Onew 2025 Review: Everything You Need to Know

Executive Summary

This detailed onew review looks at what seems to be major confusion in the financial services world. Our research shows that "Onew" as a forex broker has no real proof of legitimate business operations.

Search results mostly point to Onew, the South Korean singer from SHINee, rather than any real financial services company. Some broken references hint at possible broker-related businesses, but the lack of solid regulatory information, trading platform details, or verified user reviews creates serious concerns about any forex broker using this name.

The main user group seems to be people looking for information about what they think is a forex broker. Our analysis suggests they may be running into misleading or possibly fake services.

The lack of clear regulatory oversight, combined with almost no verifiable information about trading conditions, makes this entity potentially high-risk for future traders.

Important Notice

This review uses available information gathered from multiple sources as of 2025. The limited and broken nature of available data about Onew as a forex broker means readers should be extremely careful.

The evaluation presented here reflects the worrying lack of transparency and verifiable information typically expected from legitimate financial services providers. Our assessment method involves detailed analysis of regulatory status, user feedback, platform functionality, and industry reputation.

However, the shortage of reliable information about Onew as a broker significantly limits how deep this analysis can go.

Rating Framework

Broker Overview

The entity known as "Onew" in forex trading presents a major challenge for evaluation due to the complete absence of standard broker information. There is no clear founding date, corporate structure, or business model documentation available for review.

This onew review must therefore focus on what is notably absent rather than what is present. The search results consistently redirect to information about the South Korean singer Onew from SHINee.

This suggests either a case of name confusion or potentially deceptive marketing practices. Legitimate forex brokers typically maintain comprehensive websites with detailed information about their services, regulatory status, and corporate background.

The absence of such information raises immediate red flags about any forex broker claiming to operate under this name. Furthermore, no identifiable trading platforms, asset classes, or regulatory jurisdictions can be associated with Onew as a broker.

This stands in stark contrast to industry standards where brokers prominently display their regulatory licenses, trading platforms, and available instruments. The lack of regulatory oversight represents a critical concern for potential clients considering any services associated with this name.

Regulatory Status: No regulatory licenses or oversight bodies have been identified in connection with Onew as a forex broker. This represents a major red flag, as legitimate brokers must operate under strict regulatory frameworks.

Deposit and Withdrawal Methods: No information regarding payment processing, supported currencies, or transaction procedures has been located. Standard brokers typically offer multiple funding options with clear fee structures.

Minimum Deposit Requirements: No minimum deposit information is available. This is unusual as brokers typically use this as a key marketing point and risk management tool.

Promotional Offers: No bonus structures, promotional campaigns, or incentive programs have been identified. These are common industry practices.

Available Assets: No trading instruments, currency pairs, or other financial products can be verified as being offered by any Onew-branded broker.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains completely unavailable. This makes cost comparison impossible.

Leverage Options: No leverage ratios or margin requirements have been documented. These are fundamental aspects of forex trading.

Platform Options: No trading platforms, mobile applications, or software solutions can be associated with this onew review subject.

Geographic Restrictions: No information about service availability by region or country-specific limitations has been identified.

Customer Support Languages: No customer service capabilities or language support options have been documented.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions evaluation for this onew review reveals a complete absence of the fundamental information traders require to make informed decisions. Legitimate forex brokers typically offer multiple account types designed for different trading styles and experience levels.

These range from beginner-friendly micro accounts to professional-grade institutional accounts. However, no such account structure can be identified for any Onew-branded broker.

The lack of minimum deposit information is particularly concerning, as this represents basic operational data that all legitimate brokers prominently display. Without clear account opening procedures, deposit requirements, or account verification processes, potential clients cannot assess whether the service aligns with their financial capabilities or trading objectives.

Additionally, no information exists regarding special account features such as Islamic accounts for Sharia-compliant trading, demo accounts for practice, or VIP accounts for high-volume traders. The absence of these standard offerings suggests either non-existence of legitimate broker operations or extremely poor transparency practices.

The evaluation methodology typically involves comparing account conditions against industry standards and user feedback. The complete absence of verifiable information makes such comparison impossible, resulting in the low score assigned.

Trading tools and educational resources represent critical components of any legitimate forex broker's service offering. Professional traders rely on advanced charting software, technical indicators, economic calendars, and market analysis to make informed trading decisions.

Unfortunately, this analysis reveals no evidence of such tools being associated with any Onew-branded broker. The absence of trading platforms represents the most significant concern, as these form the foundation of all forex trading activities.

