Matsui 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Matsui Securities, a long-established brokerage firm in Japan, presents an intriguing yet cautionary option for experienced traders. Founded in 1996 and regulated by the Japan Financial Services Agency (FSA), Matsui offers a diverse range of trading options, including access to both Japanese and U.S. financial markets. At the heart of Matsui's appeal lies its competitive pricing model, with free deposits and withdrawals, low starting commissions, and significant market exposure. However, prospective customers should be aware of substantial challenges, particularly related to transparency and customer service. Numerous user complaints highlight difficulties concerning fund withdrawals and inconsistent responsiveness from customer support. As such, while seasoned traders may find value in Matsui's offerings, those who prioritize strong customer service and clarity in fees should proceed with caution.

⚠️ Important Risk Advisory & Verification Steps

-

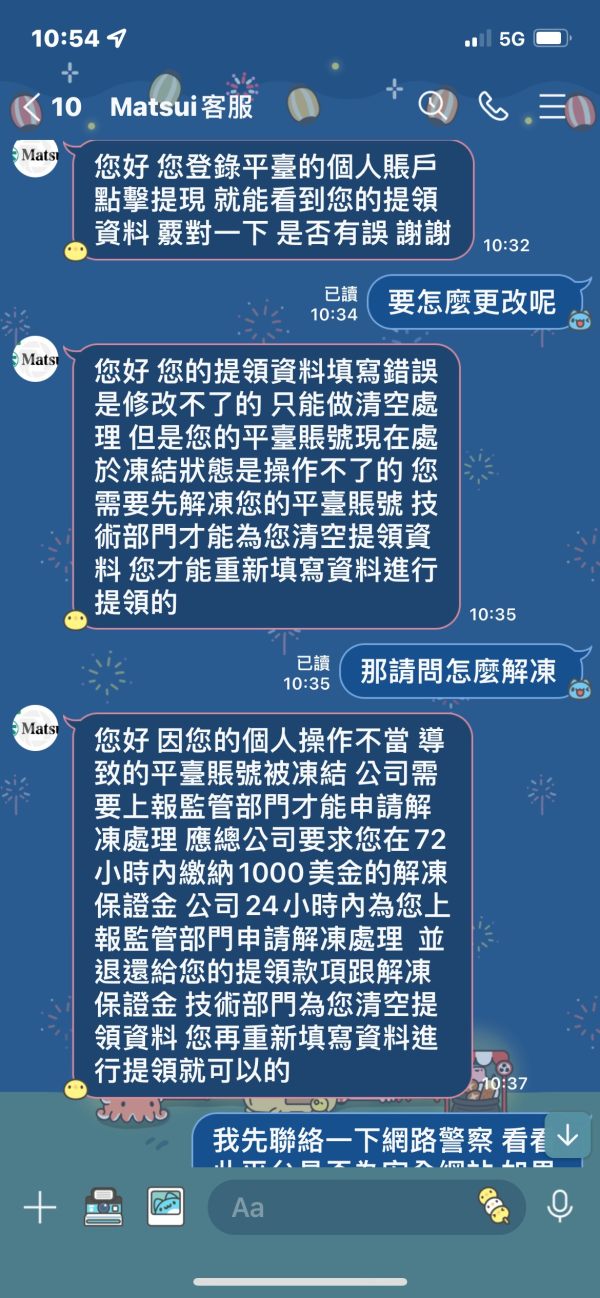

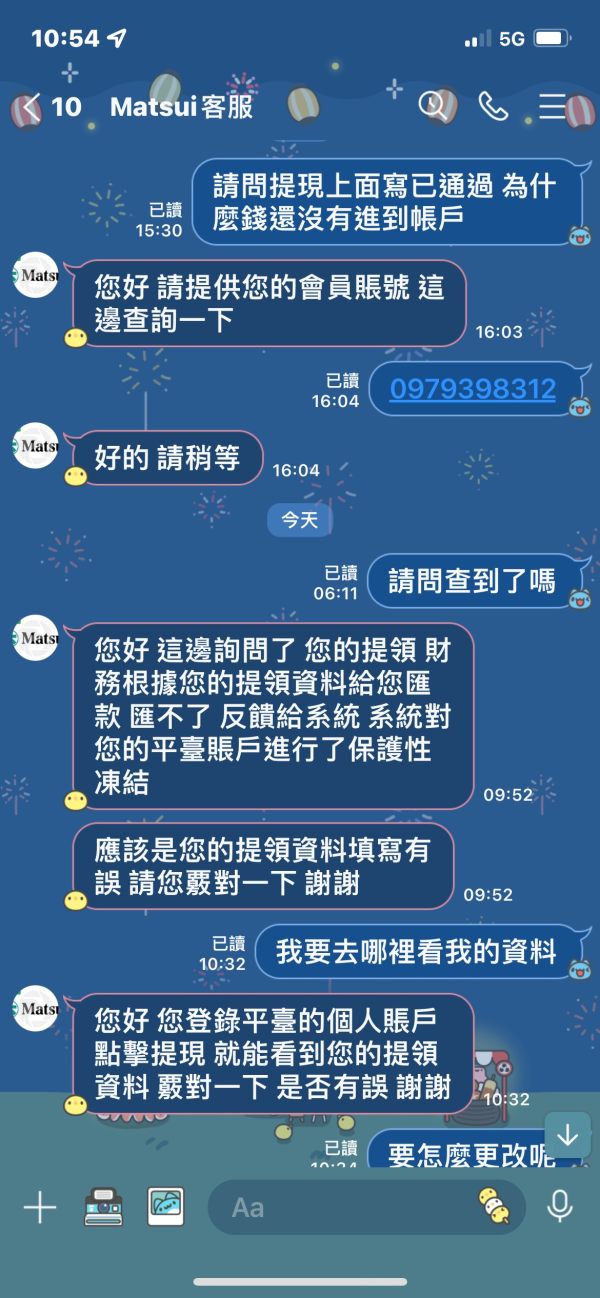

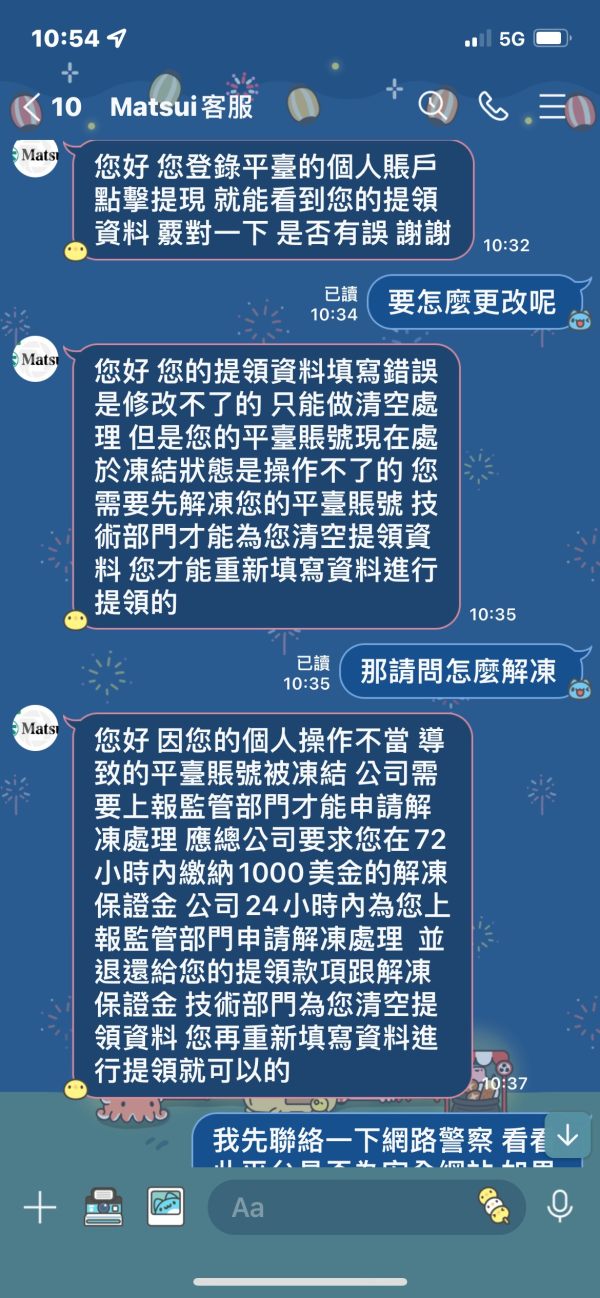

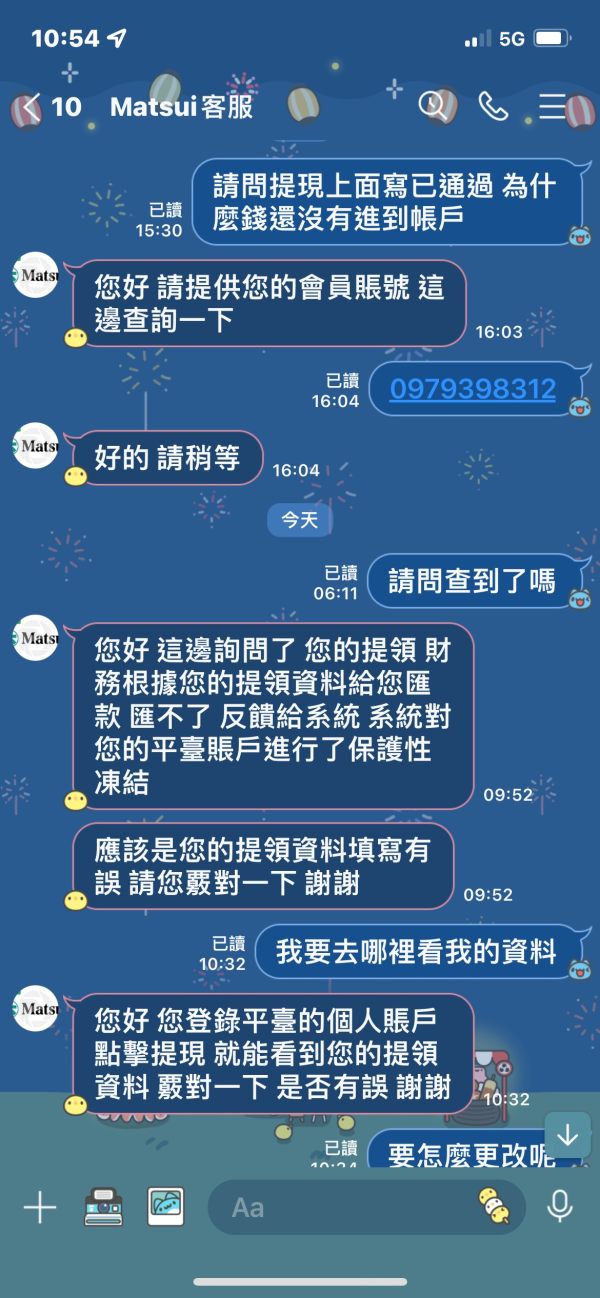

