Regarding the legitimacy of ACDEX forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is ACDEX safe?

Pros

Cons

Is ACDEX markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RevokedLicense Type:

Forex Execution License (STP)

Licensed Entity:

ACDEX PTY LTD

Effective Date:

2014-11-11Email Address of Licensed Institution:

compliance@lcs.net.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2024-01-23Address of Licensed Institution:

ACDEX PTY LTD, Level 12, 197 St Georges Terrace PERTH WA 6000Phone Number of Licensed Institution:

0409 687 602Licensed Institution Certified Documents:

Is ACDEX Safe or Scam?

Introduction

ACDEX is a forex broker that positions itself within the competitive landscape of online trading, primarily catering to traders interested in foreign exchange, commodities, and indices. With the growing number of online trading platforms, it is crucial for traders to carefully evaluate the legitimacy and reliability of brokers like ACDEX before investing their hard-earned money. The forex market is fraught with risks, and the presence of unregulated or poorly regulated brokers can lead to significant financial losses for traders. Therefore, conducting thorough research and due diligence is essential.

This article aims to provide an objective analysis of ACDEX, examining its regulatory status, company background, trading conditions, customer experience, and overall safety. The evaluation is based on a comprehensive review of multiple sources, including user feedback, regulatory information, and expert assessments, to determine whether ACDEX is a safe trading platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its legitimacy and safety. ACDEX claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent oversight of financial services in Australia. Regulation by a reputable authority like ASIC generally indicates that the broker must adhere to specific compliance and operational standards, thereby ensuring a level of protection for traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 464367 | Australia | Verified |

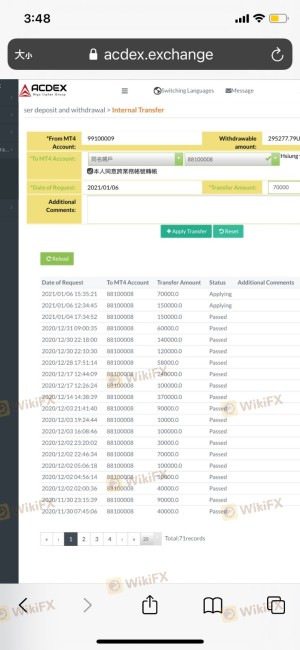

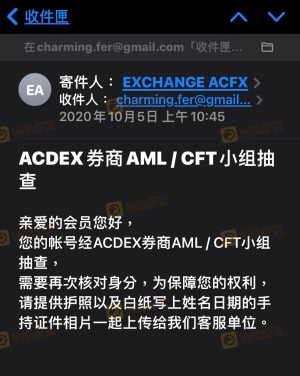

Despite its claims of regulation, there are numerous reports and complaints regarding ACDEX's withdrawal difficulties and potential scams. Users have expressed concerns about the broker's operational practices, indicating a possible disconnect between its regulatory claims and actual customer experiences. This discrepancy raises red flags about the broker's legitimacy and compliance with regulatory standards.

Company Background Investigation

ACDEX was established in 2014 and is based in Hong Kong. The company presents itself as a credible player in the forex market, but its history and ownership structure warrant further scrutiny. The management team of ACDEX is composed of individuals with varying degrees of experience in the financial sector; however, detailed information about their backgrounds is not readily available, leading to questions about the company's transparency and governance.

The lack of accessible information about the company's ownership and management could indicate a lack of accountability, which is a concerning factor for potential investors. Transparency in operations and clear communication about the company's structure are vital for building trust with clients. Given the complexity of the forex market, a broker's ability to provide clear and comprehensive information about its operations is essential for ensuring client confidence.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions and fee structures is critical. ACDEX offers a variety of trading instruments, including forex pairs, commodities, and indices. However, the overall cost structure and any unusual fees associated with trading on ACDEX's platform should be carefully examined.

| Fee Type | ACDEX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

Reports from users indicate that there may be hidden fees or unfavorable trading conditions that are not clearly disclosed upfront. Such practices can significantly impact a trader's profitability and may suggest a lack of transparency on the broker's part. It is essential for traders to be aware of all potential costs associated with their trades, as unexpected fees can lead to financial difficulties.

