WCG Markets 2025 Review: Everything You Need to Know

Executive Summary

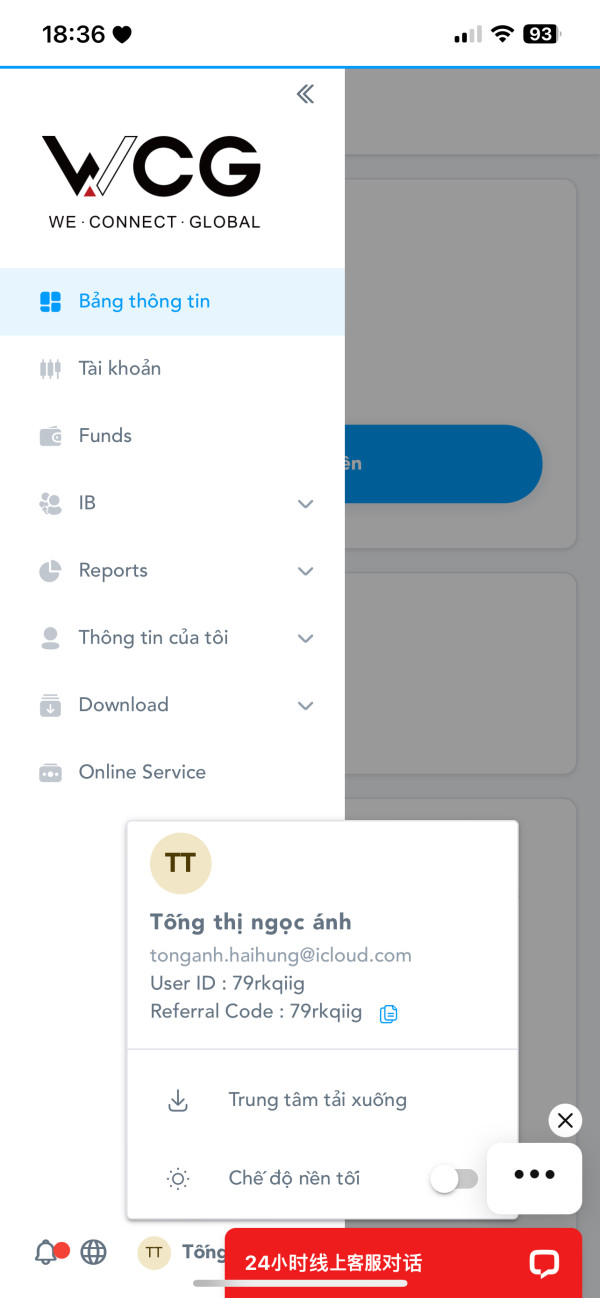

WCG Markets is a forex broker established in 2020. It is registered in Saint Vincent and the Grenadines. This wcg markets review reveals a complex regulatory landscape with generally poor user feedback across multiple platforms. The broker offers leverage up to 200:1. It supports trading in various asset classes through the MetaTrader 4 platform.

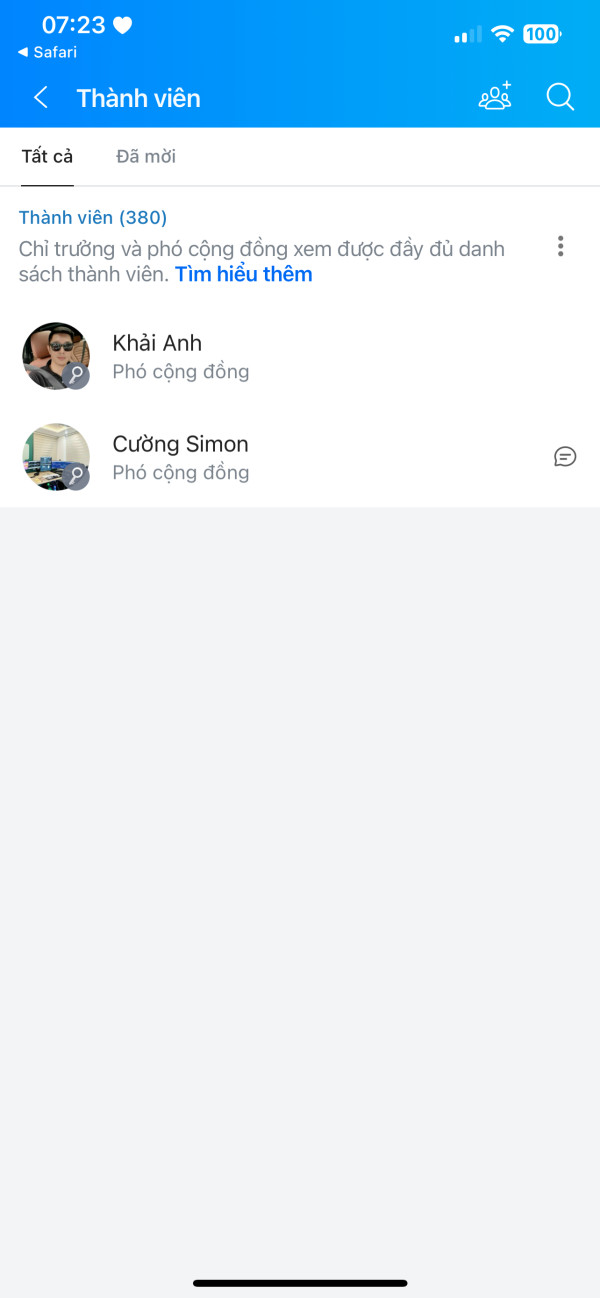

The company claims regulation under multiple jurisdictions including Saint Vincent and the Grenadines Financial Services Authority, Canada's FINTRAC, and Vanuatu's VFSC. However, the complexity of its regulatory status and ownership structure raises questions about its legitimacy and reliability. User reviews consistently highlight concerns about service quality, platform stability, and fund security. These issues create significant red flags for potential investors.

WCG Markets primarily targets investors seeking high-leverage trading opportunities. However, potential clients should carefully consider the significant risks associated with this broker. The platform provides access to forex, precious metals, crude oil, futures, stocks, and cryptocurrencies. Specific details about spreads, minimum deposits, and comprehensive fee structures remain unclear in available documentation.

Given the predominantly negative user feedback and regulatory uncertainties, this broker requires careful due diligence before any trading decisions.

Important Disclaimers

WCG Markets operates under a complex regulatory framework spanning multiple jurisdictions. Users must understand the varying legal protections and compliance requirements in different regions. The regulatory claims made by the broker require independent verification. The legitimacy of some licenses remains questionable.

This review relies on publicly available information and user feedback, which may not provide a complete picture of the broker's operations. The forex trading industry is subject to rapid changes in regulations, fee structures, and service offerings. Potential investors should conduct their own comprehensive research. They should also consider consulting with financial advisors before making any trading decisions.

Information presented here reflects the current understanding based on available sources and may not capture all aspects of the broker's services or recent developments in their business operations.