Withdrawal Issues: Numerous reports indicate that users face significant challenges in withdrawing their funds from Matsui, often resulting in prolonged delays and lack of communication from the customer support team. Investors should be aware that using Matsui may pose risks related to liquidity and access to their funds.

Potential Harms: Customers may experience frustration or financial difficulty due to delayed withdrawals and unresponsive support channels.

Self-Verification of Legitimacy:

Check Regulatory Status: Verify that Matsui Securities is indeed regulated under the Japan Financial Services Agency (FSA). This regulatory framework can provide a degree of safety.

Research User Reviews: Engage with third-party platforms and forums to gauge current user sentiment and experiences with Matsui.

Understand Fees and Commissions: Make sure to inquire directly about any fees or commission structures, particularly those concerning withdrawals, to avoid unexpected charges.

Rating Framework

Broker Overview

Company Background and Positioning

Matsui Securities Co., Ltd. was founded in 1996 and operates from its headquarters in Tokyo, Japan. With over 20 years of experience in the securities market, Matsui has evolved and adapted to the changing financial landscape, becoming one of Japan's first full-service online brokerage firms. It is now positioned as a cost-effective provider for retail traders, offering a broad array of products, including Japanese stocks, U.S. stocks, foreign exchange, futures, and various investment trusts.

Matsuis strategy appears focused on catering to seasoned traders who prioritize low-cost trading, as evidenced by their competitive commission structures and the absence of fees for deposits and withdrawals. However, as noted previously, this comes with the critical caveat of navigating potentially turbulent waters concerning transparency and customer support.

Core Business Overview

Matsui Securities operates under the regulatory oversight of Japan's Financial Services Agency (FSA) and provides a wide range of market instruments, enabling clients to access diverse options from equities to forex. Customers can engage in trading through several tailored platforms designed for mobile and desktop environments, showcasing Matsui's commitment to meeting the needs of various trader profiles, from active equities investors to those interested in forex and derivatives.

