KPCB Review 1

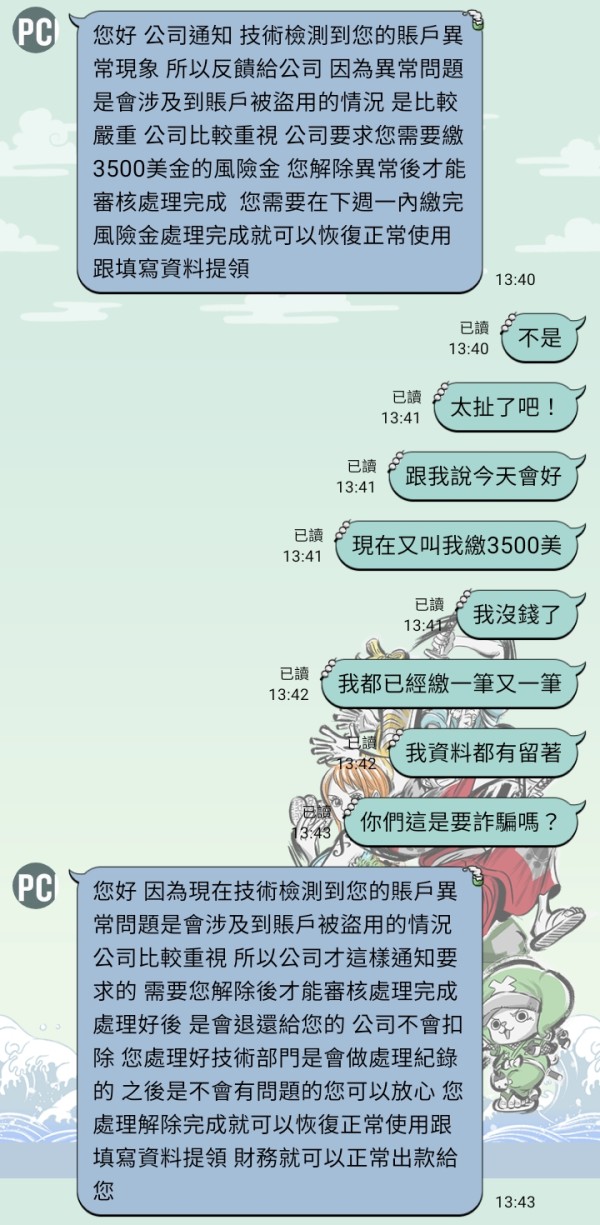

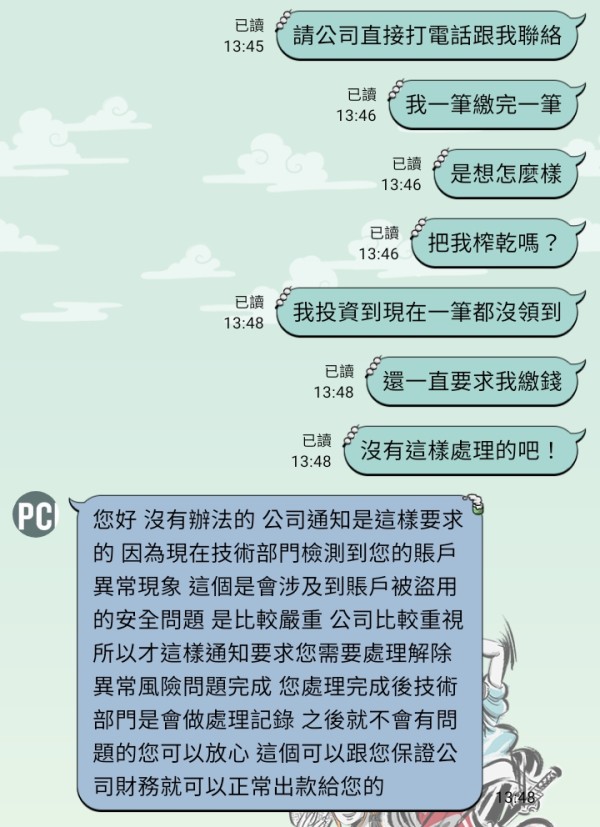

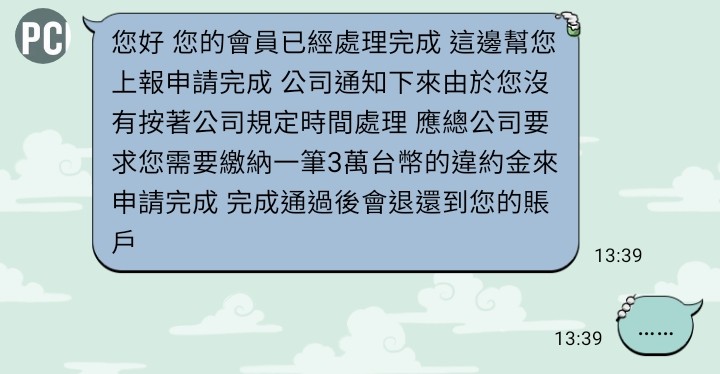

