Is LFXM safe?

Business

License

Is LFXM Safe or Scam?

Introduction

LFXM is a forex broker that has recently attracted attention in the trading community. Positioned in the market as a platform for forex and CFD trading, it claims to offer competitive trading conditions and a user-friendly interface. However, the growing number of unregulated brokers in the forex market has led traders to exercise caution when selecting their trading partners. It is essential for traders to thoroughly evaluate brokers like LFXM to ensure their safety and legitimacy. This article investigates the credibility of LFXM by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The findings are based on a review of multiple sources, including regulatory databases, user reviews, and expert analyses.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and protecting clients' funds. Unfortunately, LFXM operates without significant regulatory oversight, which raises serious concerns about its legitimacy and trustworthiness.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

LFXM has been found to be registered in Saint Vincent and the Grenadines, a location often associated with lax regulatory frameworks. The absence of a reputable regulatory body overseeing LFXM means that traders have little recourse in the event of disputes or misconduct. Additionally, the lack of a regulatory history raises red flags about the broker's operational practices. In general, brokers regulated by tier-1 authorities, such as the FCA or ASIC, are subject to stringent rules that enhance client protection. The absence of such regulation for LFXM suggests a higher risk for traders.

Company Background Investigation

LFXM's company background reveals a lack of transparency that further complicates its credibility. The broker does not provide comprehensive information about its ownership structure or the team behind its operations. This lack of clarity can be concerning for potential clients, as it raises questions about accountability and the broker's commitment to ethical trading practices.

The management teams qualifications are also unclear, which is a significant factor in determining a broker's reliability. An experienced and knowledgeable management team can provide reassurance to traders about the broker's operational integrity. However, LFXM fails to disclose essential information regarding its leadership, leaving potential clients in the dark about who is managing their investments. This opacity is a notable concern in assessing whether LFXM is safe or a scam.

Trading Conditions Analysis

When it comes to trading conditions, LFXM offers various features that may initially appear attractive. However, a closer examination reveals potential issues that could impact traders negatively. The broker claims to provide competitive spreads and leverage options, but the details surrounding fees and costs are not transparently communicated.

| Fee Type | LFXM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Low |

The spreads offered by LFXM are higher than the industry average, which could lead to increased trading costs over time. Additionally, the lack of a clear commission structure raises concerns about hidden fees that may not be disclosed upfront. These factors contribute to the uncertainty surrounding the overall cost of trading with LFXM. Traders should be wary of brokers that do not provide clear and upfront information about their costs, as this can lead to unexpected expenses that diminish trading profitability.

Customer Funds Security

The security of customer funds is another critical aspect to consider when evaluating whether LFXM is safe. Unfortunately, LFXM does not appear to implement strong measures to protect client funds. There is no information available regarding the segregation of client accounts, which is a standard practice among reputable brokers. Segregation ensures that traders' funds are kept separate from the broker's operational funds, providing an additional layer of protection in case of financial difficulties faced by the broker.

Moreover, the absence of investor protection mechanisms, such as compensation schemes, means that traders' funds are at a higher risk. In the event of insolvency or mismanagement, clients may not have any legal recourse to recover their investments. This lack of security measures is a significant concern for anyone considering trading with LFXM.

Customer Experience and Complaints

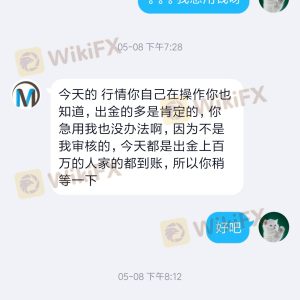

Customer feedback plays a vital role in assessing the reliability of a broker. In the case of LFXM, numerous user reviews indicate a pattern of dissatisfaction among clients. Common complaints include difficulties with withdrawals, poor customer service, and lack of responsiveness to inquiries.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service | Medium | Inconsistent |

| Transparency | High | Lacking |

Many users have reported challenges when attempting to withdraw their funds, with some claiming that their requests were ignored or delayed for extended periods. Such issues are significant red flags and suggest that LFXM may not prioritize customer satisfaction or transparency. In a trustworthy trading environment, clients should expect timely responses and efficient handling of their requests.

Platform and Trade Execution

The trading platform offered by LFXM is another crucial aspect to consider. While the broker claims to provide a user-friendly interface, user reports indicate varying experiences regarding platform performance. Issues such as slippage, order rejections, and connectivity problems have been cited by traders, which can severely impact trading outcomes.

Furthermore, the execution quality of trades is of utmost importance. Traders rely on brokers to execute their orders promptly and accurately. However, reports of slippage and rejected orders raise concerns about whether LFXM is providing the level of service that traders expect. Any signs of platform manipulation or poor execution quality can significantly undermine a trader's confidence in the broker.

Risk Assessment

Using LFXM comes with inherent risks that potential traders should be aware of. The lack of regulation, combined with poor customer feedback and transparency issues, creates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from reputable bodies |

| Financial Risk | High | Potential for loss of funds due to mismanagement |

| Operational Risk | Medium | Possible issues with trade execution and platform reliability |

To mitigate these risks, traders should conduct thorough research before committing funds to LFXM. It is advisable to start with a minimal investment, if at all, until more information is gathered about the broker's reliability and practices. Additionally, seeking alternative brokers with strong regulatory oversight and positive customer feedback can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that LFXM presents several red flags that warrant caution. The lack of regulation, poor customer feedback, and transparency issues indicate that LFXM may not be a safe choice for traders. There are legitimate concerns regarding the broker's operational practices, which could pose significant risks to clients' investments.

For traders seeking a reliable and safe trading experience, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers regulated by tier-1 authorities, such as the FCA or ASIC, provide a more secure trading environment, with greater protections for clients. Overall, while LFXM may offer attractive trading conditions on the surface, the underlying risks make it a broker that traders should approach with caution.

Is LFXM a scam, or is it legit?

The latest exposure and evaluation content of LFXM brokers.

LFXM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LFXM latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.