Is LiveTrade safe?

Pros

Cons

Is Livetrade Safe or a Scam?

Introduction

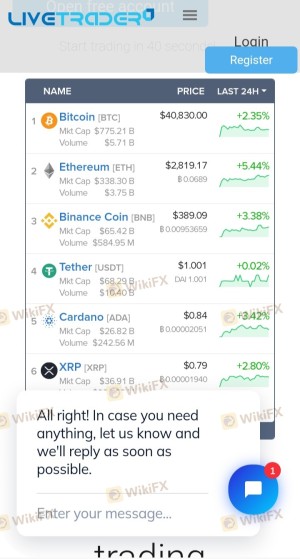

Livetrade positions itself as a player in the forex market, offering trading services that attract both novice and experienced traders. However, as the forex market is fraught with risks and potential scams, it is crucial for traders to conduct thorough evaluations of their brokers. In this article, we will investigate whether Livetrade is a trustworthy platform or if it raises red flags that warrant caution. Our analysis will be based on various sources, including regulatory information, company history, trading conditions, and customer feedback, to provide a comprehensive overview of Livetrade's safety profile.

Regulation and Legitimacy

One of the most critical factors in assessing the safety of a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices designed to protect clients' funds. Unfortunately, Livetrade is not regulated by any reputable financial authority, which raises concerns about its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation means that Livetrade does not have to comply with the strict requirements imposed by top-tier regulators such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia. This lack of oversight can lead to a higher risk of fraudulent activities and a lack of recourse for clients in case of disputes or financial mishaps. Furthermore, the regulatory quality significantly impacts the overall safety of a broker, and without any regulatory backing, it is challenging to ascertain Livetrade's credibility.

Company Background Investigation

Livetrade's company history and ownership structure are also essential elements to consider when evaluating its safety. Established in 2020, Livetrade claims to operate from the United States; however, there is little verifiable information regarding its actual location or the identities of its owners. This opacity can be concerning, as it suggests a lack of transparency that is often associated with less reputable brokers.

Moreover, the management team behind Livetrade lacks publicly available information regarding their professional backgrounds and experience in the trading industry. A knowledgeable and experienced management team is crucial for a broker's credibility, as it often reflects the quality of service and operational standards. The lack of transparency in Livetrade's operations and management raises questions about its trustworthiness and commitment to ethical business practices.

Trading Conditions Analysis

When assessing the overall trading conditions offered by Livetrade, it is essential to analyze its fee structure and any potential hidden costs. Livetrade does not provide clear information regarding its trading fees, which can be a significant red flag for traders. A transparent fee structure is vital for traders to understand their potential costs and profitability.

| Fee Type | Livetrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | 0.5 - 1.5% |

The absence of clear fee disclosure can lead to unexpected costs for traders, potentially impacting their trading performance. Additionally, any unusual or excessive fees can be indicative of a broker that prioritizes profit over client interests. Without a transparent fee structure, traders may find themselves at a disadvantage, making it difficult to assess the overall cost of trading with Livetrade.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Livetrade's approach to fund security is unclear, as there is no available information regarding the measures it has in place to protect client funds. Key aspects such as fund segregation, investor protection, and negative balance protection are critical in determining the safety of a broker.

Historically, unregulated brokers have been associated with various financial disputes and issues regarding fund security. Without regulatory oversight, Livetrade may not have the necessary safeguards to protect client investments. Traders should be aware of the potential risks involved when dealing with an unregulated broker like Livetrade, as they may face challenges in recovering their funds in case of financial misconduct or operational failures.

Customer Experience and Complaints

An essential aspect of evaluating a broker's safety is analyzing customer feedback and experiences. Reviews and complaints from actual users can provide valuable insights into Livetrade's operational practices and reliability. Common complaints about unregulated brokers often include difficulties in fund withdrawals, lack of responsive customer service, and issues with trade execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Trade Execution Problems | High | Poor |

Several users have reported difficulties in withdrawing their funds from Livetrade, which is a significant concern for any trader. The company's response to such complaints has been described as inadequate, with many traders expressing frustration over the lack of support and resolution. These patterns of complaints raise serious concerns about the overall reliability of Livetrade as a broker.

Platform and Trade Execution

The performance and stability of a trading platform are vital for a seamless trading experience. Livetrade's platform has been reported to have issues with execution quality, including slippage and order rejections. Such issues can severely impact a trader's ability to execute trades effectively, leading to potential losses.

Traders have also raised concerns about the platform's stability, with reports of frequent downtimes and technical difficulties. These factors can create a frustrating trading environment and diminish the overall user experience. The combination of poor execution quality and platform instability raises additional concerns about Livetrade's reliability as a trading platform.

Risk Assessment

Using Livetrade comes with inherent risks that traders should consider before committing their funds. The lack of regulation, combined with the issues surrounding fund safety and customer complaints, contributes to a higher risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk. |

| Fund Safety Risk | High | Lack of transparency in fund protection. |

| Execution Risk | Medium | Reports of slippage and rejections. |

To mitigate these risks, traders should consider conducting due diligence before engaging with Livetrade. Seeking out regulated brokers with established reputations can provide a safer trading environment and greater peace of mind.

Conclusion and Recommendations

In conclusion, the evidence suggests that Livetrade presents several red flags that warrant caution. Its lack of regulation, transparency issues, and negative customer feedback indicate a potentially unsafe trading environment. Traders should be particularly wary of the risks associated with unregulated brokers, as they may face significant challenges in protecting their investments.

For those looking to engage in forex trading, it is advisable to seek out regulated brokers with a solid track record and positive user experiences. By prioritizing safety and reliability, traders can better navigate the complexities of the forex market and minimize their exposure to potential scams. In light of the findings, it is prudent to approach Livetrade with skepticism and consider alternative options that offer greater security and transparency.

Is LiveTrade a scam, or is it legit?

The latest exposure and evaluation content of LiveTrade brokers.

LiveTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LiveTrade latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.