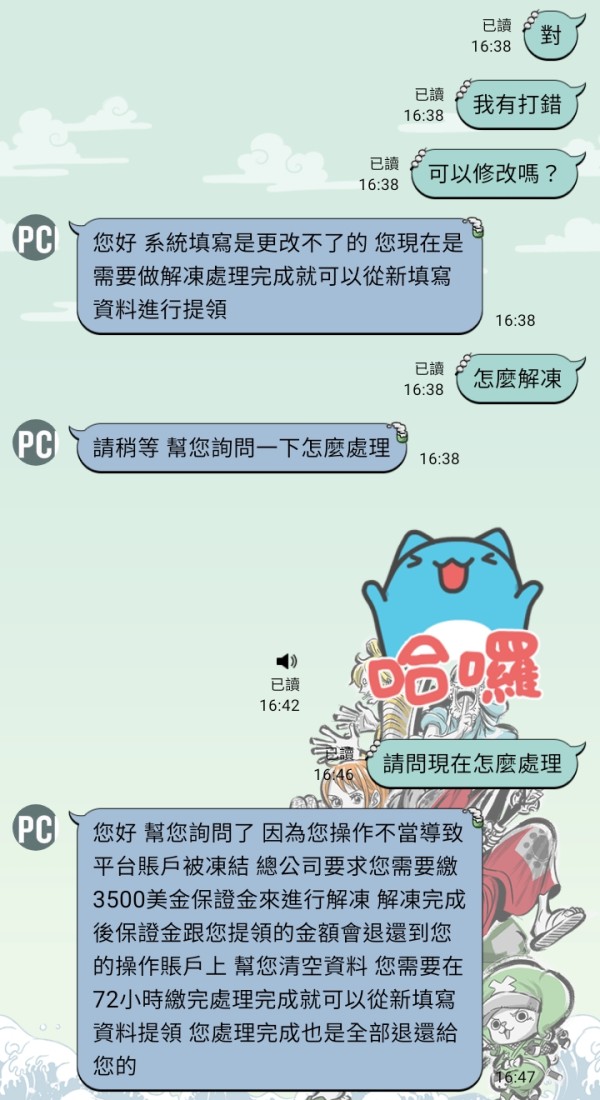

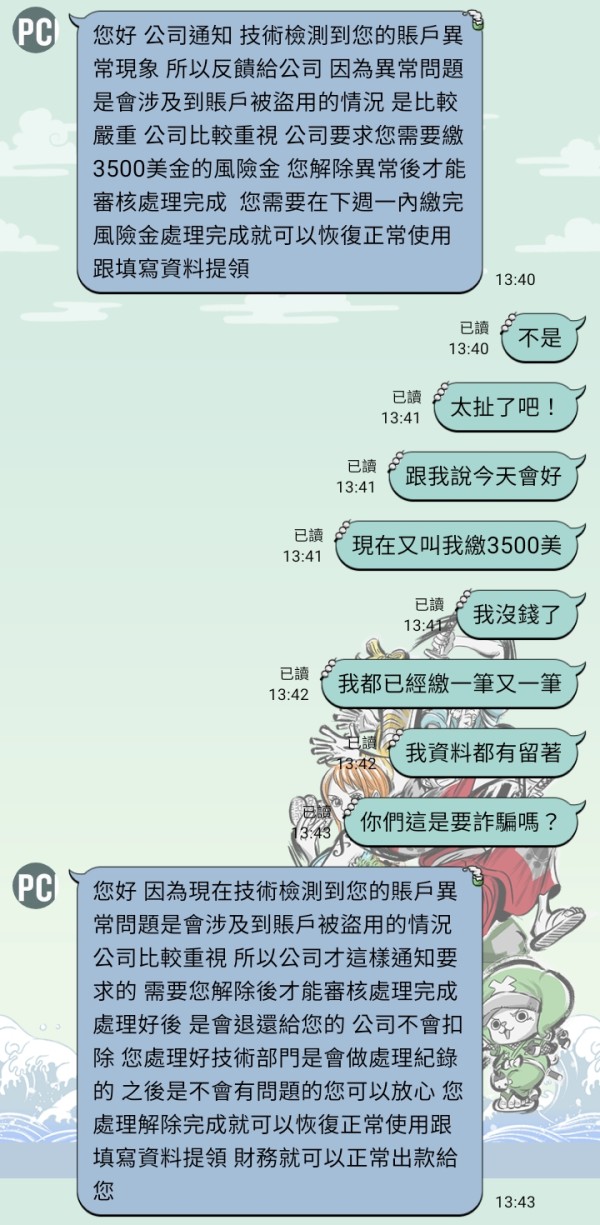

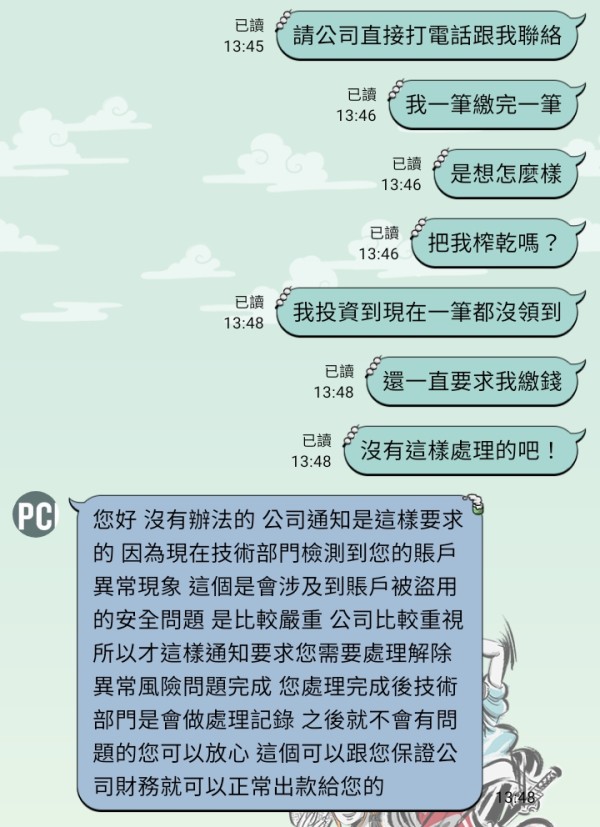

