Regarding the legitimacy of Royal Capital forex brokers, it provides a comprehensive investigation into the security aspects of regulatory and WikiBit, as well as whether there are any negative scam reviews.

Rating Index

Software Index

Risk Control

Is Royal Capital safe?

The regulatory license is the strongest proof.

HKGX Type A1 License

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Type A1 License

Licensed Institution:

英倫金業(亞洲)有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.llg9999.comExpiration Time:

--Address of Licensed Institution:

九龍長沙灣道永康街9號7樓709室Phone Number of Licensed Institution:

37537900Licensed Institution Certified Documents:

FSPR Financial Service Corporate

Financial Service Providers Register

Financial Service Providers Register

Current Status:

ExceededLicense Type:

Financial Service Corporate

Licensed Institution:

RC GLOBAL LIMITED

Effective Date:

2016-04-28Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Suite B, 25 Porana Rd Wairau Valley AucklandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Royal Capital A Scam?

Introduction

Royal Capital is a brokerage firm that positions itself within the competitive landscape of the foreign exchange (forex) market, offering a range of trading services across various financial instruments. As with any broker, it is crucial for traders to evaluate the legitimacy and safety of Royal Capital before committing their funds. The forex market can be rife with scams and unregulated entities, making due diligence essential for protecting ones investments. This article aims to provide an objective assessment of Royal Capital by investigating its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. Our analysis is based on data collected from reputable financial review websites, regulatory databases, and user feedback.

Regulation and Legitimacy

The regulatory status of a brokerage is a fundamental aspect that influences its credibility and trustworthiness. Royal Capital claims to be regulated by the Chinese Gold & Silver Exchange Society (CGSE) and the Financial Service Providers Register (FSPR) in New Zealand. However, the quality and rigor of these regulations can vary significantly. Below is a summary of Royal Capital's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | 076 | Hong Kong | Verified |

| FSPR | 489386 | New Zealand | Exceeded |

While being regulated by CGSE provides a level of oversight, it is essential to note that it is not considered a top-tier regulator like the FCA or ASIC. Furthermore, reports indicate that Royal Capital has faced scrutiny regarding its compliance with regulatory standards. Traders should be cautious, as a lack of stringent regulation can expose them to higher risks. The history of compliance issues or any regulatory warnings against the broker should be thoroughly researched by potential clients.

Company Background Investigation

Royal Capital was established in 2012 and has since developed a presence in the financial markets, specifically in Hong Kong. The ownership structure and management teams experience play a critical role in determining the broker's reliability. The firm claims to have a diverse management team with backgrounds in finance and trading, but detailed information about their qualifications and previous roles is limited. Transparency regarding company ownership and management is vital for establishing trust, and the lack of this information may raise concerns for potential clients.

Moreover, the level of transparency in disclosing operational practices and financial health is a significant factor in assessing whether Royal Capital is safe. A broker that is open about its operations and financial status is generally more trustworthy than those that are not. It is advisable for traders to seek brokers that maintain high levels of transparency and provide comprehensive information about their corporate structure and management.

Trading Conditions Analysis

When assessing whether Royal Capital is safe, an examination of its trading conditions is imperative. The broker offers various account types, with different minimum deposit requirements and trading fees. However, the overall cost structure appears to be somewhat opaque, which can be a red flag for traders. Below is a comparison of core trading costs at Royal Capital versus the industry average:

| Fee Type | Royal Capital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.0 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 3-5% | 1-3% |

The spreads offered by Royal Capital are higher than the industry average, which could indicate less favorable trading conditions for clients. Additionally, while the absence of commissions may seem attractive, it is essential to consider the overall cost of trading, including spreads and potential hidden fees. Traders should be wary of any unusual fees or policies that could affect their profitability.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. Royal Capital claims to implement measures such as segregated accounts to protect client deposits. This means that client funds are kept separate from the company's operational funds, which is a standard practice among reputable brokers. However, the effectiveness of these measures can only be verified through consistent regulatory oversight and the absence of historical incidents related to fund misappropriation.

Moreover, the broker's policies on investor protection, including negative balance protection, should be clearly outlined. Traders should inquire about the mechanisms in place to safeguard their investments, especially in volatile market conditions. Any past incidents involving fund security or disputes regarding withdrawals should also be carefully examined to determine whether Royal Capital is safe for trading.

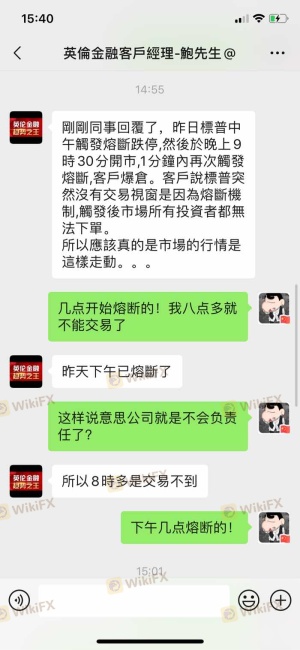

Customer Experience and Complaints

Understanding customer experiences can provide valuable insights into a brokers reliability. Various online platforms report mixed reviews regarding Royal Capital, with some users praising the trading conditions while others highlight significant issues. Common complaints include difficulties in fund withdrawals and inadequate customer support. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Availability | Medium | Limited hours |

| Slippage and Execution Issues | High | Unresolved |

Typical cases involve clients reporting delays in processing withdrawals, which can be a significant concern for traders. The responsiveness of customer support is crucial, and a lack of timely assistance can lead to frustration and financial loss. It is essential for potential clients to consider these factors when evaluating whether Royal Capital is safe for their trading activities.

Platform and Trade Execution

The performance of the trading platform is a key factor in a broker's overall reliability. Royal Capital utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and advanced trading tools. However, reports of execution delays and slippage have been noted by some users, raising questions about the platform's reliability. Traders should assess the quality of order execution, including the rate of slippage and any instances of rejected orders, as these factors can significantly impact trading performance.

Risk Assessment

Engaging with any broker comes with inherent risks. For Royal Capital, the following risk categories have been identified:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited top-tier regulation |

| Fund Security Risk | Medium | Segregated accounts but past issues |

| Execution Risk | High | Reports of slippage and delays |

| Customer Service Risk | Medium | Mixed feedback on support responsiveness |

To mitigate these risks, potential traders should conduct thorough research, maintain realistic expectations, and consider diversifying their investments. It is advisable to start with a demo account to test the platform and its features before committing significant capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that while Royal Capital is a regulated broker, it has several areas of concern that potential traders should be aware of. The regulatory oversight is not as robust as that of top-tier brokers, and there have been reports of customer complaints related to fund withdrawals and execution issues. Therefore, it is prudent for traders to approach Royal Capital with caution.

If you are a beginner or risk-averse trader, it may be wise to consider alternative brokers with more established reputations and stronger regulatory frameworks. Brokers such as Exness or IC Markets are often recommended for their competitive trading conditions and higher levels of customer support. Ultimately, ensuring that Royal Capital is safe for your trading needs requires careful consideration of these factors and a thorough analysis of your individual trading goals and risk tolerance.

Is Royal Capital a scam, or is it legit?

The latest exposure and evaluation content of Royal Capital brokers.