Is SICH CAPITAL safe?

Business

License

Is Sich Capital Safe or Scam?

Introduction

Sich Capital is an online trading broker that positions itself within the forex market, claiming to offer a range of trading services to clients around the globe. However, the importance of thoroughly vetting forex brokers cannot be overstated. Traders often invest significant amounts of money, and the lack of proper regulation or transparency can lead to substantial financial losses. This article aims to provide an objective analysis of Sich Capital's legitimacy by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The investigation is based on data gathered from multiple credible sources, including user reviews and regulatory databases.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. A regulated broker operates under the oversight of a financial authority, which helps ensure fair trading practices and the protection of client funds. Unfortunately, Sich Capital lacks regulation from any reputable authority, which is a significant red flag for potential clients.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a valid license means that Sich Capital does not adhere to industry standards, which can expose traders to higher risks. Moreover, the broker has received numerous complaints regarding its operations, further raising concerns about its legitimacy. The lack of regulatory oversight suggests that traders should exercise extreme caution when considering this broker, as there are no legal frameworks in place to protect their investments.

Company Background Investigation

Sich Capital's history and ownership structure are crucial for understanding its operational integrity. The broker claims to be based in Australia; however, there are inconsistencies in its online presence. The website contains numerous grammatical errors, indicating a lack of professionalism and attention to detail. Furthermore, the companys ownership and management team remain largely anonymous, which diminishes transparency and raises questions about accountability.

The absence of identifiable management with a solid track record in financial services is concerning. A reputable broker typically has a management team with proven expertise and experience. In Sich Capital's case, the lack of such information could imply that the company is not committed to maintaining a trustworthy trading environment. This opacity could be a tactic employed by fraudulent brokers to avoid scrutiny and accountability.

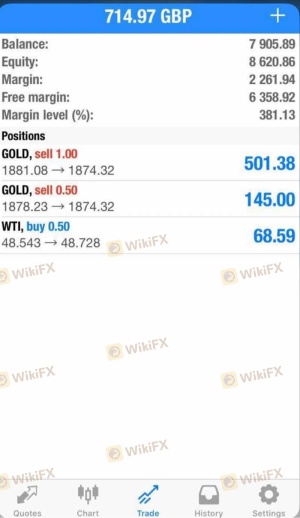

Trading Conditions Analysis

Understanding the trading conditions offered by Sich Capital is essential for evaluating its overall value to traders. The broker claims to provide competitive spreads and low fees, but many users report hidden charges that are not clearly disclosed.

| Fee Type | Sich Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

The lack of transparency regarding fees is troubling, as it could lead to unexpected costs for traders. Many brokers provide clear and detailed information about their fee structures, enabling clients to make informed decisions. In contrast, Sich Capital's vague policies could be a tactic to entice traders with seemingly low costs, only to impose additional charges later on.

Customer Fund Safety

When it comes to trading, the safety of customer funds is paramount. Sich Capital's lack of regulatory oversight raises concerns about its fund security measures. A reputable broker typically offers segregated accounts, investor protection schemes, and negative balance protection to safeguard client funds.

Unfortunately, there is little information available regarding Sich Capital's policies on these critical issues. The absence of these safety measures could expose traders to significant risks, especially if the broker were to face financial difficulties or operational issues. Furthermore, historical complaints indicate that clients have faced challenges in withdrawing their funds, suggesting that the broker may not prioritize fund security.

Customer Experience and Complaints

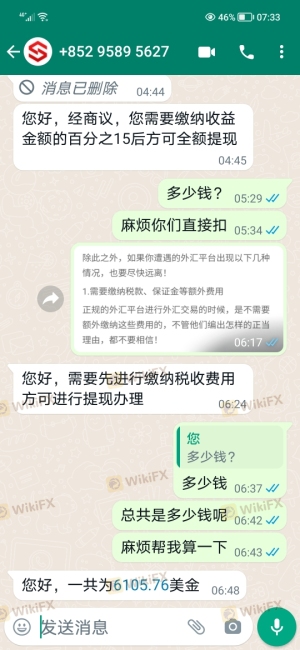

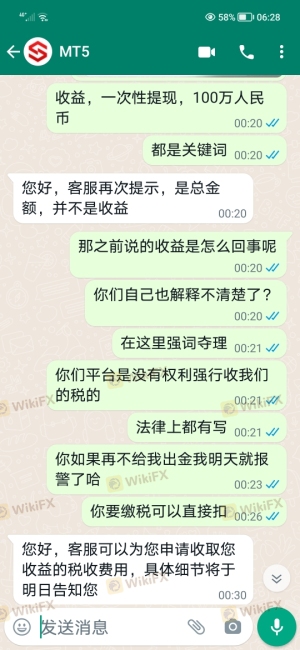

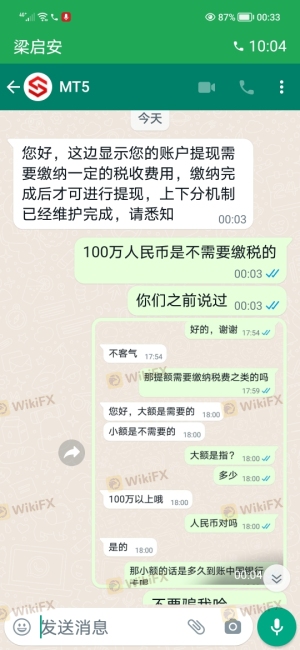

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of Sich Capital reveal a pattern of negative experiences, with many users expressing frustration over withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include unauthorized withdrawals, lack of responsiveness from customer support, and misleading information regarding trading conditions. Such issues highlight a concerning trend that could indicate a lack of integrity within the organization. For potential clients, these complaints serve as a warning about the possible risks associated with trading through Sich Capital.

Platform and Execution

The quality of the trading platform is another critical factor in evaluating a broker. Sich Capital's platform has been described as unstable, with reports of frequent downtime and execution issues. Traders have also noted instances of slippage and order rejections, which can significantly impact trading performance.

A reliable trading platform should offer a seamless experience, allowing users to execute trades quickly and efficiently. Unfortunately, the reported issues with Sich Capital suggest that traders may face challenges that could hinder their ability to trade effectively. The lack of a robust platform could be indicative of deeper operational issues within the broker.

Risk Assessment

Using Sich Capital poses several risks that should not be overlooked. The absence of regulation, coupled with a history of customer complaints and poor platform performance, creates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Operational Risk | High | Frequent platform issues and downtime |

| Fund Safety Risk | High | Lack of transparency regarding fund security |

To mitigate these risks, it is advisable for traders to conduct thorough research and consider alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Sich Capital is not a safe trading option. The lack of regulatory oversight, combined with negative customer feedback and operational issues, raises significant concerns about the broker's legitimacy. Traders should exercise extreme caution when considering Sich Capital, as it may expose them to unnecessary risks.

For those seeking reliable trading options, it is recommended to explore brokers that are regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically offer better security measures, transparency, and customer support, ensuring a safer trading experience. Ultimately, it is crucial for traders to prioritize their financial safety and choose brokers that uphold industry standards.

Is SICH CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of SICH CAPITAL brokers.

SICH CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SICH CAPITAL latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.