Is STPL safe?

Pros

Cons

Is STPL Safe or Scam?

Introduction

STPL, a forex broker operating under the name Star Trader Pte Ltd, has garnered attention in the forex trading community for its offerings and platform. As traders increasingly seek opportunities in the foreign exchange market, it is crucial to assess the legitimacy and safety of brokers like STPL. The forex market is rife with both reputable firms and potential scams, making it essential for traders to perform thorough due diligence before engaging with any broker. This article investigates the safety and credibility of STPL by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

Our investigation is based on a comprehensive review of available online resources, including regulatory databases, customer feedback, and financial analysis. By employing a structured assessment framework, we aim to provide a balanced evaluation of whether STPL is a safe trading option or a potential scam.

Regulation and Legitimacy

Regulatory oversight is a cornerstone of trust in the financial services industry. A broker's regulatory status can significantly influence its operations and the protection it offers to clients. In the case of STPL, there are notable concerns regarding its regulatory framework.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

As illustrated in the table above, STPL does not appear to be regulated by any recognized financial authority. This lack of oversight raises significant red flags for potential clients. Regulatory bodies such as the FCA (UK), ASIC (Australia), or SEC (USA) enforce strict compliance standards that protect traders from fraud and malpractice. Without such regulation, STPL operates in a high-risk environment where clients may have limited recourse in cases of disputes or financial loss.

The absence of valid regulatory information suggests that STPL may not adhere to the rigorous standards expected from reputable brokers. This lack of oversight can lead to concerns about the broker's operational integrity and compliance with industry norms. Traders should be wary of engaging with unregulated brokers, as they are often associated with higher risks, including potential scams or fraudulent activities. Therefore, the question "Is STPL safe?" leans towards a cautious "no" due to its unregulated status.

Company Background Investigation

Understanding a company's history, ownership structure, and management team is critical when evaluating its reliability. STPL, registered in Hong Kong, has been operational for a period between two to five years. However, the lack of comprehensive information regarding its ownership and management raises further concerns about transparency.

The management team's background is a crucial factor in assessing the broker's credibility. Unfortunately, specific details about the individuals behind STPL remain obscure, which can hinder trust. A transparent broker typically provides information about its founders and key executives, including their professional experience and qualifications.

Moreover, the company's commitment to transparency is further called into question by the absence of publicly available financial disclosures or operational reports. This opacity can be a warning sign, as reputable brokers often share insights into their financial health, business practices, and compliance history. Without this information, it is challenging to ascertain whether STPL operates ethically or competently.

In summary, the lack of transparency regarding STPL's ownership, management, and operational history raises significant concerns about its legitimacy. As traders ponder the question, "Is STPL safe?" the current evidence suggests a need for caution due to the broker's unclear background.

Trading Conditions Analysis

When considering a broker, the trading conditions they offer, including fees and spreads, play a vital role in determining their attractiveness to traders. STPL's fee structure and trading conditions warrant careful examination to assess their competitiveness and fairness.

STPL advertises various trading instruments, including major currency pairs. However, the specifics of their pricing model remain ambiguous, raising questions about potential hidden fees or unfavorable trading conditions. The following table summarizes the core trading costs associated with STPL:

| Fee Type | STPL | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | N/A | 1-2 pips |

| Commission Model | N/A | $5-10 per lot |

| Overnight Interest Range | N/A | 0.5-1.5% |

As evidenced by the table, specific details regarding STPL's trading costs are either unavailable or lack clarity. This ambiguity can be concerning for traders who rely on transparent fee structures to make informed decisions. Moreover, if STPL employs a commission model or spreads that significantly deviate from industry averages, it could indicate a less favorable trading environment.

Additionally, potential traders should be aware of any unusual fee policies that could result in unexpected costs. For instance, brokers that charge high conversion fees or withdrawal fees may not be operating in the best interests of their clients.

In conclusion, the lack of transparency surrounding STPL's trading conditions raises questions about its overall safety and fairness. As traders contemplate the crucial question, "Is STPL safe?" it is essential to consider the potential implications of unclear or unfavorable trading conditions.

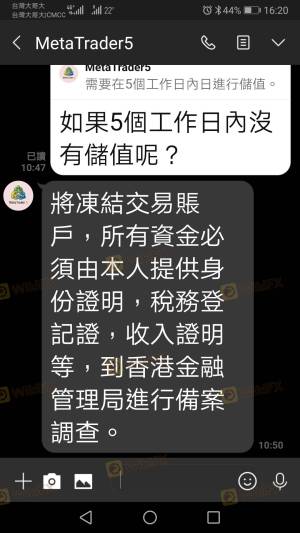

Client Fund Security

The safety of client funds is a paramount concern for any trader. A reputable broker should implement robust measures to ensure the security of their clients' investments. In the case of STPL, it is essential to evaluate its fund safety protocols.

STPL claims to adhere to certain security measures, but the absence of regulatory oversight complicates the assessment of its fund security. Key areas to consider include fund segregation, investor protection, and negative balance protection policies.

Fund Segregation: A reputable broker should maintain client funds in segregated accounts, separate from the company's operational funds. This separation ensures that client deposits are protected in the event of the broker's insolvency.

Investor Protection: Many regulated brokers are required to participate in compensation schemes that protect clients in case of broker failure. Without regulation, STPL may not offer such protections, leaving clients vulnerable to potential losses.

Negative Balance Protection: This policy ensures that clients cannot lose more than their deposited amount. If STPL does not provide this safeguard, traders could face significant financial risks.

- Thorough Research: Conduct extensive research on the broker's reputation and client feedback before opening an account.

- Start Small: Begin with a small investment to test the broker's services and assess fund withdrawal processes.

