Regarding the legitimacy of Price Markets forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Price Markets safe?

Pros

Cons

Is Price Markets markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Price Markets UK Ltd

Effective Date:

2016-10-03Email Address of Licensed Institution:

compliance@pricemarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://pricemarkets.comExpiration Time:

2023-04-06Address of Licensed Institution:

Westlink House 981 Great West Road Brentford TW8 9DN UNITED KINGDOMPhone Number of Licensed Institution:

4402088175269Licensed Institution Certified Documents:

Is Price Markets Safe or a Scam?

Introduction

Price Markets is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market since its inception in 2013. With its headquarters in the United Kingdom, Price Markets claims to offer a range of trading services, including forex, commodities, and indices through various trading platforms. However, potential traders must exercise caution when evaluating forex brokers, as the industry is rife with both legitimate and fraudulent entities. This article aims to provide a comprehensive review of Price Markets, assessing its legitimacy, regulatory status, trading conditions, customer experiences, and overall risk profile. Our evaluation will be based on a thorough analysis of available data, user feedback, and regulatory frameworks to determine whether Price Markets is a safe option for traders or if it exhibits characteristics of a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is often considered the cornerstone of its legitimacy. Price Markets claims to be regulated by the Financial Conduct Authority (FCA) in the UK. Regulation by a reputable authority like the FCA is essential as it imposes strict standards on brokers, including the protection of client funds, transparency in operations, and adherence to fair trading practices. However, recent reports indicate that Price Markets' FCA license has been revoked, raising significant concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 725804 | United Kingdom | Revoked |

The revocation of Price Markets' license suggests that it may no longer meet the regulatory standards set by the FCA. This situation necessitates a careful examination of the broker's compliance history and any past infractions. A broker operating without valid regulation poses a higher risk to traders, as there are fewer safeguards in place to protect their investments. The lack of regulatory oversight can lead to potential issues such as withdrawal problems, mismanagement of funds, and lack of accountability.

Company Background Investigation

Price Markets was established in 2013 and has since aimed to provide a technologically advanced trading environment. The company claims to have developed a robust trading infrastructure, utilizing the ECN model to facilitate trades across various asset classes. However, the transparency regarding its ownership structure and management team is limited. A thorough investigation into the backgrounds of the key executives is essential to evaluate their experience and credibility in the financial services industry.

The management team should ideally possess a solid track record in trading, finance, or related fields, which can instill confidence in potential clients. Transparency in operations and clear communication regarding the company's history and ownership can also enhance trustworthiness. Unfortunately, the lack of accessible information about the company's leadership raises red flags, making it difficult for traders to ascertain the broker's reliability.

Trading Conditions Analysis

When evaluating whether Price Markets is safe, it is crucial to understand its trading conditions and fee structures. Price Markets offers a minimum deposit requirement of $5,000 for its standard account, which is significantly higher than many competitors. This high barrier to entry may deter novice traders who are looking to start with smaller capital.

The fee structure includes various costs associated with trading, such as spreads, commissions, and overnight interest rates. Potential traders should be aware of any unusual or hidden fees that could impact their trading profitability. Below is a comparison of core trading costs:

| Fee Type | Price Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 1.5 pips |

| Commission Model | $3.50 per lot | $6.00 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by Price Markets appear competitive, the overall cost of trading can accumulate quickly, especially for frequent traders. Additionally, the lack of clarity regarding overnight interest rates could lead to unexpected charges for traders holding positions overnight. Understanding the total cost of trading is essential for any trader considering this broker.

Client Fund Security

The safety of client funds is paramount when determining whether Price Markets is safe. The broker claims to maintain segregated accounts for client funds, which is a standard practice among regulated brokers. This means that client funds are kept separate from the broker's operational funds, providing a layer of protection in the event of insolvency.

Furthermore, the FCA requires brokers to participate in the Financial Services Compensation Scheme (FSCS), which protects retail clients up to £85,000 in case of broker failure. However, given the recent revocation of Price Markets' license, the effectiveness of these protections is questionable. Any historical incidents of fund mismanagement or security breaches would further compound concerns regarding client fund safety.

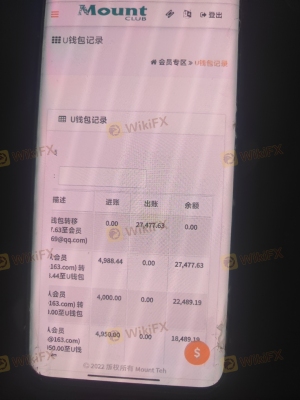

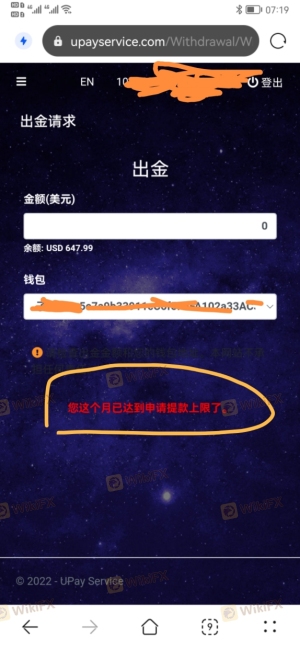

Customer Experience and Complaints

Examining customer feedback is critical in assessing whether Price Markets is a scam. Numerous reviews and testimonials reveal a mixed bag of experiences. While some users report satisfactory trading experiences, others highlight significant issues, particularly regarding withdrawal requests and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor Response |

| Account Closure | Medium | Delayed Resolution |

| Misleading Information | High | Inadequate Response |

Several traders have reported difficulties in withdrawing their funds, with claims of unresponsive customer service. These patterns of complaints can indicate systemic issues within the broker's operations, raising further doubts about its reliability. A few notable cases include users who faced prolonged delays in receiving their funds, leading to frustration and loss of trust in the broker.

Platform and Execution

The trading platform offered by Price Markets is a crucial factor in evaluating its safety. The broker utilizes the popular MetaTrader 4 platform, known for its user-friendly interface and advanced analytical tools. However, the platform's performance, including execution quality, slippage, and order rejection rates, must be assessed to ensure a smooth trading experience.

Traders have reported mixed experiences regarding execution quality, with some noting instances of slippage during volatile market conditions. Additionally, any signs of platform manipulation, such as sudden price spikes or unauthorized trade closures, would significantly undermine the broker's credibility.

Risk Assessment

The overall risk associated with trading through Price Markets must be carefully considered. Given the broker's revoked regulatory status and mixed customer feedback, the risk profile appears elevated. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | License revoked, no current oversight |

| Fund Security | Medium | Segregated accounts, but questionable |

| Customer Support | High | Poor response to complaints |

| Trading Conditions | Medium | High minimum deposit, potential fees |

To mitigate risks, traders should conduct thorough research, consider diversifying their investments, and only trade with funds they can afford to lose. Engaging with reputable brokers that maintain valid regulatory licenses is also advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that Price Markets poses significant risks for potential traders. The revocation of its FCA license, combined with numerous customer complaints regarding fund withdrawals and service quality, raises serious concerns about its legitimacy. While the broker offers competitive trading conditions, the lack of regulatory oversight and transparency is alarming.

Traders seeking a reliable forex broker should consider alternatives that maintain active regulatory licenses and have a proven track record of customer satisfaction. Some recommended brokers include IG, Pepperstone, and Swissquote, which are known for their robust regulatory frameworks and positive user experiences. Ultimately, exercising caution and conducting thorough due diligence is essential for any trader considering Price Markets.

Is Price Markets a scam, or is it legit?

The latest exposure and evaluation content of Price Markets brokers.

Price Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Price Markets latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.