Regarding the legitimacy of SHYING forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is SHYING safe?

Pros

Cons

Is SHYING markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Exness (UK) Ltd

Effective Date:

2016-09-01Email Address of Licensed Institution:

ukcompliance@exness.comSharing Status:

No SharingWebsite of Licensed Institution:

www.exness.ukExpiration Time:

--Address of Licensed Institution:

107 Cheapside London EC2V 6DN UNITED KINGDOMPhone Number of Licensed Institution:

+442033754207Licensed Institution Certified Documents:

Is Shying A Scam?

Introduction

Shying is a relatively new entrant in the forex trading market, established in 2020 and based in Hong Kong. It offers traders access to the popular MetaTrader 4 (MT4) platform, which is widely used in the industry for its robust features and ease of use. However, the rise of many new brokers has also led to increased scrutiny regarding their legitimacy and reliability. As a trader, it is crucial to evaluate the trustworthiness of any forex broker before committing your funds. This article aims to provide an objective assessment of Shying, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a comprehensive analysis of various online sources, including user reviews, regulatory disclosures, and expert opinions.

Regulation and Legitimacy

The regulatory environment is one of the most critical factors in determining the safety of a forex broker. Regulation serves to protect traders by ensuring that brokers adhere to strict operational guidelines and maintain transparency in their dealings. Shying claims to be regulated, but the details surrounding its licensing are somewhat ambiguous.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 730729A | United Kingdom | Suspicious Clone |

| NFA | 0531292 | United States | Not Registered |

The Financial Conduct Authority (FCA) and the National Futures Association (NFA) are reputable regulators that provide oversight to forex brokers. However, Shying has been flagged as a "suspicious clone" of FCA-regulated entities, which raises red flags regarding its legitimacy. Traders should be cautious, as brokers lacking proper regulation may expose them to higher risks, including potential fraud. Moreover, while Shying has not faced negative regulatory disclosures to date, the absence of a solid regulatory framework is concerning. Investors should prioritize brokers with clear regulatory credentials to ensure their funds are adequately protected.

Company Background Investigation

Shying was founded in 2020, making it a relatively new player in the forex market. The companys ownership structure and management team are not well-documented, which can be a significant concern for potential investors. A lack of transparency in these areas often leads to questions about the broker's reliability and ethical practices.

The management teams background and expertise play a crucial role in the broker's operational integrity. Unfortunately, there is limited information available about Shying's management, which complicates the assessment of its credibility. The absence of a well-established reputation can deter potential clients who are looking for a broker with a proven track record of reliability and customer service.

Moreover, the level of transparency regarding company operations and financial disclosures is also a vital factor. A broker that openly shares information about its financial health, trading practices, and customer service policies is generally more trustworthy. As such, the lack of detailed information regarding Shying's operations may lead to skepticism among potential clients.

Trading Conditions Analysis

Understanding the trading conditions offered by Shying is essential for evaluating its overall value to traders. The broker operates on a commission-based model, but the specifics of its fee structure are not readily available. This lack of clarity may lead to unexpected costs for traders.

| Fee Type | Shying | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Model | Not Disclosed | Varies by broker |

| Overnight Interest Range | Not Disclosed | 0.5% - 1.5% |

The absence of clear information about spreads, commissions, and overnight interest rates raises concerns about Shying's transparency. Traders may find themselves facing higher costs than anticipated if they do not fully understand the fee structure before opening an account. Additionally, the potential for hidden fees or unfavorable trading conditions should not be overlooked.

Traders should also consider the types of accounts offered by Shying, as different account types can come with varying levels of service and costs. Without this information, it becomes challenging to assess whether Shying provides competitive trading conditions compared to other brokers in the market.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Shying claims to implement several measures to protect client funds, but the specifics are unclear.

Traders should look for brokers that offer segregated accounts, which ensure that client funds are kept separate from the broker's operational funds. This practice provides an additional layer of security, especially in the event of financial difficulties faced by the broker. Additionally, the presence of negative balance protection policies can help safeguard traders from losing more than their initial investment.

However, without detailed disclosures regarding Shying's fund security measures, traders may find themselves at risk. The lack of historical incidents regarding fund safety is a positive sign, but potential investors should remain vigilant and conduct thorough due diligence.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. Analyzing user experiences with Shying reveals a mixed bag of feedback.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Account Freezing | High | No Resolution |

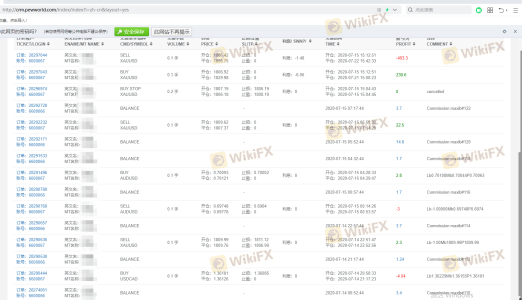

Common complaints against Shying include withdrawal issues and account freezing, which are significant red flags for any broker. Traders have reported difficulties in accessing their funds, with some claiming that their accounts were frozen without proper justification. Such issues can severely impact a trader's ability to operate effectively and may indicate deeper problems within the broker's operational practices.

While Shying has responded to some complaints, the overall quality of customer service appears to be lacking. Traders should be cautious when dealing with a broker that has a history of unresolved complaints, as this may reflect poorly on its commitment to client satisfaction.

Platform and Execution

The trading platform is a crucial aspect of a broker's service, impacting the overall trading experience. Shying utilizes the MT4 platform, which is known for its user-friendly interface and extensive functionality. However, the platform's performance and execution quality are critical factors to consider.

Traders have reported mixed experiences regarding order execution, with some experiencing slippage and delays. These issues can significantly affect trading outcomes, particularly in volatile market conditions. Moreover, any signs of potential platform manipulation, such as unusual spreads or frequent requotes, should raise concerns about the broker's integrity.

Risk Assessment

Using Shying as a forex broker comes with several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulation raises concerns. |

| Financial Risk | Medium | Unclear fee structure may lead to unexpected costs. |

| Operational Risk | High | History of complaints regarding account management. |

Traders should be particularly wary of the regulatory risks associated with Shying, as the broker appears to operate in a gray area regarding its licensing. To mitigate these risks, it is advisable to start with a small deposit and thoroughly test the broker's services before committing larger amounts.

Conclusion and Recommendations

In conclusion, is Shying safe or a scam? The available evidence suggests that potential traders should exercise caution. While Shying has not been directly implicated in fraudulent activities, its ambiguous regulatory status, lack of transparency, and history of customer complaints raise significant concerns.

For traders seeking a reliable forex broker, it may be prudent to consider alternatives that offer clearer regulatory oversight, transparent fee structures, and a proven track record of customer service. Brokers such as Interactive Brokers or Exness, which are well-regulated and have positive customer feedback, may be more suitable options for those looking to trade safely in the forex market.

Is SHYING a scam, or is it legit?

The latest exposure and evaluation content of SHYING brokers.

SHYING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SHYING latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.