Is FTel safe?

Pros

Cons

Is FTEL Safe or Scam?

Introduction

FTEL is a forex broker that has gained attention in the online trading community for its offerings in the foreign exchange market. As a trader, it is crucial to thoroughly evaluate any broker before committing funds, as the forex market can be rife with scams and unregulated entities. The importance of assessing the legitimacy and safety of a broker cannot be overstated, as it directly impacts the security of traders' investments and their overall trading experience. This article aims to provide an objective analysis of FTEL, examining its regulatory status, company background, trading conditions, client experiences, and risk factors. The information presented is derived from various online sources, including regulatory databases, user reviews, and expert evaluations.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical indicator of its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict standards and provide a secure trading environment. In the case of FTEL, it has been reported that the broker does not hold any licenses from recognized regulatory authorities. This lack of regulation raises significant concerns regarding its operational practices and the safety of client funds.

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight is a red flag for potential traders. Established regulatory bodies, such as the FCA (Financial Conduct Authority) in the UK or the ASIC (Australian Securities and Investments Commission), enforce strict guidelines that protect traders from fraud and malpractice. Without such oversight, brokers like FTEL may operate with minimal accountability, increasing the risk of scams. Furthermore, historical compliance issues have been noted, as the broker has been associated with suspicious activities, including allegations of high potential risk and counterfeit trading platforms.

Company Background Investigation

FTEL's company background reveals a lack of transparency that is concerning for potential clients. Information regarding its history, ownership structure, and management team is either sparse or absent. This opacity makes it difficult for traders to gauge the broker's reliability and operational integrity. A reputable broker typically provides detailed information about its founding, ownership, and key personnel, including their professional backgrounds and qualifications.

In the case of FTEL, the absence of such disclosures raises questions about its legitimacy. Traders should be wary of brokers that do not openly share their company history or management credentials, as this can indicate a lack of accountability. Moreover, the level of transparency in a broker's operations is crucial for building trust with clients. Without clear information, it is challenging to assess whether FTEL is indeed safe or if it poses potential risks to traders.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital for making an informed decision. FTEL offers a variety of trading instruments, including forex pairs and commodities. However, the overall fee structure and trading conditions have raised concerns among users. Reports indicate that FTEL has an unusually high spread on major currency pairs, which can significantly impact trading profitability.

| Fee Type | FTEL | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Low |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The high trading costs associated with FTEL can be detrimental to traders, especially those who engage in frequent trading. Additionally, the commission model remains unclear, which can lead to unexpected charges. Such inconsistencies in fees can deter traders from using the platform, as they may feel uncertain about the true costs involved in trading with FTEL. Overall, the trading conditions at FTEL do not align with industry standards, raising further concerns about its reliability and safety.

Client Fund Security

The security of client funds is paramount when selecting a forex broker. Traders need to ensure that their investments are protected against potential risks, including fraud and mismanagement. FTEL's approach to fund security has been questioned, as there is no clear information available regarding its policies on fund segregation, investor protection, or negative balance protection.

Traders should be particularly cautious if a broker does not provide robust measures to safeguard client funds. The absence of such protections can leave traders vulnerable to significant losses. Moreover, any historical issues related to fund security or disputes with clients further highlight the risks associated with using FTEL as a trading platform. Without transparent and effective security measures, it is challenging to ascertain whether FTEL is safe for traders.

Customer Experience and Complaints

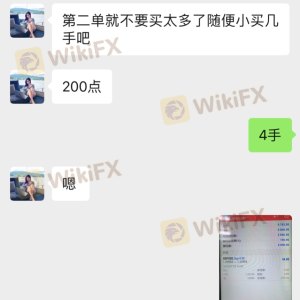

Customer feedback is an essential aspect of evaluating a broker's performance. In the case of FTEL, numerous user reviews and complaints have surfaced, indicating a range of issues experienced by traders. Common complaints include difficulties with withdrawals, lack of responsive customer support, and instances of perceived fraud.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Fraud Allegations | High | Unaddressed |

The severity of these complaints raises significant concerns about FTEL's commitment to customer service and its overall reliability. Traders have reported challenges in accessing their funds, which is a major red flag for any broker. Additionally, the company's slow response times to inquiries and complaints further exacerbate the situation, leaving traders feeling unsupported. Such negative experiences can indicate that FTEL may not be a safe option for potential clients.

Platform and Trade Execution

A broker's trading platform is a critical component of the trading experience. FTEL's platform has received mixed reviews regarding its performance, stability, and user experience. Reports of slippage, order rejections, and technical issues have been noted, which can significantly impact trading outcomes.

The quality of order execution is another crucial factor to consider. Traders expect timely execution of their orders, especially in a fast-paced market like forex. However, if a broker experiences frequent slippage or order rejections, it can lead to frustration and potential financial losses for traders. The presence of any signs of platform manipulation should also raise alarms, as it indicates a lack of integrity in the broker's operations.

Risk Assessment

Engaging with FTEL carries inherent risks that traders must consider. The lack of regulation, unclear trading conditions, and negative user feedback collectively contribute to a high-risk environment for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | High fees and withdrawal issues |

| Operational Risk | Medium | Technical issues with the platform |

To mitigate these risks, traders should approach FTEL with caution. It is advisable to conduct thorough research and consider opening a small account to test the platform before committing larger amounts of capital. Additionally, traders should remain vigilant and be prepared to switch to a more reputable broker if they encounter issues.

Conclusion and Recommendations

In conclusion, the evidence suggests that FTEL may not be a safe choice for traders. The lack of regulatory oversight, high trading costs, and negative customer experiences raise significant concerns about the broker's legitimacy and reliability. Traders should exercise caution and consider alternative options that offer better regulatory protection and more transparent trading conditions.

For those seeking reliable forex brokers, it is advisable to explore options that are regulated by top-tier authorities and have a proven track record of customer satisfaction. By doing so, traders can enhance their chances of a secure and positive trading experience in the forex market.

Is FTel a scam, or is it legit?

The latest exposure and evaluation content of FTel brokers.

FTel Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FTel latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.