Is Super EZ Forex safe?

Pros

Cons

Is Super Ez Forex Safe or a Scam?

Introduction

Super Ez Forex is an automated trading system that claims to simplify the forex trading process for both novice and experienced traders. Positioned as a user-friendly solution, it promises to help users achieve consistent profits through its proprietary trading indicators and algorithms. However, as with any trading platform, it is essential for traders to conduct thorough due diligence before committing their funds. The forex market is rife with potential pitfalls, and the risk of encountering scams is ever-present. This article aims to critically evaluate whether Super Ez Forex is a legitimate trading option or a potential scam. Our investigation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial for determining its legitimacy and safety. Regulated brokers are subject to oversight, which helps protect traders' interests. Unfortunately, Super Ez Forex lacks valid regulatory information, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Super Ez Forex does not adhere to any established financial standards or practices. This lack of oversight can expose traders to higher risks, including potential fraud or mismanagement of funds. Additionally, the company's website does not provide any information about its compliance history, which further complicates the assessment of its credibility.

The importance of regulation cannot be overstated; it serves as a safety net for traders, ensuring that their funds are managed responsibly. Without such protections, traders may find themselves vulnerable to unscrupulous practices. Therefore, the question of Is Super Ez Forex safe? remains unanswered, leaning towards a negative assessment given its lack of regulatory oversight.

Company Background Investigation

Understanding the history and ownership structure of Super Ez Forex is vital for evaluating its trustworthiness. Unfortunately, the company provides minimal information about its origins, management team, or operational history, which raises red flags.

The platform appears to be a relatively recent entry into the forex market, but specific details about its founding date or the experience of its management team are conspicuously absent. This lack of transparency makes it challenging to assess the company's credibility and the expertise of those behind it.

Moreover, the absence of an identifiable corporate structure or contact information further complicates matters. A reputable trading platform typically provides detailed information about its management team, including their qualifications and experience in the financial sector. The lack of such information raises questions about the companys commitment to transparency and accountability, leading to doubts about whether Super Ez Forex is safe for traders.

Trading Conditions Analysis

When evaluating a trading platform, the overall cost structure and trading conditions play a significant role in determining its attractiveness. Super Ez Forex charges a one-time fee of $323.67, which includes an 8.25% tax. This pricing model appears to be significantly higher than the industry average for similar trading indicators.

| Fee Type | Super Ez Forex | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads, commissions, and overnight interest rates is concerning. Typically, traders expect transparent pricing, including any potential hidden fees. The opaque nature of Super Ez Forex's fee structure may indicate a lack of professionalism and could lead to unexpected costs for traders.

Additionally, the lack of a refund policy raises further questions about the company's commitment to customer satisfaction. In a well-regulated environment, traders usually have the option to recover their funds if they are dissatisfied with the service. The absence of such a policy in the case of Super Ez Forex further complicates the question of whether it is a trustworthy platform.

Customer Fund Security

The security of customer funds is paramount when evaluating any trading platform. Super Ez Forexs website does not provide adequate information regarding its measures for protecting client funds. Key aspects to consider include the segregation of client funds, investor protection schemes, and negative balance protection policies.

Traders should be wary of platforms that do not clearly outline their security protocols, as this can lead to significant financial risks. The lack of information on whether customer funds are held in segregated accounts or if there are any investor compensation schemes in place raises concerns.

Additionally, historical issues related to fund security can provide insights into a platform's reliability. Unfortunately, there is no publicly available information regarding past incidents involving Super Ez Forex, but the absence of a solid security framework is a significant red flag. This lack of transparency raises doubts about whether Super Ez Forex is safe for traders looking to protect their investments.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the real user experience with Super Ez Forex. Unfortunately, the platform has garnered limited reviews, and those available are mixed at best. Many users express frustration over the lack of transparency and the high costs associated with the service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Lack of Transparency | High | Poor |

| High Fees | Medium | Poor |

| Withdrawal Issues | High | Poor |

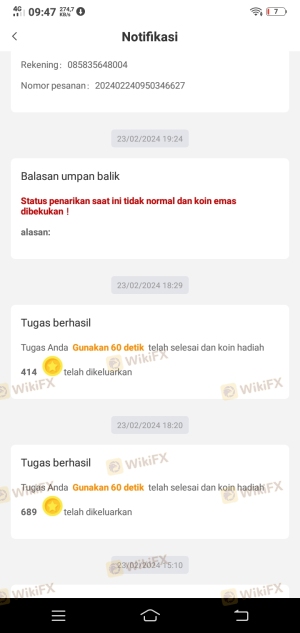

Common complaints include high fees, inadequate customer support, and difficulties in withdrawing funds. The lack of a robust customer service framework can exacerbate these issues, leaving traders feeling unsupported.

One notable case involved a user who reported difficulties in withdrawing funds after several months of trading with the platform. The user claimed that their requests were met with vague responses, leading to frustration and distrust. Such experiences contribute to the growing sentiment that Super Ez Forex may not be safe for traders seeking reliable support.

Platform and Execution

The performance of a trading platform significantly impacts the overall trading experience. Super Ez Forex claims to offer a user-friendly interface compatible with the popular MetaTrader 4 platform. However, there are no independent reviews verifying the platform's execution quality or reliability.

Traders often report issues such as slippage, high rejection rates, and overall platform instability with unregulated brokers. Given the limited information available regarding Super Ez Forex, it is difficult to ascertain whether these issues are prevalent.

However, the lack of transparency regarding order execution practices raises concerns about potential manipulation or unfair practices. Without verified performance metrics, traders may be left vulnerable to subpar execution, further questioning whether Super Ez Forex is a safe option.

Risk Assessment

Engaging with Super Ez Forex involves several risks that traders should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of transparency in fees |

| Operational Risk | Medium | Unverified platform performance |

| Customer Support Risk | High | Poor response to complaints |

Traders should approach Super Ez Forex with caution due to the high levels of regulatory and financial risk. The absence of a reliable support system further complicates matters, making it essential for potential users to weigh their options carefully.

To mitigate these risks, it is advisable to conduct thorough research, consider alternative platforms with better regulatory standing, and only invest funds that one can afford to lose.

Conclusion and Recommendations

In conclusion, the investigation into Super Ez Forex raises significant concerns about its safety and legitimacy. The lack of regulatory oversight, transparency regarding fees, and poor customer feedback collectively suggest that Super Ez Forex may not be a safe trading option. Traders should be particularly cautious about engaging with platforms that do not prioritize transparency and customer security.

For those seeking reliable trading platforms, consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Platforms like eToro or IG offer robust regulatory frameworks and transparent fee structures, making them safer options for traders.

Ultimately, while the allure of automated trading systems like Super Ez Forex may be tempting, the potential risks far outweigh the benefits. Always prioritize safety and due diligence when navigating the forex market.

Is Super EZ Forex a scam, or is it legit?

The latest exposure and evaluation content of Super EZ Forex brokers.

Super EZ Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Super EZ Forex latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.