Is SHANGQUAN safe?

Business

License

Is Shangquan Safe or Scam?

Introduction

Shangquan is an online forex broker established in 2022 and registered in Hong Kong. It positions itself as a gateway for traders to access a diverse range of financial instruments, including forex, commodities, and cryptocurrencies, through the popular MT5 trading platform. However, as the forex market is rife with unregulated entities, it is crucial for traders to exercise caution when selecting a broker. The potential for scams in this industry is significant, making it imperative to conduct thorough evaluations of brokers like Shangquan. This article aims to assess the safety and legitimacy of Shangquan by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk factors.

Regulation and Legitimacy

When assessing whether Shangquan is safe, one of the most critical factors to consider is its regulatory status. A broker's regulation indicates its adherence to financial standards and its obligation to protect client funds. Unfortunately, Shangquan is unregulated, which raises significant red flags regarding its legitimacy. Below is a summary table of the regulatory information related to Shangquan:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unlicensed |

The absence of regulation means that Shangquan does not have to adhere to any financial standards or consumer protection measures. This lack of oversight increases the risk of fraud, as unregulated brokers can operate without accountability. Historical data indicates that many unlicensed brokers often engage in practices that can lead to significant financial loss for traders. Therefore, it is crucial to approach Shangquan with caution and skepticism, especially considering the high-risk nature associated with trading through an unregulated platform.

Company Background Investigation

Shangquan claims to be owned by Shangquan International, which is purportedly based in Hong Kong. However, a deeper investigation into the company's history and ownership structure reveals a lack of transparency. The company was established in 2022, which is relatively new in the forex industry, and there is limited information available regarding its management team or the professional backgrounds of its executives. This absence of information raises further concerns about the company's credibility and operational integrity.

The lack of transparency in business operations and ownership can be indicative of potential risks. A reputable broker typically provides detailed information about its management team and operational history. In the case of Shangquan, the limited disclosure may suggest that the company is not committed to maintaining a trustworthy relationship with its clients. This ambiguity further fuels the question: Is Shangquan safe? Without clear insights into its management and operational practices, traders may find themselves at risk.

Trading Conditions Analysis

An essential aspect of evaluating whether Shangquan is safe lies in understanding its trading conditions. Shangquan claims to offer competitive trading fees, but the specifics of its fee structure remain unclear. Below is a comparison of the core trading costs associated with Shangquan and the industry average:

| Cost Type | Shangquan | Industry Average |

|---|---|---|

| Spread on Major Pairs | Unclear | 1.0 - 1.5 pips |

| Commission Structure | N/A | Varies (0 - 10 USD) |

| Overnight Interest Rates | Unclear | Varies (0.5% - 2%) |

The lack of clarity around spreads and commissions raises concerns about hidden fees that may not be disclosed upfront. Furthermore, high leverage ratios of up to 1:400, as advertised by Shangquan, can be appealing but also pose significant risks, particularly for inexperienced traders. Such high leverage can lead to rapid losses, making it critical for traders to fully understand the implications before engaging with this broker.

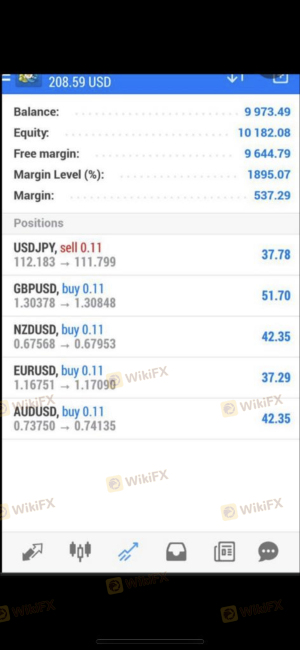

Customer Fund Security

The security of customer funds is a paramount concern for any trader. In the case of Shangquan, the absence of regulation means there are no mandated measures for fund protection. This raises serious questions about the safety of deposits made with the broker. Shangquan does not provide information regarding segregated accounts or investor protection schemes, which are standard practices among regulated brokers to safeguard client funds.

