Price Markets 2025 Review: Everything You Need to Know

Executive Summary

Price Markets stands as a regulated forex and CFD broker. The company has built its place in the competitive trading world since 2013. This complete price markets review shows a brokerage firm that works under the watch of the UK's Financial Conduct Authority with license number 725804. This gives traders regulatory safety and professional trading standards.

The broker makes itself different through its wide range of assets. It offers forex pairs, commodities, indices, stocks, bonds, and ETFs, making it attractive for traders who want portfolio variety. Price Markets runs on the MetaTrader 4 platform. This gives reliable trading structure with good liquidity to its clients.

The brokerage targets both individual retail traders and institutional investors who care about regulatory compliance and asset variety in their trading choices. With its acceptance of US traders and FCA regulatory framework, Price Markets puts itself as an accessible yet professionally managed trading environment. However, potential clients should note that specific account conditions, customer service details, and fee structures need more investigation. These elements are not fully detailed in available public information.

Important Notice

Trading conditions and available services may change a lot across different areas due to varying regulatory requirements and compliance standards. Future traders should check specific terms that apply to their region before opening accounts.

This price markets review is based on publicly available regulatory information, official company reports, and market performance data. All reviews reflect conditions as of 2025 and may change as the broker updates its services and regulatory requirements develop.

Rating Framework

Broker Overview

Price Markets started in the financial services sector in 2013. The company built itself as a specialized provider of forex and CFD trading services. The company has built its foundation on delivering liquidity solutions and trading services to a diverse clientele including individual traders, institutional investors, and competing brokerages. This multi-sided approach to market participation shows the broker's commitment to serving various segments of the trading community while keeping professional standards across all service levels.

The brokerage operates mainly through the MetaTrader 4 platform. This gives traders access to an extensive range of tradeable assets spanning multiple market categories. Price Markets offers trading opportunities in foreign exchange pairs, commodity markets, major global indices, individual stocks, government and corporate bonds, and exchange-traded funds. This complete asset selection puts the broker as a one-stop solution for traders seeking to diversify their portfolios across different market sectors and investment vehicles.

Under the regulatory supervision of the UK's Financial Conduct Authority, Price Markets keeps its operational license number 725804. This ensures compliance with strict European financial standards. This regulatory framework gives traders confidence in the broker's operational integrity and adherence to industry best practices for client protection and fair trading conditions.

Regulatory Jurisdiction: Price Markets operates under the authority of the UK Financial Conduct Authority. The company holds regulatory license number 725804. This regulatory framework ensures compliance with European financial standards and provides client protection measures standard to FCA-supervised entities.

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available documentation. This requires direct inquiry with the broker.

Minimum Deposit Requirements: The broker's minimum deposit thresholds for different account types are not specified in current available information. This makes direct contact necessary for accurate funding requirements.

Bonus and Promotional Offers: Details about welcome bonuses, promotional campaigns, or loyalty programs are not outlined in accessible broker information. These would require verification through official channels.

Tradeable Assets: Price Markets provides access to foreign exchange currency pairs, commodity markets, major international indices, individual stock securities, government and corporate bond markets, and exchange-traded funds. This offers complete market exposure across multiple asset classes.

