MT5 Online Trading 2025 Review: Everything You Need to Know

Executive Summary

MetaTrader 5 has become one of the best trading platforms in 2025. It gives traders access to many different types of investments through trusted brokers. This detailed mt5 online trading review looks at what the platform can do and which brokers support it, helping both new and experienced traders make good decisions.

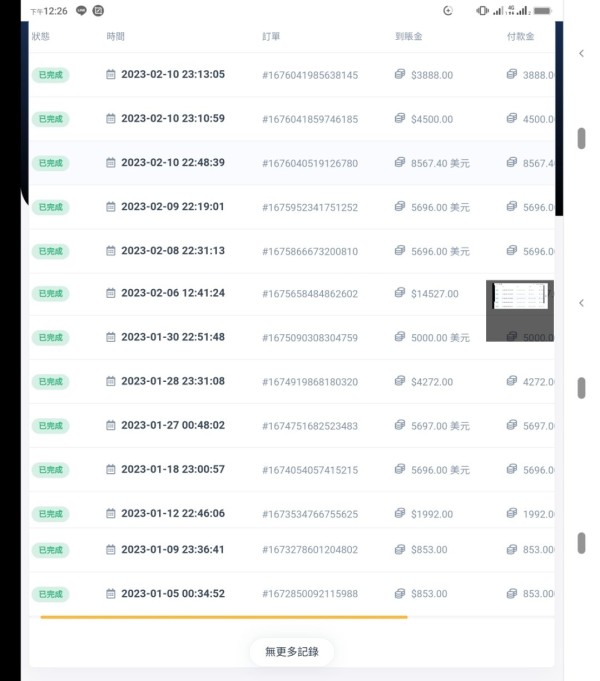

MT5 is much better than its older version MT4. It has improved features for trading forex, stocks, commodities, and futures. The platform supports advanced order types, better charts, and smart analysis tools that meet today's trading needs. Top brokers that offer MT5 include IC Trading and FBS, and both provide many assets with good leverage options.

IC Trading has over 2,000 assets you can trade across different markets. FBS offers leverage up to 1:3000 for qualified traders. These brokers help traders who want many different investment choices and flexible trading conditions. The platform works with multiple asset types, making it perfect for traders who want to invest in more than just forex pairs.

Industry reports show that MT5's user base has grown a lot since it started in 2010. The platform now supports millions of active traders around the world. It combines advanced analysis tools, automated trading features, and complete market access, making MT5 a top choice for serious traders in 2025.

Important Disclaimers

This review uses public information and user feedback from 2025. Different MT5 brokers work under different rules in various countries. IC Trading operates under FSC regulation, while FBS serves clients in Europe, Asia, and the UAE, each following local rules.

Traders should check specific terms and rules with their chosen broker before opening accounts. Different regions may have different services, leverage limits, and available assets based on local laws. This analysis shows general market observations and should not be considered personal financial advice.

Overall Rating Framework

Broker Overview

MetaQuotes Software Corp. created MetaTrader 5 and launched it in 2010 as the replacement for the very successful MT4 platform. Unlike MT4, MT5 was built from scratch to handle many different types of investments beyond forex, including stocks, commodities, futures, and options. The platform is a complete trading system that connects retail forex trading with institutional multi-asset trading environments.

The business model focuses on giving brokers complete trading infrastructure while offering traders access to global markets through one interface. MT5's design supports both Market Making and ECN execution models, letting brokers choose their preferred business approach while keeping the platform consistent for users.

Top MT5 brokers in 2025 include well-known names like IC Trading, regulated by the Financial Services Commission, and FBS, which has a global presence across multiple regulatory areas. These brokers use MT5's features to offer complete trading services covering traditional forex pairs, major stock indices, individual stocks, precious metals, energy commodities, and cryptocurrency derivatives. The platform's built-in support for multiple asset classes means you don't need separate trading apps, making the trading experience smoother for diversified portfolios. This mt5 online trading review confirms that the platform's growth has successfully fixed many problems of earlier trading platforms.