Below are key facets of Matsui's offerings:

- Regulatory Status: Regulated under FSA, offering a degree of safety to investors.

- Trading Instruments: Access to Japanese and U.S. stocks, foreign exchange, futures, options, and investment trusts.

- Customer Support: Support is available, but reports indicate challenges in responsiveness.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Matsui Securities operates under a regulatory framework established by the Japan Financial Services Agency (FSA), lending it a degree of credibility in the financial landscape. However, conflicting reports about its reliability are evident. The primary concerns arise from user reviews indicating difficulties with fund withdrawals and a lack of responsiveness from customer support. There is a troubling pattern of complaints suggesting possible lapses in the regulatory framework's effectiveness regarding investor protection.

To assist users in verifying Matsui's legitimacy:

- Check the FSA's Registry: Confirm that Matsui is listed as a licensed entity under the FSA.

- Read User Reviews: Incorporate perspectives from various financial forums to understand the experiences of other users, keeping an eye out for recurring issues regarding withdrawals or support.

Overall, while regulatory backing exists, the sheer volume of complaints raises red flags that potential clients should weigh seriously before engaging.

Trading Costs Analysis

Matsui Securities offers a comprehensive competitive edge in its pricing model. It is particularly attractive for trading in the Japan and U.S. markets, due mainly to:

- Commission Structure: Matsui implements a flat "box rate" fee structure, which can be particularly advantageous for frequent traders. Commission fees start from zero for those aged 25 or younger, enticing a younger demographic into active trading.

However, caution is warranted regarding hidden costs or sudden charges, particularly in regard to withdrawal processing. Reports from users frequently highlight unexpected fees or withdrawal difficulties, a potential downside to consider when evaluating overall trading costs.

Matsui Securities provides a suite of trading platforms designed to cater to various user needs:

- Trading Apps: The firm offers specialized apps for Japanese stocks, U.S. stocks, forex trading, and investment trusts. This segmentation allows users to tailor their trading experience according to their investment strategies and preferences.

- User-Friendly Interfaces: Many users have noted the ease of use within these platforms, although features may be limited for advanced trading strategies.

However, there is a noticeable lack of detailed information regarding the advanced features of each platform, which can be a point of contention for more experienced traders seeking tools for in-depth analysis.

User Experience Analysis

Overall user experience with Matsui can be mixed. On one hand, users report satisfaction with interfaces that are easy to navigate and rich in essential trading functionalities. On the other hand, customer feedback consistently points to frustrations surrounding:

- Customer Service: Many have reported a lack of responsiveness from support teams, which may tarnish the overall user journey.

- Onboarding Process: Issues mentioned include lengthy approval times for account setups and unclear information often leading to confusion among new users.

Given these mixed reviews, potential investors may want to consider their unique support needs before selecting Matsui as their trading partner.

Customer Support Analysis

While Matsui provides various channels for customer inquiries, including a hotline and email support primarily, user feedback suggests significant deficiencies in this area.

- Responsiveness Issues: Users express dissatisfaction with slow or negligible responses to inquiries, particularly concerning withdrawal requests.

- Support Channels: Limited availability to a single email point of contact can discourage immediate resolutions, making interactions frustrating for users in need of assistance.

These service limitations can lead to distrust among potential customers, particularly if a responsive support system is a priority in evaluating broker choices.

Account Conditions Analysis

Matsui Securities offers distinct account types including a general trading account covering various instruments and a dedicated account focused solely on forex trading. Both options are available with no opening fees, making it accessible for traders.

However, there is limited disclosure on the leverage options applicable to these accounts, which is a significant aspect for many forex and margin traders. Additionally, user experiences regarding account maintenance fees and other terms are sparse, suggesting a need for Matsui to improve communication regarding account conditions to build trust among potential investors.

Conclusion

Matsui Securities presents a compelling option for experienced traders interested in accessing the Japanese and U.S. markets at favorable pricing. However, the brokerage's challenges, particularly concerning transparency in fees, withdrawal processes, and customer service, cannot be overlooked. Potential investors are advised to weigh these factors carefully against their own trading needs and preferences. While the prospects may appear positive, the risks depicted by current user experiences necessitate cautious consideration. Thorough research and ongoing diligence will be critical for anyone considering Matsui as a trading partner.