Rating Framework

Broker Overview

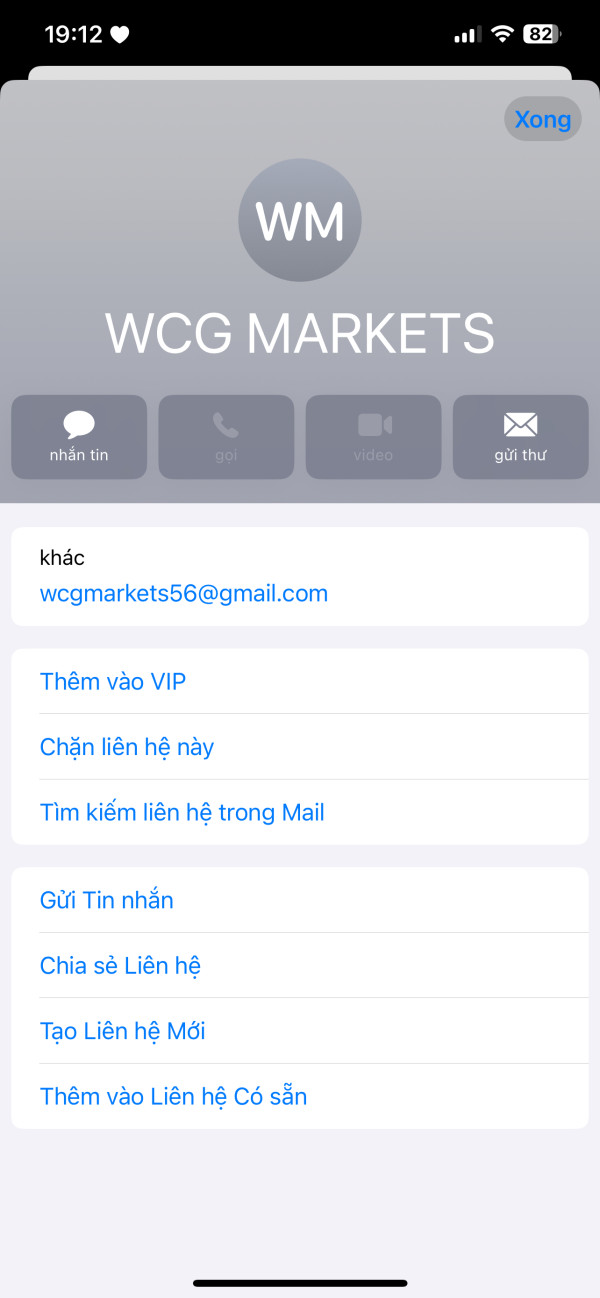

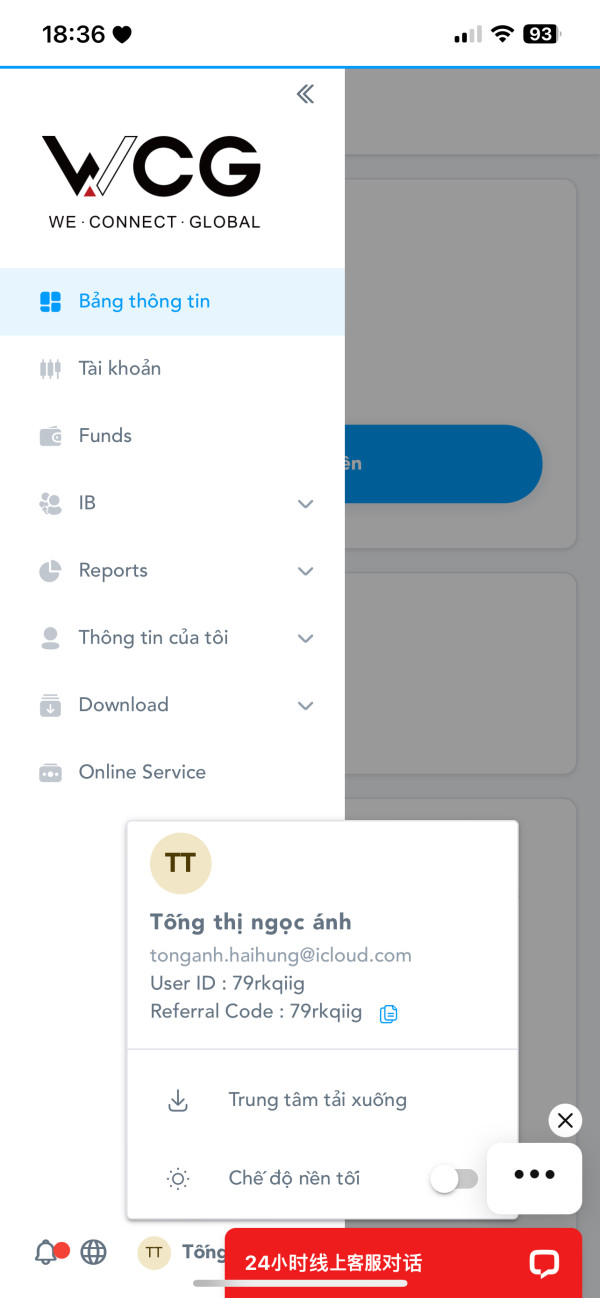

WCG Markets Ltd was established in 2020. It is registered in Saint Vincent and the Grenadines. The company claims to operate under multiple regulatory frameworks, including Canada's FINTRAC and Vanuatu's VFSC, though the specific headquarters location and detailed corporate structure remain unclear. This regulatory complexity has contributed to questions about the broker's legitimacy and operational transparency.

The broker's business model focuses on providing forex and other financial instrument trading services. However, the intricate ownership structure and regulatory claims have raised concerns among industry observers. According to available information, the company has faced various user complaints and warnings suggesting potential fraudulent activities, which significantly impacts its market reputation.

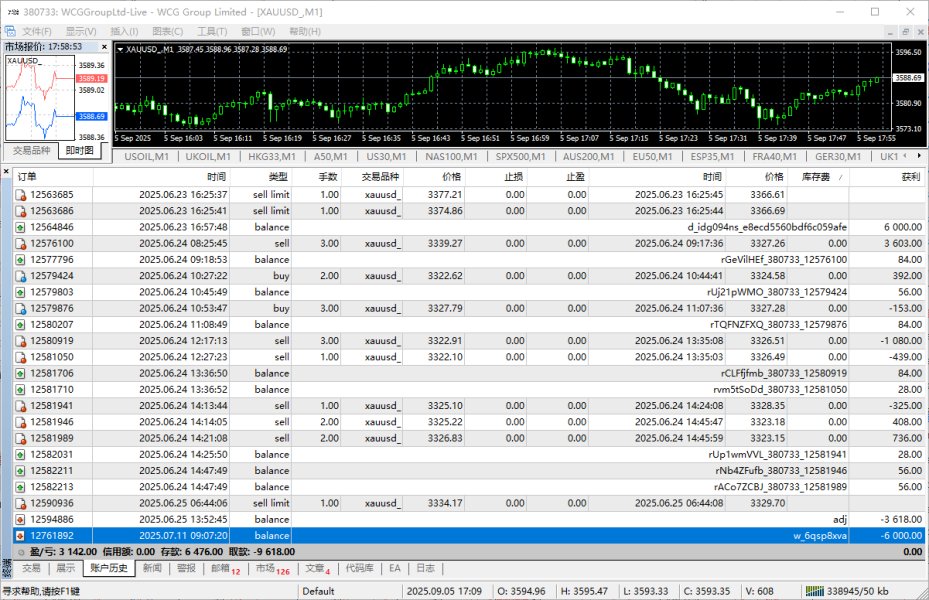

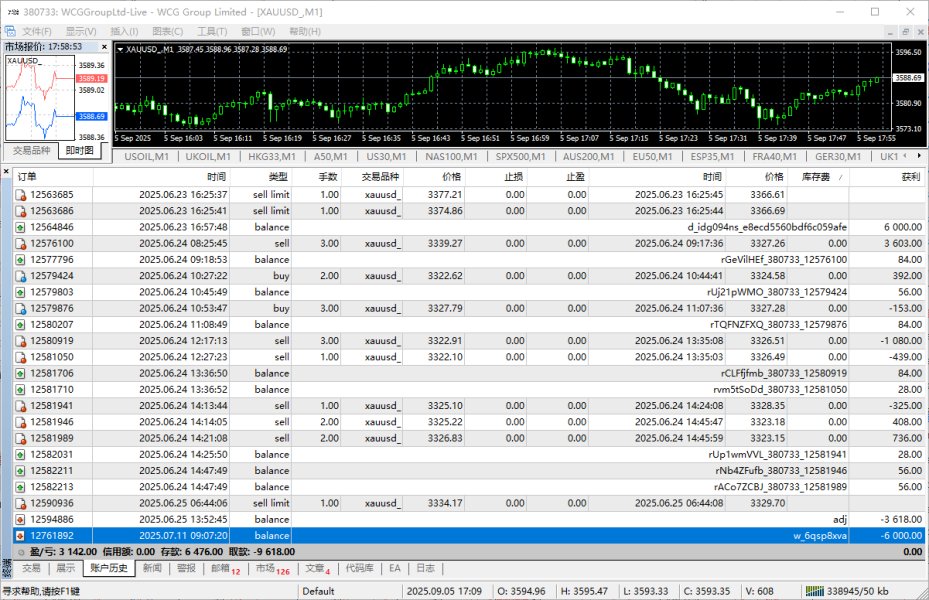

WCG Markets operates primarily through the MetaTrader 4 (MT4) trading platform. It offers access to multiple asset classes including forex pairs, precious metals, crude oil, futures contracts, stocks, and cryptocurrencies. The broker advertises leverage up to 200:1. This targets traders seeking high-leverage opportunities in volatile markets.

The primary regulatory oversight comes from the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA), with additional claims of regulation under Canada's FINTRAC and the Vanuatu Financial Services Commission (VFSC). However, the verification and legitimacy of these regulatory relationships require careful scrutiny. This wcg markets review has found inconsistencies in the available regulatory documentation.

Regulatory Jurisdictions: WCG Markets operates under the Saint Vincent and the Grenadines Financial Services Authority. It claims additional oversight from Canada's FINTRAC and Vanuatu's VFSC. The complexity of these regulatory relationships requires independent verification.