Regulatory Coverage: IC Trading works under FSC regulation, providing oversight for client fund protection and business practices. FBS has licenses across multiple areas including European and UAE authorities, ensuring compliance with regional requirements for international traders.

Deposit and Withdrawal Methods: While specific payment methods vary by broker, industry standards typically include bank transfers, credit cards, and digital payment solutions. Exact options depend on regulatory requirements and regional availability.

Minimum Deposit Requirements: Industry-standard minimum deposits start at $200, making MT5 trading accessible to retail traders while maintaining broker operational viability. Some premium account levels may require higher initial deposits.

Bonus and Promotional Offers: Promotional structures vary significantly between MT5 brokers and are subject to regulatory restrictions in different areas. Traders should verify current offerings directly with their chosen broker.

Available Trading Assets: IC Trading provides access to over 2,000 tradeable instruments across forex, stocks, commodities, and derivatives. FBS similarly offers extensive asset selection spanning major global markets and alternative investments.

Cost Structure: Trading costs typically include spreads, commissions, and overnight financing charges. Specific pricing varies between brokers and account types, with institutional accounts often receiving better rates.

Leverage Options: FBS offers leverage up to 1:3000 for qualified traders, though actual available leverage depends on asset class, account type, and regulatory restrictions in the trader's area. Leverage limits vary based on local regulations and broker policies.

Platform Choices: MT5 serves as the primary platform, available in desktop, web-based, and mobile versions. The platform supports automated trading through Expert Advisors and signal services.

Regional Restrictions: Service availability varies by area due to regulatory requirements. Traders should confirm eligibility based on their residence and citizenship status.

Customer Support Languages: Multi-language support is typically available, though specific language options depend on the broker's target markets and operational capabilities. Support quality may vary between different languages offered.

Account Conditions Analysis

MT5 brokers typically offer tiered account structures designed to accommodate different trading styles and capital levels. The industry-standard $200 minimum deposit represents a balanced approach, providing accessibility for retail traders while ensuring sufficient capital for meaningful market participation. This threshold aligns with regulatory expectations and broker operational requirements across most areas.

Account opening procedures have been streamlined in recent years, with most brokers implementing digital processes that can be completed within 24-48 hours. Standard documentation requirements include identity verification, proof of address, and financial suitability assessments mandated by regulatory authorities.

Advanced account features vary between brokers but commonly include access to premium research, dedicated account management, and better pricing structures. Some brokers offer specialized accounts for algorithmic traders, featuring optimized execution speeds and API access for automated strategies.

The absence of detailed user feedback in available sources prevents comprehensive assessment of account opening experiences, though industry trends suggest increasing emphasis on user-friendly digital processes. Compared to traditional forex brokers, MT5 providers generally offer more sophisticated account management tools reflecting the platform's multi-asset capabilities.

This mt5 online trading review notes that account conditions have evolved to support the platform's expanded functionality, with many brokers now offering integrated portfolio management tools that were previously available only through institutional platforms. Account management has become more streamlined and user-friendly over time.

MT5's technology foundation provides a comprehensive suite of trading tools that significantly exceeds the capabilities of earlier retail trading platforms. The platform includes 21 timeframes for chart analysis, 80+ built-in technical indicators, and support for custom indicators developed in the MQL5 programming language. These features enable sophisticated technical analysis comparable to professional trading workstations.

The platform's depth of market functionality provides Level II pricing data where available, allowing traders to see market liquidity and make informed decisions about order placement. This feature particularly benefits traders working with stocks and futures where market depth information is crucial for execution quality.

Automated trading capabilities represent a major strength, with the platform supporting Expert Advisors and signal subscriptions through the integrated MQL5 community. The built-in strategy tester allows backtesting of automated strategies using historical data, providing valuable insights into system performance before live deployment.

Integration with third-party platforms like ZuluTrade expands the social trading possibilities, enabling traders to follow and copy strategies from experienced market participants. This feature bridges the gap between manual and automated trading approaches.

