Mirollex 2025 Review: Everything You Need to Know

Executive Summary

Our comprehensive mirollex review reveals major concerns about this forex broker. Traders should carefully consider these issues before investing. Mirollex was established in 2020 and is based in Saint Vincent and the Grenadines. The company operates as an unregulated forex broker, which immediately raises red flags for potential investors.

The platform offers access to MetaTrader 4 and MetaTrader 5 trading platforms. These are widely-used trading systems. However, this positive aspect is overshadowed by numerous negative user experiences and concerning feedback.

Available data from various review platforms shows that Mirollex has received poor ratings. Scam Detector gives the platform a concerning score of 23, indicating extremely low trustworthiness. User feedback consistently points to serious issues including allegations of fund theft, misleading promotional practices, and poor customer service quality.

The broker's lack of regulatory oversight makes these concerns worse. Traders have limited options when disputes arise. The platform primarily targets forex trading enthusiasts, but our analysis suggests that even experienced traders should exercise extreme caution when considering this broker.

The combination of regulatory absence and negative user experiences makes Mirollex a high-risk choice. Anyone looking to engage in forex trading activities should consider other options.

Important Notice

This evaluation is based on available user feedback, industry analysis, and standard broker assessment criteria. As an unregulated forex broker, Mirollex may present different levels of risk for investors across various jurisdictions.

The absence of regulatory supervision means that trader protections commonly found with licensed brokers are not available. Our assessment methodology incorporates user testimonials, third-party review platforms, and industry standard evaluation metrics. However, potential traders should conduct their own research and consider consulting with financial advisors before making any investment decisions with this platform.

Rating Framework

Broker Overview

Mirollex entered the forex market in 2020. The company positioned itself as a trading platform provider for retail investors interested in foreign exchange markets. Based in Saint Vincent and the Grenadines, the company operates without regulatory supervision from major financial authorities.

This significantly impacts its credibility and trader protection capabilities. The broker's business model focuses on providing access to forex and CFD markets through popular trading platforms, though the lack of transparency in its operations raises substantial concerns. The company's short operational history combined with its unregulated status creates an inherently risky environment for traders.

Saint Vincent and the Grenadines has become a common jurisdiction for offshore brokers seeking minimal regulatory oversight. This often correlates with reduced trader protections and accountability standards.