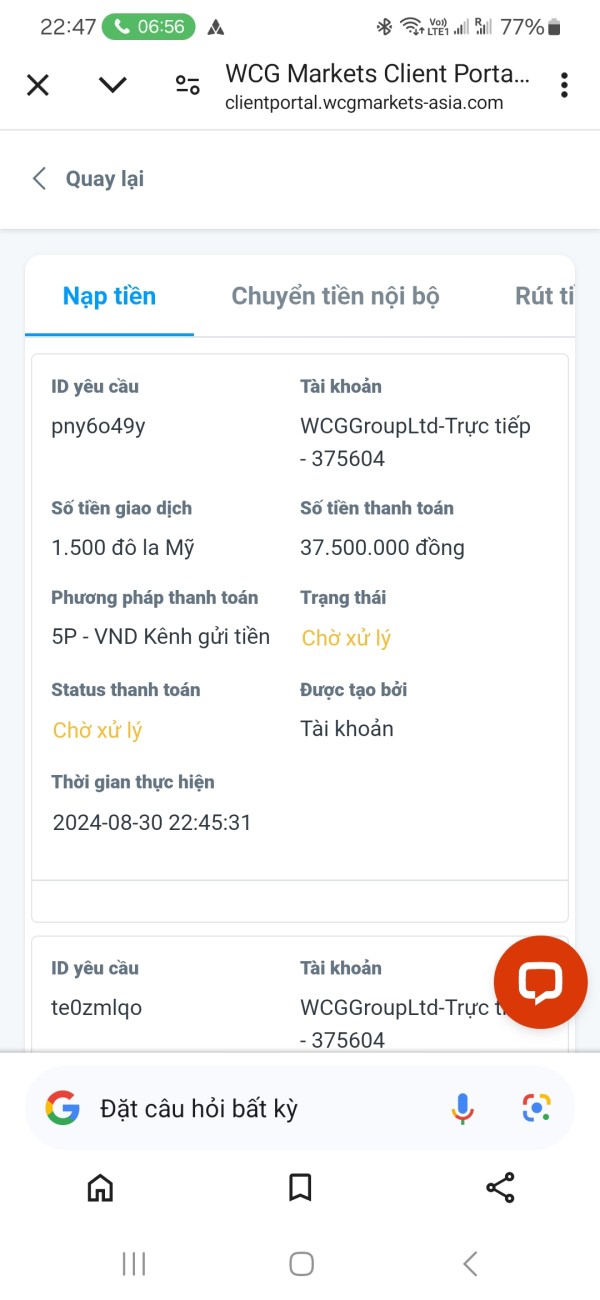

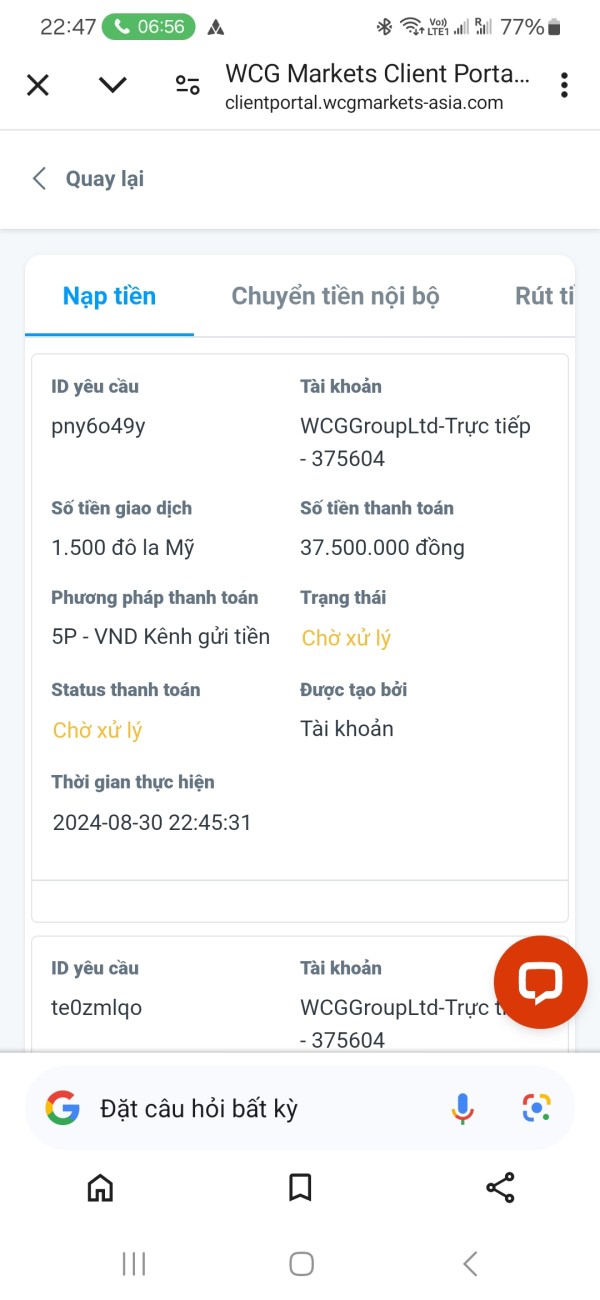

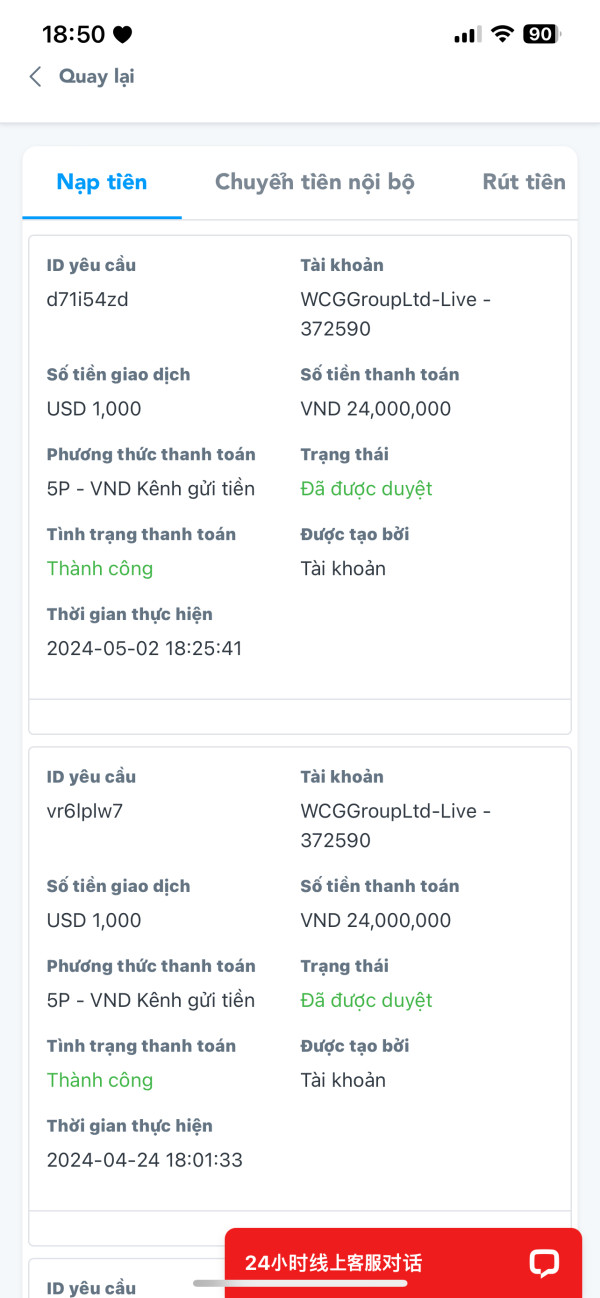

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available sources. This represents a significant transparency concern for potential clients.

Minimum Deposit Requirements: The available information does not specify minimum deposit requirements. This makes it difficult for potential traders to understand entry-level investment needs.

Bonus and Promotional Offers: Information about specific bonus structures and promotional campaigns was not mentioned in the source materials. This suggests limited marketing incentives.

Tradeable Assets: The platform supports trading in forex pairs, precious metals, crude oil, futures contracts, stocks, and cryptocurrencies. It provides diversification opportunities across multiple asset classes.

Cost Structure: Detailed information about spreads, commissions, and fee structures was not provided in available sources. This represents a significant gap in transparency for cost-conscious traders.

Leverage Ratios: WCG Markets offers leverage up to 200:1. This appeals to traders seeking amplified market exposure but also increases risk significantly.

Platform Options: The broker provides access to MetaTrader 4 (MT4). This is a widely recognized and established trading platform in the forex industry.

Regional Restrictions: Specific geographical limitations and restricted territories were not detailed in the available information.

Customer Service Languages: The available sources did not specify which languages are supported for customer service communications.

This wcg markets review highlights significant information gaps that potential clients should address through direct broker contact before making trading decisions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

