Regarding the legitimacy of ARTA TechFin forex brokers, it provides SFC and WikiBit, .

Is ARTA TechFin safe?

Pros

Cons

Is ARTA TechFin markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Arta Global Futures Limited

Effective Date: Change Record

2004-11-19Email Address of Licensed Institution:

cs@artatechfin.comSharing Status:

No SharingWebsite of Licensed Institution:

www.artagm.comExpiration Time:

--Address of Licensed Institution:

香港鰂魚涌英皇道728 號K11 ATELIER King's Road 9樓901-02室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Arta Techfin Safe or Scam?

Introduction

Arta Techfin, a Hong Kong-based broker, has positioned itself as a player in the forex market since its establishment in 2021. The firm aims to integrate traditional financial services with blockchain technology, appealing to a diverse client base including family offices and retail clients. However, as with any brokerage, traders must exercise caution and perform due diligence before engaging with the platform. The foreign exchange market is rife with risks, and choosing the wrong broker can lead to significant financial losses. This article utilizes a comprehensive evaluation framework to assess the safety and legitimacy of Arta Techfin, focusing on regulatory compliance, company background, trading conditions, customer experience, and overall risk factors.

Regulatory and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its safety. Arta Techfin claims to be regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is a reputable regulatory body. However, the broker's specific licensing details and compliance history are essential for a thorough evaluation.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

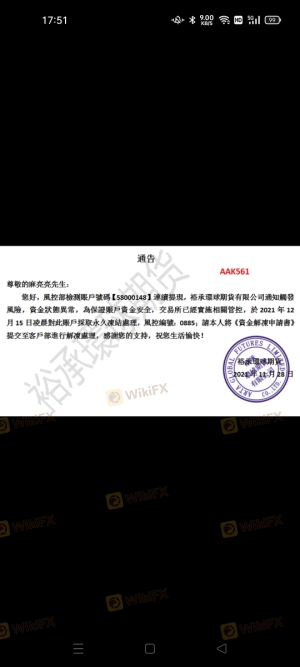

| SFC | AAK 561 | Hong Kong | Under review |

While the SFC has a stringent regulatory framework, concerns arise from the low score of 1.43 out of 10 given to Arta Techfin by WikiFX, indicating potential issues with transparency and compliance. Furthermore, there are claims that Arta Techfin may operate as a clone of a previously regulated entity, raising red flags regarding its legitimacy. The lack of negative regulatory disclosures is a positive aspect, but the overall regulatory quality and historical compliance track record remain questionable.

Company Background Investigation

Arta Techfin's history is intertwined with that of its predecessor, Freeman Fintech, which faced significant financial difficulties before being restructured in 2020. The current management team, led by CEO Eddie Lau, has experience in investment management and trading, which could lend credibility to the firm. However, the company's ownership structure, which saw substantial investment from New World Development, further complicates its narrative.

The transition from Freeman Fintech to Arta Techfin raises questions about the continuity of operations and the underlying stability of the firm. Transparency in company operations is crucial, and while Arta Techfin provides some information about its services, a deeper dive into its financial health and management practices is necessary for potential investors.

Trading Conditions Analysis

Arta Techfin's trading conditions are another crucial aspect to consider. The broker's fee structure and trading costs can significantly impact a trader's profitability. While specific details regarding spreads and commissions are not abundantly clear, it is essential to compare these costs with industry averages to gauge their competitiveness.

| Fee Type | Arta Techfin | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

Reports suggest that some traders have encountered unexpected fees and withdrawal issues, which could be indicative of a problematic fee structure. It is essential for traders to fully understand all associated costs before committing to a broker.

Client Fund Safety

The safety of client funds is paramount in evaluating whether Arta Techfin is safe. The broker claims to implement measures for fund segregation and investor protection. However, the effectiveness of these measures is often tested during times of financial distress.

Arta Techfin's commitment to safeguarding client funds needs to be substantiated with concrete policies regarding fund segregation and negative balance protection. Furthermore, any historical incidents of fund security issues or client complaints should be thoroughly investigated to assess the broker's reliability.

Customer Experience and Complaints

Customer feedback is a valuable source of information regarding a broker's operational integrity. Reviews of Arta Techfin reveal a mixed bag of experiences, with some users praising the platform's features while others report difficulties in withdrawing funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

A notable case involves a user who deposited a significant amount and faced challenges when attempting to withdraw funds, raising concerns about the broker's reliability. Such patterns of complaints should be taken seriously, as they can indicate systemic issues within the brokerage.

Platform and Execution

The performance of a trading platform can significantly affect a trader's experience. Arta Techfin's platform is designed to facilitate trading, but the quality of order execution, slippage, and rejection rates must be evaluated.

Traders have reported varying experiences regarding order execution, with some noting delays and issues that could impact trading outcomes. The absence of clear information about platform performance and potential manipulation is a concern that traders should consider when evaluating whether Arta Techfin is safe.

Risk Assessment

Using Arta Techfin comes with inherent risks, which need to be assessed comprehensively.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Uncertain compliance history. |

| Operational Risk | Medium | Mixed customer feedback. |

| Financial Stability Risk | High | History of financial distress. |

To mitigate these risks, potential clients should conduct thorough research, consider starting with a minimal investment, and be wary of any red flags that may arise during their engagement with the broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that while Arta Techfin operates under a recognized regulatory body, significant concerns regarding its legitimacy and operational integrity remain. The low WikiFX score, mixed customer feedback, and historical ties to a troubled predecessor raise caution flags for potential traders.

Traders should approach Arta Techfin with a degree of skepticism, particularly if they are risk-averse or new to forex trading. It may be prudent to explore more established and reputable alternatives in the forex market, such as brokers with strong regulatory backing and positive customer reviews.

Ultimately, whether Arta Techfin is safe or a potential scam hinges on individual risk tolerance and the thoroughness of due diligence conducted by traders before making financial commitments.

Is ARTA TechFin a scam, or is it legit?

The latest exposure and evaluation content of ARTA TechFin brokers.

ARTA TechFin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ARTA TechFin latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.