Is MAC safe?

Pros

Cons

Is MAC Safe or a Scam?

Introduction

In the rapidly evolving world of forex trading, the choice of a broker can significantly impact a trader's success. One such broker, MAC, has emerged as a player in the forex market, offering various trading instruments and services. However, with numerous reports and reviews circulating online, potential traders are left questioning: Is MAC safe or is it a scam? This article aims to provide a comprehensive analysis of MAC, focusing on its regulatory status, company background, trading conditions, client experiences, and overall risk assessment. By evaluating these crucial aspects, we hope to equip traders with the necessary information to make informed decisions.

The forex market is fraught with risks, and choosing the right broker is paramount. Traders need to exercise caution and conduct thorough evaluations of brokers before committing their funds. This investigation will utilize a combination of qualitative assessments and quantitative data, drawing insights from various online sources, user reviews, and regulatory filings.

Regulatory Status and Legitimacy

Understanding a broker's regulatory status is crucial in determining its legitimacy. A well-regulated broker typically adheres to stringent operational standards and offers a higher level of protection for client funds. Unfortunately, MAC has been flagged as a suspicious clone by the UKs Financial Conduct Authority (FCA). This designation raises serious concerns about its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Suspicious Clone |

The FCA is known for its rigorous regulatory framework, which aims to protect consumers and ensure fair trading practices. The designation of MAC as a suspicious clone indicates that it may be impersonating a legitimate firm to gain the trust of potential clients. This lack of regulatory oversight is a significant red flag, suggesting that traders should approach MAC with extreme caution.

Furthermore, the unavailability of MAC's official website further complicates the assessment of its regulatory compliance. A brokers website is often a primary source of information regarding its licenses, terms, and conditions. The absence of a functional website limits access to essential details that potential clients need to make informed decisions.

Company Background Investigation

To further evaluate whether MAC is safe, it is essential to delve into its company background. MAC claims to be based in the United Kingdom, with a history of operating for 5 to 10 years. However, the lack of verifiable information regarding its ownership and management structure raises questions about its transparency and accountability.

The management team‘s background and experience play a vital role in a broker's credibility. Unfortunately, there is little information available regarding the qualifications and expertise of MAC’s leadership. A transparent broker typically provides detailed information about its management team, including their professional backgrounds and industry experience. The absence of such information can lead to skepticism about the broker's operations.

Moreover, the overall transparency in terms of information disclosure is lacking. Reliable brokers usually maintain a high level of transparency, providing clients with clear and accessible information about their services, fees, and trading conditions. In contrast, MACs opaque nature raises concerns about its trustworthiness and operational integrity.

Trading Conditions Analysis

Analyzing the trading conditions offered by MAC is critical for understanding its attractiveness to traders. A brokers fee structure can significantly impact a trader's profitability, and MAC's fees have come under scrutiny. Reports suggest that MAC has a convoluted fee structure, with potential hidden costs that could affect trading outcomes.

| Fee Type | MAC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information regarding spreads, commissions, and overnight interest rates is concerning. Traders often rely on transparent fee structures to gauge the cost-effectiveness of trading with a particular broker. The absence of such clarity can lead to unexpected charges, diminishing the overall trading experience.

Additionally, the reports of MAC refusing to pay commissions and avoiding responsibility further exacerbate concerns regarding its trading conditions. Such practices can be detrimental to traders, especially those who rely on timely commission payments to sustain their trading activities.

Client Fund Safety

When evaluating whether MAC is safe, the security of client funds is paramount. A reputable broker implements robust safety measures to protect client deposits. However, MAC's status as a suspicious clone raises significant concerns about its financial security practices.

The absence of information regarding client fund segregation, investor protection policies, and negative balance protection is alarming. Reliable brokers typically segregate client funds from their operational funds, ensuring that traders deposits are safe even in the event of financial difficulties. The lack of clarity surrounding MAC's financial security measures poses a significant risk to potential clients.

Moreover, historical issues related to fund security or disputes can provide insights into a broker's reliability. Reports of MAC's refusal to allow withdrawals and its history of shirking responsibilities suggest a troubling pattern that could jeopardize client funds. Traders must be cautious and consider these factors when assessing the safety of their investments.

Customer Experience and Complaints

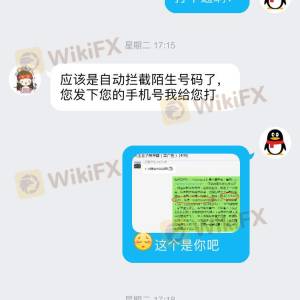

Analyzing customer feedback is crucial in determining the overall reputation of MAC. Numerous online reviews highlight a range of experiences, with many users expressing dissatisfaction with the broker's services. Common complaints include issues with fund withdrawals, lack of customer support, and unfulfilled promises regarding commission payments.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Commission Payments | High | Poor |

The severity of these complaints cannot be understated. High-severity complaints, especially regarding fund withdrawals, indicate potential operational deficiencies that could affect traders' financial security. The reported poor response from the company suggests a lack of accountability and customer service, which is critical in the forex trading environment.

Several users have shared their experiences of being unable to contact customer support or receiving evasive responses. Such patterns are concerning and indicate that MAC may not prioritize its clients' needs, further raising the question of whether MAC is safe for traders.

Platform and Execution Quality

The trading platform's performance is another critical factor in assessing whether MAC is a reliable broker. A robust trading platform is essential for executing trades efficiently and effectively. However, reports indicate that MAC's platform may not meet the expectations of traders.

Issues such as order execution quality, slippage, and high rejection rates have been reported, raising concerns about the platform's reliability. Traders expect a seamless trading experience, and any signs of manipulation or inefficient execution can lead to significant financial losses.

Moreover, the absence of a reliable platform can deter traders from engaging with MAC, as they may seek more reputable alternatives that offer better trading conditions and execution quality.

Risk Assessment

In evaluating the risks associated with using MAC, it is essential to summarize the key risk areas that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Suspicious clone status by FCA. |

| Financial Risk | High | Lack of information on fund security measures. |

| Operational Risk | Medium | Reports of poor customer support and withdrawal issues. |

The overall risk profile suggests that engaging with MAC carries significant risks. The high regulatory and financial risks pose substantial threats to traders' investments. To mitigate these risks, it is advisable for traders to conduct thorough research and consider alternative brokers with better regulatory standing and proven track records.

Conclusion and Recommendations

In conclusion, the evidence presented raises serious concerns regarding the legitimacy and safety of MAC as a forex broker. The designation as a suspicious clone by the FCA, coupled with reports of poor customer service, withdrawal issues, and lack of transparency, suggests that MAC may not be a safe option for traders.

For those considering trading with MAC, it is crucial to exercise extreme caution and seek alternative brokers that offer better regulatory oversight, transparent trading conditions, and robust customer support. Reputable alternatives include brokers regulated by top-tier authorities, which provide a safer trading environment and a more reliable trading experience.

In light of the findings, we recommend that traders prioritize their financial security and choose brokers with verifiable legitimacy and a commitment to client protection. Ultimately, ensuring that MAC is safe should remain a top priority for any trader looking to navigate the forex market successfully.

Is MAC a scam, or is it legit?

The latest exposure and evaluation content of MAC brokers.

MAC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MAC latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.