Is Kraken safe?

Pros

Cons

Is Kraken A Scam?

Introduction

Kraken, established in 2011, is one of the oldest and most prominent cryptocurrency exchanges in the world. Based in San Francisco, it has carved out a significant position in the cryptocurrency market, particularly known for its robust security measures and a wide array of digital assets. As the cryptocurrency landscape continues to evolve, traders must exercise caution when selecting a trading platform. The importance of assessing the legitimacy and safety of a broker cannot be overstated, especially considering the number of scams and fraudulent activities in the crypto space. This article aims to provide a comprehensive evaluation of Kraken, focusing on its regulatory status, company background, trading conditions, customer safety, user experience, and potential risks. The analysis is based on extensive research, including reviews from various financial sources, user feedback, and regulatory information.

Regulation and Legitimacy

Regulation plays a crucial role in determining the legitimacy of a trading platform. Kraken is registered with multiple regulatory bodies, including the Financial Crimes Enforcement Network (FinCEN) in the United States and the Financial Transactions and Reports Analysis Centre (FINTRAC) in Canada. However, it is essential to note that Kraken does not hold a license from some of the more stringent regulatory agencies, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | 31000176593851 | USA | Registered |

| FINTRAC | M19343731 | Canada | Registered |

| FCA | 757895 | UK | Registered |

| AUSTRAC | 163 237 634 | Australia | Registered |

The regulatory framework surrounding Kraken is a mixed bag. While it is compliant with legal requirements in the jurisdictions it operates, the lack of oversight from major financial regulatory bodies raises concerns about the quality of regulation. Kraken's history of compliance has been relatively clean, but the absence of robust regulatory oversight means that users should remain vigilant.

Company Background Investigation

Kraken was co-founded by Jesse Powell, who previously worked as a security consultant for the now-defunct Mt. Gox exchange. This experience shaped Kraken's foundational philosophy, emphasizing security and reliability. Over the years, Kraken has expanded its services to include spot trading, futures trading, margin trading, and staking, making it appealing to a broad audience of traders.

The company's ownership structure is relatively transparent, as it operates under Payward, Inc. Kraken has raised significant venture capital, which has enabled it to scale its operations and enhance its technological infrastructure. The management team comprises experienced professionals from various sectors, including finance and technology, which adds to its credibility.

However, while Kraken has built a strong reputation over the years, it has faced scrutiny regarding its transparency and communication with users. Some users have reported difficulties in accessing information or receiving timely updates, which can be concerning for potential investors.

Trading Conditions Analysis

Kraken's fee structure is competitive, particularly for high-volume traders. The platform employs a maker-taker model, where fees vary based on the user's trading volume over the past 30 days.

| Fee Type | Kraken | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.00% - 0.26% | 0.10% - 0.30% |

| Commission Model | Maker-Taker | Varies |

| Overnight Interest Range | 0.01% - 0.02% | 0.02% - 0.05% |

While the fees are generally lower than many competitors, some users have expressed concerns about hidden fees, particularly when using the instant buy feature, which incurs a higher fee compared to trading directly on the exchange. This inconsistency in fee structures can confuse new traders and may lead to unexpected costs.

Customer Funds Safety

One of the most critical aspects of any trading platform is the security of customer funds. Kraken takes several measures to ensure the safety of its users' assets, including storing 95% of all deposits in cold storage, which is offline and less susceptible to hacking attempts. Additionally, the exchange employs two-factor authentication (2FA) and other encryption methods to protect user accounts.

Despite these measures, there have been instances where users reported unauthorized access to their accounts, leading to significant losses. While Kraken's security protocols are robust, the decentralized nature of cryptocurrencies means that users must also take personal responsibility for securing their accounts.

Customer Experience and Complaints

User feedback on Kraken has been mixed. Many users appreciate the platform's security features and the variety of cryptocurrencies available for trading. However, common complaints include slow customer support response times and issues with account verification.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Slow Customer Support | High | Mixed |

| Account Verification Delays | Medium | Improving |

| Withdrawal Issues | High | Varies |

For example, some users have reported long wait times for customer support, especially during peak trading hours. Others have experienced issues with fund withdrawals, where their accounts were frozen due to security checks. These experiences highlight the importance of having a responsive customer support system in place.

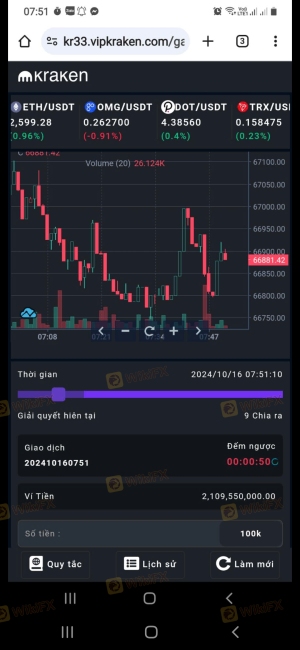

Platform and Trade Execution

Kraken's trading platform is known for its reliability and user-friendly interface. The platform supports various order types, including market, limit, and stop-loss orders. However, some users have reported issues with order execution quality, particularly during periods of high volatility.

The presence of slippage and rejected orders can impact trading performance, especially for those employing high-frequency trading strategies. While Kraken has made strides in improving its platform stability, users should remain cautious during market fluctuations.

Risk Assessment

When evaluating Kraken, it's essential to consider the overall risk associated with trading on the platform.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited oversight from major regulators. |

| Security Risk | Low | Strong security measures in place. |

| Operational Risk | Medium | Potential for downtime during high volatility. |

| Customer Service Risk | High | Mixed reviews regarding support responsiveness. |

To mitigate these risks, users should familiarize themselves with Kraken's features, ensure their accounts are secured with strong passwords and 2FA, and stay informed about market conditions.

Conclusion and Recommendations

In conclusion, Kraken is a well-established cryptocurrency exchange with a strong focus on security and a diverse range of trading options. However, the lack of robust regulatory oversight and mixed user experiences raise cautionary flags. While there are no significant indications of fraud, potential users should approach with a healthy degree of skepticism and conduct thorough research before committing funds.

For new traders, Kraken offers a user-friendly platform with a variety of educational resources, making it a suitable choice for those looking to enter the cryptocurrency market. However, for more experienced traders seeking advanced features and lower fees, exploring alternatives like Binance or Coinbase might be beneficial.

In summary, while Kraken is generally considered safe, it is crucial for traders to remain vigilant and informed about potential risks associated with using the platform.

Is Kraken a scam, or is it legit?

The latest exposure and evaluation content of Kraken brokers.

Kraken Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Kraken latest industry rating score is 1.29, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.29 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.