Customer Funds Security

The safety of client funds is paramount when selecting a forex broker. ACDEX claims to implement various security measures to protect customer funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is often called into question, especially in light of reported withdrawal issues.

Traders should carefully assess whether their funds are held in segregated accounts, as this practice ensures that client funds are kept separate from the broker's operational funds. Additionally, the presence of negative balance protection policies can provide an extra layer of security for traders, preventing them from losing more than their initial investment. However, historical disputes regarding fund safety and withdrawal difficulties raise concerns about ACDEX's commitment to safeguarding client assets.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. Reviews of ACDEX indicate a mixed bag of experiences, with some users praising the platform's customer service while others report significant issues, particularly related to fund withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Service Delays | Medium | Average |

Common complaints include difficulties in withdrawing funds, unclear communication regarding account management, and delays in customer support responses. Such issues can severely impact a trader's experience and raise doubts about the broker's operational integrity. Analyzing specific case studies of customer complaints can provide further insight into ACDEX's handling of client issues and its overall reliability.

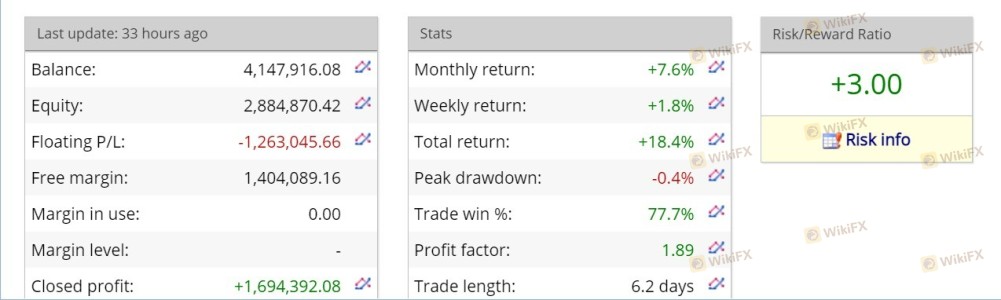

Platform and Trade Execution

The performance and stability of a trading platform are critical for successful trading. ACDEX utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust functionality. However, the quality of order execution, including slippage rates and order rejections, must also be assessed.

Traders have reported mixed experiences regarding order execution on ACDEX's platform, with some noting instances of slippage and delays in trade confirmations. Such issues could indicate potential manipulation or inefficiencies within the trading system, which could adversely affect traders' profitability.

Risk Assessment

Using ACDEX as a trading platform carries various risks that potential users should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Reports of withdrawal issues and potential scams. |

| Fund Security | Medium | Concerns regarding the safety of client funds. |

| Customer Service Reliability | Medium | Mixed reviews regarding responsiveness and support. |

To mitigate these risks, potential traders should conduct thorough research and consider alternative brokers with better reputations and proven track records. It is advisable to start with a demo account or invest a small amount initially to gauge the platform's reliability before committing significant capital.

Conclusion and Recommendations

In conclusion, while ACDEX presents itself as a regulated forex broker, numerous reports and user experiences raise significant concerns about its legitimacy and operational practices. Issues related to fund withdrawals, transparency, and customer service suggest that traders should exercise caution when considering this platform.

For traders seeking a safe and reliable trading environment, it may be prudent to explore alternative brokers with stronger regulatory oversight and positive user feedback. Options such as Forex.com, Plus500, or XTB may provide more secure trading experiences. Ultimately, thorough research and careful consideration of potential risks are essential for making informed trading decisions.

In summary, is ACDEX safe? The evidence suggests that potential traders should remain vigilant and consider the risks associated with this broker before proceeding.

Is ACDEX a scam, or is it legit?

The latest exposure and evaluation content of ACDEX brokers.

ACDEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ACDEX latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.