Regarding the legitimacy of SapphireFX forex brokers, it provides ASIC and WikiBit, .

Is SapphireFX safe?

Pros

Cons

Is SapphireFX markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Forex Execution License (STP)

Licensed Entity:

SAPPHIRE COMMODITIES (PTY) LTD

Effective Date:

2008-07-29Email Address of Licensed Institution:

roberti@farmarco.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

ROBERT IMRAY, 4 SiMila STreeT, TOOWOOMBA QLD 4350Phone Number of Licensed Institution:

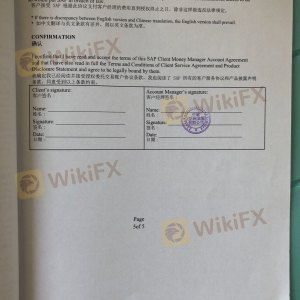

07 4637 6400Licensed Institution Certified Documents:

Is Sapphirefx Safe or Scam?

Introduction

Sapphirefx is a forex broker that has recently gained attention in the trading community. Positioned as a platform for both novice and experienced traders, it claims to offer a range of trading instruments and competitive trading conditions. However, the growing number of complaints and concerns surrounding its legitimacy has led many traders to question: Is Sapphirefx safe? Evaluating a forex broker's credibility is crucial for traders, as the wrong choice can lead to significant financial losses. This article aims to provide a comprehensive analysis of Sapphirefx, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. The evaluation will be based on a thorough review of online resources, user feedback, and expert opinions.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its safety. A regulated broker must adhere to strict guidelines that protect traders' interests. Unfortunately, Sapphirefx does not appear to be regulated by any reputable financial authority, raising red flags about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Sapphirefx is not subject to oversight by any governing body, leaving traders vulnerable to potential fraud. Regulatory bodies like the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) enforce rules that protect clients, including maintaining segregated accounts and ensuring transparency in operations. Sapphirefx's lack of regulation suggests that it may not follow these essential practices, making it imperative for traders to exercise caution.

Company Background Investigation

Sapphirefx is relatively new in the forex market, and its company history raises several concerns. The broker claims to operate from offshore locations, which often serve as hubs for unregulated trading activities. The company's ownership structure is opaque, with little information available about its founders or management team.

Transparency is vital in the financial industry, and the lack of clear information regarding Sapphirefx's leadership can be alarming. A strong management team with a proven track record can significantly enhance a broker's credibility. However, without such transparency, traders are left in the dark regarding the qualifications and intentions of the people behind Sapphirefx.

Trading Conditions Analysis

When assessing whether Sapphirefx is safe, understanding its trading conditions is essential. The broker claims to offer competitive spreads and low fees, but many users have reported hidden charges and unfavorable trading conditions.

| Fee Type | Sapphirefx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 2% | 1% |

Traders have noted that while the advertised spreads may seem attractive, the actual trading costs can be significantly higher due to undisclosed fees. Furthermore, the commission structure lacks clarity, which can lead to unexpected expenses. Such practices are concerning and warrant a closer look when determining if Sapphirefx is a trustworthy broker.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker's reliability. Sapphirefx has not provided sufficient information on its fund protection measures. A reputable broker typically segregates client funds from its operational funds, ensuring that traders' money is safe even in the event of company insolvency.

Moreover, protections like negative balance protection are crucial, as they prevent traders from losing more than their initial investment. However, there are no indications that Sapphirefx offers such safeguards. The lack of transparency regarding these safety measures raises questions about the security of funds held with this broker.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of any broker. In the case of Sapphirefx, numerous complaints have surfaced regarding withdrawal issues and poor customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inadequate |

| Poor Customer Support | Medium | Slow Response |

| Misleading Information | High | Ignored |

Many users have reported that after depositing funds, they faced significant challenges when attempting to withdraw their money. Complaints about unresponsive customer service and lack of assistance in resolving issues are common. These recurring problems suggest a pattern of behavior that is concerning for potential clients.

Platform and Execution

The trading platform's performance is another critical aspect of evaluating Sapphirefx. Users have reported mixed experiences regarding platform stability and execution quality.

Many traders have experienced slippage and delays in order execution, which can significantly impact trading outcomes. Moreover, the absence of a demo account limits potential clients' ability to test the platform before committing real funds. Such limitations can lead to a lack of confidence in the broker, further questioning Is Sapphirefx safe?

Risk Assessment

In summary, the overall risk associated with using Sapphirefx is considerable.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Safety Risk | High | Lack of protection |

| Customer Service Risk | Medium | Poor response times |

Given these risks, traders should approach Sapphirefx with caution. It is advisable to conduct thorough research and consider alternatives that offer better regulatory oversight and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that potential clients should be wary of Sapphirefx. The lack of regulation, transparency, and consistent customer complaints indicate that there are significant risks involved in trading with this broker. While some users may have had positive experiences, the overarching trends point to a concerning pattern that raises questions about the broker's safety and legitimacy.

For traders seeking a reliable broker, it is recommended to consider alternatives that are regulated and have a proven track record of customer satisfaction. Brokers with strong regulatory oversight and positive user reviews can provide a safer trading environment, ensuring that traders' investments are better protected. Always prioritize safety and due diligence when selecting a forex broker to mitigate the risks associated with trading.

Is SapphireFX a scam, or is it legit?

The latest exposure and evaluation content of SapphireFX brokers.

SapphireFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SapphireFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.