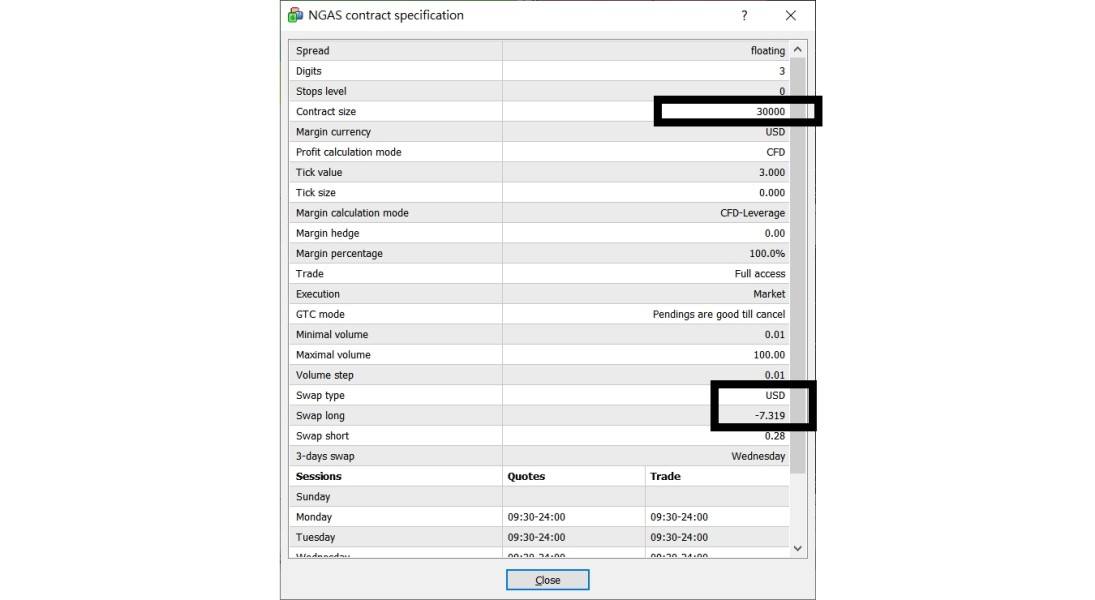

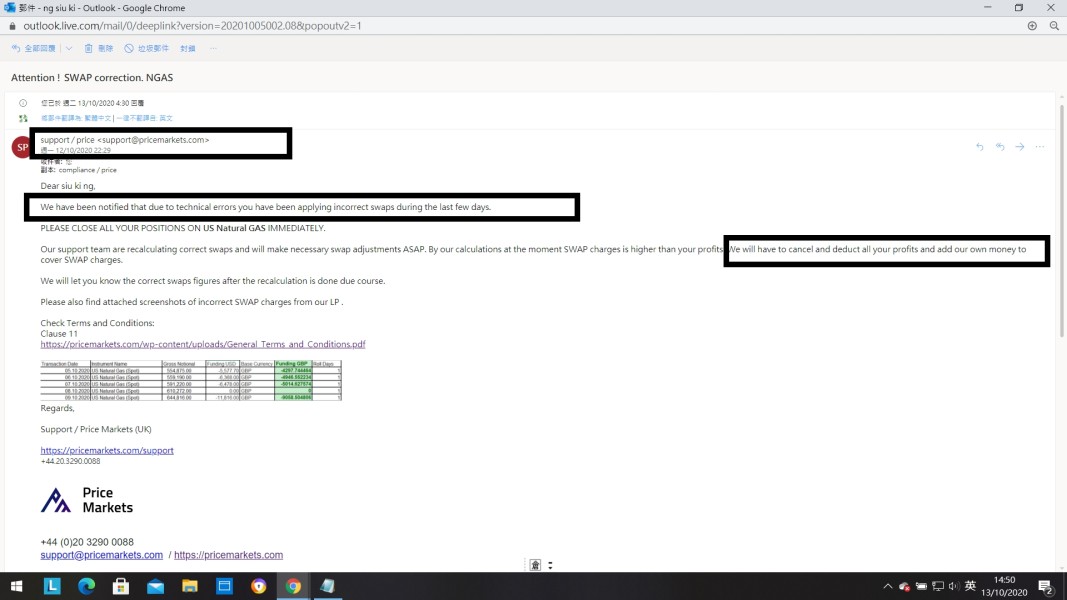

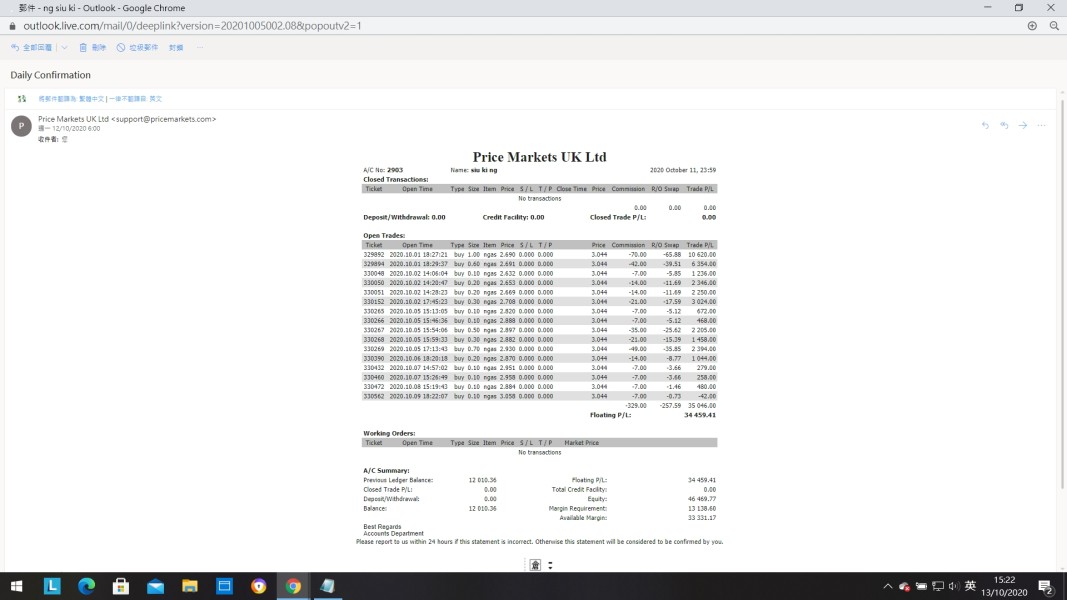

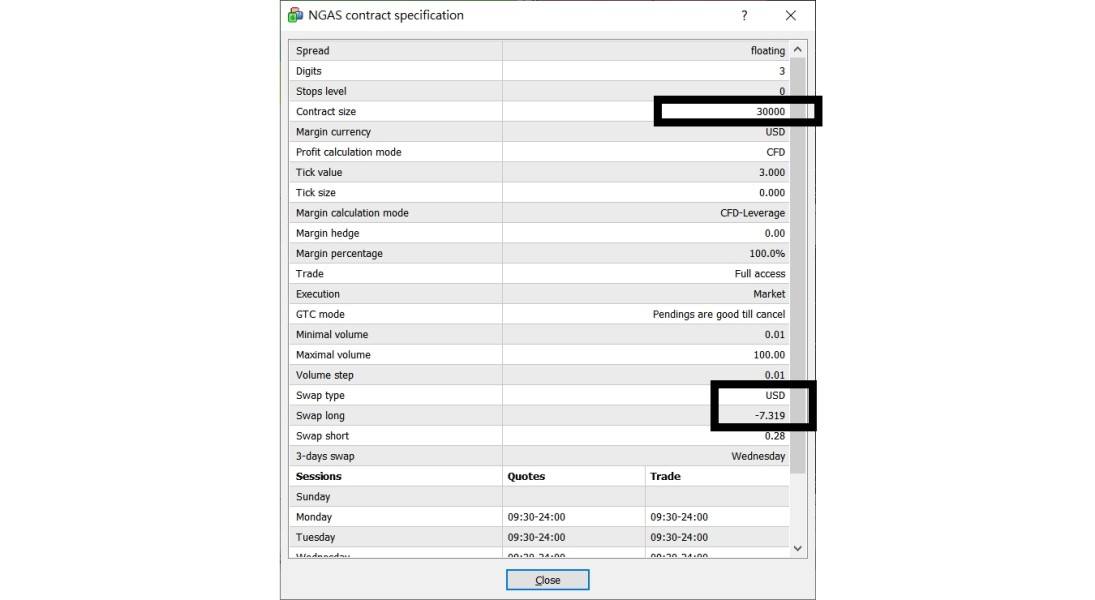

Cost Structure: Specific details about spreads, commission rates, overnight financing charges, and other trading costs are not fully outlined in available information. This requires direct inquiry for accurate pricing details.

