Is LatAm FX safe?

Pros

Cons

Is LatAm FX A Scam?

Introduction

LatAm FX is a forex broker that positions itself in the competitive landscape of online trading, primarily targeting clients in Latin America. As the forex market continues to expand, the number of brokers offering their services has surged, making it essential for traders to conduct thorough due diligence before committing their funds. Evaluating the safety and legitimacy of a broker like LatAm FX is crucial, as the lack of regulation can expose investors to significant risks, including fraud and loss of capital.

In this article, we will investigate whether LatAm FX is a scam or a legitimate trading platform. Our analysis will be based on information gathered from various credible sources, including user reviews, regulatory databases, and financial reports. We will assess the broker's regulatory status, company background, trading conditions, customer experiences, and overall risk profile to provide a comprehensive evaluation of its safety.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors to consider when assessing its legitimacy. A well-regulated broker is typically subject to strict oversight, which helps protect investors' funds and ensures fair trading practices. In the case of LatAm FX, it is registered in Seychelles, an offshore jurisdiction known for lenient regulatory standards.

Core Regulatory Information

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Seychelles FSA | 133076 | Seychelles | Not Found |

LatAm FX claims to be registered under the Seychelles Financial Services Authority (FSA), but attempts to verify this registration have proven unsuccessful. This lack of transparency raises significant concerns about the broker's legitimacy. Moreover, the absence of regulation by major financial authorities, such as the FCA in the UK or ASIC in Australia, further diminishes the broker's credibility.

The regulatory quality is paramount, as it ensures that a broker adheres to established standards for client protection, capital adequacy, and operational integrity. The fact that LatAm FX operates without oversight from reputable authorities indicates a high-risk trading environment. Therefore, it is prudent for traders to exercise caution and consider the potential implications of trading with an unregulated entity.

Company Background Investigation

LatAm FX is operated by LatAm Global Markets Inc., a company that has been in the market since 2018. Despite its relatively recent establishment, the broker has not provided substantial information about its ownership structure or the backgrounds of its management team.

The lack of transparency regarding the company's leadership raises questions about its operational integrity and commitment to ethical trading practices. A strong management team with relevant experience in finance and trading can significantly enhance a broker's credibility. However, without this information, it is challenging to evaluate the broker's reliability.

Moreover, the company's communication regarding its operations is sparse, which can be a red flag for potential investors. A trustworthy broker should provide clear and accessible information about its services, management, and operational practices. In this case, the opacity surrounding LatAm FX's corporate structure and leadership may indicate underlying issues that warrant further investigation.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions it offers is essential. LatAm FX presents a variety of account types, but the overall fee structure and trading costs are critical factors that can impact a trader's profitability.

Core Trading Cost Comparison

| Fee Type | LatAm FX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.9 - 3 pips | 1 - 2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

LatAm FX advertises spreads on major currency pairs that are notably higher than the industry average. This discrepancy suggests that traders may incur additional costs that could affect their overall returns. Furthermore, the absence of a commission model is unusual, as many reputable brokers charge a commission on trades, which can help ensure transparency in pricing.

Additionally, the broker's overnight interest rates appear to be higher than average, which could further erode a trader's profits, especially for those engaging in long-term positions. Traders should be wary of these costs, as they can significantly impact the profitability of their trading strategies.

Client Funds Security

The safety of client funds is paramount in the forex trading environment. LatAm FX claims to implement various security measures, but the lack of regulatory oversight raises concerns about the effectiveness of these protections.

The broker's website does not provide detailed information on fund segregation, investor protection schemes, or negative balance protection policies. These elements are crucial for safeguarding traders' investments. Without robust security measures in place, clients may be at risk of losing their funds in the event of the broker's insolvency or fraudulent activities.

Historically, unregulated brokers have been associated with various financial disputes and security breaches. Traders should be particularly cautious about investing with LatAm FX due to the absence of information regarding its fund protection policies and any past security incidents.

Customer Experience and Complaints

Customer feedback offers valuable insights into a broker's reliability and service quality. Reviews of LatAm FX indicate a mix of experiences, with several users reporting issues related to withdrawals and customer support.

