Is Olymp Investments safe?

Business

License

Is Olymp Investments A Scam?

Introduction

Olymp Investments is an emerging player in the forex trading market, offering a variety of trading options to its users. Established in 2020, the broker positions itself as a platform for both novice and experienced traders, aiming to provide a user-friendly trading experience. However, as the online trading environment becomes increasingly saturated, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and reliability of their chosen brokers. The potential for scams and fraudulent activities is prevalent in the trading industry, necessitating a careful assessment of brokers like Olymp Investments. This article investigates the safety and credibility of Olymp Investments by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk factors.

Regulation and Legitimacy

The regulatory status of a broker is one of the foremost indicators of its legitimacy and trustworthiness. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects traders' interests. In the case of Olymp Investments, it is crucial to determine whether it operates under the jurisdiction of a reputable regulatory body.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

As per the information available, Olymp Investments is not regulated by any recognized financial authority. This lack of regulation raises significant concerns regarding the safety of traders' funds and the overall operational integrity of the broker. Without regulatory oversight, traders may find it challenging to seek recourse in case of disputes or issues related to fund withdrawals. The absence of a regulatory framework also increases the likelihood of unethical practices, making it imperative for potential users to consider the risks associated with trading on this platform.

Company Background Investigation

Olymp Investments, founded in 2020, claims to provide a comprehensive trading platform for various financial instruments. However, the company's brief history raises questions about its stability and reliability. The ownership structure of Olymp Investments remains unclear, as there is limited information available about its founders or management team. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their leadership and operational history.

Furthermore, the absence of a well-documented history may indicate potential risks associated with the broker's reliability. Traders often prefer companies with a long-standing presence in the market, as this can be indicative of their ability to navigate economic challenges and regulatory requirements successfully. The lack of transparency in Olymp Investments' operations further complicates the evaluation of its legitimacy.

Trading Conditions Analysis

A thorough examination of the trading conditions offered by Olymp Investments is essential to assess its overall value proposition. This includes analyzing the fee structure, spreads, and other trading costs that may impact a trader's profitability.

| Fee Type | Olymp Investments | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Currently, specific details about Olymp Investments' trading costs are not readily available, making it challenging to compare these against industry standards. The absence of clear information regarding spreads and commissions is a red flag; traders should be wary of any broker that does not transparently disclose its fee structure. Unusual or hidden fees can significantly erode profitability, leading to potential losses that traders may not anticipate.

Client Fund Security

The safety of client funds is paramount when evaluating a broker's credibility. It is essential to understand the measures a broker implements to protect traders' investments. Olymp Investments claims to prioritize fund security; however, the lack of regulation raises concerns about the effectiveness of these measures. Key aspects to consider include fund segregation, investor protection schemes, and negative balance protection policies.

Traders should be cautious when dealing with unregulated brokers, as they often lack the necessary investor protection mechanisms. In the event of financial difficulties, traders may find themselves without legal recourse to recover their funds. Historical incidents involving fund security breaches or disputes can further tarnish a broker's reputation, and it is crucial to investigate any such occurrences related to Olymp Investments.

Customer Experience and Complaints

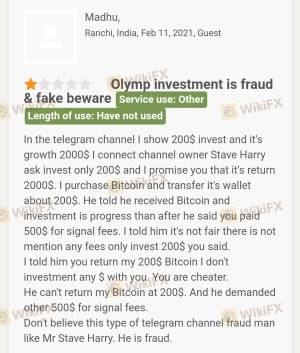

Analyzing customer feedback and experiences is vital to understanding a broker's reputation. Olymp Investments has received mixed reviews from users, with some expressing satisfaction with the platform's functionality, while others have raised concerns regarding withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Average |

Common complaints include withdrawal delays, which can be particularly concerning for traders who rely on timely access to their funds. Additionally, the lack of transparency regarding fees and trading conditions has led some users to question the broker's integrity. In some instances, users have reported difficulties in contacting customer support, further exacerbating their frustrations.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Olymp Investments offers a trading platform that is designed to be user-friendly; however, the execution quality, slippage, and rejection rates must be evaluated to ascertain its reliability. Traders should be aware of any signs of platform manipulation, which can severely impact their trading outcomes.

Risk Assessment

When considering the use of Olymp Investments, it is essential to evaluate the overall risk associated with trading on the platform.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Stability | Medium | Limited company history. |

| Fund Security | High | Lack of investor protection. |

Given the high-risk levels associated with regulatory compliance, financial stability, and fund security, traders should approach Olymp Investments with caution. It is advisable to conduct thorough research and consider alternative options before committing funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Olymp Investments may not be a safe trading option for most traders. The lack of regulation, combined with limited transparency and mixed customer feedback, raises significant red flags. Traders should be particularly cautious of the potential risks associated with using this broker. If you are considering trading forex, it may be prudent to explore more reputable alternatives that offer regulatory oversight and a proven track record of reliability. Recommended options include brokers with strong regulatory frameworks, transparent fee structures, and positive user experiences. Always prioritize safety and due diligence when selecting a trading platform.

Is Olymp Investments a scam, or is it legit?

The latest exposure and evaluation content of Olymp Investments brokers.

Olymp Investments Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Olymp Investments latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.