Leverage Ratios: Maximum leverage offerings and margin requirements for different asset classes are not specified in current documentation. These should be confirmed directly with the broker.

Platform Options: The broker provides trading access through the MetaTrader 4 platform. This offers standard MT4 functionality and trading tools.

Geographic Restrictions: Price Markets accepts traders from the United States. However, specific restrictions for other areas may apply and should be verified based on individual circumstances.

Customer Support Languages: The range of languages supported by customer service representatives is not detailed in available information.

This complete price markets review indicates that while basic operational information is available, many specific trading conditions require direct verification with the broker for complete accuracy.

Account Conditions Analysis

The account structure and conditions offered by Price Markets require careful examination. However, specific details about account types, minimum deposit requirements, and tier-based benefits are not fully detailed in available public information. This lack of transparency about account specifications may present challenges for potential clients seeking to understand their options before committing to the platform.

Without clear information about different account categories, traders cannot easily assess which account type might best suit their trading volume, experience level, or investment capacity. The absence of published minimum deposit requirements also makes it difficult for future clients to plan their initial funding and compare Price Markets' accessibility against other brokers in the market.

Account opening procedures, verification requirements, and approval timeframes are similarly not detailed in accessible documentation. This information gap may require potential clients to start contact with the broker directly to understand the onboarding process. This could be viewed as an additional barrier to entry for some traders who prefer to research thoroughly before engaging with customer service.

The availability of specialized account features, such as Islamic accounts for clients requiring Sharia-compliant trading conditions, managed accounts, or institutional-grade services, remains unclear from available information. This price markets review suggests that traders with specific account requirements should verify availability and conditions directly with the broker. This ensures their needs can be met within the available account framework.

Price Markets shows strength in its asset diversity. The company offers traders access to multiple market categories including forex pairs, commodities, indices, stocks, bonds, and ETFs. This complete selection provides traders with significant opportunities for portfolio diversification and cross-market trading strategies. This represents one of the broker's notable advantages in the competitive landscape.

The use of MetaTrader 4 as the primary trading platform provides traders with access to a well-established and widely recognized trading environment. MT4's standard features include technical analysis tools, automated trading capabilities through Expert Advisors, and customizable chart displays. However, specific enhancements or proprietary tools offered by Price Markets are not detailed in available information.

Research and market analysis resources, educational materials, and trading guides that might be provided to clients are not fully outlined in accessible documentation. The absence of detailed information about analytical support, market commentary, or educational programs may indicate either limited offerings in these areas or insufficient public disclosure of available resources.

Automated trading support through Expert Advisors and algorithmic trading capabilities would be standard with MetaTrader 4 implementation. However, any specific restrictions, enhanced features, or additional automation tools provided by Price Markets are not clearly documented. Traders interested in automated strategies should verify the full extent of available automation features and any associated limitations directly with the broker.

Customer Service and Support Analysis

Customer service quality and accessibility represent critical factors in broker selection. However, specific information about Price Markets' support infrastructure is not fully detailed in available documentation. The absence of clear information about available contact methods, whether through phone, email, live chat, or other communication channels, creates uncertainty about support accessibility.

Response times for customer inquiries, resolution procedures for trading disputes, and escalation processes for complex issues are not outlined in accessible broker information. This lack of transparency about service level commitments may concern traders who prioritize responsive customer support. This is particularly true for those engaging in active trading strategies where timely assistance could impact trading outcomes.

The availability of multilingual support services, given the broker's international client acceptance including US traders, is not specified in current documentation. Language support capabilities could significantly impact user experience for non-English speaking traders and should be verified based on individual communication preferences.

Operating hours for customer service, weekend support availability, and holiday schedules are similarly not detailed in available information. Traders operating across different time zones or those who prefer extended support hours would need to verify these operational parameters directly with the broker. This ensures compatibility with their trading schedules and support expectations.

Trading Experience Analysis

The trading experience evaluation for Price Markets faces limitations due to insufficient detailed information about platform performance, execution quality, and user interface characteristics. While the broker uses MetaTrader 4, which provides a standardized trading environment, specific performance metrics such as execution speeds, slippage rates, and platform stability during high-volatility periods are not documented in available information.

