Is MCM safe?

Pros

Cons

Is MCM Safe or Scam?

Introduction

MCM, a foreign exchange broker, has garnered attention in the trading community for its appealing offers and trading conditions. However, the question remains: Is MCM safe or a scam? In the volatile world of forex trading, it is essential for traders to critically evaluate the brokers they choose to work with. This is particularly important given the prevalence of scams in the industry, where unregulated or poorly regulated brokers can jeopardize traders' funds and personal information.

To address the question of MCM's legitimacy, this article employs a comprehensive investigative approach, analyzing key aspects such as regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk assessment. The findings aim to provide a balanced view of whether MCM is a safe option for traders or if it raises red flags that warrant caution.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its reliability and safety. MCM operates without regulation from any recognized financial authority, which is a significant concern for potential clients. The absence of oversight means that there are no guarantees regarding the safety of client funds or the integrity of trading practices.

Here is a summary of MCM's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation is a serious red flag, as it leaves traders vulnerable to potential fraud and mismanagement. Regulated brokers are typically required to adhere to strict standards that protect investors, such as maintaining segregated accounts for client funds and providing negative balance protection. MCM's unregulated status places it in a high-risk category, making it imperative for traders to exercise caution.

Company Background Investigation

MCM's history and ownership structure are crucial for understanding its legitimacy. The broker appears to operate from offshore locations, which are often associated with lax regulatory environments and higher risks of fraud. The company's website lacks transparency regarding its ownership and management team, raising further concerns about its credibility.

The management teams background is often a strong indicator of a broker's reliability. However, MCM does not provide sufficient information about its executives or their qualifications. This lack of transparency can be alarming for potential clients who seek assurance that their funds are managed by experienced professionals.

In terms of information disclosure, MCM's website is sparse, lacking critical legal documents and clear terms of service. This raises questions about the broker's commitment to transparency and accountability.

Trading Conditions Analysis

Understanding the trading conditions offered by MCM is vital for assessing its overall appeal. While the broker claims to provide competitive spreads and flexible trading options, the absence of clear information on fees and commissions is concerning.

Here is a comparison of MCM's core trading costs against industry averages:

| Fee Type | MCM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1.0 - 2.0 pips |

| Commission Structure | Not Specified | Varies (0 - $10) |

| Overnight Interest Range | Not Specified | Varies |

The lack of specified fees can lead to unexpected costs, which is a common tactic employed by unregulated brokers to extract more funds from traders. Additionally, if the broker imposes high overnight fees or commissions, it could significantly impact a trader's profitability.

Client Fund Security

The safety of client funds is paramount when evaluating a broker. MCM does not appear to have robust security measures in place to protect client deposits. The absence of segregated accounts means that client funds may be co-mingled with the broker's operating capital, increasing the risk of loss in the event of financial difficulties.

Furthermore, MCM does not offer negative balance protection, which is a critical safety feature that prevents traders from losing more than their initial investment. The lack of these essential protections raises alarms about the security of funds held with MCM.

Historically, unregulated brokers have faced numerous allegations regarding the mishandling of client funds, and MCM's lack of regulatory oversight places it in a similar category of risk.

Customer Experience and Complaints

Examining customer feedback and experiences provides insight into the operational practices of MCM. Reviews and testimonials often reveal common patterns of complaints that can indicate systemic issues within a brokerage.

Here is a summary of common complaint types associated with MCM:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Below Average |

| Misleading Information | High | No Response |

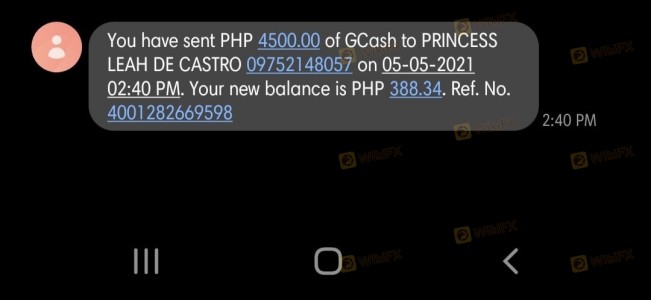

Many users have reported difficulties in withdrawing their funds, which is a common issue with unregulated brokers. Delays in processing withdrawal requests can lead to frustration and financial strain for traders. Moreover, the lack of responsive customer service exacerbates these issues, leaving clients feeling unsupported.

Two typical case studies highlight these concerns: one trader reported waiting over three months for a withdrawal, while another experienced multiple rejections without clear explanations. Such experiences contribute to the perception that MCM may not be a trustworthy broker.

Platform and Trade Execution

The performance and reliability of a trading platform are critical factors for any trader. MCM's trading platform has been described as lacking in features and stability. Users have reported issues with order execution, including slippage and rejections during high volatility periods.

These problems can significantly impact trading outcomes, particularly for those employing strategies that require precise execution. Furthermore, any signs of platform manipulation, such as frequent rejections of profitable trades, can raise ethical concerns about the broker's practices.

Risk Assessment

When considering whether MCM is safe, a risk assessment is essential. The following table summarizes the key risk areas associated with trading with MCM:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of segregated accounts |

| Withdrawal Risk | High | Complaints about delayed withdrawals |

| Customer Support Risk | Medium | Inconsistent support response |

To mitigate these risks, traders should consider using regulated brokers that provide clear information about fees, strong customer support, and robust fund protection measures.

Conclusion and Recommendations

In conclusion, the evidence suggests that MCM raises several red flags that indicate it may not be a safe option for traders. The lack of regulation, poor transparency, and numerous complaints regarding fund withdrawals and customer support all contribute to the perception that MCM operates in a high-risk environment.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by reputable authorities and offer clear trading conditions. Brokers that provide robust customer support, transparent fee structures, and strong fund protection measures are recommended.

In summary, potential clients should approach MCM with caution and thoroughly research any broker before making a commitment. The question remains: Is MCM safe? The current evidence suggests that it may be prudent to look elsewhere for safer trading opportunities.

Is MCM a scam, or is it legit?

The latest exposure and evaluation content of MCM brokers.

MCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MCM latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.