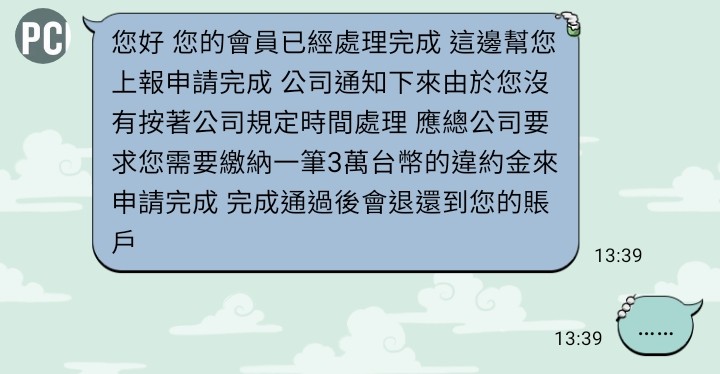

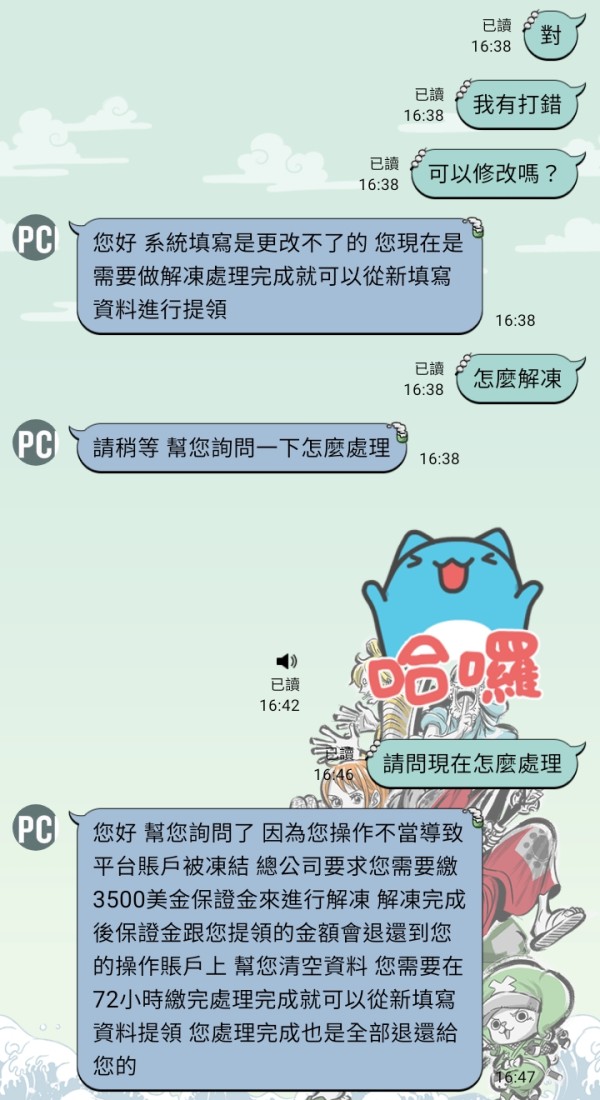

It rejected withdrawal for many reasons.