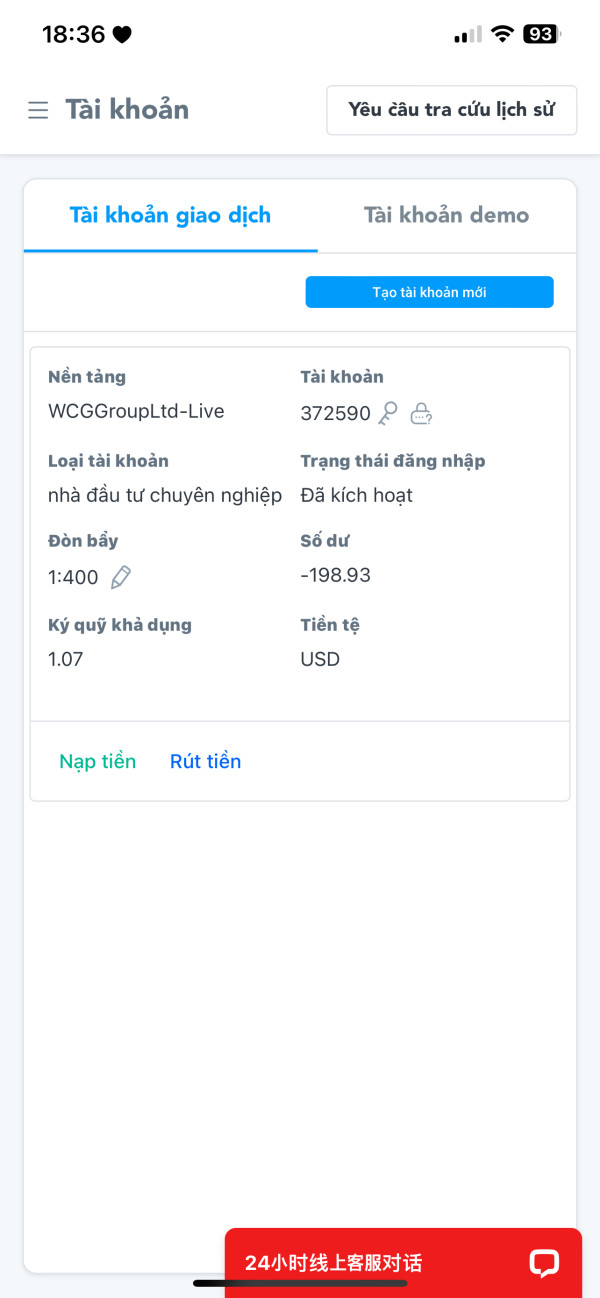

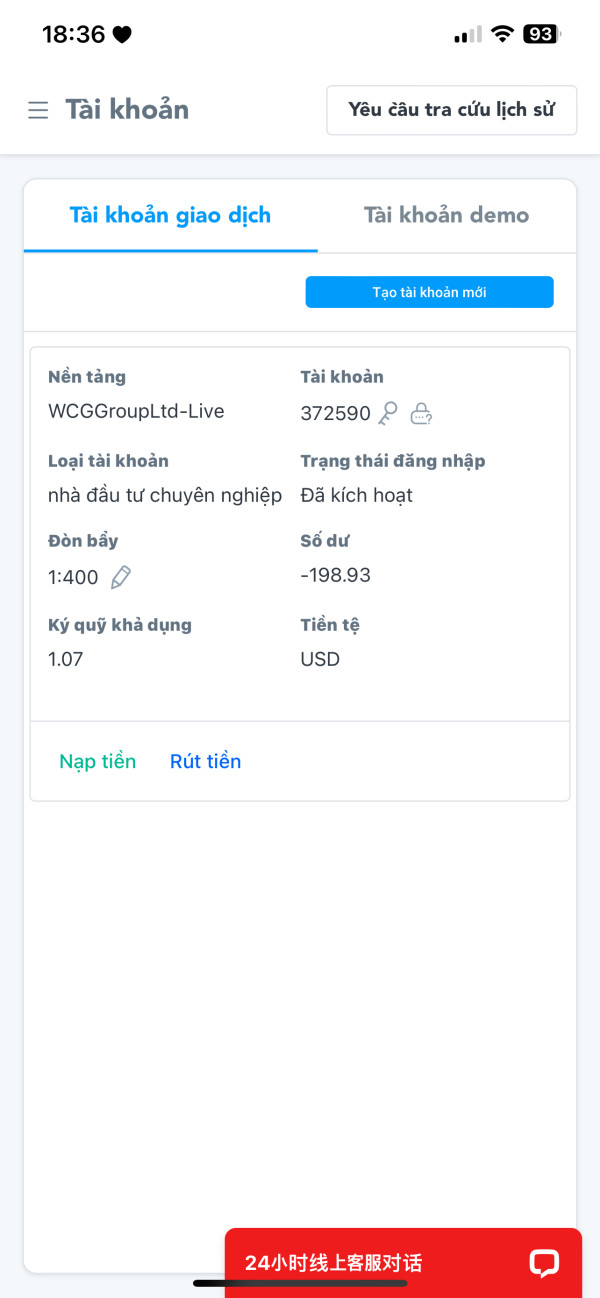

WCG Markets receives a below-average rating for account conditions due to limited transparency about account types and requirements. The available information does not specify different account tiers, their respective features, or minimum deposit requirements. This creates uncertainty for potential clients trying to understand their options.

The lack of detailed information about account opening procedures represents a significant weakness in the broker's transparency. Most reputable brokers provide clear documentation about account types, from basic retail accounts to professional or VIP tiers with enhanced features. User feedback suggests confusion about account conditions and unclear deposit requirements.

The absence of information about special account features, such as Islamic accounts for Sharia-compliant trading or demo accounts for practice trading, further diminishes the appeal for diverse trader needs. Additionally, no information was available about account maintenance fees, inactivity charges, or other account-related costs. These costs could impact long-term trading profitability.

User reviews indicate dissatisfaction with account-related processes, though specific details about account conditions remain unclear. The lack of comprehensive account information makes it difficult for traders to make informed decisions. They cannot determine whether WCG Markets meets their specific trading requirements and financial capabilities.

This wcg markets review recommends that potential clients directly contact the broker for detailed account condition information before proceeding with any registration or deposit processes.

WCG Markets achieves an average rating for tools and resources, primarily based on its provision of the MetaTrader 4 platform. MT4 is an industry-standard trading software. MT4 offers essential trading functionalities including technical analysis tools, automated trading capabilities through Expert Advisors, and customizable chart displays.

However, the broker appears to lack comprehensive additional analytical tools or proprietary research resources that could enhance the trading experience. The available information does not mention advanced market analysis, economic calendars, trading signals, or educational webinars. Many competitive brokers provide these features to support trader development and decision-making.

Educational resources appear to be limited or non-existent based on available information. This is particularly concerning for novice traders who require guidance and learning materials. The absence of trading guides, video tutorials, or market commentary represents a significant gap in value-added services.

User feedback suggests disappointment with the quality and availability of analytical resources. This indicates that the broker may not provide sufficient support tools for informed trading decisions. The lack of mobile trading app information also raises questions about accessibility and convenience for traders who prefer mobile platforms.

While the MT4 platform provides basic trading functionality, the apparent absence of comprehensive educational and analytical resources limits the overall value proposition for traders seeking a full-service broker experience.

Customer Service and Support Analysis (Score: 5/10)

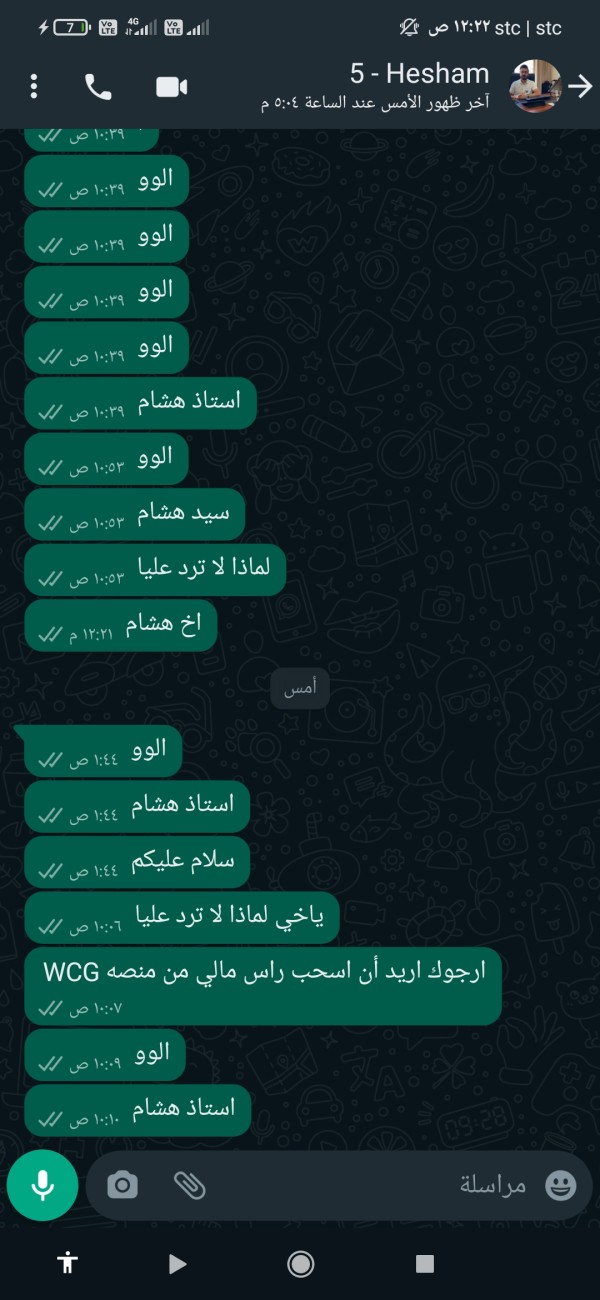

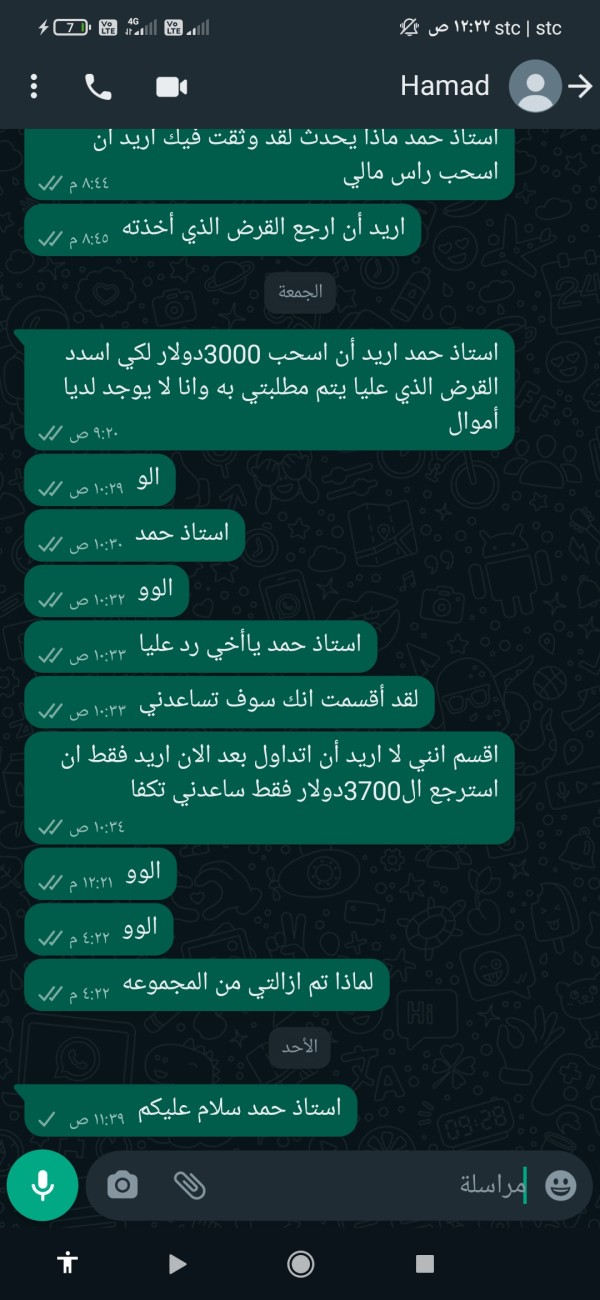

WCG Markets receives a below-average rating for customer service and support, primarily based on consistently negative user feedback regarding service quality and responsiveness. Available information does not specify customer service channels, operating hours, or supported languages. This creates uncertainty about accessibility and support availability.

