Is Nexus Trade safe?

Pros

Cons

Is Nexus Trade A Scam?

Introduction

Nexus Trade is a cryptocurrency exchange that positions itself within the forex market, claiming to provide a platform for trading a wide range of cryptocurrencies and fiat currencies. As the financial landscape continues to evolve, traders must exercise caution when selecting a brokerage. The rise of online trading has led to an influx of brokers, some of which may not adhere to regulatory standards or ethical practices. This article aims to evaluate whether Nexus Trade is a trustworthy platform or if it falls into the category of scams. Our investigation is based on a thorough analysis of available online resources, user reviews, and regulatory information to provide a well-rounded assessment of Nexus Trade's legitimacy.

Regulation and Legitimacy

Regulation is a crucial factor in determining the safety and reliability of a trading platform. A regulated broker must adhere to strict guidelines that protect clients' interests and funds. Unfortunately, Nexus Trade is not regulated by any reputable authority, raising significant concerns about its legitimacy. Below is a summary of the regulatory status of Nexus Trade:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation means that Nexus Trade operates without oversight, which can lead to unethical practices such as price manipulation and inadequate customer support. Additionally, the company's registration in St. Vincent and the Grenadines, a jurisdiction known for minimal regulatory requirements, further compounds the risk. The Financial Conduct Authority (FCA) in the UK has issued warnings against Nexus Trade, indicating that it targets investors without proper authorization. This history of non-compliance and lack of regulatory oversight raises serious questions about whether Nexus Trade is safe for traders.

Company Background Investigation

Nexus Trade claims to have a presence in the financial markets since its inception, but details about its ownership and management remain sparse. The company's website provides limited information about its founders or the management team, which is a red flag for potential investors. Transparency is key in building trust, and the lack of information regarding the individuals behind Nexus Trade can be concerning.

Moreover, the company's business model appears to be focused on attracting deposits rather than providing a robust trading environment. Without a clear understanding of who operates the platform, it becomes increasingly difficult to assess the company's credibility. The absence of a physical office and verifiable contact information further diminishes the trustworthiness of Nexus Trade. Given these factors, it is essential to question the overall transparency and integrity of the company.

Trading Conditions Analysis

The trading conditions offered by Nexus Trade are another area of concern. While the platform claims to offer competitive fees and a wide range of trading options, the absence of a clear fee structure can create confusion for traders. Below is a comparison of core trading costs:

| Fee Type | Nexus Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | 0.22% per trade | 0.1-0.3% per trade |

| Overnight Interest Range | N/A | Varies |

The commission structure of 0.22% per trade is above the industry average, which may deter traders looking for cost-effective options. Additionally, the lack of clarity regarding spreads and overnight fees raises questions about the platform's overall cost-effectiveness. Traders should be cautious of any hidden fees that may arise, as these can significantly impact profitability. The combination of high fees and unclear trading conditions suggests that Nexus Trade may not be the most favorable option for traders seeking transparent and competitive trading environments.

Client Fund Security

When evaluating a trading platform, the security of client funds is paramount. Nexus Trade has not provided sufficient information about its fund security measures, which is a significant concern for potential investors. Key aspects to consider include fund segregation, investor protection, and negative balance protection policies.

While Nexus Trade claims to implement security measures, the lack of regulatory oversight means that there is no guarantee of fund protection. Historically, unregulated brokers have been known to misappropriate client funds, leading to significant financial losses for traders. The absence of transparent policies regarding fund security raises alarms about the safety of investing with Nexus Trade. It is crucial for traders to prioritize platforms that offer robust security measures to protect their investments.

Customer Experience and Complaints

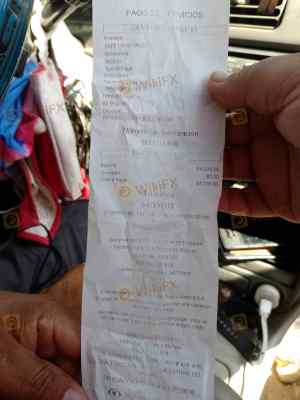

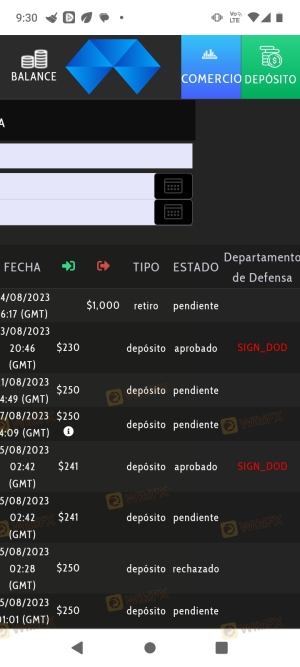

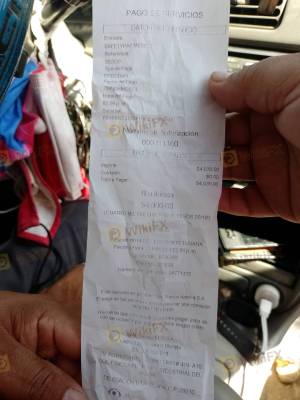

Customer feedback plays a vital role in assessing the reliability of a trading platform. Unfortunately, Nexus Trade has received numerous negative reviews from users, highlighting issues such as withdrawal problems and poor customer support. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support Quality | Medium | Unresponsive |

| Misleading Information | High | Ignored Complaints |

Many users have reported being unable to withdraw their funds, which is a significant red flag for any trading platform. Furthermore, the quality of customer support has been criticized, with many users claiming that their inquiries were ignored or inadequately addressed. These patterns of complaints suggest a lack of professionalism and accountability on the part of Nexus Trade, reinforcing the notion that it may not be a safe platform for traders.

Platform and Execution

The performance and reliability of a trading platform are critical to a trader's success. Nexus Trade claims to offer a user-friendly trading platform; however, user reviews indicate that the platform may not perform as promised. Issues such as slow order execution, slippage, and high rejection rates have been reported, which can significantly hinder a trader's ability to execute strategies effectively.

Additionally, there are concerns about potential platform manipulation, which can occur in unregulated environments. Traders should be wary of platforms that do not provide sufficient transparency regarding their order execution processes. The combination of poor performance and questionable practices raises concerns about whether Nexus Trade is safe for trading.

Risk Assessment

Engaging with Nexus Trade presents several risks that potential investors should consider. Below is a summary of the key risk areas associated with using this platform:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Fund Security Risk | High | Lack of transparency regarding fund safety |

| Customer Service Risk | Medium | Poor response to customer inquiries |

| Execution Risk | High | Slow order execution and potential slippage |

To mitigate these risks, traders should conduct thorough research and consider using regulated platforms with established reputations. It is crucial to prioritize platforms that offer clear security measures and responsive customer support to protect investments effectively.

Conclusion and Recommendations

In conclusion, the evidence suggests that Nexus Trade may not be a trustworthy trading platform. The lack of regulation, poor customer feedback, and questionable trading conditions raise significant concerns about its legitimacy. Traders should exercise caution and consider alternative, regulated brokers that offer greater transparency and security.

For those seeking reliable trading options, it is advisable to explore well-established platforms with positive reputations and robust regulatory oversight. In light of the findings, it is clear that Nexus Trade is not safe, and potential investors should proceed with extreme caution or consider safer alternatives.

Is Nexus Trade a scam, or is it legit?

The latest exposure and evaluation content of Nexus Trade brokers.

Nexus Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Nexus Trade latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.