KPCB Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

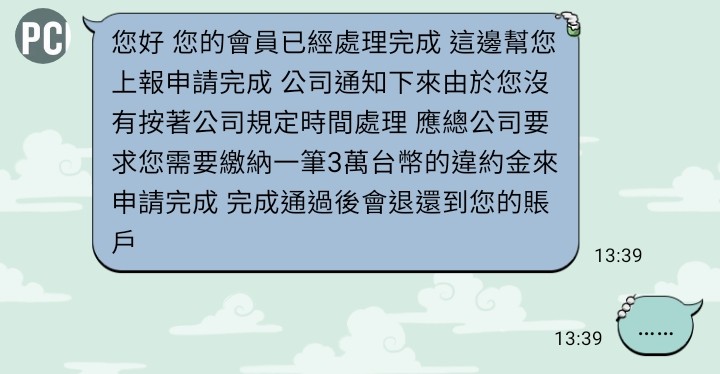

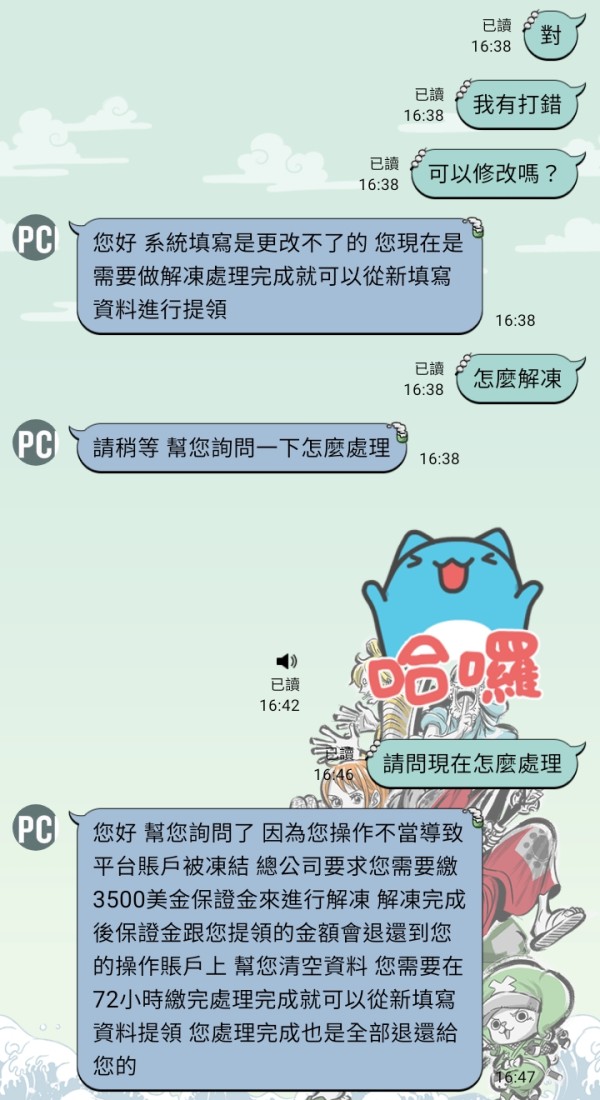

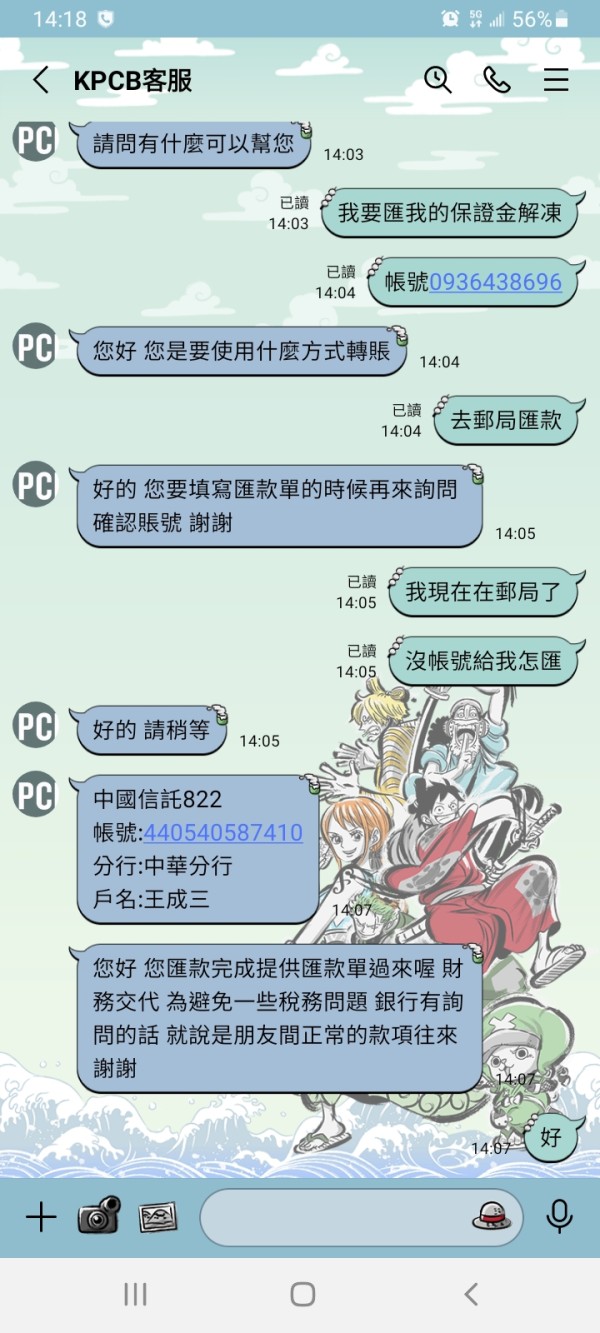

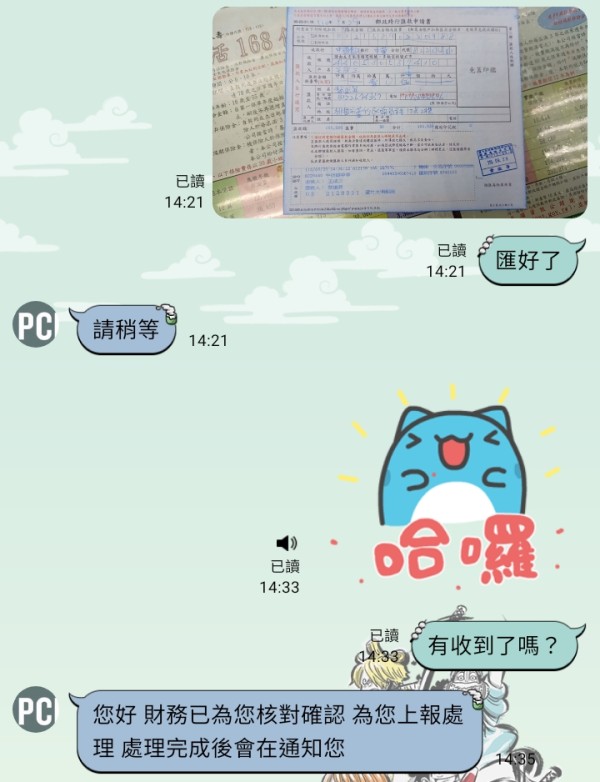

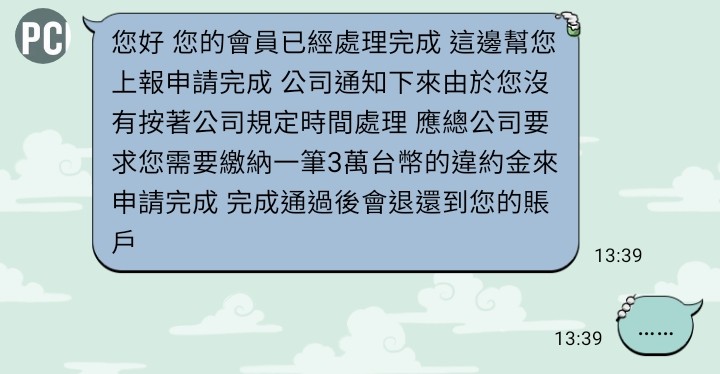