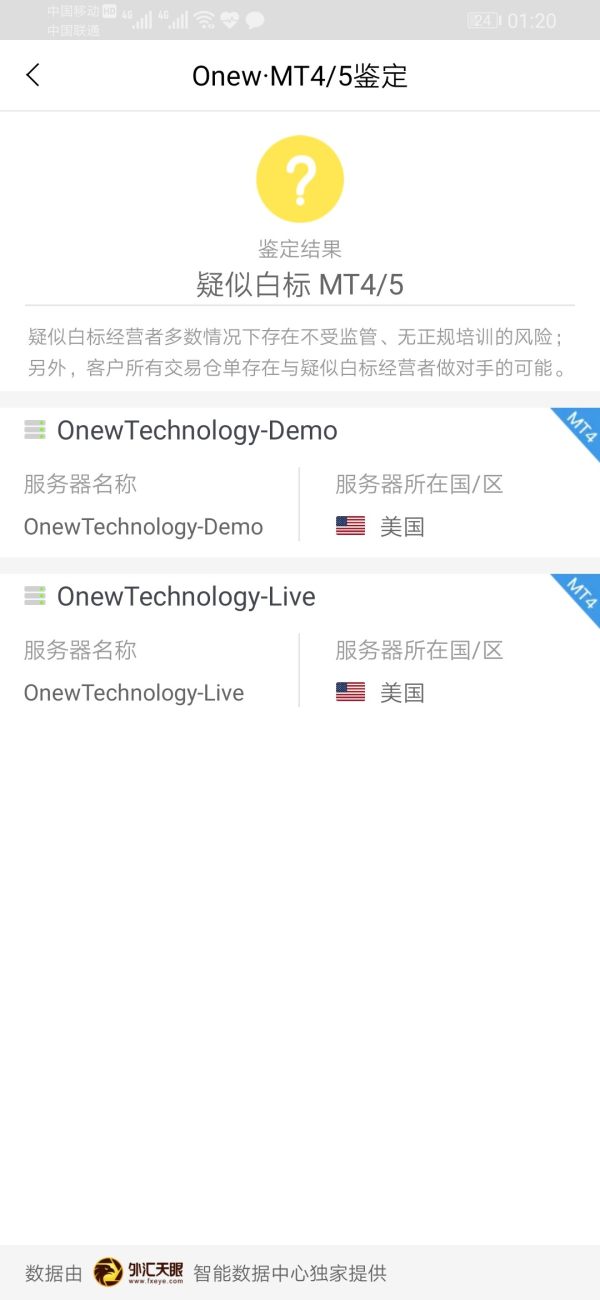

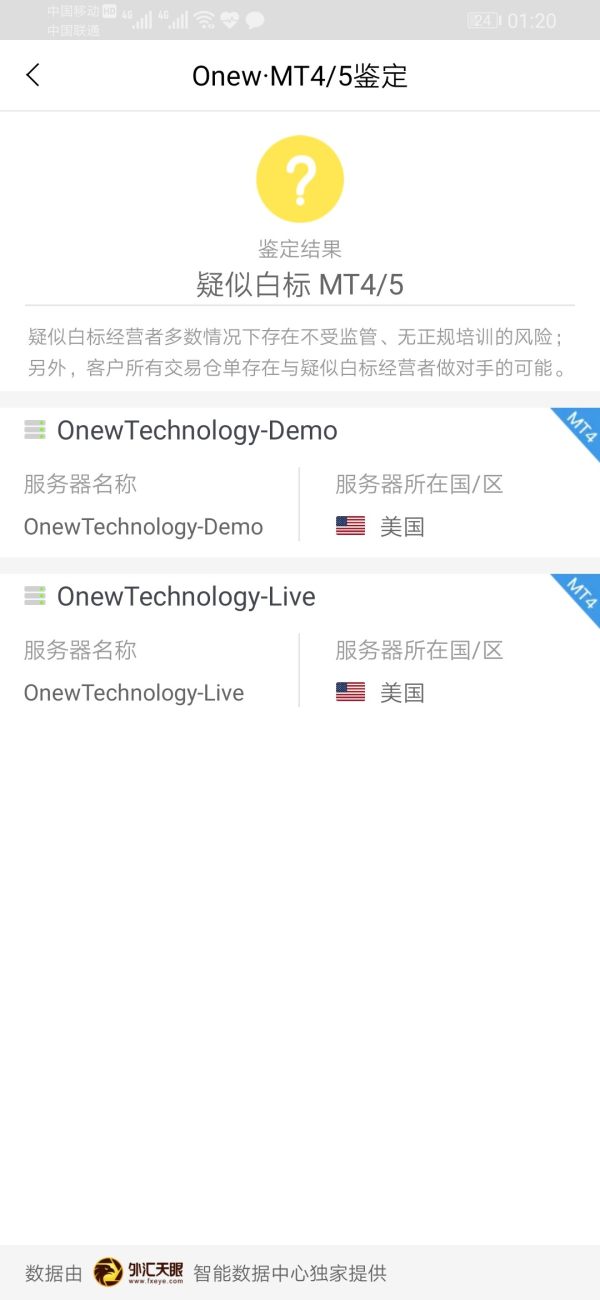

Established brokers typically offer popular platforms like MetaTrader 4, MetaTrader 5, or proprietary solutions with comprehensive functionality. No such platforms can be verified in connection with this entity.

