lack of clear information regarding overnight interest rates raises concerns about transparency. Traders should always be wary of brokers that do not provide straightforward fee structures, as this can often lead to hidden costs that may not be immediately apparent.

Client Funds Safety

The safety of client funds is paramount when considering a brokerage. Discover Finance's measures for ensuring fund security are unclear, with no information available on whether client funds are held in segregated accounts or if there are investor protection mechanisms in place.

The lack of clarity regarding these safety measures is concerning. Reputable brokers typically offer robust security protocols, including fund segregation, which protects clients' money in the event of financial difficulties. Additionally, the absence of negative balance protection policies poses a risk for traders, as they may be liable for losses exceeding their deposits. Historical issues related to fund security can further exacerbate these concerns, making it vital for traders to prioritize broker safety.

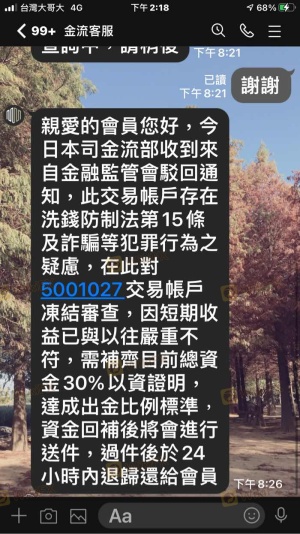

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a brokerage's credibility. Discover Finance has received mixed reviews from users, with several complaints indicating issues related to withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Fair |

Common complaints include difficulty accessing funds and a lack of timely responses from customer support. These issues can create a frustrating experience for traders, leading to distrust in the brokerage's operations. A brokerage that fails to address customer concerns effectively may not be a reliable choice for trading.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for any trader. Discover Finance's platform has been reported to experience occasional downtime and execution delays, which can significantly impact trading outcomes.

Traders have reported instances of slippage and rejected orders, raising questions about the platform's integrity. A stable and efficient trading platform is essential for executing trades promptly and accurately. Any signs of manipulation or consistent execution issues can be indicative of a broker that does not prioritize its clients' best interests.

Risk Assessment

Using Discover Finance comes with inherent risks that potential traders should consider carefully.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Financial Risk | Medium | Lack of clarity on fees may lead to unexpected losses. |

| Operational Risk | High | Reports of withdrawal issues and platform instability. |

Given the findings, it is crucial for traders to implement risk mitigation strategies, such as limiting exposure and conducting thorough research before engaging with Discover Finance.

Conclusion and Recommendations

In conclusion, the evidence suggests that Discover Finance may not be a safe brokerage. The lack of regulatory oversight, transparency issues, and negative customer feedback raise significant red flags. Traders must be cautious and consider alternative options that offer better security and credibility.

For those seeking reliable trading platforms, it is advisable to explore brokers that are regulated by top-tier authorities and have a proven track record of positive user experiences. Prioritizing safety and transparency is essential for successful trading in the forex market.

Is Discover finance a scam, or is it legit?

The latest exposure and evaluation content of Discover finance brokers.

Discover finance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Discover finance latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.