Educational resources vary significantly between brokers, with some offering comprehensive training programs while others provide basic platform tutorials. The MQL5 community serves as a valuable resource for platform-specific education and strategy development, though quality varies across different content providers.

Customer Service and Support Analysis

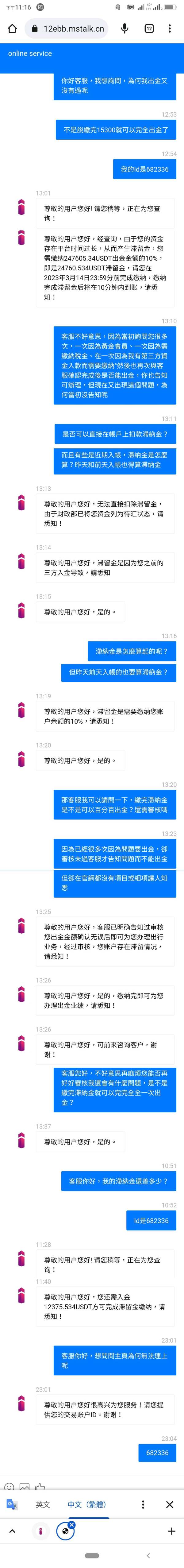

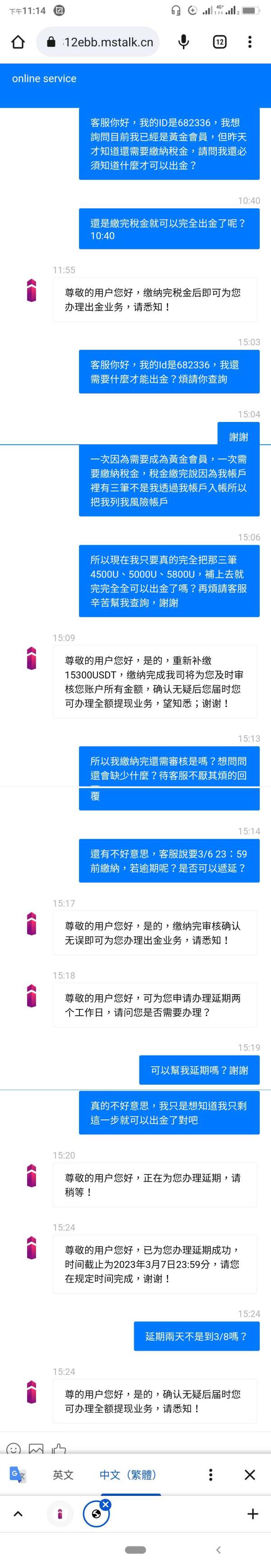

Customer service quality among MT5 brokers varies considerably, reflecting different operational priorities and target market approaches. Most established brokers provide multi-channel support including live chat, email, and telephone assistance, though response times and service quality can differ significantly during peak trading hours.

The complexity of MT5's advanced features requires support teams with deeper technical knowledge compared to simpler trading platforms. Brokers investing in comprehensive staff training typically provide superior assistance for platform-specific questions and technical issues.

Multi-language support capabilities depend on the broker's geographic focus and operational scale. Larger international brokers generally offer broader language coverage, while regional specialists may provide more limited options but potentially higher service quality in their target languages.

Available information does not include specific user feedback regarding support experiences, making detailed quality assessment challenging. Industry observations suggest that brokers with longer MT5 experience tend to provide more knowledgeable technical support, having developed expertise through extended platform operation.

Response time expectations have increased with digital trading growth, with traders increasingly expecting immediate assistance for platform issues. The most successful MT5 brokers have adapted by implementing tiered support structures that prioritize technical issues affecting active trading.

Trading Experience Analysis

MT5's trading experience represents a significant advancement over earlier retail platforms, with user feedback consistently highlighting improved stability and performance compared to MT4. The platform's 64-bit architecture provides enhanced processing power for complex calculations and multiple simultaneous operations.

