Is Prospero safe?

Business

License

Is Prospero Safe or a Scam?

Introduction

Prospero is a relatively new player in the forex trading market, having been established in 2022. It positions itself as a broker offering competitive trading conditions for forex, CFDs, and commodities. However, the rise of online trading scams has made it essential for traders to critically assess the legitimacy and safety of any broker before investing their funds. This article aims to investigate whether Prospero is safe by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our assessment is based on a thorough analysis of various online reviews and regulatory sources, ensuring a comprehensive overview of whether Prospero is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety. Regulated brokers are subject to stringent oversight by financial authorities, which helps ensure they adhere to industry standards and protect traders' interests. Unfortunately, Prospero does not appear to be regulated by any recognized financial authority, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation is a major red flag, indicating that Prospero operates without the necessary oversight to ensure fair practices and financial security. Traders should be cautious, as unregulated brokers often lack the safeguards needed to protect clients' funds. Furthermore, the lack of a regulatory license raises questions about the broker's compliance history and operational transparency. Given these factors, it is crucial for potential investors to recognize that Prospero may not be safe due to its unregulated status.

Company Background Investigation

Prospero claims to operate from an address in St. Vincent and the Grenadines, which is known for its lenient regulatory framework. However, the broker's website does not provide comprehensive information about its ownership structure or management team. This lack of transparency is concerning, as reputable brokers typically disclose information about their leadership and organizational history.

The company has been operational for less than a year, which means it has not yet established a track record in the industry. The absence of customer reviews further complicates the evaluation of its credibility. Without verified testimonials or a history of client interactions, it is difficult to gauge the reliability of Prospero. The lack of transparency regarding its ownership and management raises further doubts about whether Prospero is safe for traders looking to invest their hard-earned money.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Prospero claims to offer competitive spreads and low fees; however, the specifics of its fee structure are not clearly outlined on its website. This lack of clarity can be a tactic to obscure potentially unfavorable trading conditions.

| Fee Type | Prospero | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not Specified | 1.0 - 2.0 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Rate | Not Specified | Varies |

The ambiguity surrounding the fees and spreads could indicate that Prospero may impose hidden costs that traders are unaware of until after they open an account. Additionally, the absence of information on overnight interest rates and commission structures further complicates the assessment of its trading conditions. Traders should be wary of brokers that do not provide clear and transparent fee structures, as this can lead to unexpected financial burdens. Thus, it is essential to consider whether Prospero is safe given its unclear trading conditions.

Customer Funds Safety

A broker's approach to safeguarding customer funds is a vital aspect of its overall trustworthiness. Prospero's website does not provide detailed information about its security measures, including whether it uses segregated accounts to protect client funds.

Segregation of funds is a standard practice among regulated brokers, ensuring that client deposits are kept separate from the broker's operational funds. Moreover, the absence of investor protection mechanisms or negative balance protection policies raises concerns about the safety of traders' investments. Without proper safeguards, traders risk losing their entire investment in the event of insolvency or mismanagement. Historical data on any past security breaches or fund mismanagement by Prospero is also lacking, which contributes to the uncertainty surrounding the safety of funds held with this broker. Given these factors, it is imperative to question whether Prospero is safe for traders looking to secure their investments.

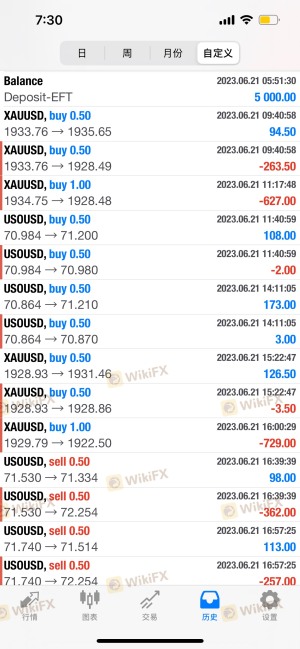

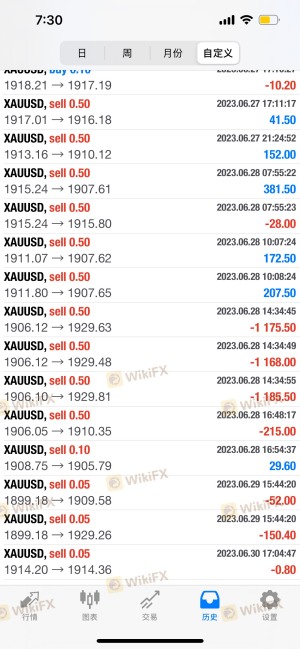

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Unfortunately, there is a notable scarcity of reviews regarding Prospero, making it challenging to assess the overall customer experience. However, many potential clients have expressed concerns about the broker's lack of transparency and regulatory compliance.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Lack of Transparency | Medium | No Response |

| Pressure to Deposit More Funds | High | Aggressive Tactics |

Common complaints include difficulties withdrawing funds, lack of response from customer service, and aggressive sales tactics encouraging clients to deposit more money. These issues indicate that Prospero may not prioritize customer satisfaction or transparency, which is critical for building trust with clients. The absence of a robust customer support system raises further questions about whether Prospero is safe to trade with, as effective communication is essential in resolving issues that may arise during trading.

Platform and Trade Execution

The performance of a trading platform is essential for a seamless trading experience. Prospero claims to offer a user-friendly platform; however, there is limited information available about its technical performance, stability, and execution quality. Traders rely on efficient execution to capitalize on market opportunities, and any signs of manipulation, such as slippage or order rejections, can significantly impact trading outcomes.

Without concrete data on order execution quality or user experiences with the platform, it is difficult to ascertain whether Prospero provides a reliable trading environment. Traders should be cautious of platforms that lack transparency regarding their execution policies. Given the uncertainty surrounding the platform's performance, potential clients must consider whether Prospero is safe for their trading activities.

Risk Assessment

Using Prospero presents several risks that potential traders should be aware of. The unregulated status of the broker, combined with its lack of transparency and customer feedback, contributes to an overall high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities. |

| Transparency Risk | High | Lack of information about ownership and fees. |

| Customer Support Risk | Medium | Poor response to customer inquiries and complaints. |

| Trading Execution Risk | High | Unclear execution policies and potential manipulation. |

To mitigate these risks, traders should conduct thorough research before engaging with any broker. It is advisable to seek out brokers with established reputations, clear regulatory oversight, and positive customer feedback. By taking these precautions, traders can reduce the likelihood of encountering issues associated with unregulated or suspicious brokers like Prospero.

Conclusion and Recommendations

In conclusion, the analysis of Prospero raises significant concerns regarding its legitimacy and safety. The lack of regulation, transparency, and customer feedback paints a troubling picture of this broker. While it may offer attractive trading conditions, the risks associated with using an unregulated broker far outweigh any potential benefits. Therefore, it is prudent for traders to exercise caution and consider alternative options.

For those seeking to engage in forex trading, it is recommended to choose brokers that are regulated by reputable financial authorities and have a proven track record of customer satisfaction. Some reliable alternatives include brokers regulated by the FCA, ASIC, or other top-tier regulators. By prioritizing safety and transparency, traders can better protect their investments and ensure a more secure trading experience. Ultimately, it is essential to question whether Prospero is safe and to proceed with caution when dealing with this broker.

Is Prospero a scam, or is it legit?

The latest exposure and evaluation content of Prospero brokers.

Prospero Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Prospero latest industry rating score is 1.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.