Order execution quality, including fill rates, requote frequency, and price improvement instances, represents crucial aspects of trading experience that require assessment through actual platform usage or direct performance data from the broker. The absence of published execution statistics makes it challenging to evaluate Price Markets' operational efficiency compared to industry benchmarks.

Platform functionality completeness, including available order types, risk management tools, and advanced trading features, would typically align with standard MetaTrader 4 capabilities. However, any proprietary enhancements or restrictions implemented by Price Markets are not clearly outlined. Traders requiring specific order types or advanced risk management features should verify availability within the broker's MT4 implementation.

Mobile trading experience through smartphone applications, tablet compatibility, and mobile platform feature parity with desktop versions are not detailed in accessible documentation. Given the increasing importance of mobile trading capabilities, this price markets review suggests that mobile-focused traders should evaluate the mobile offering directly before committing to the platform.

Trust and Reliability Analysis

Price Markets shows strong regulatory credentials through its Financial Conduct Authority supervision. The company holds license number 725804 under one of the world's most respected financial regulatory frameworks. The FCA's strict oversight requirements, including capital adequacy standards, client money protection rules, and operational transparency mandates, provide substantial assurance about the broker's operational integrity and client protection measures.

The establishment date of 2013 indicates over a decade of market presence. This suggests operational stability and the ability to navigate various market conditions and regulatory changes. This longevity in the competitive brokerage landscape typically indicates sound business practices and adequate capitalization to maintain operations through different market cycles.

Client fund protection measures, segregation of customer deposits, and insurance coverage details are not specifically outlined in available information. However, FCA regulation typically mandates strict client money handling procedures. The specific mechanisms employed by Price Markets for client fund protection should be verified directly with the broker for complete transparency.

Company financial transparency, including published financial statements, ownership structure, and management team information, is not readily accessible in public documentation. While regulatory compliance provides baseline assurance, additional transparency about company finances and leadership could enhance client confidence in the broker's long-term stability and operational commitment.

User Experience Analysis

Overall user satisfaction and experience quality assessment is limited by the absence of comprehensive user feedback and detailed interface descriptions in available documentation. The lack of accessible user reviews, satisfaction surveys, or third-party user experience evaluations makes it challenging to assess real-world user satisfaction with Price Markets' services.

Interface design and platform usability would primarily depend on MetaTrader 4's standard user interface. However, any customizations, branding modifications, or additional features implemented by Price Markets are not detailed in available information. The learning curve and ease of use would typically align with standard MT4 expectations, though broker-specific modifications could impact user experience.

Registration and account verification processes, including required documentation, approval timeframes, and onboarding support, are not fully outlined in accessible documentation. The efficiency and user-friendliness of these initial processes significantly impact overall user experience and should be evaluated based on individual experience or direct inquiry with the broker.

Fund management experience, including deposit processing speed, withdrawal efficiency, and transaction transparency, requires assessment through actual usage or direct information from the broker. The convenience and reliability of financial transactions represent fundamental aspects of user experience that significantly impact overall satisfaction with the brokerage relationship.

Conclusion

Price Markets presents itself as a regulated forex and CFD broker operating under FCA supervision since 2013. The company offers traders access to diverse asset classes including forex, commodities, indices, stocks, bonds, and ETFs through the MetaTrader 4 platform. The regulatory framework and multi-asset approach position the broker as a potentially suitable choice for traders seeking diversified investment opportunities within a regulated environment.

The broker appears most appropriate for individual investors and institutional clients who prioritize regulatory compliance and asset variety over extensively detailed public information about trading conditions. The acceptance of US traders and FCA regulatory status provide foundational credibility. However, future clients should conduct thorough due diligence about specific trading terms.

Primary advantages include strong regulatory oversight, comprehensive asset selection, and established market presence. Notable limitations involve insufficient public disclosure of account conditions, customer service details, and specific trading costs. Potential clients should engage directly with Price Markets to obtain complete information about trading conditions, fees, and service levels before making commitment decisions.