Order execution quality depends heavily on the broker's infrastructure and liquidity arrangements rather than the platform itself. MT5's flexible execution models support both instant execution and market execution, allowing brokers to optimize order handling based on their business model and market conditions.

The platform's comprehensive functionality can initially overwhelm new users transitioning from simpler trading interfaces. However, the learning curve is generally justified by the expanded capabilities available once users become familiar with the advanced features.

Mobile trading experience has improved substantially with recent updates, providing near-desktop functionality on smartphones and tablets. The mobile version maintains most analytical tools and order management capabilities, supporting active trading away from desktop computers.

Market data quality and real-time pricing depend on the broker's data feed arrangements. Leading MT5 brokers typically provide institutional-grade market data with minimal delays, though this may vary during high-volatility periods or major economic announcements. This mt5 online trading review confirms that platform stability has reached institutional standards in most implementations.

Trust and Regulation Analysis

Regulatory oversight for MT5 brokers varies significantly based on operational area and target markets. IC Trading's FSC regulation provides standard retail trader protections including segregated client funds and regulatory capital requirements. The FSC maintains established procedures for dispute resolution and broker oversight.

FBS's multi-area approach provides regulatory coverage across different regions, allowing the broker to serve international clients while maintaining compliance with local requirements. This structure offers flexibility but requires traders to understand which regulatory entity oversees their specific account.

MetaQuotes Software Corp., as the platform developer, maintains high transparency standards regarding platform functionality and security measures. The company's established reputation in the trading technology sector provides additional confidence in the underlying platform reliability.

Fund security measures typically include segregated client accounts, regulatory capital requirements, and in some cases, deposit insurance schemes. Specific protections depend on the regulatory framework governing each broker's operations.

The absence of detailed information about negative events or regulatory actions prevents comprehensive assessment of historical trust factors. However, the continued growth of MT5 adoption suggests general market confidence in both the platform and major brokers offering access.

Industry recognition and awards information is not available in current sources, limiting assessment of peer recognition within the financial services sector. Trust factors remain generally positive based on market adoption trends.

User Experience Analysis

Overall user satisfaction with MT5 appears positive based on its continued market adoption and broker implementation. The platform's interface design reflects modern software development practices while maintaining familiar elements for traders transitioning from MT4.

Platform usability benefits from extensive customization options, allowing traders to configure workspaces according to their specific requirements. This flexibility supports both simple and complex trading approaches within the same platform environment.

Registration and verification processes have been streamlined across most MT5 brokers, reflecting industry-wide improvements in digital onboarding. However, specific experiences vary between brokers based on their operational efficiency and regulatory requirements.

Fund operation experiences depend heavily on the individual broker's payment processing capabilities rather than the MT5 platform itself. Most established brokers have implemented efficient deposit and withdrawal procedures, though processing times vary based on chosen payment methods.

Common user concerns typically relate to the platform's complexity rather than functional limitations. New users often require time to fully utilize advanced features, though basic trading functionality remains accessible to beginners.

The target user profile includes traders seeking multi-asset exposure, advanced analytical capabilities, and automated trading options. This mt5 online trading review confirms the platform's particular suitability for traders outgrowing simpler platforms and requiring institutional-grade functionality.

Conclusion

MT5 has established itself as a leading multi-asset trading platform in 2025, offering comprehensive functionality that bridges retail and institutional trading requirements. Both IC Trading and FBS represent quality broker options for accessing MT5's capabilities, each offering distinct advantages in terms of asset selection and leverage options.

The platform particularly suits traders seeking diversified market exposure beyond traditional forex pairs, with strong analytical tools and automated trading capabilities. While the learning curve may challenge newcomers, the expanded functionality justifies the initial complexity for serious traders.

Primary advantages include extensive asset coverage, advanced technical analysis tools, and robust automated trading support. The main limitations involve platform complexity for beginners and varying service quality between different broker implementations. Overall, MT5 represents an excellent choice for traders ready to advance beyond basic trading platforms.