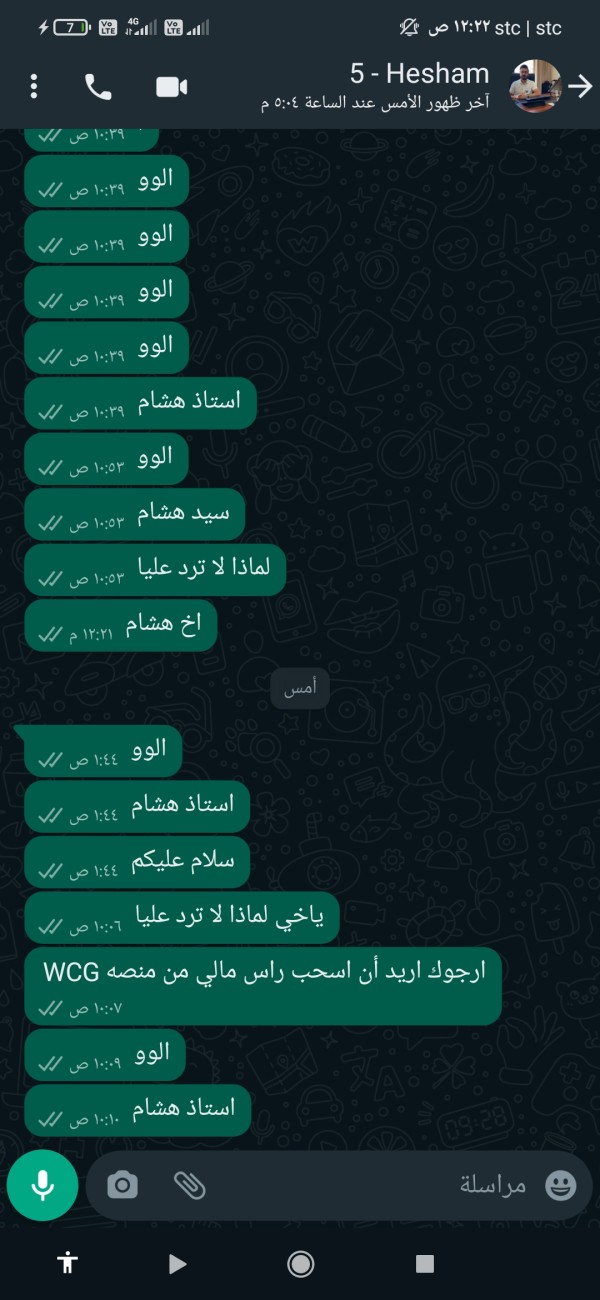

User reviews indicate prolonged response times and unsatisfactory resolution of customer inquiries and concerns. The lack of transparent communication channels and unclear customer service procedures appears to be a recurring complaint. Users who have attempted to contact the broker for assistance report these issues consistently.

The absence of detailed information about customer support infrastructure, including live chat availability, phone support, or email response times, suggests limited investment in customer service capabilities. Most reputable brokers provide multiple communication channels and clearly defined service level agreements for customer support.

User feedback consistently highlights poor service quality, with complaints ranging from unresponsive customer service representatives to inadequate resolution of trading-related issues. The lack of multilingual support information also raises concerns about accessibility for international clients.

The overall customer service experience appears to fall short of industry standards, with users expressing frustration about communication difficulties and unresolved concerns. This represents a significant weakness for a financial services provider where reliable customer support is essential for addressing urgent trading and account-related issues.

Trading Experience Analysis (Score: 5/10)

WCG Markets receives a below-average rating for trading experience due to user reports of platform stability issues and execution problems. While the broker offers the MetaTrader 4 platform, which is generally reliable, user feedback suggests specific implementation problems. These include slippage and requote issues during trade execution.

Platform stability concerns have been raised by multiple users, indicating potential technical infrastructure limitations that could impact trading performance. The presence of slippage and requotes suggests possible issues with liquidity provision or order routing. These problems can negatively affect trading outcomes and profitability.

The available information does not provide details about advanced trading features, mobile platform capabilities, or enhanced order types that could improve the trading experience. The lack of information about execution speeds, server locations, or technology infrastructure raises questions. It suggests the broker may not be committed to providing optimal trading conditions.

User reviews consistently report unsatisfactory trading experiences, with particular emphasis on execution quality issues and platform reliability concerns. These technical problems can significantly impact trading strategies, especially for scalpers and high-frequency traders. These traders require precise execution and minimal slippage.

The overall trading environment appears to fall short of industry standards, with user feedback suggesting that technical issues and execution problems create challenges for effective trading. This wcg markets review indicates that traders should carefully evaluate these execution quality concerns before committing to the platform.

Trustworthiness Analysis (Score: 3/10)

WCG Markets receives a poor rating for trustworthiness due to complex and questionable regulatory status, lack of corporate transparency, and numerous user complaints suggesting potential fraudulent activities. The broker's registration in Saint Vincent and the Grenadines, combined with unclear regulatory claims in other jurisdictions, creates significant concerns. These concerns relate to legitimate oversight and client protection.

The absence of clear management information and corporate structure transparency represents a major red flag for potential clients. Reputable brokers typically provide detailed information about their leadership team, corporate governance, and operational transparency. None of this appears to be readily available for WCG Markets.

