Is Expert Trade safe?

Pros

Cons

Is Expert Trade A Scam?

Introduction

Expert Trade positions itself as a player in the forex market, offering trading services across various financial instruments. As the popularity of online trading continues to rise, it becomes increasingly important for traders to carefully evaluate the brokers they choose to work with. The potential for scams and unregulated practices in the forex industry necessitates a thorough investigation into the legitimacy of any trading platform. This article aims to assess whether Expert Trade is a safe and reliable broker or if it exhibits characteristics of a scam. To achieve this, we will analyze the broker's regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk profile.

Regulation and Legality

The regulatory status of a broker is a critical factor in determining its legitimacy. A well-regulated broker is generally considered safer for traders, as regulatory bodies impose strict standards for operational conduct and client fund protection. Unfortunately, Expert Trade lacks valid regulatory oversight, which raises significant concerns regarding its operational legitimacy.

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a license from reputable regulatory authorities such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the USA indicates that Expert Trade is not subject to the safeguards and compliance requirements that protect traders. This lack of regulation not only puts clients' funds at risk but also suggests that the broker operates in a potentially untrustworthy environment.

Moreover, the claims made by Expert Trade regarding its regulatory status are misleading, as no verifiable information can be found to support these assertions. This lack of transparency is a major red flag for potential investors, highlighting the need for caution when considering this broker.

Company Background Investigation

Understanding the company behind a trading platform is essential for assessing its credibility. Expert Trade claims to have been in operation for several years, but details about its ownership structure and management team are scarce. The lack of transparency regarding the company's history and the identities of its key personnel raises concerns about its reliability and accountability.

A thorough background check reveals that Expert Trade operates without the oversight of any established financial authority. This lack of governance can lead to unethical practices, as there are no regulatory bodies to hold the company accountable for its actions. The absence of clear information about the management team further complicates the assessment of the broker's trustworthiness.

In the forex industry, transparency is crucial, and brokers that fail to provide adequate information about their operations and management may not have the best interests of their clients at heart. Thus, it is essential for traders to be wary of Expert Trade and consider the implications of engaging with a broker that lacks a transparent operational framework.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's profitability and overall experience. Expert Trade presents various trading options, but the details surrounding its fee structure and trading costs are not entirely clear.

| Fee Type | Expert Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific information regarding spreads and commissions is concerning. Typically, reputable brokers provide transparent fee structures that allow traders to understand the costs associated with trading. However, Expert Trade does not disclose this vital information, which may indicate hidden fees or unfavorable trading conditions that could erode traders' profits.

Moreover, the lack of clarity regarding overnight interest rates and commissions raises questions about the broker's practices. Traders should be cautious when engaging with a broker that does not provide transparent information about its trading conditions, as this could lead to unexpected costs and a detrimental trading experience.

Customer Funds Security

The safety of customer funds is paramount when evaluating a broker's credibility. Expert Trade claims to implement various security measures to protect clients' investments, but the absence of regulation significantly undermines these claims.

Traders should be aware of the importance of fund segregation, investor protection schemes, and negative balance protection policies. Unfortunately, Expert Trade does not provide sufficient information regarding these critical aspects of fund security. The lack of transparency surrounding the broker's safety measures raises significant concerns about the safeguarding of clients' funds.

Historical incidents of fund mismanagement or disputes can further exacerbate these concerns. Without a regulatory framework to ensure compliance with industry standards, traders may find themselves vulnerable to potential losses. Thus, it is crucial to approach Expert Trade with caution, as the lack of clear information regarding fund security measures poses a significant risk to investors.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. An analysis of client experiences with Expert Trade reveals a pattern of dissatisfaction and complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Support | High | Poor |

Common complaints include difficulties in withdrawing funds, lack of transparency regarding fees, and inadequate customer support. Many users have reported delays in processing withdrawal requests, which can be particularly alarming for traders who need access to their funds.

In addition, the quality of customer support has been criticized, with many clients expressing frustration over unresponsive service. These issues indicate that Expert Trade may not prioritize client satisfaction, further contributing to the perception of the broker as untrustworthy.

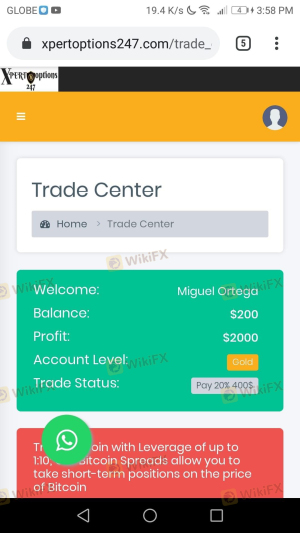

Two notable case studies highlight the challenges faced by traders using Expert Trade. One client reported being unable to withdraw their funds for several months, while another expressed frustration over the lack of communication from the support team. These experiences underscore the need for caution when considering Expert Trade as a trading partner.

Platform and Trade Execution

The performance of a trading platform is critical to a trader's success. Expert Trade claims to offer a user-friendly interface and efficient trade execution, but the reality may differ.

Users have reported issues with order execution quality, including slippage and rejected orders. These problems can significantly impact a trader's ability to capitalize on market opportunities. Furthermore, any signs of platform manipulation can erode trust in the broker and lead to significant financial losses.

A thorough evaluation of Expert Trade's platform performance is essential for potential clients. Traders should consider whether the platform meets their needs in terms of stability, speed, and reliability before committing their funds.

Risk Assessment

Engaging with Expert Trade poses various risks that potential clients should carefully consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Lack of transparency in fees and conditions. |

| Withdrawal Risk | High | Client reports of withdrawal issues. |

The overall risk profile indicates that trading with Expert Trade carries significant dangers. The absence of regulatory oversight, coupled with unclear fees and withdrawal issues, creates an environment where traders may face substantial financial risks.

To mitigate these risks, traders should conduct thorough research, consider diversifying their investments, and only trade with funds they can afford to lose. Additionally, seeking out brokers with established regulatory oversight can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, Expert Trade exhibits numerous characteristics that warrant caution. The lack of regulatory oversight, poor customer feedback, and unclear trading conditions all suggest that this broker may not be a safe option for traders.

While Expert Trade may offer some appealing features, the potential risks associated with engaging with an unregulated broker far outweigh the benefits. Therefore, it is advisable for traders to explore alternative options that provide greater transparency, regulatory protection, and positive client experiences.

For those seeking reliable trading partners, consider brokers that are regulated by reputable authorities, such as the FCA or ASIC. These brokers often offer better security, transparency, and support, ensuring a safer trading experience.

Is Expert Trade a scam, or is it legit?

The latest exposure and evaluation content of Expert Trade brokers.

Expert Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Expert Trade latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.