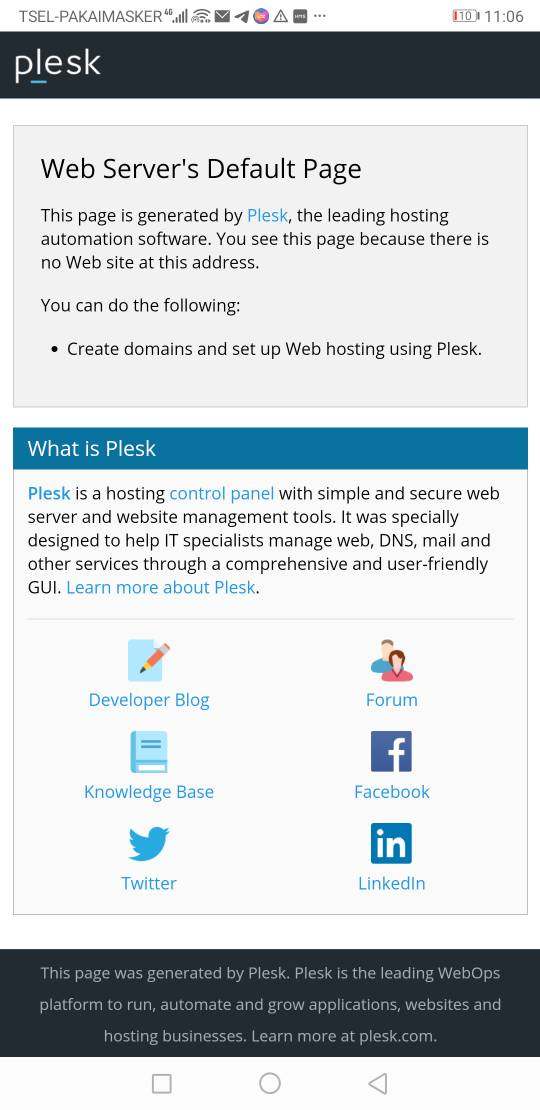

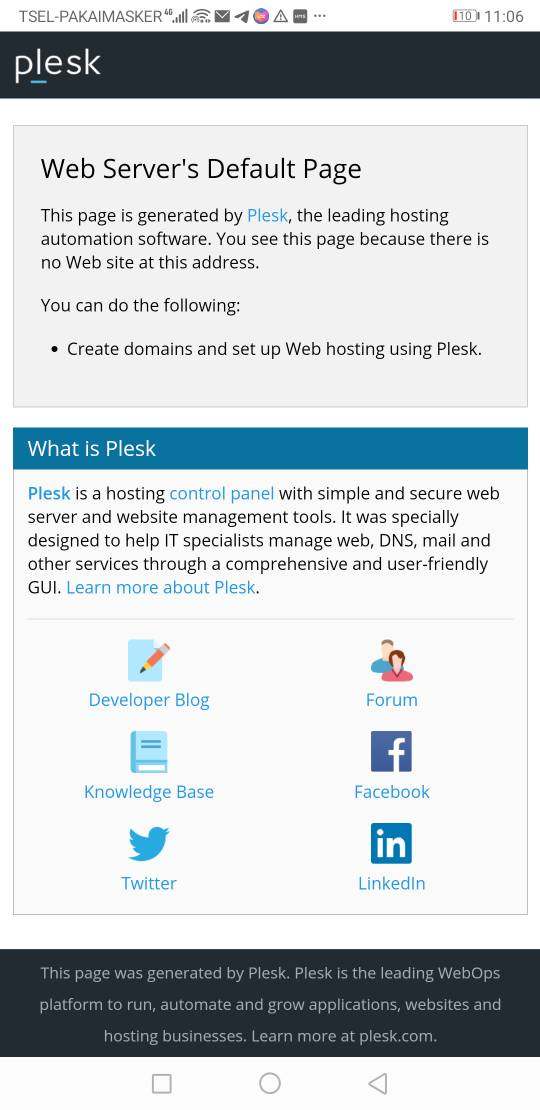

Regarding trading infrastructure, Mirollex provides access to MetaTrader 4 and MetaTrader 5 platforms. These are industry-standard solutions used by millions of traders worldwide. These platforms offer comprehensive charting tools, automated trading capabilities, and support for expert advisors.

However, the quality of a broker extends far beyond platform selection. It encompasses regulatory compliance, fund security, and operational transparency. The broker claims to offer forex and CFD trading services, though specific details about asset coverage, account types, and trading conditions remain unclear based on available information.

This lack of transparency is particularly concerning for potential clients who need comprehensive information to make informed trading decisions.

Regulatory Status: Available information indicates that Mirollex operates without supervision from recognized financial regulatory authorities. This absence of regulatory oversight means traders lack the protections typically associated with licensed brokers, including segregated client funds and compensation schemes.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees has not been detailed in available sources. This lack of transparency regarding financial transactions is concerning for potential clients.

Minimum Deposit Requirements: The platform's minimum deposit requirements are not clearly specified in available documentation. This makes it difficult for potential traders to assess accessibility and entry barriers.

Promotional Offers: Details about bonus programs, promotional campaigns, or special offers are not mentioned in available sources. However, traders should be cautious of unrealistic promotional claims that are common among unregulated brokers.

Trading Assets: The platform appears to focus on forex and CFD trading. However, specific information about currency pairs, commodities, indices, or other available instruments has not been comprehensively detailed.

Cost Structure: Critical information regarding spreads, commissions, overnight fees, and other trading costs remains unclear based on available sources. This transparency gap makes it impossible for traders to accurately assess the true cost of trading with this mirollex review subject.

Leverage Ratios: Specific leverage offerings and margin requirements have not been clearly outlined in available documentation.

Platform Options: The broker provides access to MetaTrader 4 and MetaTrader 5. These are reputable and widely-used trading platforms in the forex industry.

Geographic Restrictions: Information about restricted countries or regional limitations has not been specified in available sources.

Customer Support Languages: The range of supported languages for customer service has not been detailed in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Mirollex present several concerning aspects. These contribute to its poor rating in this category. Based on available information, the broker fails to provide clear details about account types, minimum deposit requirements, or specific features that would help potential traders make informed decisions.

This lack of transparency is particularly problematic in the forex industry. Account specifications directly impact trading costs and accessibility. User feedback suggests that account opening processes lack clarity, with some traders reporting unexpected conditions or requirements that were not clearly communicated during the registration phase.

The absence of detailed information about account features such as Islamic accounts, demo account availability, or professional trading accounts further diminishes the broker's appeal. This affects diverse trader segments. When compared to regulated brokers that provide comprehensive account documentation and clear terms of service, Mirollex's approach appears unprofessional and potentially misleading.

The combination of poor user experiences and lack of transparent account information makes it difficult to recommend this broker for serious trading activities. Our mirollex review analysis indicates that the broker's account conditions fail to meet industry standards for transparency and user protection, contributing significantly to its low overall rating.

Mirollex receives a moderate score in this category primarily due to its provision of MetaTrader 4 and MetaTrader 5 platforms. These are industry-standard trading solutions. These platforms offer comprehensive charting capabilities, technical analysis tools, automated trading support through expert advisors, and mobile trading applications.

The availability of these established platforms provides traders with familiar and reliable trading environments. However, the broker appears to lack additional educational resources, market analysis tools, or proprietary trading aids that many competitors offer. Modern forex brokers typically provide economic calendars, market sentiment indicators, trading signals, educational webinars, and comprehensive learning materials.

The absence of such supplementary resources limits the overall value proposition for traders. This is particularly true for those who are new to forex markets. User feedback suggests that while the basic trading platforms function adequately, the lack of additional tools and educational support impacts the overall trading experience.

Professional traders often rely on multiple analytical resources and educational materials to enhance their trading strategies. This makes this gap particularly noticeable. The limited scope of tools and resources beyond the basic trading platforms prevents Mirollex from achieving higher scores in this evaluation category, despite the positive aspect of offering recognized trading software.

