Naga Markets 2025 Review: Everything You Need to Know

Naga Markets has emerged as a noteworthy player in the online trading landscape, particularly recognized for its social trading features and a diverse array of tradable assets. While many users praise its user-friendly platform and innovative tools, there are also concerns regarding high spreads and customer service. This review synthesizes various sources to provide a comprehensive overview of Naga Markets, highlighting its strengths and weaknesses as a broker.

Note: It is essential to recognize that Naga operates through different entities across various regions, which may affect trading conditions and regulatory oversight. This review aims to present a fair and accurate assessment based on available data.

Rating Overview

We evaluate brokers based on extensive research and user feedback.

Broker Overview

Founded in 2015, Naga Markets is a subsidiary of the Naga Group AG, a publicly traded fintech company based in Germany. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC), which adds a layer of security for traders. Naga supports a variety of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary web trader. Traders can access a wide range of assets, including forex, cryptocurrencies, stocks, indices, commodities, and ETFs.

Detailed Breakdown

Regulatory Regions

Naga Markets operates under the regulation of CySEC, which allows it to provide services across the European Economic Area (EEA). However, it does not accept clients from the United States and certain other countries. The company also has an offshore entity, which raises questions about the level of protection for clients outside of regulated regions.

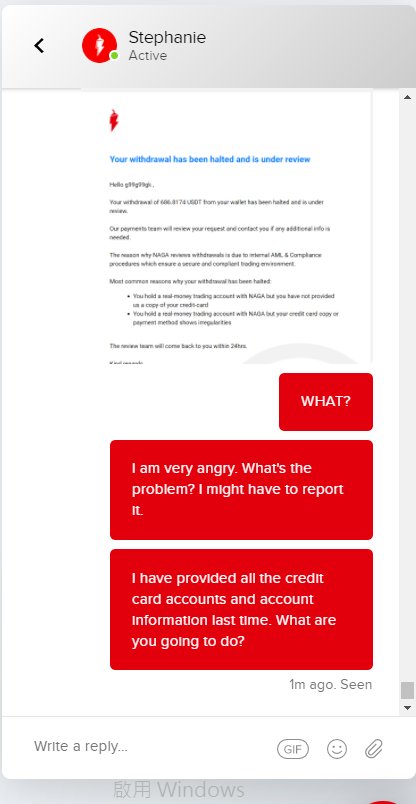

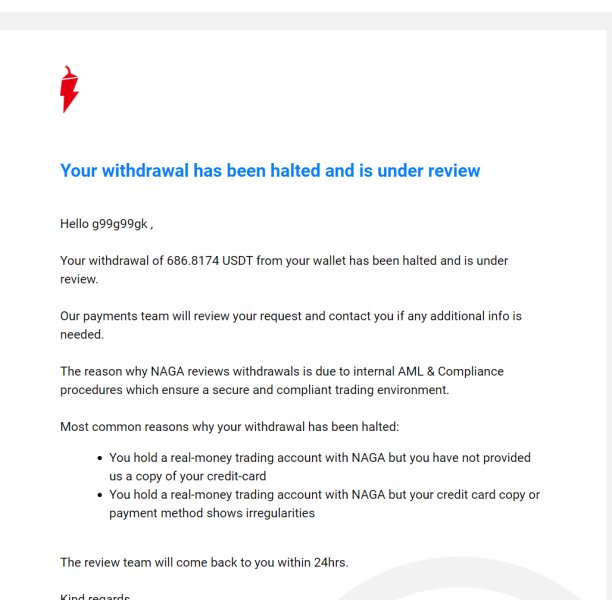

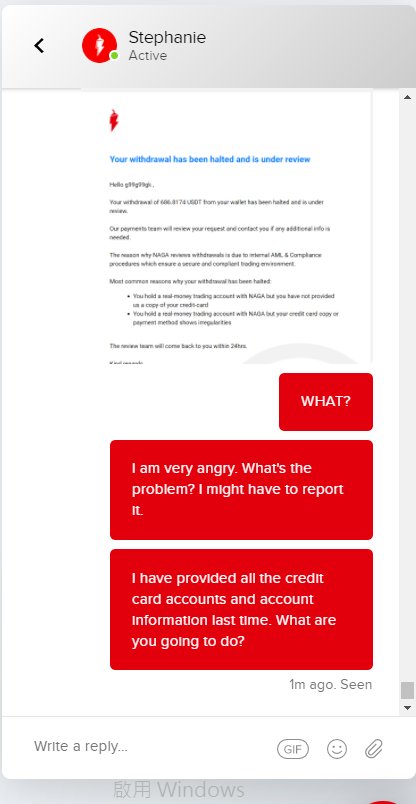

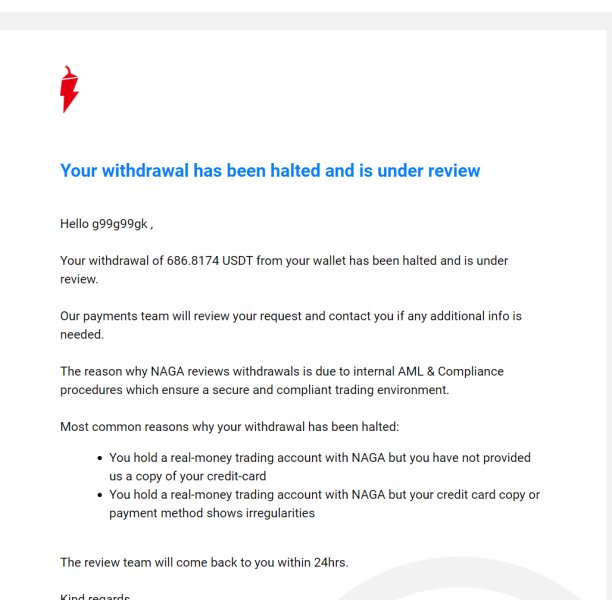

Deposit/Withdrawal Currencies and Cryptocurrencies

Naga supports multiple currencies for deposits and withdrawals, including USD, EUR, and GBP. The minimum deposit required to open an account is $250, which is relatively standard within the industry. Naga also accepts deposits in cryptocurrencies, although specific details about the supported cryptocurrencies were not extensively covered in the sources.

Currently, Naga Markets does not offer significant trading bonuses or promotions, which some traders may find disappointing. The absence of welcome bonuses or account replenishment promotions might deter potential clients looking for added incentives.

Tradable Asset Classes

Naga Markets offers more than 950 tradable instruments, including major forex pairs, commodities, indices, stocks, and cryptocurrencies. The diversity of assets allows traders to create a well-rounded portfolio. However, some users have reported that the selection of cryptocurrencies is limited compared to other brokers.

