KVB 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

KVB, an online broker with a contentious reputation, presents traders with low-cost trading conditions and a variety of platforms. Founded in 2001 and headquartered in the Comoros, KVB caters primarily to experienced traders looking for budget-friendly options in their trading ventures. However, it is crucial to note that the broker is mired in regulatory scrutiny, particularly concerning its licensing and customer withdrawal processes. While its competitive pricing and platform diversity may appeal to proficient traders, the associated risks highlight the necessity for caution. Therefore, this review aims to provide a detailed examination of KVBs offerings, making it essential reading for any potential user.

⚠️ Important Risk Advisory & Verification Steps

Investors should exercise caution:

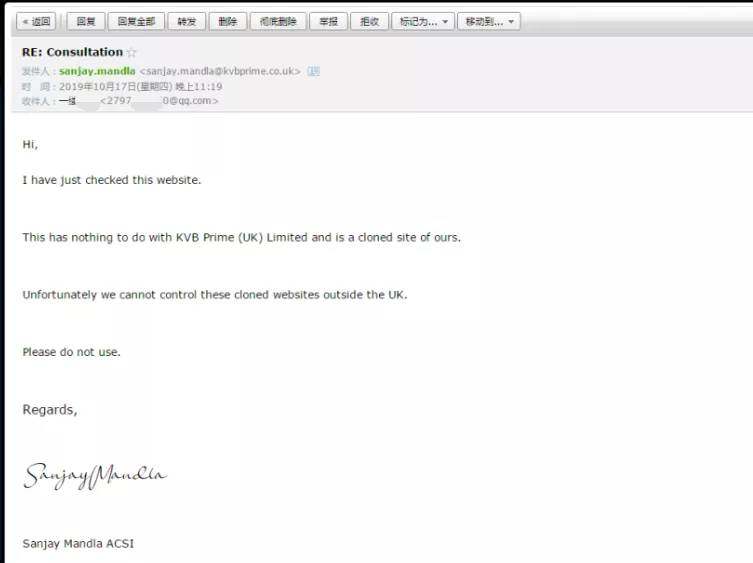

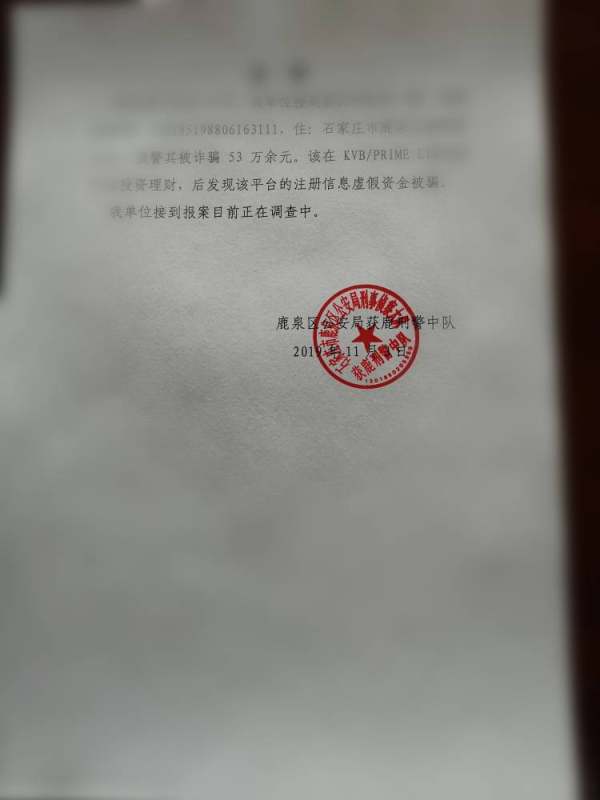

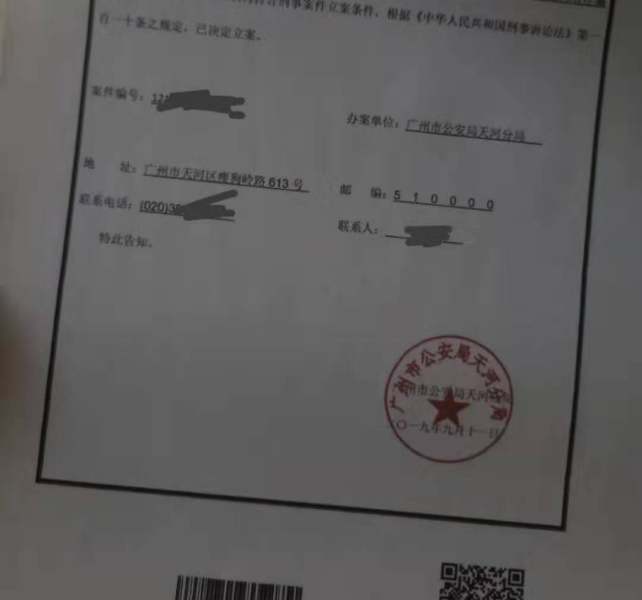

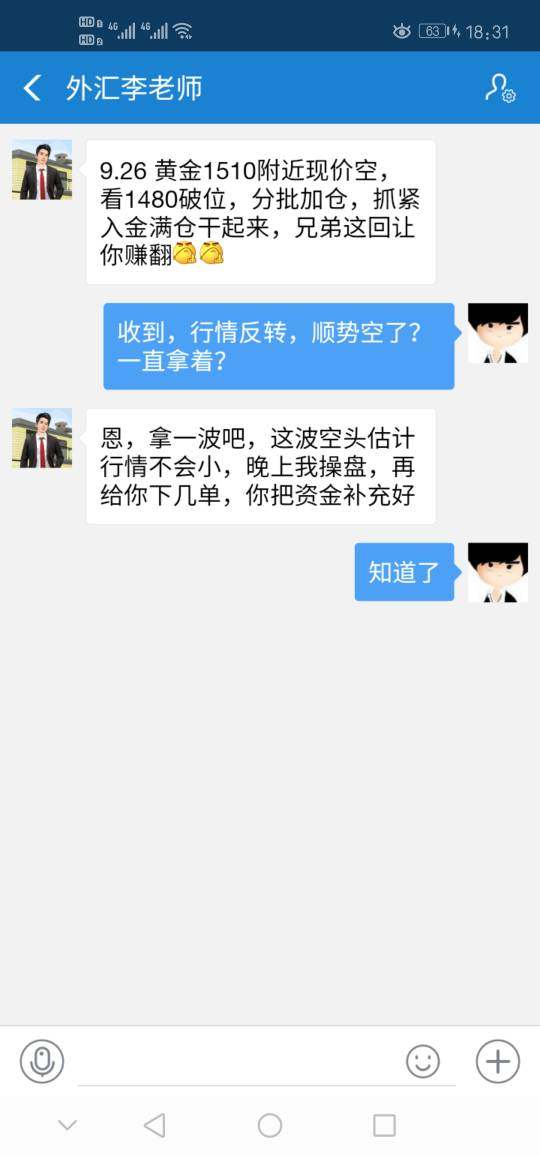

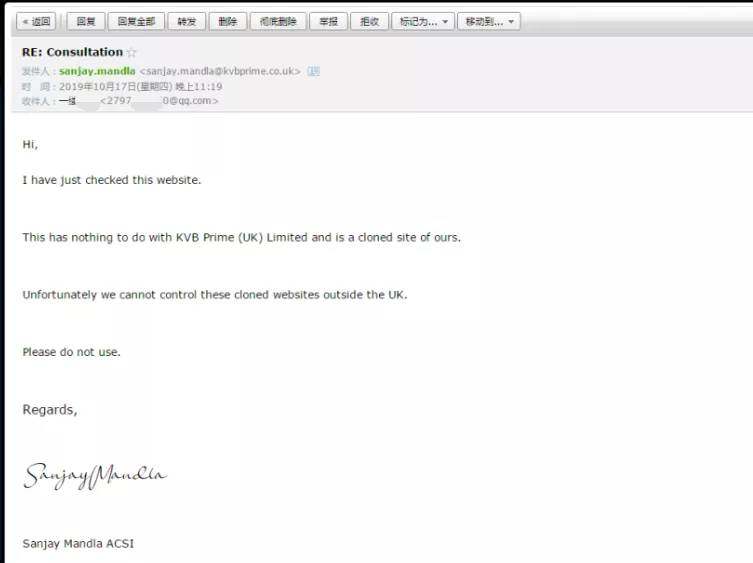

