Is Mirollex safe?

Business

License

Is Mirollex Safe or a Scam?

Introduction

Mirollex is an online trading platform that positions itself as a broker specializing in forex and cryptocurrency markets. With the increasing popularity of online trading, it has become imperative for traders to carefully assess the legitimacy and reliability of brokers before committing their funds. This scrutiny is particularly crucial in an environment rife with scams and unregulated entities. In this article, we will explore whether Mirollex is safe or if it poses risks to its users. Our investigation is based on a thorough analysis of online reviews, regulatory information, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

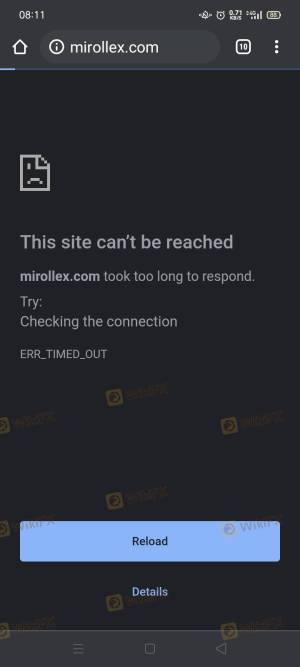

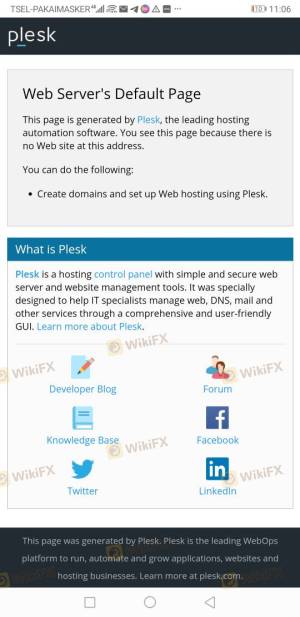

The regulatory status of a trading platform is a critical factor in determining its legitimacy. Mirollex claims to operate out of Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. This raises significant concerns about the safety of funds deposited with the broker. Below is a summary of the regulatory information for Mirollex:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of regulation means that Mirollex does not adhere to the strict standards imposed by reputable financial authorities, which typically include customer fund protection, transparency, and operational oversight. Furthermore, the lack of a license raises questions about the broker's commitment to ethical trading practices and compliance with financial regulations. Historical compliance issues with similar offshore brokers have often led to significant financial losses for traders, making it crucial to consider these factors when evaluating whether Mirollex is safe.

Company Background Investigation

Mirollex's company history and ownership structure are essential to understanding its credibility. The broker claims to be operated by Mirollex LLC, yet detailed information about its management team is sparse. The CEO, Andreas Kral, has been described as having a questionable digital footprint, raising suspicions about his legitimacy and the overall transparency of the organization.

Furthermore, the company's incorporation in a jurisdiction known for facilitating unregulated financial activities adds another layer of concern. The lack of publicly available information about the firm's operations and its leadership team makes it difficult for potential investors to assess the risks involved. Given the opaque nature of Mirollex's business practices, it is prudent for traders to approach this broker with caution, as the absence of transparency is a significant red flag.

Trading Conditions Analysis

Understanding the trading conditions offered by Mirollex is vital for evaluating its safety. The broker claims to provide competitive trading fees and conditions. However, the specifics of these fees remain unclear, leading to potential hidden costs that could affect traders' profitability. Below is a comparison of core trading costs associated with Mirollex:

| Fee Type | Mirollex | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Variable | 1-2 pips |

| Commission Model | N/A | Varies widely |

| Overnight Interest Range | N/A | Varies widely |

The lack of transparency regarding commissions and overnight fees could indicate that traders might face unexpected costs. Such practices are common among unregulated brokers, who may impose fees that are not clearly disclosed upfront. This uncertainty contributes to the overall risk profile of trading with Mirollex, raising further doubts about whether Mirollex is safe for investors.

Client Fund Safety

The safety of client funds is a paramount concern when dealing with any broker. Mirollex claims to implement measures to protect client funds, yet there is little evidence to support these assertions. The broker does not provide clear information regarding the segregation of client funds or investor protection policies.

In most reputable trading environments, funds are kept in segregated accounts to ensure that they are not misused by the broker. However, Mirollex's lack of transparency raises questions about whether such practices are in place. Additionally, the absence of any investor compensation schemes means that traders could potentially lose their entire investment without recourse. The lack of historical incidents involving fund security does not necessarily imply safety; rather, it could indicate a lack of trading activity or transparency.

Customer Experience and Complaints

Analyzing customer feedback is crucial in understanding the overall experience associated with a broker like Mirollex. Reviews from users indicate a mixed bag of experiences, with many reporting issues related to withdrawal difficulties and unresponsive customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal issues | High | Poor |

| Unresponsive customer service | Medium | Poor |

| Misleading marketing claims | High | Poor |

Many users have voiced concerns over the inability to withdraw their funds, which is a significant red flag for any trading platform. The lack of timely responses from customer service further exacerbates these issues, leaving traders feeling frustrated and vulnerable. In some cases, users have reported that the marketing claims made by Mirollex were misleading, leading them to believe they would receive returns that were not delivered.

Platform and Trade Execution

The performance of the trading platform is another critical factor in evaluating whether Mirollex is safe. Users have reported mixed experiences regarding the platform's stability and usability. Concerns have been raised about order execution quality, including instances of slippage and order rejections.

A reliable trading platform should provide seamless execution with minimal slippage. However, if users experience frequent issues with order filling, it may indicate underlying problems with the broker's infrastructure. The lack of transparency regarding these operational aspects further complicates the assessment of Mirollex's reliability.

Risk Assessment

Overall, the risks associated with trading through Mirollex are considerable. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Poor response times to complaints and issues. |

| Platform Stability Risk | Medium | Reports of slippage and order rejections. |

Given these risks, potential traders should exercise extreme caution when considering Mirollex. It is advisable to conduct thorough research and consider alternative platforms with stronger regulatory oversight and proven track records.

Conclusion and Recommendations

In conclusion, the evidence suggests that Mirollex exhibits numerous characteristics commonly associated with unregulated and potentially fraudulent brokers. The lack of regulation, transparency issues, and negative customer feedback raise significant concerns about whether Mirollex is safe for traders.

For those considering trading in the forex and cryptocurrency markets, it is essential to opt for brokers that are regulated and have a solid reputation for client fund protection and customer service. Some reliable alternatives include brokers like eToro, IG Markets, and OANDA, which have established themselves as trustworthy platforms in the industry.

Ultimately, the decision to engage with Mirollex should be approached with caution, as the risks involved could lead to significant financial losses.

Is Mirollex a scam, or is it legit?

The latest exposure and evaluation content of Mirollex brokers.

Mirollex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Mirollex latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.