Complaint Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delay | Medium | Average |

| Misleading Promotions | High | Unresponsive |

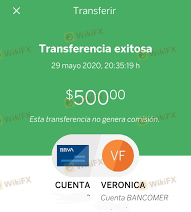

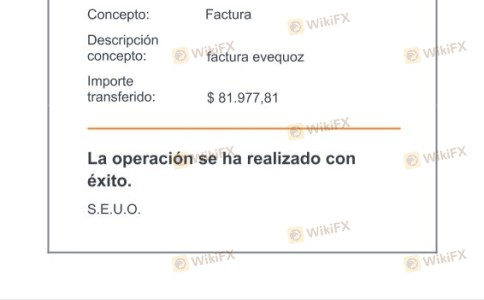

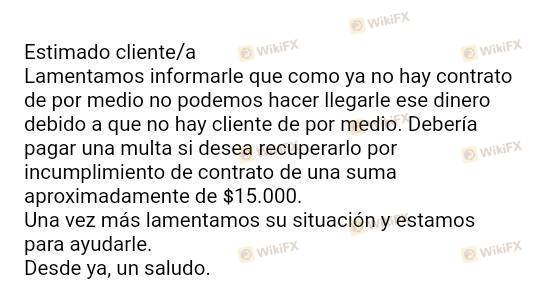

Common complaints include difficulties in withdrawing funds, which is a significant concern for traders. Users have reported that after depositing money, they faced challenges when attempting to access their funds. Additionally, the quality of customer support has been criticized, with many traders experiencing long response times or unhelpful replies.

Such complaints are serious and may indicate systemic issues within the broker's operations. A broker's ability to respond effectively to client concerns is crucial for maintaining trust and credibility. The negative feedback surrounding LatAm FX's customer service and withdrawal processes is a significant red flag for potential investors.

Platform and Trade Execution

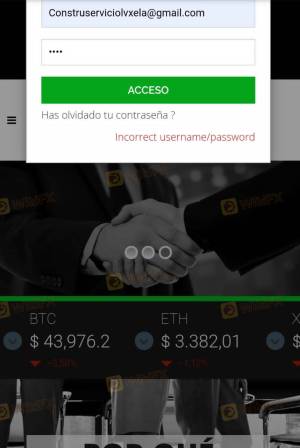

The trading platform is another critical aspect of the trading experience. LatAm FX offers a proprietary platform, which may lack some of the advanced features and reliability found in industry-standard platforms like MetaTrader 4 or MetaTrader 5.

Users have reported mixed experiences regarding platform stability and order execution quality. Instances of slippage and rejected orders have been noted, which can be detrimental to traders, particularly in volatile market conditions.

Risk Assessment

Using LatAm FX presents several risks that potential traders should consider. The combination of unregulated status, high trading costs, and negative customer feedback contributes to an overall high-risk profile.

Risk Rating Summary

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Financial Risk | Medium | High trading costs and fees |

| Operational Risk | High | Negative customer feedback |

To mitigate these risks, traders should consider using well-regulated brokers with transparent fee structures and reliable customer support. Engaging in thorough research and due diligence is essential when selecting a trading platform.

Conclusion and Recommendations

In conclusion, the evidence suggests that LatAm FX is not a safe broker for trading. The lack of regulation, high trading costs, negative customer experiences, and insufficient transparency raise significant concerns about the broker's legitimacy.

Traders should be cautious and consider alternative options that offer regulatory oversight and a proven track record of reliability. Recommended alternatives include brokers regulated by reputable authorities, such as the FCA in the UK or ASIC in Australia, which provide a safer trading environment and better protection for investors' funds.

Ultimately, while the allure of trading with a broker like LatAm FX may be tempting, the associated risks far outweigh the potential rewards. It is advisable for traders to prioritize their safety and choose a broker that meets high standards of regulation and service quality.

Is LatAm FX a scam, or is it legit?

The latest exposure and evaluation content of LatAm FX brokers.

LatAm FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LatAm FX latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.