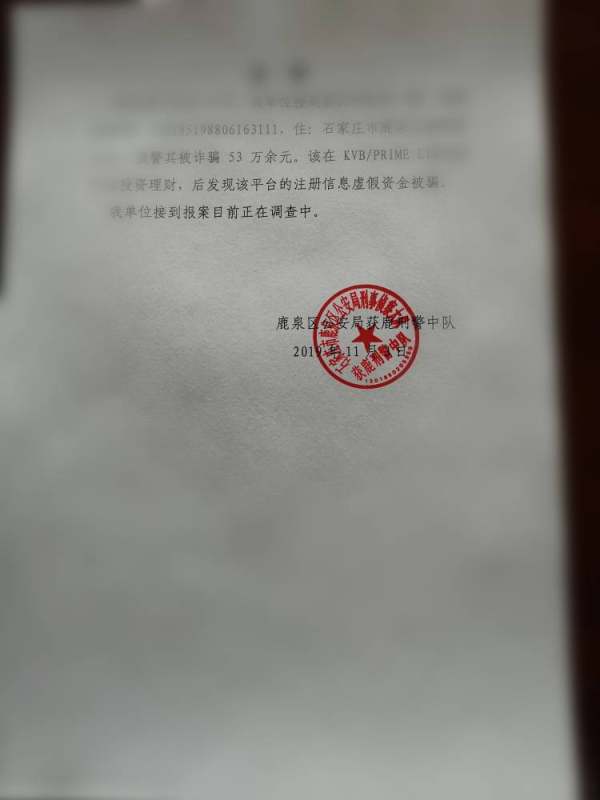

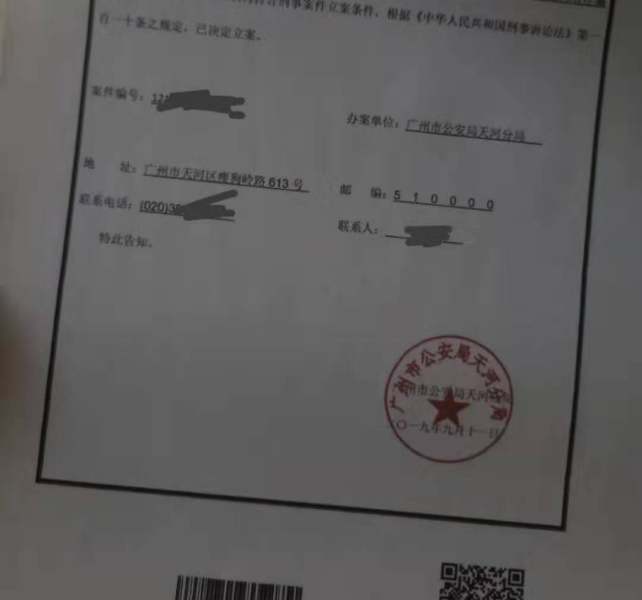

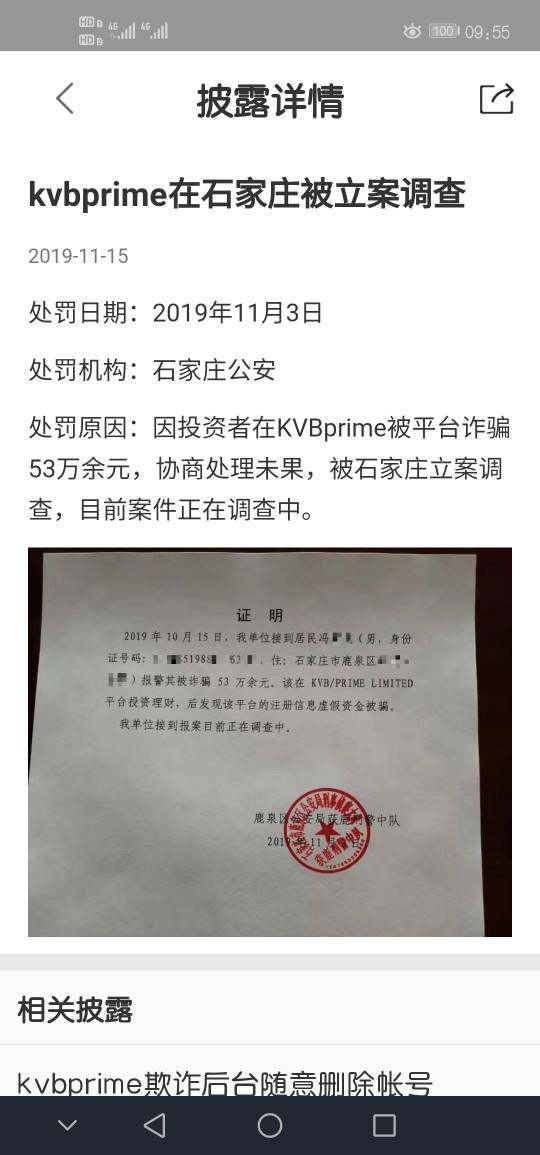

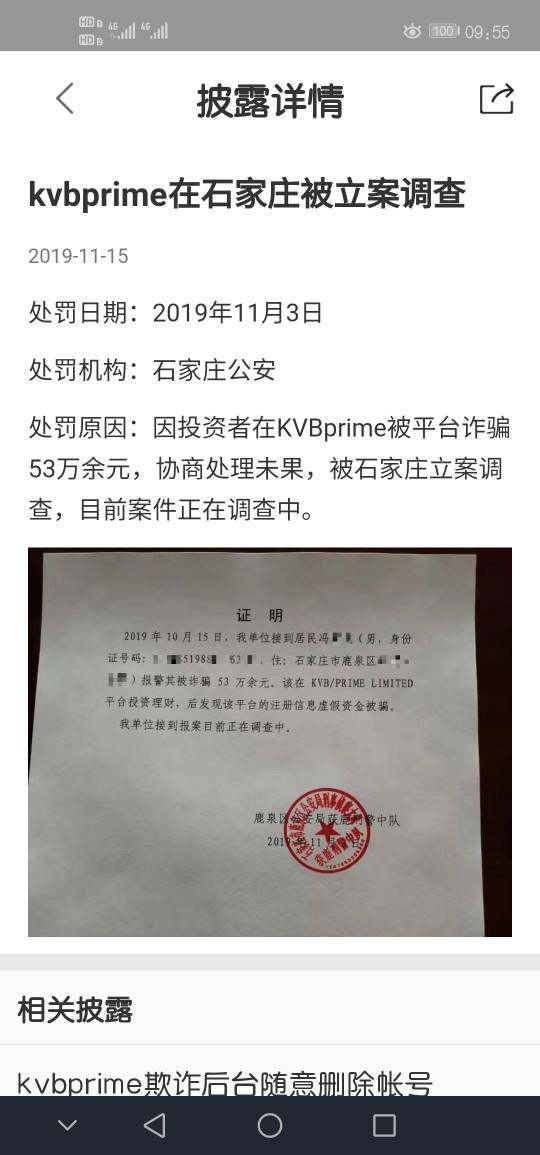

- Regulatory Risk: KVB has faced significant regulatory issues, including revoked licenses. This raises concerns about its operational compliance and overall legitimacy.

