Is OPTION SECURITIES safe?

Pros

Cons

Is Option Securities Safe or Scam?

Introduction

Option Securities is an online brokerage platform that emerged in the forex market in 2021, primarily serving clients in Argentina. As with any financial service, especially in the volatile world of forex trading, it is essential for traders to conduct thorough due diligence before engaging with a broker. The potential for fraud and mismanagement is prevalent in this industry, making it crucial for investors to assess the credibility and reliability of their trading partners. This article will evaluate the safety and legitimacy of Option Securities through a comprehensive analysis of its regulatory status, company background, trading conditions, client experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its safety. Regulatory bodies enforce standards that protect investors and ensure fair trading practices. Unfortunately, according to various sources, Option Securities is not currently regulated by any recognized financial authority. This lack of oversight raises significant concerns about the safety of client funds and the broker's operational integrity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that Option Securities does not have to adhere to the stringent standards set by financial authorities, which often include requirements for capital reserves, transparency, and investor protection measures. This lack of oversight can lead to higher risks for traders, as there are no regulatory bodies to intervene in cases of disputes or financial mismanagement. Furthermore, the absence of any historical compliance issues is irrelevant when there is no regulatory framework to begin with. Thus, the question of Is Option Securities Safe? becomes increasingly complex and concerning.

Company Background Investigation

Option Securities, established in 2021, is relatively new to the forex market, which can be both a positive and a negative aspect. On one hand, new brokers may offer innovative technologies and user-friendly platforms; on the other hand, their lack of a proven track record can be a red flag. The ownership structure of Option Securities remains unclear, as there is limited publicly available information about its founders or management team. This opacity can hinder potential investors from making informed decisions.

The management team's background is equally critical. A well-experienced team can inspire confidence, while a lack of qualifications can raise suspicion. Unfortunately, the details regarding the qualifications and experiences of the management team at Option Securities are sparse, further complicating the evaluation of its credibility. Moreover, the overall transparency of the company regarding its operations and financial health is questionable, leaving potential clients to wonder about the integrity of their practices.

Trading Conditions Analysis

When evaluating a brokerage, understanding its fee structure is essential for assessing overall trading costs. Option Securities presents a standard fee model, but the absence of clear information regarding its fee structure raises eyebrows.

| Fee Type | Option Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-3 pips |

| Commission Model | N/A | $0-$10 per trade |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding spreads, commissions, and other fees can be indicative of potential hidden costs that traders may encounter. This uncertainty leads to the question of Is Option Securities Safe? as traders may find themselves paying more than expected due to undisclosed fees or unfavorable trading conditions.

Client Fund Safety

The safety of client funds is paramount when considering a brokerage. Option Securities claims to implement measures for the protection of client funds; however, without regulatory oversight, it is difficult to ascertain the effectiveness of these measures.

The brokerage's policies on fund segregation, investor protection, and negative balance protection are crucial to evaluate. Traders should expect that their funds are held in segregated accounts, separate from the broker's operational funds. Furthermore, the absence of any historical issues regarding fund safety could be misleading if there are no regulatory bodies to monitor or report such incidents.

Client Experience and Complaints

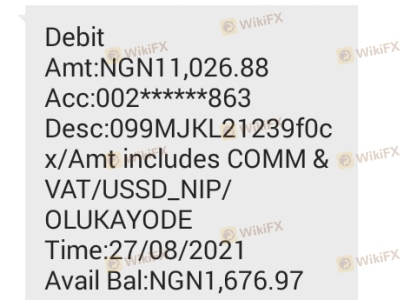

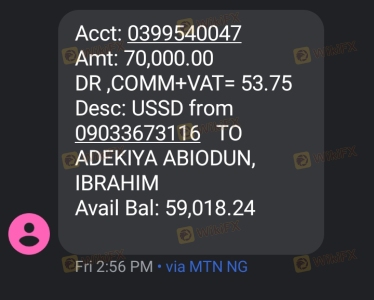

Client feedback is an invaluable resource for assessing a broker's reliability. Reviews and testimonials can provide insights into the user experience and highlight any recurring issues. Unfortunately, Option Securities has received several complaints regarding its customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Unresolved |

Common complaints include difficulties in withdrawing funds and inadequate customer support. Such issues can severely impact a trader's experience and trust in the broker. One notable case involved a user who reported being unable to withdraw their funds after multiple attempts, raising concerns about the broker's operational integrity. This leads to the question of Is Option Securities Safe?, as unresolved complaints can indicate deeper systemic issues within the brokerage.

Platform and Execution

The quality of a trading platform is another critical factor in evaluating a broker. Option Securities claims to offer a user-friendly platform; however, the lack of detailed reviews makes it difficult to assess its performance, stability, and overall user experience.

Traders should be wary of platforms that exhibit high slippage rates or frequent order rejections, as these can significantly affect trading outcomes. Without concrete information on execution quality, potential clients may be left questioning whether they can rely on the platform for timely and accurate trade execution.

Risk Assessment

Engaging with Option Securities presents a variety of risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk of fraud. |

| Fund Safety Risk | High | Lack of transparency in fund protection measures. |

| Customer Service Risk | Medium | Reports of poor customer support and withdrawal issues. |

To mitigate these risks, traders should consider diversifying their investments and only trading with funds they can afford to lose. Additionally, seeking out more transparent and regulated brokers may provide a safer trading environment.

Conclusion and Recommendations

In summary, the evidence suggests that Option Securities may not be a safe choice for traders. The lack of regulatory oversight, coupled with insufficient transparency about its operations and client experiences, raises significant concerns. Potential clients should approach this broker with caution and consider alternative options that offer better regulatory protections and clearer fee structures.

For traders seeking reliable alternatives, brokers such as Fidelity, Charles Schwab, and Interactive Brokers, which are well-regulated and have established reputations, are recommended. Ultimately, ensuring the safety of investments should be the top priority for any trader venturing into the forex market.

Is OPTION SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of OPTION SECURITIES brokers.

OPTION SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OPTION SECURITIES latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.