Regarding the legitimacy of NAGA Markets forex brokers, it provides CYSEC and WikiBit, .

Is NAGA Markets safe?

Pros

Cons

Is NAGA Markets markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Naga Markets Europe Ltd

Effective Date:

2013-06-20Email Address of Licensed Institution:

regulatory@nagamarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.nagamarkets.com, Naga.com/eu, Naga.com/de, Naga.com/it, Naga.com/es, Naga.com/pl, Naga.com/cz, Naga.com/nl, Naga.com/ro, Naga.com/ntExpiration Time:

--Address of Licensed Institution:

Agias Zonis 11, 3027, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 041 410Licensed Institution Certified Documents:

Is Naga Markets Safe or Scam?

Introduction

Naga Markets is a multi-asset brokerage firm that has gained attention in the forex trading community since its inception in 2015. Positioned as a user-friendly platform, Naga Markets provides access to a wide array of financial instruments, including forex, stocks, commodities, and cryptocurrencies. As the financial landscape continues to evolve, traders must exercise caution when selecting a broker, as the potential for scams and fraudulent activities remains a concern. This article aims to assess the safety and legitimacy of Naga Markets through a comprehensive analysis of its regulatory status, company background, trading conditions, and customer experiences. Our evaluation methodology incorporates data from various reputable sources, including regulatory bodies and user reviews, to provide a balanced perspective on whether Naga Markets is a safe trading platform.

Regulation and Legitimacy

The regulatory framework governing a broker is paramount in determining its legitimacy and the safety of client funds. Naga Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is recognized as one of the most reputable regulatory bodies in Europe. Regulatory oversight ensures that brokers adhere to strict guidelines and maintain a level of transparency in their operations. Below is a summary of Naga Markets' regulatory information:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 204/13 | Cyprus | Verified |

CySEC's stringent regulations require brokers to keep client funds in segregated accounts, ensuring that they are not used for company operations. Additionally, Naga Markets is a member of the Investor Compensation Fund, which provides further protection for clients in the event of broker insolvency. Despite these positive regulatory aspects, it is essential to note that Naga Markets also operates through an offshore entity in Saint Vincent and the Grenadines, which does not have the same regulatory oversight as CySEC. This dual structure raises questions about the overall safety of client funds, as offshore regulations can vary significantly.

Company Background Investigation

Naga Markets is a subsidiary of Naga Group AG, a publicly traded fintech company listed on the Frankfurt Stock Exchange. Founded in 2015, Naga Group AG has established itself as a significant player in the trading and investment sector, focusing on innovative trading solutions and social trading platforms. The management team comprises experienced professionals with backgrounds in finance and technology, which contributes to the company's credibility.

Naga Markets aims to provide a transparent trading environment, offering various educational resources and a user-friendly platform. However, the company has faced criticism regarding its information disclosure levels. While it provides essential details about its operations and services, some users have reported a lack of clarity regarding fees and trading conditions, which can lead to confusion among traders. Overall, the company's structure and management experience lend credibility to its operations, but potential clients should remain vigilant regarding any lack of transparency.

Trading Conditions Analysis

The trading conditions offered by a broker play a crucial role in determining its attractiveness to traders. Naga Markets provides a competitive fee structure, but it is essential to evaluate whether these fees align with industry standards. The overall cost of trading with Naga Markets includes spreads, commissions, and overnight financing fees. Below is a comparison of Naga Markets' core trading costs against industry averages:

| Fee Type | Naga Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 0.8 pips |

| Commission Model | Varies by account | Varies by broker |

| Overnight Interest Range | 0.20% | 0.15% |

While Naga Markets does not charge a commission on most trades, its spreads, particularly for the EUR/USD pair, are slightly higher than the industry average. This can impact profitability, especially for high-frequency traders. Additionally, the broker charges withdrawal fees that vary based on the account type, which may be considered unusual in an increasingly competitive market. Traders should carefully review the fee structure to ensure that they are comfortable with the costs associated with their trading activity.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Naga Markets implements several measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the company's operating funds, reducing the risk of misuse. Furthermore, the negative balance protection policy prevents traders from losing more than their deposited amount, which is a critical feature for risk management.

Despite these protective measures, it is essential to investigate any historical issues regarding fund safety. Naga Markets has not been publicly associated with significant incidents of fund mismanagement or fraud, which is a positive indicator for potential clients. However, the presence of an offshore entity raises questions about the level of protection offered to clients outside the EU. Traders should weigh the benefits of regulatory oversight against the potential risks associated with offshore operations.

Customer Experience and Complaints

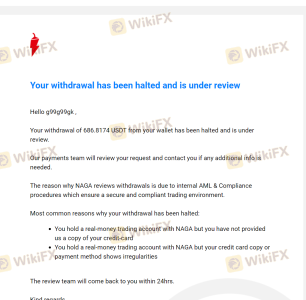

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. Naga Markets has received mixed reviews from users, with some praising its user-friendly platform and social trading features, while others have expressed concerns regarding customer service and withdrawal processes. Common complaints include delays in withdrawals, issues with account verification, and a lack of responsiveness from customer support.

Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Slow response |

| Account Verification Issues | High | Unresolved issues |

| Customer Support Availability | Medium | Limited hours |

For instance, one user reported a frustrating experience with delayed withdrawals, leading to dissatisfaction with the overall service. In contrast, another trader highlighted the efficient support received during the registration process. These mixed reviews suggest that while Naga Markets offers a robust trading platform, it may need to improve its customer support and communication strategies to enhance the overall user experience.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for successful trading. Naga Markets offers the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, along with its proprietary Naga Trader platform. These platforms are known for their stability and user-friendly interfaces, catering to both novice and experienced traders.

However, some users have reported issues with trade execution, including slippage and order rejections. Such problems can significantly impact a trader's performance, leading to frustration and potential losses. It is essential for traders to assess the execution quality and reliability of the platform before committing significant capital.

Risk Assessment

Using Naga Markets as a trading platform involves certain risks that traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Dual structure with offshore entity |

| Fund Safety Risk | Medium | Segregated accounts, but offshore concerns |

| Customer Service Risk | High | Mixed reviews on responsiveness |

| Execution Risk | Medium | Reports of slippage and order issues |

To mitigate these risks, traders are advised to conduct thorough research, maintain a diversified portfolio, and utilize risk management strategies such as setting stop-loss orders. Additionally, it may be beneficial to start with a demo account to familiarize oneself with the platform before trading with real funds.

Conclusion and Recommendations

After a comprehensive analysis of Naga Markets, it can be concluded that while the broker is regulated by CySEC and offers a range of trading instruments, there are areas of concern that potential clients should consider. The presence of an offshore entity raises questions about fund safety, and customer feedback indicates that improvements are needed in customer service and trade execution.

In summary, Naga Markets is not a scam, but traders should approach with caution and be aware of the potential risks involved. For traders seeking a reliable platform, it may be prudent to explore alternatives that offer more robust regulatory oversight and customer support. Recommended alternatives include brokers with a strong reputation and multiple regulatory licenses, such as Interactive Brokers or Saxo Bank, which provide enhanced safety and trading conditions.

Is NAGA Markets a scam, or is it legit?

The latest exposure and evaluation content of NAGA Markets brokers.

NAGA Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NAGA Markets latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.