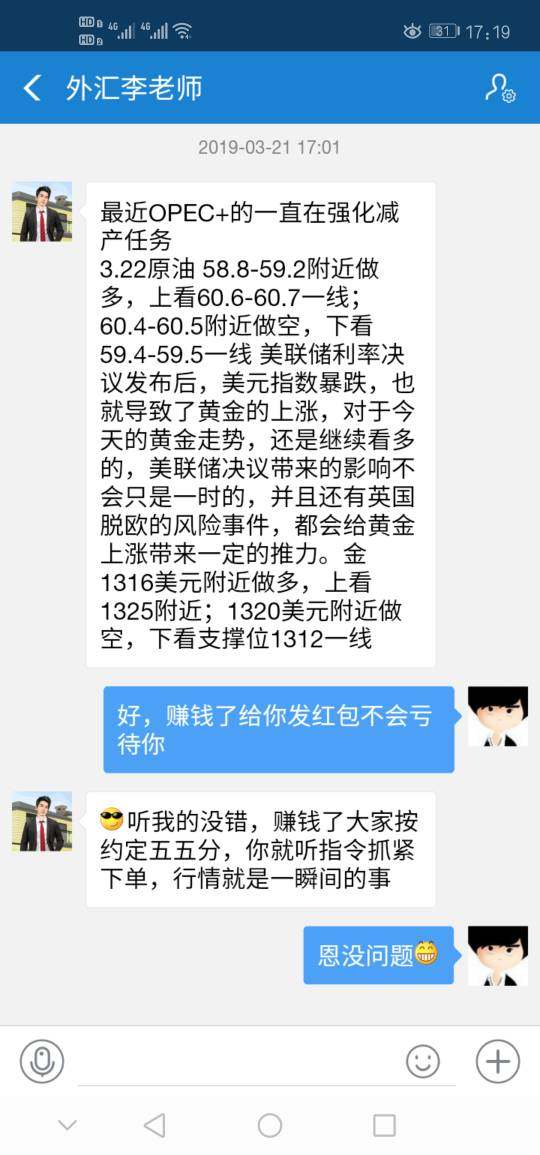

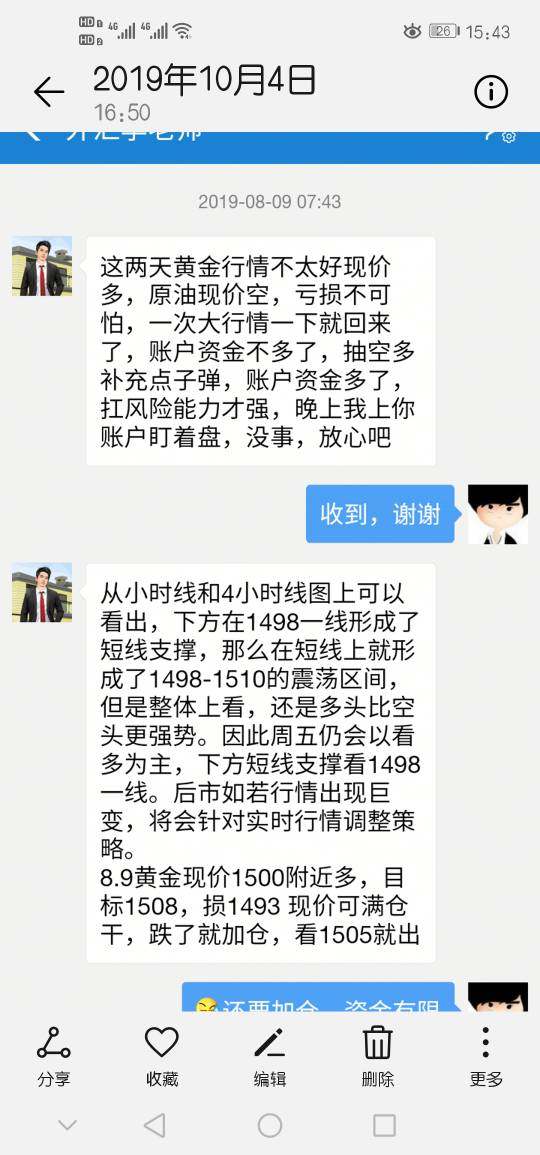

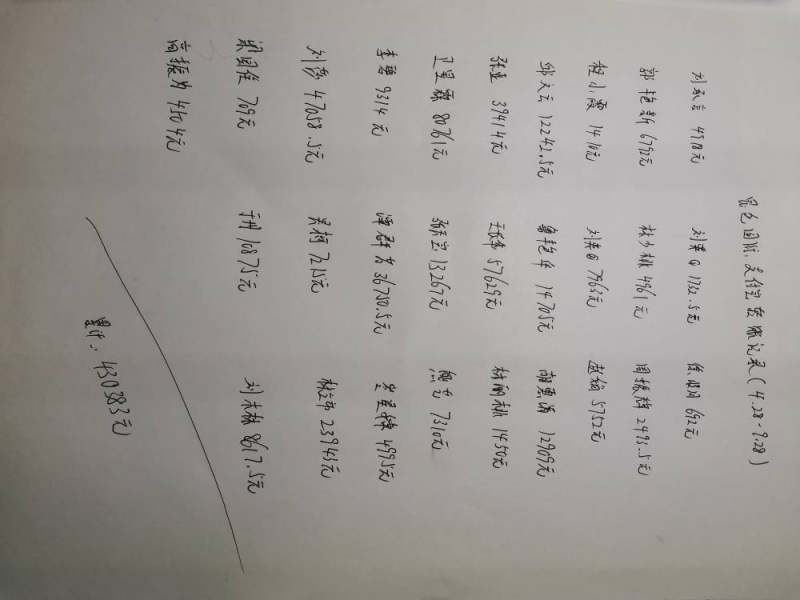

- Fund Safety: Numerous complaints related to fund security and withdrawal difficulties have surfaced from users, which is a critical area of risk.

- User Experience: Mixed reviews regarding customer service and account accessibility necessitate careful consideration.

Steps to Verify KVB's Legitimacy:

- Check registration through official regulatory bodies (e.g., ASIC, FMA) to ensure current licensing status.

- Review user feedback on multiple platforms to get a well-rounded understanding of the broker's service quality.

- Monitor withdrawal performance by checking the experiences of current and former users regarding fund retrieval processes.

Rating Framework

Broker Overview

Company Background and Positioning

KVB was established in 2001, and its operational headquarters is located in the Comoros. Throughout its history, it has attempted to position itself as a cost-effective trading solution for experienced traders. Despite its low trading fees and several platform offerings, KVB's regulatory trajectory has raised questions, with mixed signals regarding its compliance in various jurisdictions, particularly in light of recent revocations of licenses.