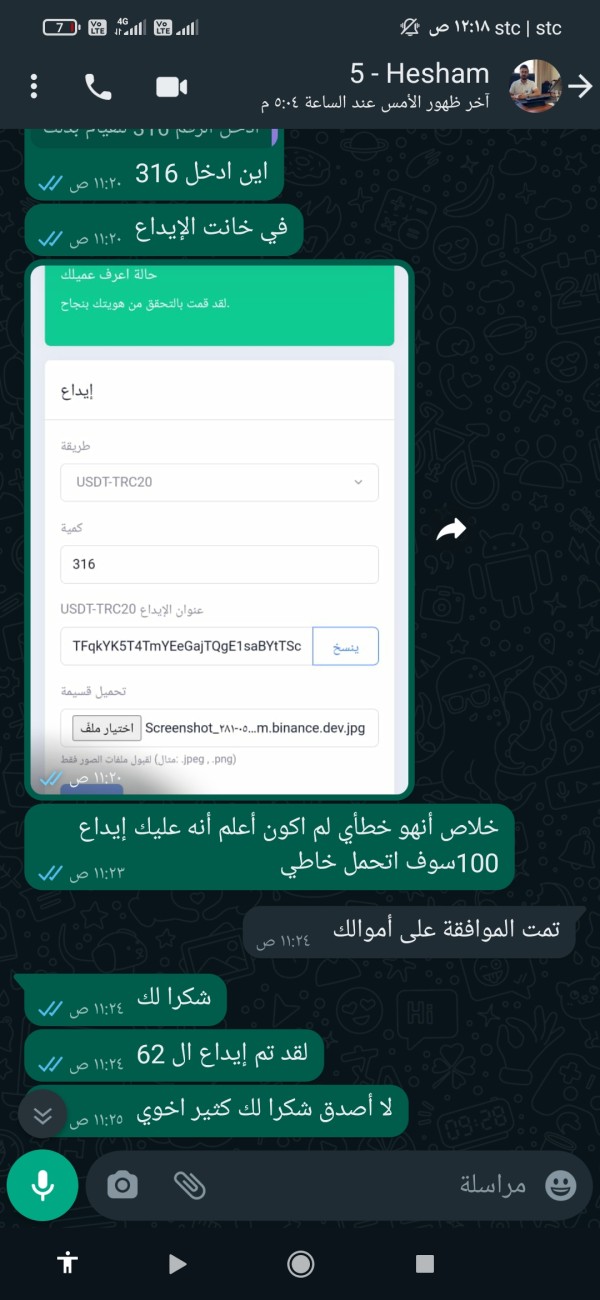

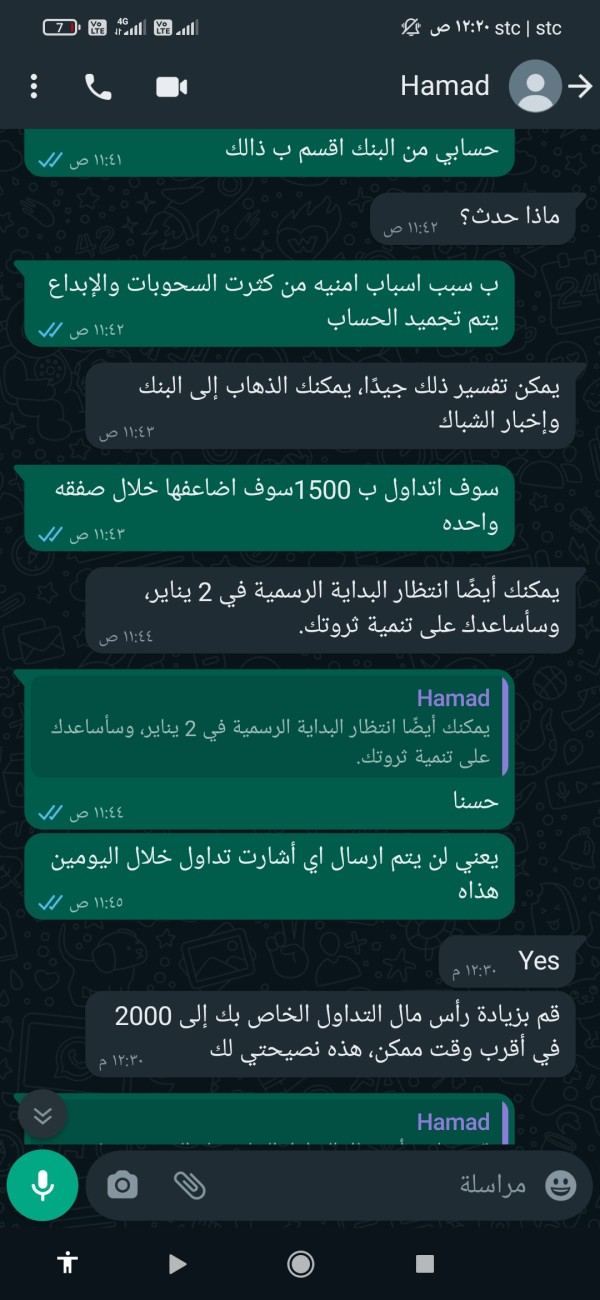

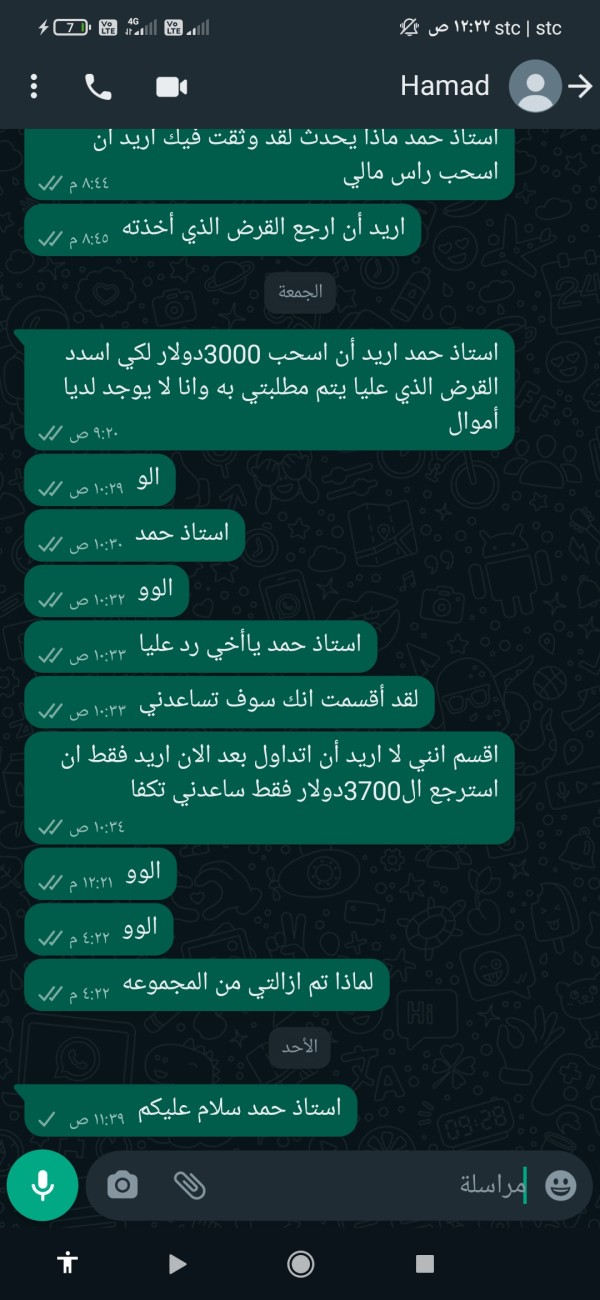

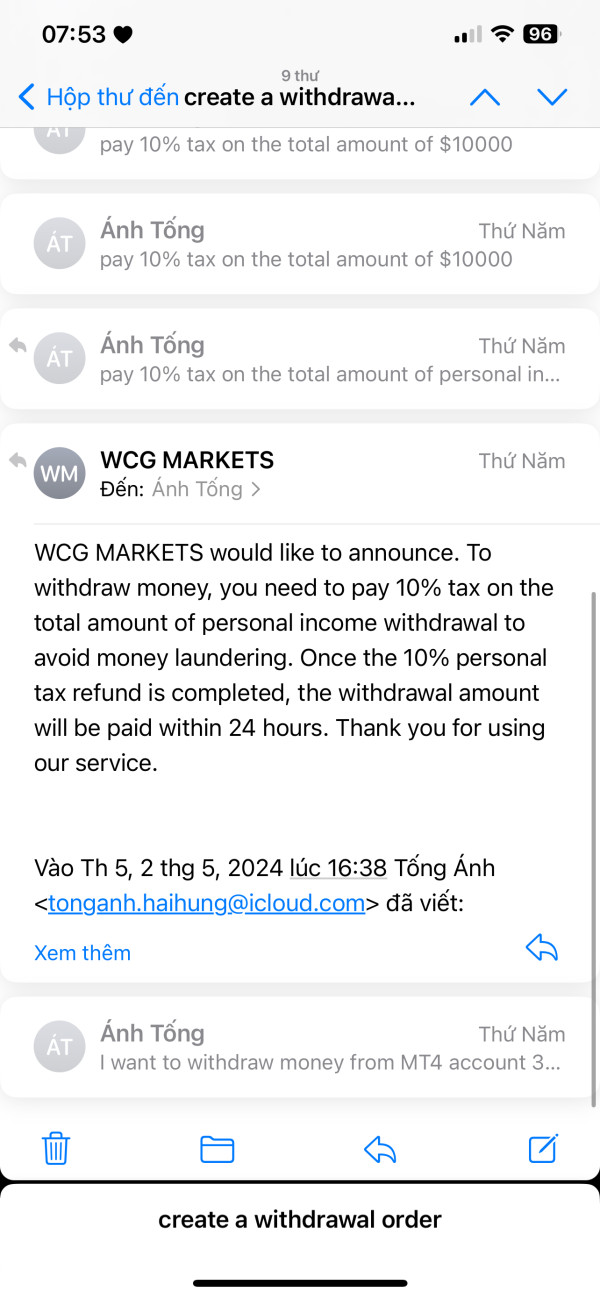

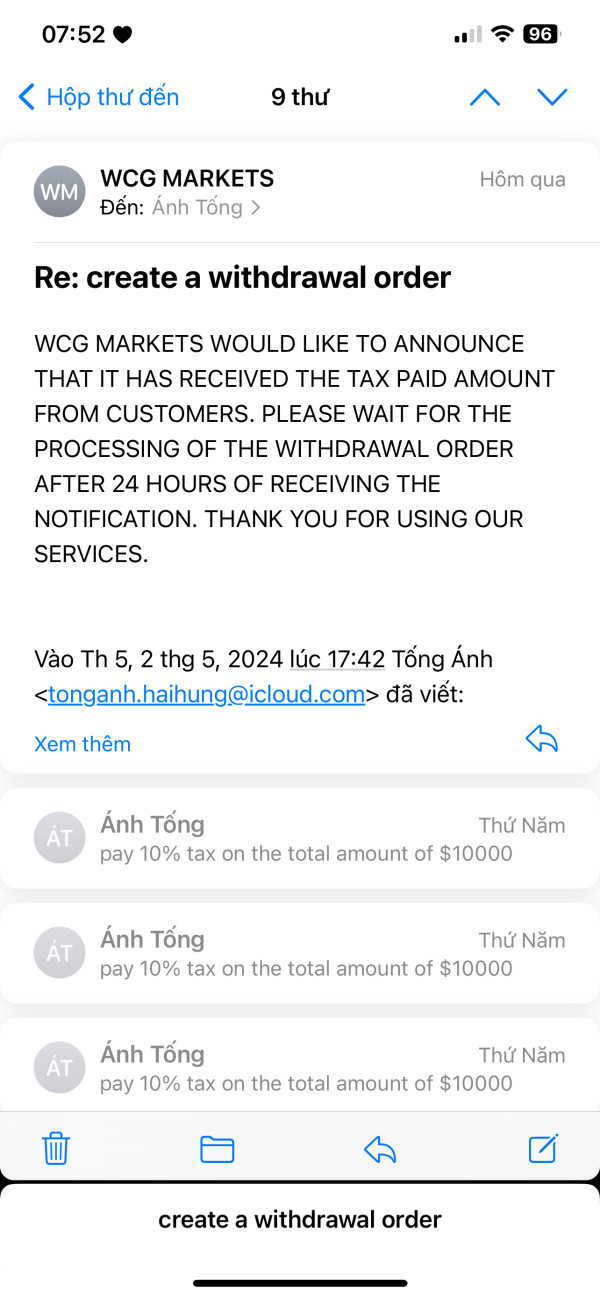

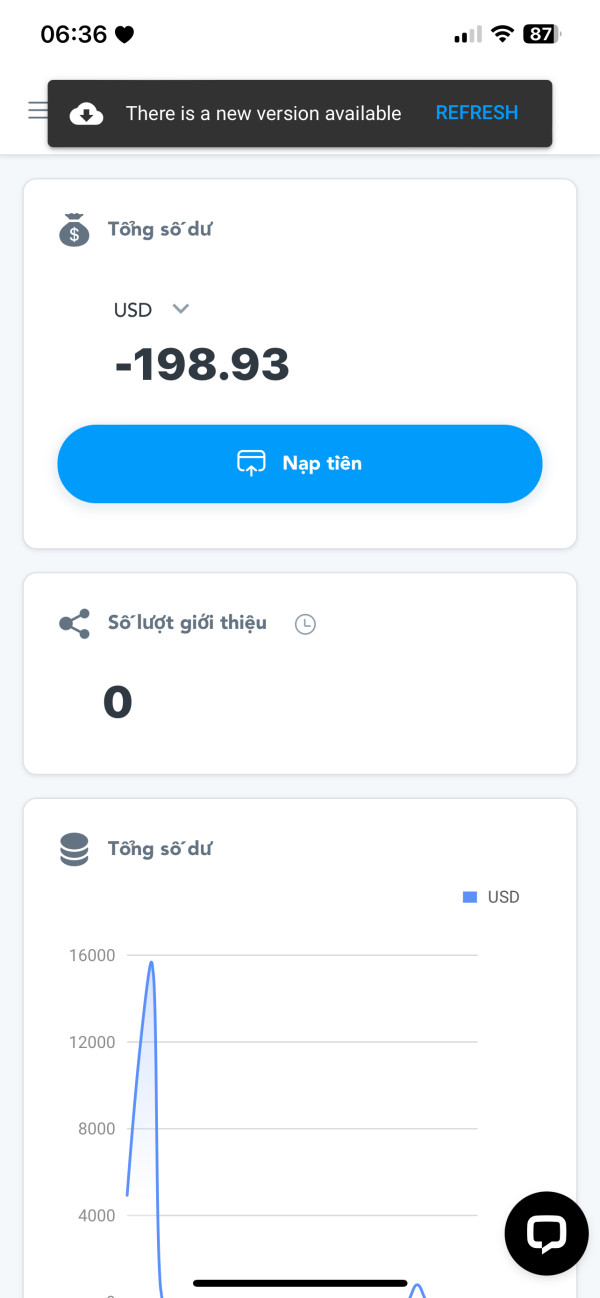

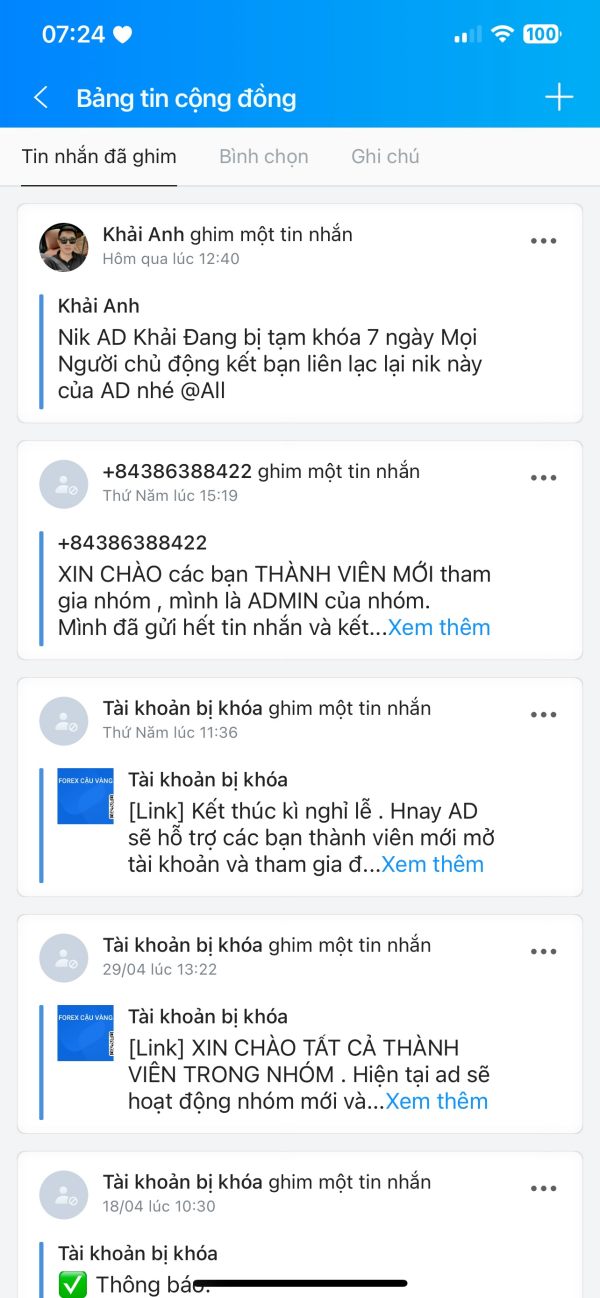

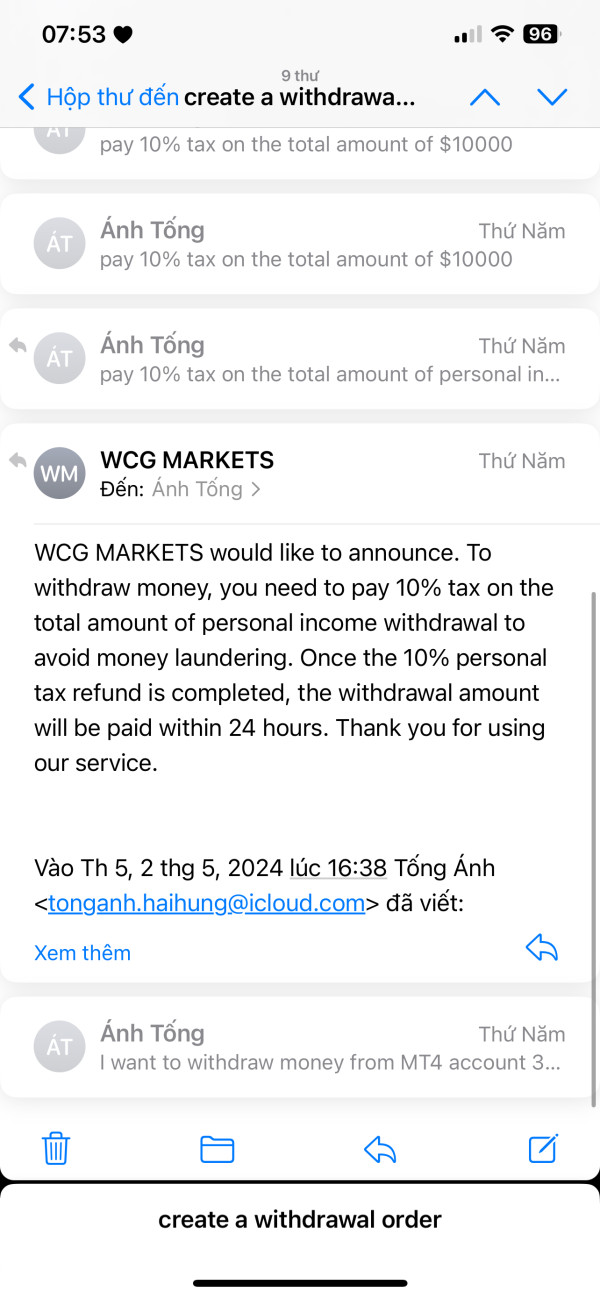

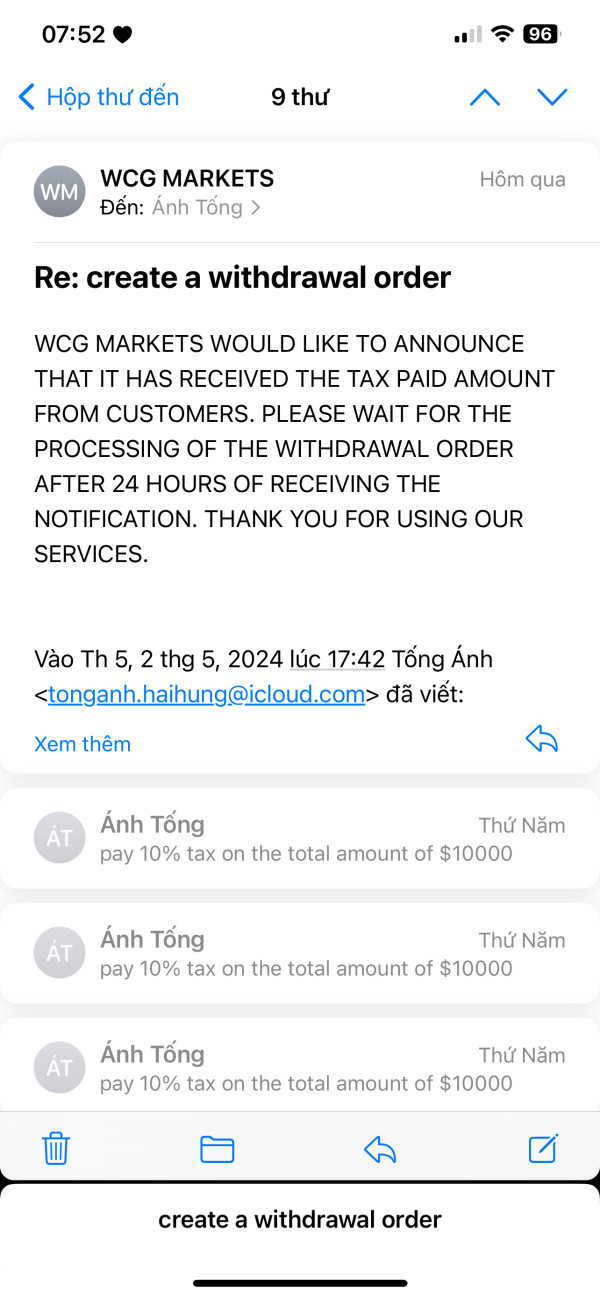

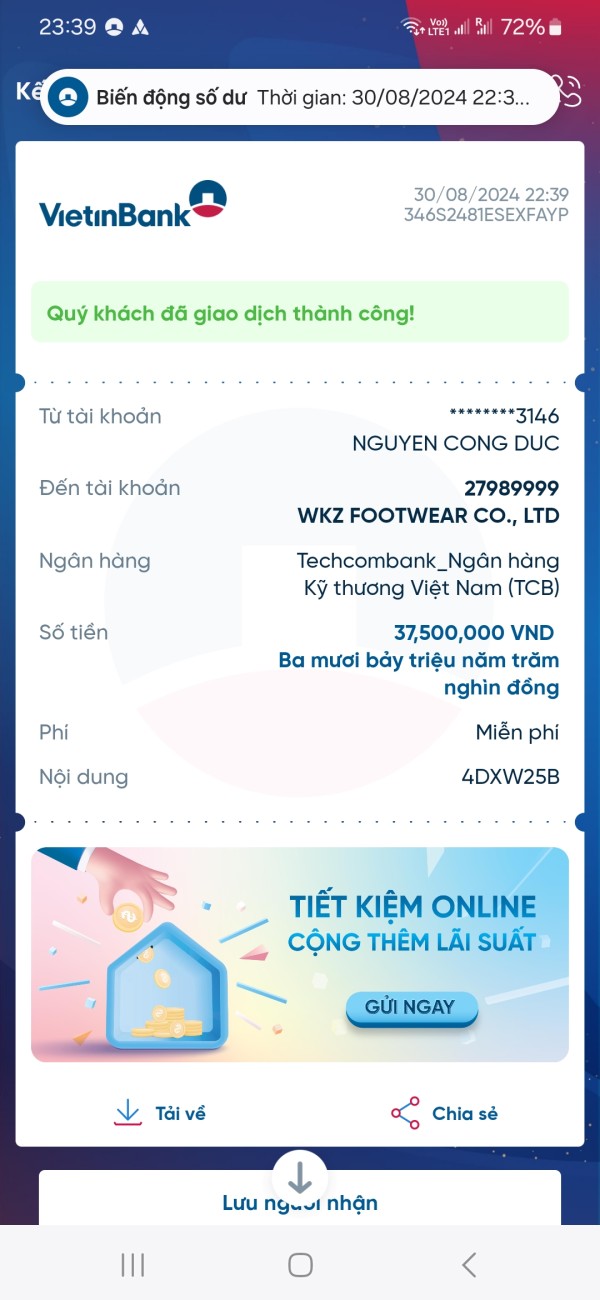

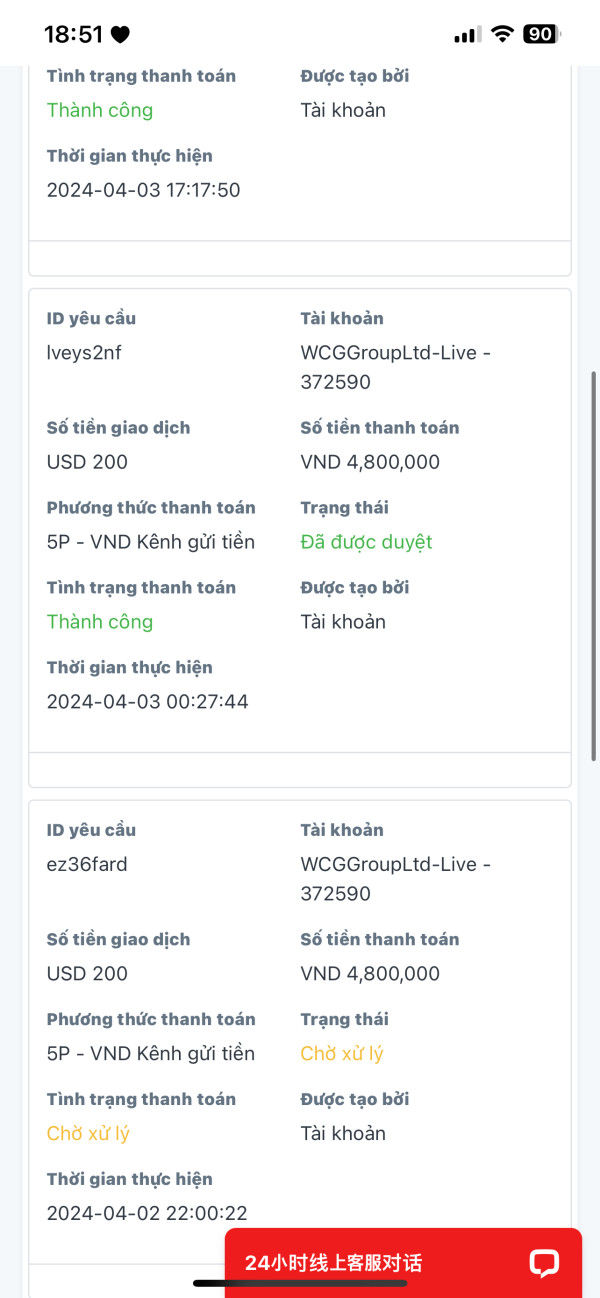

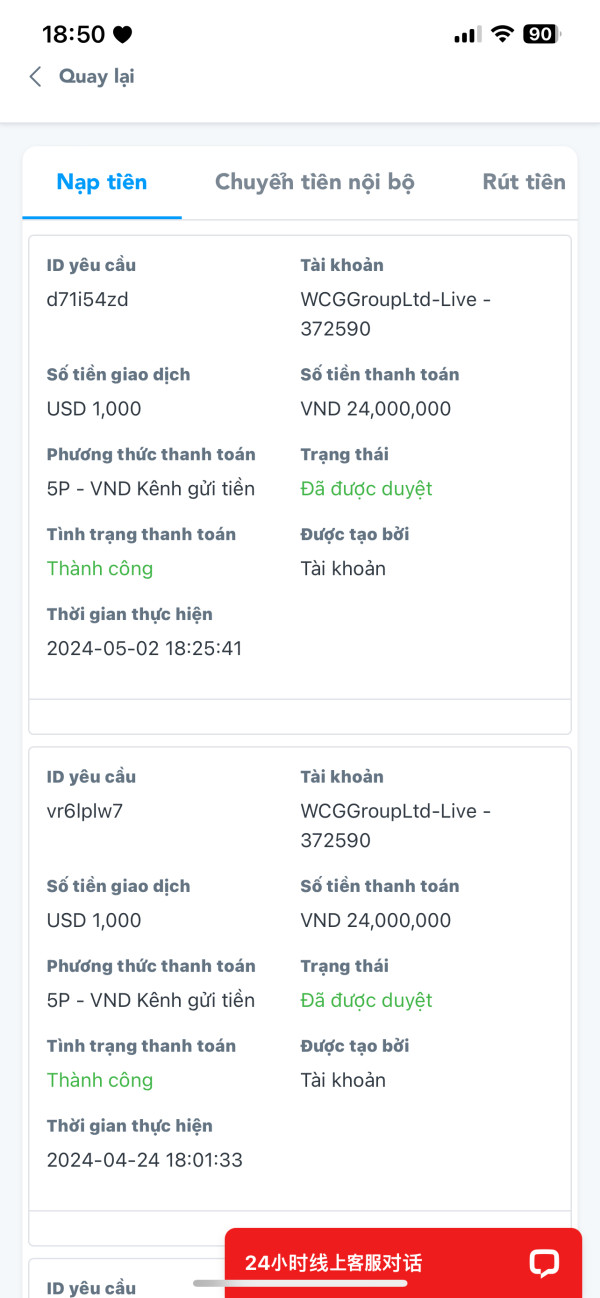

User reviews and industry warnings have highlighted concerns about potential fraudulent activities, fund security issues, and questionable business practices. Multiple complaints suggest difficulties with fund withdrawals and unresponsive customer service. These issues arise when clients attempt to address concerns about their accounts or investments.

The regulatory complexity and multiple jurisdiction claims require independent verification, as some regulatory relationships may not provide meaningful client protection or oversight. The Saint Vincent and the Grenadines regulatory framework is generally considered less stringent than major financial centers.

Industry reputation appears to be significantly damaged by negative user experiences and warnings from various review platforms. The accumulation of complaints and concerns about fund safety represents a critical risk factor that potential clients must carefully consider before engaging with this broker.

User Experience Analysis (Score: 4/10)