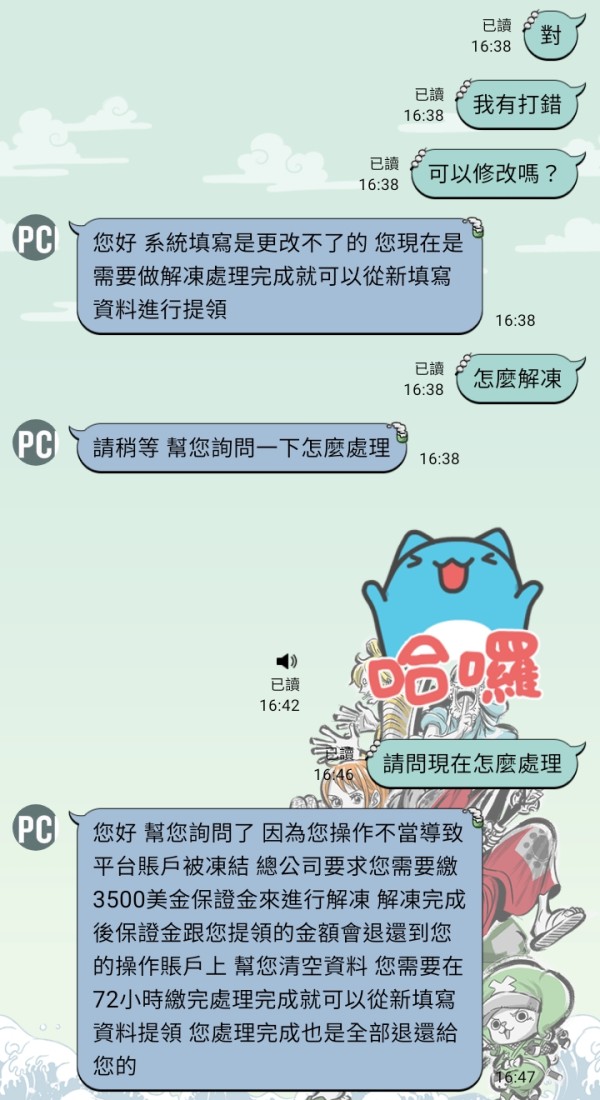

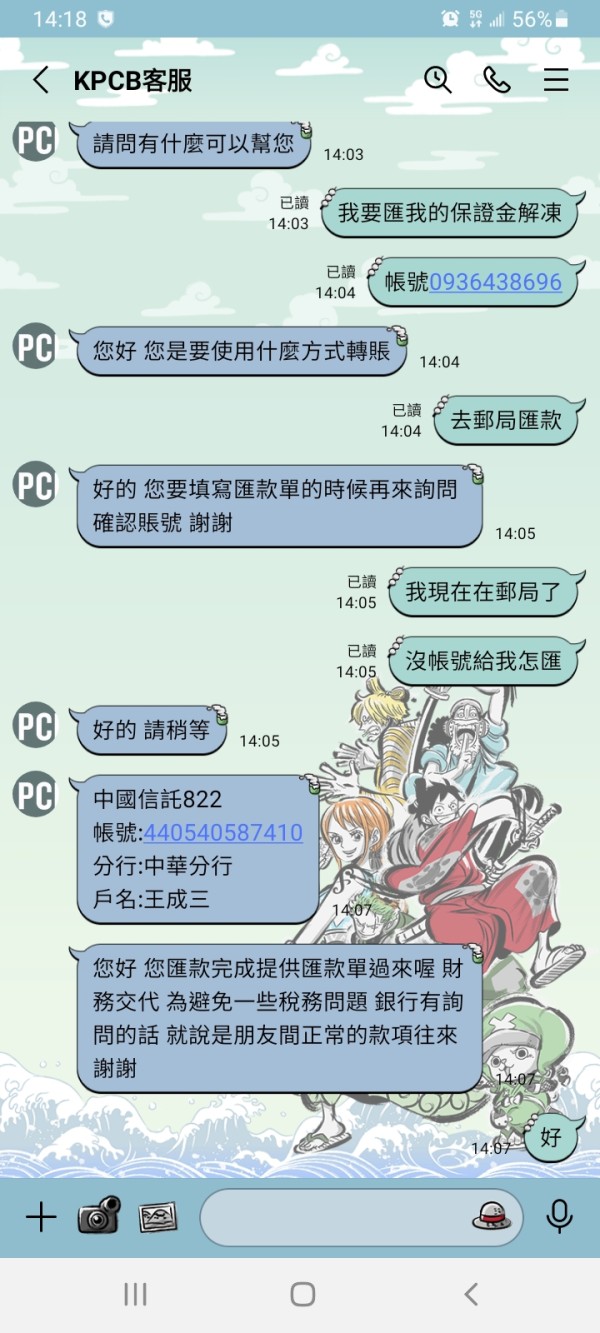

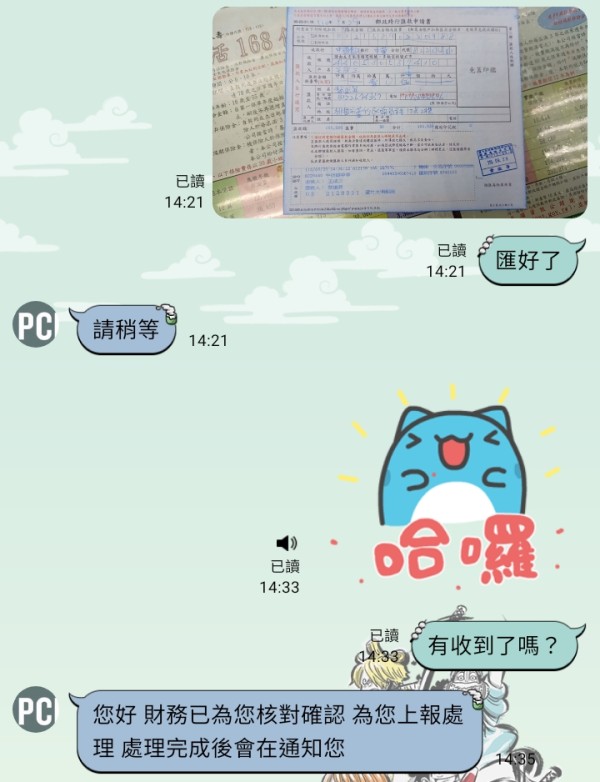

It rejected withdrawal for many reasons.

This Kpcb review gives a fair look at what used to be called Kleiner Perkins Caufield & Byers, now just Kleiner Perkins. The company works as a venture capital firm instead of a regular forex broker, focusing mainly on technology, aerospace, and mobile market investments. People consistently praise their KPCB Fellows program for giving great networking chances to students and tech professionals.