Core Business Overview

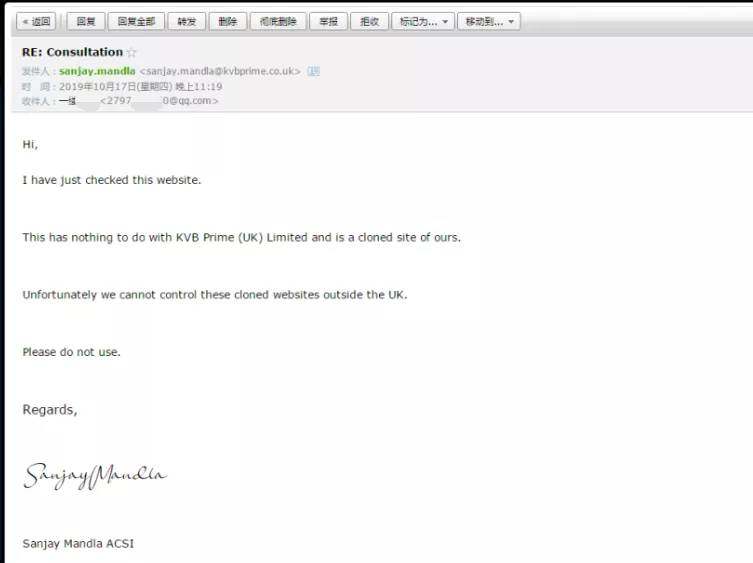

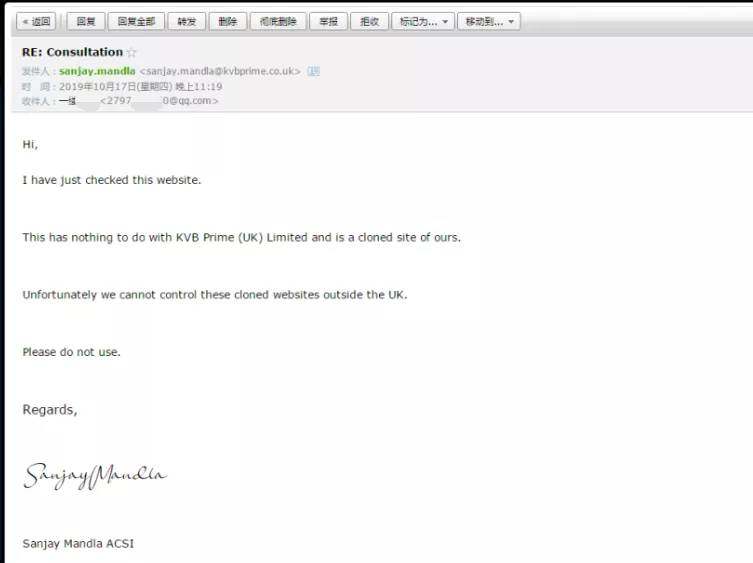

KVB specializes in various trading services, including futures, forex, equities, and cryptocurrencies. It provides access to multiple trading platforms, including the popular MT4, and claims to operate under the oversight of regulatory bodies like the Anjouan Offshore Finance Authority (AofA) and the Financial Conduct Authority (FCA). However, the legitimacy of these claims has been called into question by various user complaints and regulatory reports.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Regulatory Information Conflicts

KVB's regulation status is fraught with concerns. Multiple reports indicate that while it claims affiliation with various regulatory bodies, KVB has recently faced license revocations, particularly from the Securities and Futures Commission (SFC) in Hong Kong. The transparency of these claims is thus questionable, underscoring the risks for potential clients in terms of regulatory oversight and legal accountability.

User Self-Verification Guide

To ensure KVB's legitimacy, users should:

- Search for KVBs name on the ASIC website to verify current licenses.

- Check the SFC and FMA sites for any news relating to license revocations or compliance issues.

- Review third-party platforms like WikiFX or Trustpilot for user feedback and experiences.

Industry Reputation Summary

"The lack of access to funds and poor customer service responses were pivotal in my decision to stop using KVB." – Former user review.

Trading Costs Analysis

Advantages in Commissions

KVB offers competitive trading commissions, often reported at $0, which makes it attractive to cost-conscious traders. Additionally, the leverage available reaches an impressive 1:1000, allowing for significant trading potential.