Additionally, the lack of a transparent withdrawal process can further complicate the situation. Reports from users indicate difficulties in accessing their funds, a common issue with unregulated brokers. This situation poses a significant risk to potential clients, as it is unclear how Shangquan handles client funds and whether they are protected from misappropriation or loss.

Customer Experience and Complaints

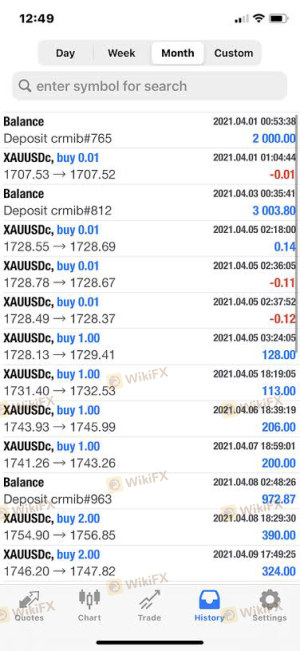

Analyzing customer feedback is crucial in determining whether Shangquan is safe for traders. Numerous reviews and complaints from users indicate a pattern of negative experiences, particularly regarding withdrawal issues and customer service responsiveness. Below is a summary of the primary complaint types encountered by Shangquan users:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Management | Medium | Average |

| Customer Support | High | Poor |

Several users have reported being unable to withdraw their funds, with some alleging that their requests were ignored or denied altogether. This pattern of complaints raises significant concerns about the broker's operational integrity and its commitment to customer service. In one case, a trader reported being unable to access their account for weeks, leading to frustrations and financial losses. Such experiences highlight the potential risks associated with trading through Shangquan.

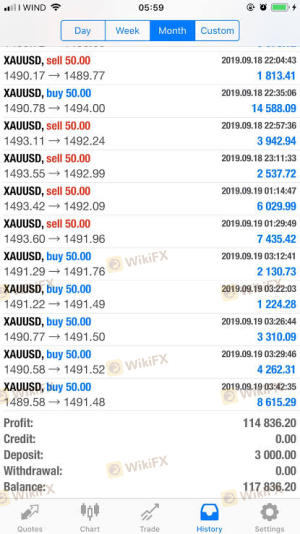

Platform and Execution

The trading platform offered by Shangquan is based on the widely used MT5 software, which is known for its robust features and user-friendly interface. However, the performance and reliability of the platform can significantly impact trading experiences. Users have reported instances of slippage and order rejections, which can lead to unexpected losses.

It is vital to assess whether there are any indications of platform manipulation. Traders should be wary if they notice unusual trading conditions or discrepancies between the market price and the execution price provided by the broker. A thorough evaluation of the platform's execution quality is essential to determine if Shangquan is safe for trading.

Risk Assessment

Using Shangquan comes with inherent risks that traders must consider. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | No protection for client funds. |

| Operational Risk | Medium | Limited transparency and poor customer feedback. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Shangquan. It is advisable to start with a small investment and monitor the broker's performance closely. Additionally, exploring alternative, regulated brokers may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Shangquan is not a safe broker for forex trading. The lack of regulation, transparency issues, negative customer experiences, and significant risks associated with fund security raise serious concerns about its legitimacy. Traders are advised to exercise extreme caution and consider alternative, regulated brokers that offer better protection and support.

For those seeking reliable alternatives, consider brokers with established regulatory oversight, transparent fee structures, and positive customer reviews. Engaging with a reputable broker can help ensure a more secure and trustworthy trading experience. Always prioritize your financial safety and conduct thorough research before making any investment decisions.

Is SHANGQUAN a scam, or is it legit?

The latest exposure and evaluation content of SHANGQUAN brokers.

SHANGQUAN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SHANGQUAN latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.