Costs (Spreads, Fees, Commissions)

The cost of trading with Naga varies depending on the account type and market conditions. Spreads start from 1.3 pips for major currency pairs, which is competitive but can be higher on standard accounts. Additionally, Naga charges withdrawal fees ranging from $0 to $5 depending on the user's account level, which some users have criticized as being high.

Leverage

Naga Markets offers leverage up to 1:30 for retail clients under CySEC regulations, which is standard for EU brokers. For professional accounts, leverage can be as high as 1:1000, providing more trading flexibility for experienced traders.

Traders at Naga can utilize MT4, MT5, and the proprietary web trader. Both MT4 and MT5 are well-regarded platforms known for their advanced trading capabilities and user-friendly interfaces. The proprietary platform is designed to enhance the social trading experience, allowing users to interact and copy trades easily.

Restricted Regions

Naga does not accept clients from the United States, Canada, and several other countries due to regulatory restrictions. This limitation may hinder its appeal to a broader audience.

Available Customer Service Languages

Naga Markets provides customer support in multiple languages, catering to its diverse user base. However, the support is only available 24/5, which could be a drawback for traders who prefer round-the-clock assistance.

Repeated Rating Overview

Detailed Analysis of Ratings

-

Account Conditions (6.5): Naga offers various account types, but the high minimum deposit for premium accounts and withdrawal fees have drawn criticism.

Tools and Resources (7.0): The platform provides a range of educational resources, including webinars and e-books, which are beneficial for both novice and experienced traders.

Customer Service and Support (6.0): While customer service is generally responsive, the lack of 24/7 support and mixed reviews regarding service quality can be a concern.

Trading Experience (7.5): The trading platforms are user-friendly and offer advanced tools, enhancing the overall trading experience.

Trustworthiness (7.0): Naga is regulated by CySEC, which provides a level of trust, but concerns about its offshore entity and mixed user reviews warrant caution.

User Experience (7.0): The overall user experience is positive, with many traders appreciating the social trading features and community engagement.

In conclusion, the Naga Markets review indicates that while the broker has several appealing features, including a wide range of tradable assets and a user-friendly platform, potential traders should be aware of the high spreads, withdrawal fees, and the absence of significant bonuses. The mixed reviews from users highlight the importance of conducting thorough research before engaging with Naga Markets.