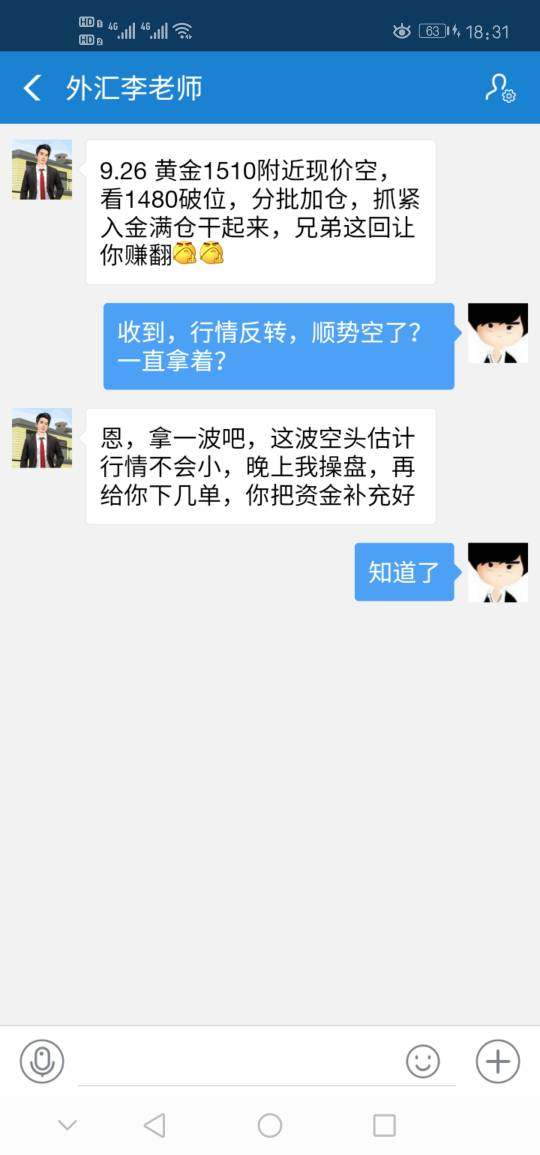

Traps of Non-Trading Fees

Despite the advantageous commission structure, several users have noted hidden fees associated with withdrawals and account inactivity, making it essential to read the fine print before committing.

"Withdrawals would often take unexpectedly long, with unclear fees applied." – User feedback.

Cost Structure Summary

The combination of low commissions and high leverage may appeal significantly to active traders looking to minimize their costs, yet the potential of hidden fees gestures a degree of concern that shouldn't be overlooked.

Platform Diversity

KVB provides a range of platforms including MT4, the KVB app, and the Acts Trade platform. While these interfaces generally meet users' trading needs, some have reported usability issues concerning account management features.

Quality of Tools and Resources

Users have highlighted that the available analytical tools are adequate but not necessarily advanced, which may not support more sophisticated trading strategies.

Platform Experience Summary

"Overall, the platform is straightforward but lacks the versatility I've found with other brokers." – User quote.