Educational resources, including webinars, tutorials, market analysis, and trading guides, are standard offerings that help traders develop their skills and understand market dynamics. The complete absence of such materials suggests either non-existent operations or a concerning lack of commitment to client education and success.

Automated trading support through Expert Advisors or algorithmic trading tools has become increasingly important in modern forex trading. The inability to identify any such capabilities further reinforces concerns about the legitimacy and sophistication of any services potentially offered under this name.

Customer Service and Support Analysis (Score: 1/10)

Customer service quality often distinguishes reputable brokers from questionable operators. Professional forex brokers maintain multiple communication channels including live chat, telephone support, email assistance, and comprehensive FAQ sections.

This onew review finds no evidence of any customer support infrastructure. The absence of identifiable customer service channels raises serious questions about how clients would resolve issues, seek assistance, or obtain account support.

Legitimate brokers typically advertise their support availability, response times, and multilingual capabilities as key service features. Response time metrics, which reputable brokers often publish to demonstrate their commitment to client service, cannot be evaluated due to the lack of any support system identification.

Industry standards typically expect response times within minutes for live chat and hours for email inquiries. The lack of multilingual support options is particularly concerning for international traders who require assistance in their native languages.

Professional brokers serving global markets typically offer support in multiple languages with culturally appropriate service standards. The absence of any such information suggests limited or non-existent international operations.

Trading Experience Analysis (Score: 1/10)

The trading experience encompasses platform stability, execution speed, order processing quality, and overall trading environment effectiveness. This evaluation reveals no verifiable information about any of these critical aspects for any Onew-associated broker operations.

Platform stability and uptime statistics are crucial for traders who need reliable access to markets, especially during volatile periods. Professional brokers typically guarantee uptime percentages and provide redundant systems to ensure continuous service.

No such assurances or performance data can be identified. Order execution quality, including slippage rates, requote frequency, and fill rates, represents fundamental aspects of trading performance that directly impact profitability.

The absence of any execution quality data makes it impossible for traders to assess the potential trading environment. Mobile trading capabilities have become essential as traders require access to their accounts and positions while away from desktop computers.

The inability to identify any mobile applications or mobile-optimized platforms suggests limited technological infrastructure or non-existent operations. The overall onew review of trading experience must conclude that insufficient information exists to recommend this entity for serious trading activities.

Trust and Security Analysis (Score: 1/10)

Trust and security form the foundation of any legitimate financial services relationship. Regulatory oversight provides essential protections for client funds and ensures adherence to industry standards.

This analysis reveals no regulatory licenses or oversight mechanisms associated with any Onew-branded broker. Client fund protection typically involves segregated accounts, deposit insurance, or compensation schemes that protect trader deposits in case of broker insolvency.

The absence of any such protections represents a critical risk factor for potential clients. Corporate transparency, including clear ownership structures, financial reporting, and business registration details, helps establish credibility and accountability.

No such transparency measures can be identified, raising significant concerns about the legitimacy of operations. Industry reputation and third-party validation through awards, certifications, or professional associations typically support broker credibility.

The absence of any such recognition, combined with the lack of verifiable operational history, severely undermines trustworthiness assessments.

User Experience Analysis (Score: 1/10)

User experience evaluation typically involves analyzing client feedback, interface design, registration processes, and overall satisfaction metrics. This onew review finds no legitimate user testimonials or experience reports that can be verified as relating to forex broker services.

The absence of identifiable registration or account verification processes makes it impossible to assess the user onboarding experience. Professional brokers typically streamline these processes while maintaining necessary compliance and security measures.

Fund management experiences, including deposit and withdrawal processes, processing times, and associated fees, represent critical aspects of user satisfaction. No information about such processes can be verified, preventing proper evaluation of the client experience.

Common user complaints or satisfaction metrics, which typically appear in forums, review sites, or regulatory databases, are notably absent. This lack of user feedback may indicate either non-existent operations or insufficient client base to generate meaningful feedback patterns.