Customer Service Analysis (Score: 4/10)

Customer service represents one of the most critical aspects of forex broker operations. Mirollex's performance in this area shows significant deficiencies based on available user feedback. Traders have reported poor response times, inadequate problem resolution capabilities, and unsatisfactory communication quality from the support team.

The lack of detailed information about customer service channels, operating hours, and multilingual support capabilities raises additional concerns. This affects the broker's commitment to client service. Professional forex brokers typically offer multiple contact methods including live chat, telephone support, email assistance, and comprehensive FAQ sections.

User testimonials indicate frustration with the support team's ability to resolve account-related issues. These particularly involve fund withdrawals and technical problems. Some traders report that customer service representatives appear unprepared to handle complex inquiries or provide satisfactory solutions to legitimate concerns.

The absence of transparent customer service policies and the negative feedback regarding support quality significantly impact trader confidence and overall satisfaction. When combined with the broker's unregulated status, poor customer service creates additional risks for traders who may need assistance with their accounts or trading activities.

Trading Experience Analysis (Score: 3/10)

The trading experience with Mirollex appears to be problematic based on available user feedback and platform analysis. The broker offers access to MetaTrader platforms, which are generally reliable and feature-rich. However, user reports suggest issues with platform stability, order execution quality, and overall trading conditions.

Traders have mentioned concerns about slippage, requotes, and inconsistent spread behavior. These can significantly impact trading profitability and strategy implementation. These technical issues are particularly problematic for scalpers and high-frequency traders who rely on precise order execution and stable trading conditions.

The lack of detailed information about execution models, liquidity providers, and trading infrastructure raises questions about the broker's ability to provide professional-grade trading services. Reputable brokers typically provide transparency about their execution methods and technology infrastructure. Mobile trading experience, while supported through standard MetaTrader applications, may be limited by the broker's overall technical capabilities and server reliability.

User feedback suggests that the trading environment may not meet the expectations of serious forex traders who require consistent performance and reliable execution. Our mirollex review indicates that despite access to quality trading platforms, the overall trading experience is compromised by technical issues and operational concerns that impact trader satisfaction and success.

Trustworthiness Analysis (Score: 2/10)

Trustworthiness represents the most concerning aspect of Mirollex's operations. It earns the lowest score in our evaluation framework. The broker's unregulated status immediately places it in a high-risk category, as traders lack the protections and oversight provided by recognized financial authorities.

The Scam Detector rating of 23 out of 100 indicates extremely poor trustworthiness according to third-party evaluation criteria. This low score reflects various risk factors including regulatory absence, negative user feedback, and operational transparency issues that commonly characterize problematic brokers. User reports of fund theft and misleading promotional practices represent serious allegations that significantly undermine the broker's credibility.

While individual claims require careful verification, the pattern of negative feedback suggests systemic issues with the broker's operations and client treatment. The lack of regulatory supervision means that Mirollex is not subject to capital adequacy requirements, client fund segregation mandates, or operational oversight that licensed brokers must maintain.

This regulatory gap creates substantial risks for traders. There are limited recourse options when disputes arise. The combination of regulatory absence, negative third-party ratings, and concerning user feedback makes Mirollex a high-risk choice for forex trading activities, regardless of other platform features or services offered.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Mirollex appears to be significantly below industry standards. This is based on available feedback and review analysis. Traders consistently report negative experiences across multiple aspects of the broker's services, from account management to customer support and fund security.

The registration and verification processes appear to lack clarity. Some users report unexpected requirements or delays that were not properly communicated. Professional brokers typically provide streamlined onboarding processes with clear documentation requirements and reasonable processing timeframes.

Fund management experiences represent a particular area of concern. Multiple user reports suggest difficulties with withdrawal processes and fund security. These issues are especially problematic given the broker's unregulated status, which provides limited recourse for traders experiencing fund-related problems.

The predominance of negative user reviews across multiple platforms suggests systematic issues with service quality and operational standards. While individual experiences may vary, the overall pattern of feedback indicates that Mirollex fails to meet basic expectations for professional forex broker services. Traders considering this platform should be aware that the user experience typically falls well below industry standards, with significant risks related to fund security and service quality that may impact their trading activities and financial security.

Conclusion

Based on our comprehensive analysis, this mirollex review concludes that the broker presents significant risks. These outweigh any potential benefits for forex traders. The combination of unregulated status, poor user feedback, and concerning third-party ratings makes Mirollex unsuitable for serious trading activities.

The platform offers access to reputable MetaTrader software. However, this single positive aspect cannot compensate for the fundamental issues surrounding regulatory compliance, fund security, and operational transparency. The broker may only be considered by traders with extremely high risk tolerance who fully understand the potential for total loss.

The primary advantages include access to industry-standard trading platforms. The substantial disadvantages encompass regulatory absence, poor trustworthiness ratings, negative user experiences, and inadequate customer service. For most traders, these risks far exceed any potential benefits, making alternative regulated brokers a more prudent choice for forex trading activities.