Is KPCB safe?

Pros

Cons

Is KPCB Safe or a Scam?

Introduction

KPCB, a forex broker, has been gaining attention in the trading community, particularly among those looking for new platforms to engage in currency trading. As with any financial institution, it is crucial for traders to carefully evaluate the legitimacy and reliability of KPCB before committing their funds. The forex market is fraught with risks, and choosing the wrong broker can lead to significant financial losses. In this article, we will investigate whether KPCB is a safe trading option or if it raises red flags that potential investors should be wary of. Our investigation will utilize a combination of regulatory analysis, company background checks, customer feedback, and risk assessments to provide a comprehensive evaluation.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. A well-regulated broker is required to adhere to strict guidelines that protect traders' interests. Unfortunately, KPCB lacks legitimate regulatory oversight, which raises concerns about its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that KPCB is not held accountable by any financial authority, which significantly increases the risk for traders. Without oversight, there are no guarantees regarding the safety of funds, the fairness of trading conditions, or the transparency of operations. Furthermore, the lack of regulatory history raises questions about the broker's compliance with industry standards. Traders should exercise extreme caution when considering KPCB, as the absence of regulatory backing is a concerning indicator of potential fraud or mismanagement.

Company Background Investigation

KPCB's history and ownership structure play a vital role in understanding its credibility. The broker has been operational for approximately 2 to 5 years, according to various sources. However, there is little information available about its founders, management team, or corporate structure. This lack of transparency can be alarming for potential investors who rely on a broker's established history and reputable management to gauge its reliability.

The management team's background is crucial in assessing the broker's operational integrity. A team with extensive experience in finance and trading significantly enhances a broker's trustworthiness. Unfortunately, KPCB does not provide sufficient information about its management team, which can lead to skepticism among traders. The absence of detailed company information and the lack of a clear ownership structure suggest that KPCB may not prioritize transparency, further undermining its credibility.

Trading Conditions Analysis

Understanding the trading conditions offered by KPCB is essential for evaluating its overall attractiveness as a forex broker. The broker's fee structure and trading costs can significantly impact a trader's profitability. KPCB's overall fees and commissions are reportedly unclear, with several users expressing concerns over hidden charges.

| Fee Type | KPCB | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | High | Average |

The potential for high spreads and unclear commission models raises concerns for traders who expect transparency in their trading costs. Additionally, any unusually high fees can diminish profitability and deter traders from engaging with the platform. A broker that lacks clarity in its fee structure may not have the best interests of its clients at heart, further questioning whether KPCB is safe.

Client Fund Security

The safety of client funds is paramount when assessing any forex broker. KPCB's measures for safeguarding client money are crucial for establishing trust. Unfortunately, the broker has not provided clear information regarding its fund security protocols, including whether it segregates client funds from its operational funds.

Traders should look for brokers that offer investor protection schemes, negative balance protection, and robust security measures. The absence of such information from KPCB raises alarms about the potential risks involved in trading with this broker. Historical complaints suggest that some users have faced issues with fund withdrawals, which is a significant red flag.

Customer Experience and Complaints

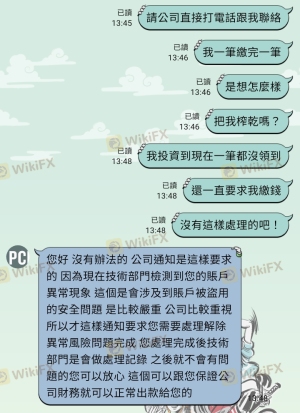

Customer feedback is a valuable source of information when evaluating a broker's reliability. KPCB has received various complaints from users, particularly regarding withdrawal issues. Many clients have reported being unable to withdraw their funds, citing vague reasons provided by the broker.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

The prevalence of withdrawal complaints indicates a troubling pattern. A broker that fails to address customer concerns effectively may not have the best intentions, leading to speculation about its operational integrity. While KPCB may provide a trading platform, the negative experiences shared by clients indicate that potential traders should be cautious.

Platform and Trade Execution

The performance and reliability of the trading platform are critical for a positive trading experience. A stable and user-friendly platform can significantly enhance traders' ability to execute trades efficiently. However, reports suggest that KPCB's platform may not meet industry standards. Users have expressed concerns about order execution quality, including slippage and rejected orders, which can be detrimental to trading outcomes.

Traders should prioritize brokers that offer reliable platforms with minimal slippage and high execution speed. If KPCB exhibits signs of platform manipulation or poor execution quality, it could indicate deeper issues within the broker's operations.

Risk Assessment

Engaging with KPCB carries inherent risks that potential traders must consider. The lack of regulation, transparency, and customer complaints suggest an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Concerns over fund security |

| Operational Risk | Medium | Reports of withdrawal issues |

To mitigate these risks, traders should conduct thorough research, consider diversifying their investments, and explore alternative brokers with better reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that KPCB raises several concerns regarding its safety and legitimacy. The lack of regulatory oversight, transparency, and numerous customer complaints indicate that traders should approach this broker with caution. While KPCB may offer trading opportunities, the potential risks outweigh the benefits for many traders.

For those looking for reliable alternatives, consider brokers that are well-regulated, transparent in their operations, and have a proven track record of customer satisfaction. Always prioritize safety and due diligence when selecting a forex broker to ensure a secure trading experience.

Is KPCB a scam, or is it legit?

The latest exposure and evaluation content of KPCB brokers.

KPCB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KPCB latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.