WCG Markets receives a below-average rating for user experience based on consistently low user satisfaction scores across multiple review platforms. The overall user sentiment indicates significant dissatisfaction with various aspects of the broker's services. These range from platform functionality to customer service interactions.

Interface design and platform usability information was not detailed in available sources, but user feedback suggests challenges with navigation and functionality. The lack of comprehensive information about registration and verification processes creates uncertainty. This affects the user onboarding experience and account setup procedures.

Fund management operations appear to be problematic based on user complaints, though specific details about deposit and withdrawal speeds and convenience were not provided in available sources. User concerns about fund safety and withdrawal difficulties represent significant user experience issues. These impact overall satisfaction.

Common user complaints center on service quality, communication difficulties, and concerns about fund security. The pattern of negative feedback suggests systematic issues with the broker's operations rather than isolated incidents. This indicates fundamental problems with the user experience design and implementation.

The target user profile appears to be high-risk tolerance investors seeking leveraged trading opportunities, but even within this demographic, satisfaction levels appear to be consistently low. The accumulation of negative reviews and user warnings suggests that the broker fails to meet basic user experience expectations across multiple touchpoints.

Conclusion

This comprehensive wcg markets review reveals a broker with significant operational and reputational challenges that make it difficult to recommend for most traders. WCG Markets demonstrates poor performance across multiple evaluation dimensions. It shows particularly concerning issues related to trustworthiness, customer service, and overall user satisfaction.

The broker's complex regulatory status, lack of corporate transparency, and consistently negative user feedback create substantial risk factors that potential clients must carefully consider. While the platform offers high leverage and multi-asset trading capabilities, these advantages are overshadowed by fundamental concerns. These concerns relate to reliability and client protection.

WCG Markets appears unsuitable for risk-averse investors and may not meet the standards expected by experienced traders seeking reliable execution and professional service. The primary advantages include high leverage availability and diverse asset offerings. However, these are significantly outweighed by regulatory uncertainties, poor customer service, and low user trust levels.

Potential clients are strongly advised to conduct thorough due diligence and consider alternative brokers with stronger regulatory oversight, better user reviews, and more transparent operational practices before making any investment decisions.