- Explore Alternatives: Consider using regulated brokers with established reputations to minimize risks associated with unregulated firms.

Historically, the lack of transparent information regarding STPL's fund security measures raises concerns about the safety of client investments. Traders should be cautious when considering STPL as a trading option, as insufficient safeguards could lead to financial loss.

As traders explore the critical question, "Is STPL safe?" the evidence suggests that the broker may not offer adequate protections for client funds.

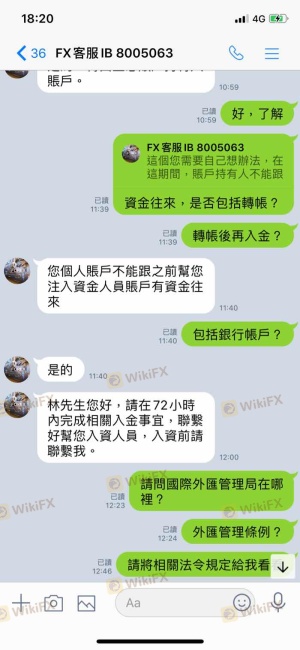

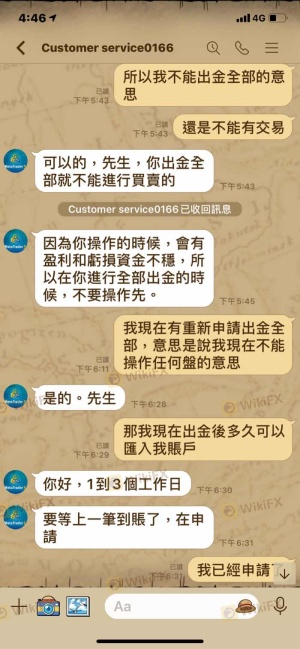

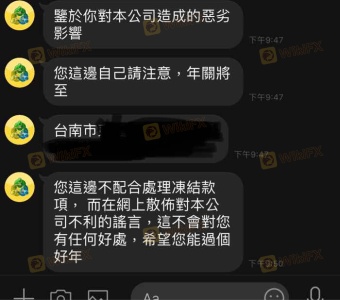

Customer Experience and Complaints

Customer feedback is a valuable resource when evaluating a broker's reliability. STPL has received mixed reviews from clients, highlighting both positive experiences and significant complaints.

Common complaints about STPL include issues related to withdrawal delays, poor customer service, and lack of responsiveness to client inquiries. The following table summarizes the main types of complaints and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Service | Medium | Inconsistent support |

| Lack of Transparency | High | No formal response |

From the table, it is evident that withdrawal delays and poor customer service are prevalent issues that could impact traders' experiences. The severity of these complaints raises concerns about STPL's operational integrity and commitment to client satisfaction.

One notable case involved a trader who reported significant delays in processing a withdrawal request, leading to frustration and financial strain. Despite multiple attempts to contact customer support, the trader received limited assistance, highlighting potential weaknesses in STPL's service delivery.

In summary, the mixed customer experiences and prevalent complaints raise concerns about STPL's reliability as a broker. As traders ponder the question, "Is STPL safe?" the evidence suggests that potential clients may face challenges in their interactions with the broker.

Platform and Trade Execution

The performance of a trading platform is critical for a trader's success. A reliable platform should offer stability, fast execution, and an intuitive user experience. STPL's platform warrants examination to assess its performance and user satisfaction.

STPL utilizes MetaTrader 4 and MetaTrader 5 platforms, which are widely recognized for their robust features and user-friendly interfaces. However, user feedback indicates that there may be issues with order execution quality, including slippage and re-quotes.

Traders have reported instances of significant slippage during high volatility, impacting their ability to execute trades at desired prices. Additionally, some users have raised concerns about the frequency of rejected orders, which can hinder trading strategies and lead to frustration.

In conclusion, while STPL offers popular trading platforms, the reported issues with execution quality and order management raise questions about its overall reliability. As traders consider the question, "Is STPL safe?" it is essential to weigh the platform's performance against the potential risks of inconsistent execution.

Risk Assessment

Engaging with any broker entails inherent risks, and STPL is no exception. A comprehensive risk assessment can help traders identify potential pitfalls associated with using STPL.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight raises significant concerns. |

| Fund Security Risk | High | Lack of fund segregation and investor protection. |

| Customer Service Risk | Medium | Reports of poor service and withdrawal delays. |

| Execution Risk | Medium | Issues with slippage and rejected orders reported. |

The high regulatory and fund security risks associated with STPL are particularly concerning. Traders should be aware that without proper oversight, their investments may be at risk, and recourse options may be limited in the event of disputes.

To mitigate these risks, traders should consider the following recommendations:

In summary, the risk assessment indicates that engaging with STPL carries significant risks that traders should carefully consider before proceeding.

Conclusion and Recommendations

Based on the evidence gathered throughout this investigation, the conclusion regarding STPL's safety is clear. The lack of regulatory oversight, transparency issues, and mixed customer experiences suggest that STPL may not be a safe trading option for prospective clients.

As traders reflect on the critical question, "Is STPL safe?" the findings indicate that there are substantial risks associated with engaging with this broker. Therefore, it is advisable for traders to exercise caution and consider alternative options that offer stronger regulatory protections and better customer service.

For those seeking reliable trading alternatives, consider brokers that are regulated by reputable authorities, provide transparent fee structures, and have a proven track record of customer satisfaction. By choosing a trustworthy broker, traders can enhance their chances of success in the forex market while minimizing risks.

Is STPL a scam, or is it legit?

The latest exposure and evaluation content of STPL brokers.

STPL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

STPL latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.