Our review shows some serious transparency problems though. Employee feedback on Comparably reveals negative views about how the company runs internally and treats its workers. The company doesn't share much about trading conditions, regulatory info, or how they operate day-to-day, which leads to our neutral rating. This Kpcb review targets people interested in technology and venture capital, including students who want networking opportunities and professionals looking to connect with Silicon Valley's investment world.

The firm positions itself as a private venture capital company rather than a retail trading platform. This fact greatly affects how we evaluate them and who should consider working with them.

This review uses available user feedback and standard industry measures to evaluate the company. Readers should know that Kleiner Perkins operates as a private venture capital firm in Menlo Park, Silicon Valley, not as a traditional forex or retail trading broker. We looked at user reviews from different platforms, including employee feedback from Comparably and reviews of the KPCB Fellows program.

Since venture capital works differently than regular trading, normal broker evaluation methods might not fully apply here. The nature of their business model and services requires different assessment approaches.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | No specific account condition information available in source materials |

| Tools and Resources | N/A | Trading tools and resources not specified in available documentation |

| Customer Service and Support | N/A | Customer service details not detailed in source materials |

| Trading Experience | N/A | Trading experience specifics not mentioned in available information |

| Trust Factor | N/A | Regulatory information not provided in source materials |

| User Experience | N/A | Specific user experience feedback not detailed in available sources |

Kleiner Perkins stands as one of Silicon Valley's most established private venture capital firms. The company started as a privately held firm and has become a leader in technology investment, working mainly with information technology, unmanned aerial vehicles, aerospace, and mobile market sectors.

Their headquarters in Menlo Park puts them right in the heart of Silicon Valley's innovation scene. This location gives them strategic access to emerging technologies and startup ventures that other firms might miss.

The firm focuses on venture capital investment rather than traditional retail trading services. This basic difference sets KPCB apart from regular forex brokers, since they mainly fund and mentor technology startups and growing companies instead of handling day-to-day trading. Their investment approach emphasizes long-term value creation through strategic partnerships with innovative technology companies.

This Kpcb review recognizes that the firm operates very differently from traditional brokerage services. Their unique position in the financial services world requires different evaluation methods that reflect what they actually do.

Regulatory Jurisdiction: Source materials don't mention which regulatory bodies oversee KPCB's operations as a venture capital firm.

Deposit and Withdrawal Methods: Available documents don't explain how clients deposit or withdraw money.

Minimum Deposit Requirements: Specific minimum investment amounts aren't mentioned in the materials we could access.

Bonus and Promotional Offers: No information about promotional offerings or bonus structures appears in available documentation.

Tradeable Assets: The source materials don't specify which assets or investment instruments clients can access through KPCB's platform.

Cost Structure: Detailed fee structures and cost breakdowns aren't provided in available source materials.

Leverage Ratios: Leverage information doesn't appear in the documentation we reviewed for this Kpcb review.

Platform Options: Specific trading platform choices and technology details aren't mentioned in source materials.

Regional Restrictions: Geographic limitations or regional access restrictions aren't detailed in available information.

Customer Service Languages: Supported languages for customer service communications aren't specified in source documentation.

Evaluating KPCB's account conditions proves difficult because of limited public information about specific account types and structures. Traditional forex brokers usually offer multiple account levels with different features and minimum deposit requirements, but KPCB operates as a venture capital firm with completely different client relationship models.

The lack of detailed account information in source materials suggests either limited public sharing or a business model that doesn't follow standard retail trading account structures. Employee feedback from Comparably shows internal operational concerns that might indirectly affect how they manage client accounts and deliver services, but we can't know for sure without more specific details.

Without specific information about account opening procedures, maintenance requirements, or special account features, we can't provide a complete assessment of this area. The firm's focus on venture capital investment rather than retail trading fundamentally changes how we should evaluate traditional account conditions.

This Kpcb review notes that potential clients should contact the firm directly to understand specific engagement terms and conditions. Publicly available information proves insufficient for thorough account condition analysis, which creates transparency concerns for anyone considering working with them.

Assessing KPCB's tools and resources faces limitations because available source materials don't describe specific trading tools, analytical resources, or technology infrastructure. Traditional broker evaluations typically look at charting software, market analysis tools, automated trading capabilities, and educational resources that help traders make better decisions.

However, as a venture capital firm, KPCB's resources likely focus on investment research, portfolio management tools, and startup evaluation frameworks rather than retail trading instruments. The KPCB Fellows program represents one clear resource that has received positive user feedback, especially regarding networking opportunities and professional development opportunities for participants.

This program seems to connect the firm with emerging talent in the technology sector. However, employee feedback from Comparably suggests potential internal resource management challenges that could affect overall service quality for clients and program participants alike.