User Experience Analysis

User Feedback Overview

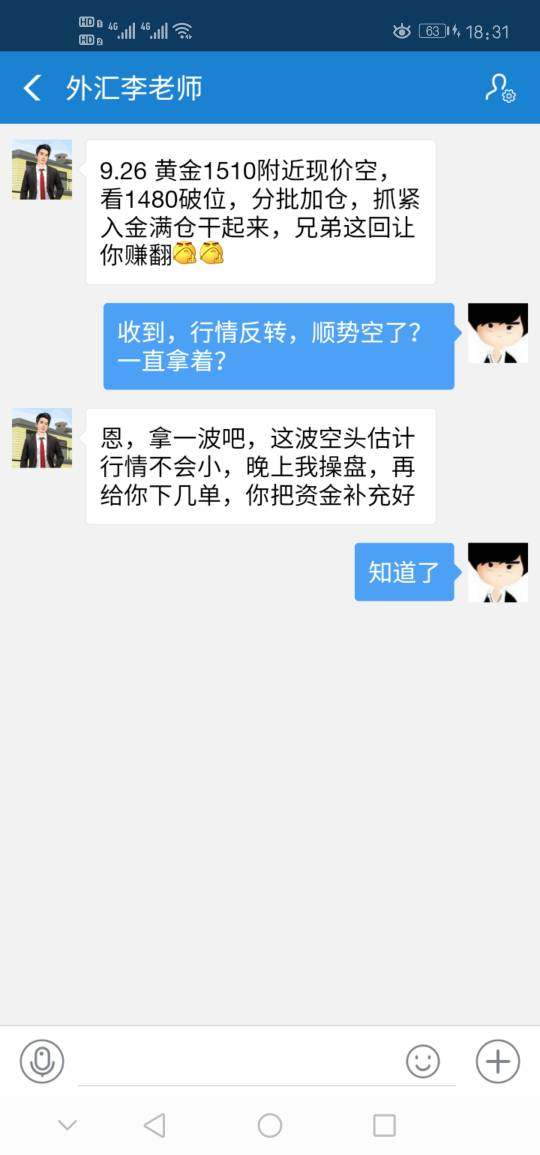

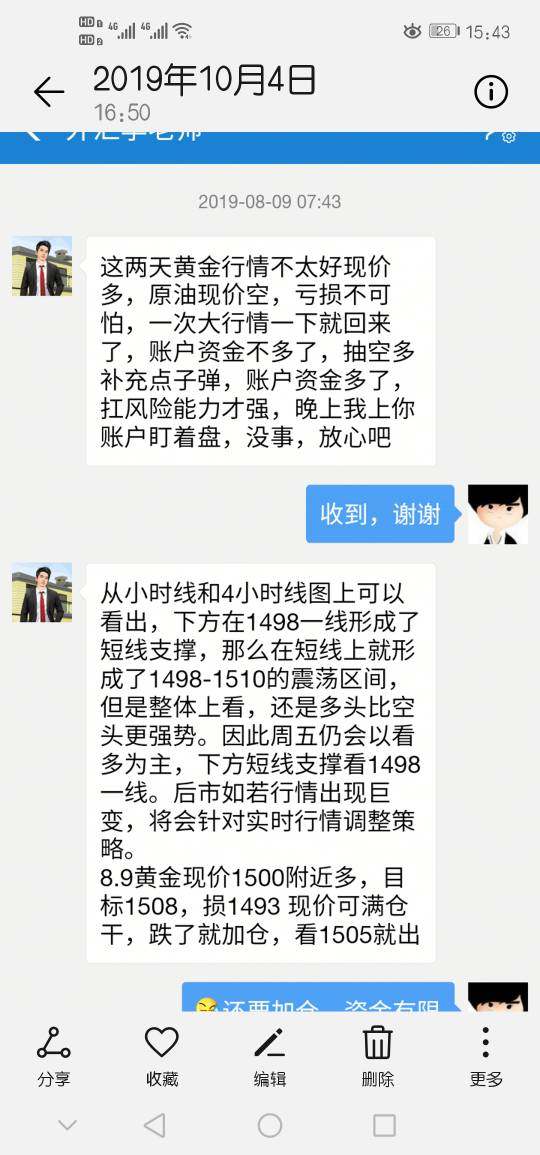

KVBs user experience reflects a broad spectrum of satisfaction levels. While some users praise the trading conditions and platform interface, others express frustration with withdrawal delays and communication issues with customer service.

Accessibility of Services

Many users report that navigating the platform is generally manageable, although experienced traders express that they desire more intuitive features for efficiency.

Overall User Experience Summary

Significant concerns about withdrawal processes combined with an inconsistent customer service experience detract from an otherwise appealing trading platform.

Customer Support Analysis

Support Channels Available

KVB provides customer support via email integration, but users have flagged long response times and inadequate resolutions to queries as significant areas for improvement.

User Feedback on Support

User reviews often cite dissatisfaction due to insufficient support, particularly regarding withdrawal inquiries and technical issues.

Overall Support Summary

While KVB does have various channels for support, the effectiveness and efficiency of these services appear largely deficient according to user feedback.

Account Conditions Analysis

Account Types Offered

KVB provides several account types with differing minimum deposit requirements, which start as low as $30. Options like classic and plus accounts cater to various trading styles.

Minimum Deposit and Fees

The brokers low minimum deposit makes it accessible for a wider range of traders, although certain accounts might require significantly higher initial deposits depending on the services offered.

Overall Conditions Summary

The diverse account options are attractive; however, mixed reviews about accessibility and issues with withdrawals complicate the overall attractiveness for new traders.

Conclusion

KVB presents a trading opportunity characterized by low-cost trading conditions and access to multiple platforms. Yet, substantial regulatory concerns, a patchy user experience, and significant customer service issues underpin a mixed reputation that ought to caution potential investors. Therefore, while KVB may attract experienced traders seeking affordability, they must be vigilant and fully aware of the associated risks. In the emerging financial landscape, the prudent approach remains to balance cost with inherent risk, ensuring that the broker selected aligns with both trading goals and risk tolerance.