Regarding the legitimacy of QUANT TEKEL forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is QUANT TEKEL safe?

Pros

Cons

Is QUANT TEKEL markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

QUANT TEKEL (PTY) LTD

Effective Date:

2023-12-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

60 NOLL AVENUE GATESVILLE CAPE TOWN 7764Phone Number of Licensed Institution:

0836473347Licensed Institution Certified Documents:

Is Qt Safe or Scam?

Introduction

In the fast-paced world of forex trading, choosing the right broker is crucial for success. One such broker that has garnered attention is Qt, which positions itself as a platform offering various trading tools and services. However, with the rise of fraudulent schemes in the forex market, traders must exercise caution and thoroughly evaluate the legitimacy of any broker before committing their funds. This article investigates the safety and credibility of Qt by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risks.

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of a trustworthy broker. It ensures that the broker adheres to specific standards designed to protect traders. Unfortunately, Qt has raised significant concerns regarding its regulatory status. The broker operates without a valid license from any recognized financial authority, which places it outside the law and exposes investors to considerable risks.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation means that Qt lacks the oversight that reputable brokers have, which typically includes client protection mechanisms and legal recourse in case of disputes. This situation is alarming, as it indicates that Qt may not be a safe option for traders who prioritize security and compliance.

Company Background Investigation

A thorough investigation into the company behind Qt reveals a lack of transparency. The broker's ownership structure remains unclear, and there is little information available about its history or development. This lack of transparency is a common red flag associated with potential scams. Furthermore, the management team's professional backgrounds are not publicly disclosed, which raises additional concerns about the broker's credibility.

The absence of a verifiable physical address is another issue that potential clients should consider. Legitimate brokers typically provide clear information about their headquarters and management team, ensuring accountability. In the case of Qt, the lack of such information further undermines its legitimacy and raises questions about its operational practices.

Trading Conditions Analysis

When evaluating a broker, understanding the cost structure is essential. Qt claims to offer competitive trading fees; however, many users report hidden charges and unfavorable conditions. The broker's fee structure lacks clarity, leading to confusion and frustration among clients.

| Fee Type | Qt | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1-2 pips |

| Commission Model | N/A | 0-10 USD |

| Overnight Interest Range | Varies | 0-5% |

The inconsistency in trading costs can significantly impact a trader's profitability. Furthermore, the presence of high-pressure sales tactics has been reported, where representatives encourage clients to deposit more funds under the pretense of potential profits. Such practices are typical of fraudulent brokers and should be taken seriously.

Client Fund Security

The safety of client funds is paramount when selecting a broker. In the case of Qt, the lack of regulatory oversight raises concerns about the security measures in place. There is no information available regarding fund segregation or investor protection policies, which are standard practices among reputable brokers.

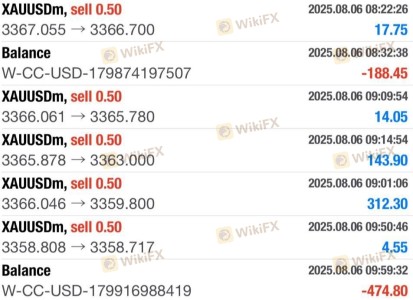

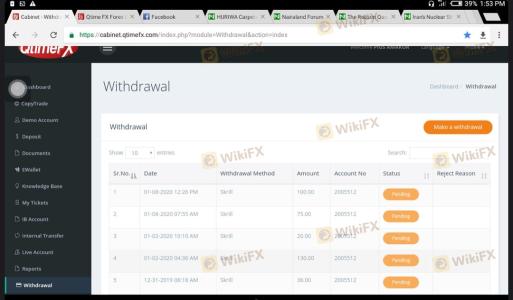

Moreover, the absence of negative balance protection means that traders could potentially lose more than their initial investment. Historical complaints regarding fund withdrawal difficulties have also surfaced, indicating that clients may face challenges accessing their money when needed. This situation poses a significant risk for anyone considering trading with Qt.

Customer Experience and Complaints

Examining customer feedback is essential for understanding a broker's reputation. Unfortunately, Qt has received overwhelmingly negative reviews from users, with many reporting lost funds and poor customer service. Common complaints include delayed withdrawals, lack of support, and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | High | Poor |

| Misleading Information | Medium | None |

For instance, one user reported being unable to withdraw their funds after multiple attempts, leading to frustration and distrust toward the broker. Such experiences highlight the potential risks associated with trading on unregulated platforms like Qt.

Platform and Execution

A broker's trading platform is crucial for a trader's success. Qt's platform has been criticized for its outdated design and slow execution speeds. Users have reported experiencing slippage and high rejection rates for their orders, which can be detrimental in the fast-paced trading environment.

Moreover, the lack of transparency regarding platform reliability raises concerns about potential manipulative practices. Traders expect a fair and efficient execution environment, and any signs of platform manipulation should be taken seriously.

Risk Assessment

Using Qt as a trading platform presents several risks that potential clients should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid oversight |

| Fund Security Risk | High | Lack of protections |

| Customer Service Risk | Medium | Poor support |

Given these risks, it is crucial for traders to conduct thorough research and consider alternative options. Engaging with a broker that has robust regulatory oversight and a solid reputation can mitigate many of these risks.

Conclusion and Recommendations

In conclusion, the investigation into Qt reveals multiple red flags that suggest it may not be a safe trading option. The lack of regulation, transparency issues, and numerous customer complaints indicate that traders should exercise caution. If you value the safety of your funds, it is advisable to avoid Qt and instead consider reputable brokers that are regulated and provide transparent services.

For traders seeking reliable alternatives, consider platforms with established regulatory frameworks, positive customer feedback, and robust security measures. Ultimately, the safety of your investments should be the top priority, and choosing a trustworthy broker is essential for long-term success in the forex market.

Is QUANT TEKEL a scam, or is it legit?

The latest exposure and evaluation content of QUANT TEKEL brokers.

QUANT TEKEL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

QUANT TEKEL latest industry rating score is 2.08, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.08 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.