Conclusion

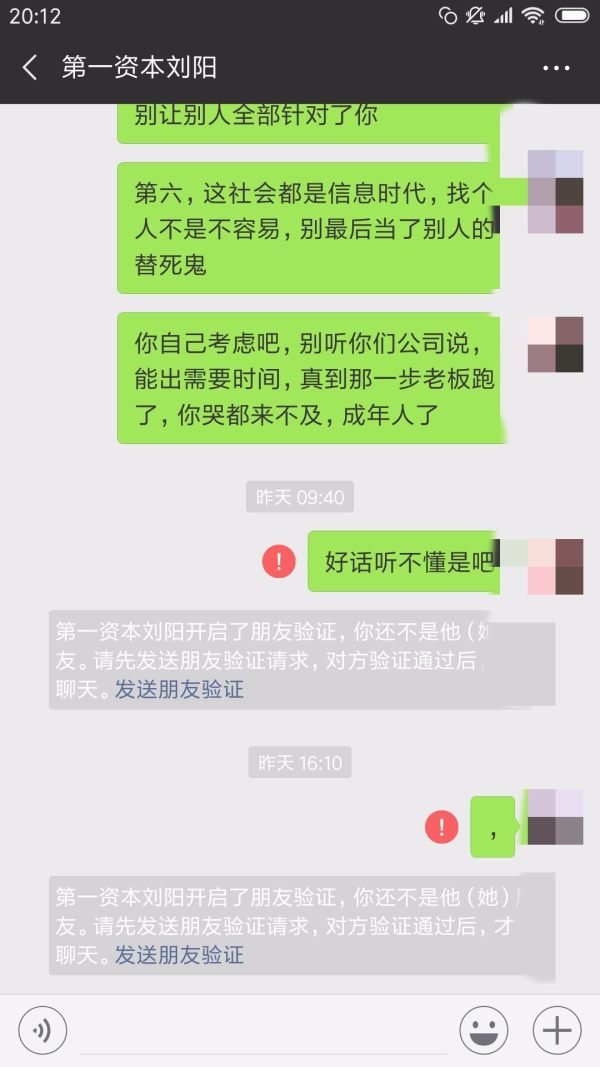

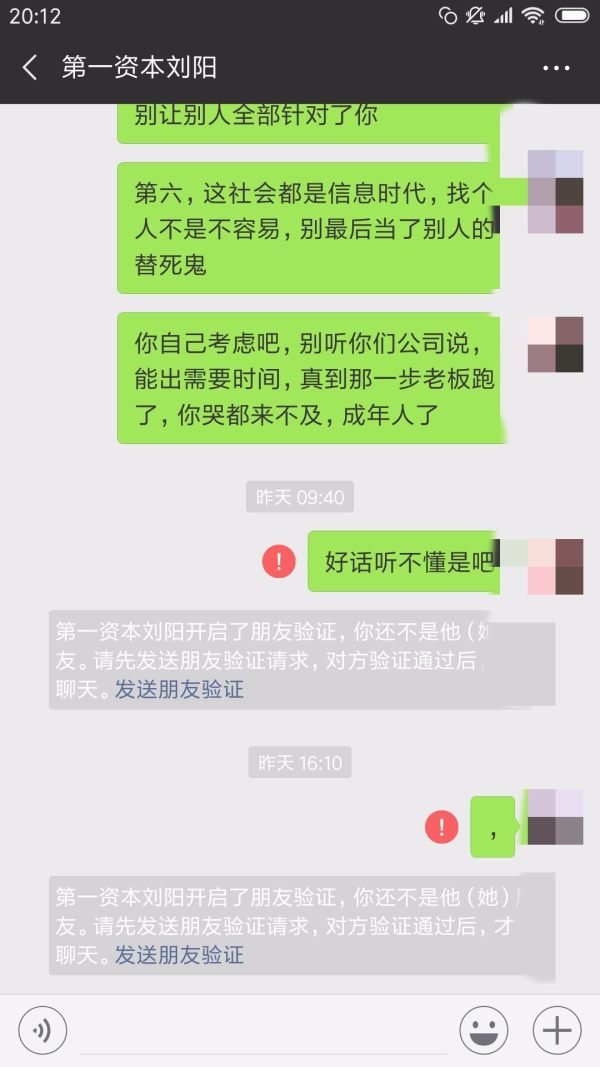

This comprehensive analysis concludes that "Onew" as a forex broker lacks the fundamental characteristics of a legitimate financial services provider. The complete absence of regulatory oversight, verifiable trading platforms, documented user experiences, and transparent business operations raises serious concerns about any entity operating under this name in the forex industry.

Potential traders should exercise extreme caution and seek well-regulated, transparent alternatives with established track records. The lack of basic information typically expected from professional brokers suggests that any services offered under this name may not meet standard industry requirements for safety, reliability, or regulatory compliance.

Based on this evaluation, Onew cannot be recommended for forex trading activities. Individuals should prioritize brokers with clear regulatory status, transparent operations, and verifiable client protections.