Without specific information about research capabilities, analytical tools, or educational offerings available to clients or participants, this evaluation can't provide definitive scoring for tools and resources. The unique nature of venture capital operations requires different resource evaluation criteria compared to traditional forex broker assessments, which makes standard comparisons difficult.

Customer service evaluation for KPCB encounters significant information limitations because source materials don't provide specific details about support channels, response times, service quality metrics, or multilingual capabilities. Traditional broker assessments typically examine live chat availability, phone support hours, email response efficiency, and customer satisfaction ratings to give clients a clear picture of what to expect.

However, venture capital firms often operate with different client service models focused on relationship management rather than transactional support. Employee feedback from Comparably reveals concerning patterns regarding internal company operations, which may indirectly reflect on external customer service quality for clients and program participants.

The negative employee assessments could potentially impact client-facing service delivery, though direct customer service feedback isn't available in source materials. Without information about support availability, problem resolution procedures, or service quality benchmarks, this evaluation can't provide comprehensive customer service analysis that would help potential clients make informed decisions.

The absence of specific customer service information in publicly available materials suggests either limited disclosure practices or a service model that differs substantially from traditional retail broker support structures. This lack of transparency creates concerns for anyone considering engaging with the firm's services or programs.

Evaluating KPCB's trading experience presents fundamental challenges because available source materials don't address platform stability, execution speed, order processing quality, mobile accessibility, or trading environment characteristics. The firm's positioning as a venture capital entity rather than a trading platform fundamentally alters the relevance of traditional trading experience metrics that most investors care about.

Conventional broker assessments examine execution quality, slippage rates, platform uptime, and user interface functionality to help traders understand what their experience will be like. Employee feedback from Comparably indicates internal operational concerns that could potentially affect any trading-related services if they exist, but we can't verify this without more specific information.

Without specific information about trading platform performance, technical capabilities, or user experience data, comprehensive trading experience evaluation becomes impossible. The venture capital business model typically involves long-term investment decisions rather than active trading, suggesting that traditional trading experience criteria may not apply to KPCB's operational framework at all.

This Kpcb review acknowledges that the absence of trading-specific information reflects the firm's focus on venture capital rather than retail trading services. However, this lack of clarity about their actual services creates confusion for potential clients who might expect traditional trading capabilities.

Trust factor assessment for KPCB reveals mixed signals based on available information that raises some concerns. While source materials don't specify regulatory oversight, licensing details, or fund security measures typically associated with financial service providers, the firm's established presence in Silicon Valley's venture capital ecosystem suggests institutional credibility that comes from years of operation.

However, employee feedback from Comparably presents concerning perspectives on company operations and internal management practices. The negative employee assessments on Comparably raise questions about internal transparency and operational integrity, which could indirectly impact client trust and confidence in the firm's ability to deliver on promises.

Without specific information about regulatory compliance, fund protection measures, or third-party oversight, this evaluation can't provide definitive trust factor scoring. The absence of detailed regulatory information in source materials may reflect different oversight requirements for venture capital firms compared to retail brokers, but this uncertainty creates additional trust concerns.

Industry reputation and handling of negative incidents require more comprehensive information than currently available in source materials to provide accurate trust factor assessment. This lack of transparency makes it difficult for potential clients to make informed decisions about working with the firm.

User experience evaluation for KPCB faces significant information constraints because source materials lack specific feedback regarding overall user satisfaction, interface design quality, registration processes, or fund operation experiences. The KPCB Fellows program appears to generate positive user feedback, particularly regarding networking opportunities and professional development benefits that participants receive.

However, this represents a limited aspect of overall user experience rather than comprehensive service evaluation. Employee feedback from Comparably suggests potential internal operational challenges that could affect user-facing experiences, though direct user testimonials aren't available in source materials to confirm or deny these concerns.

Without information about user interface design, process efficiency, or general satisfaction metrics, comprehensive user experience assessment becomes challenging. The venture capital business model typically involves different user interaction patterns compared to retail trading platforms, requiring adjusted evaluation criteria that account for these differences.

Common user complaints and improvement suggestions aren't detailed in available information, limiting the ability to provide actionable user experience insights. This lack of user feedback makes it difficult for potential clients to understand what their experience might be like when working with the firm.

This comprehensive Kpcb review concludes with a neutral overall assessment due to insufficient specific information regarding trading conditions, regulatory oversight, and detailed user feedback typically required for thorough financial service provider evaluation. The firm's positioning as a venture capital entity rather than a traditional forex broker fundamentally impacts evaluation criteria and scoring methodology in ways that make standard comparisons difficult.

KPCB appears most suitable for professionals interested in technology and venture capital sectors, particularly those seeking networking opportunities through programs like KPCB Fellows. The main advantages include the well-regarded Fellows program and established Silicon Valley presence that provides access to innovation networks, while disadvantages include limited transparency regarding operational details and concerning employee feedback on internal operations that raise questions about overall company culture and management.

FX Broker Capital Trading Markets Review